USD Rally: Dollar's Surge Linked To Trump's Moderated Criticism Of Fed Policy

Table of Contents

Trump's Previous Attacks on the Fed and their Impact on the Dollar

President Trump's past criticisms of the Federal Reserve were frequent and often harsh. He frequently attacked the Fed's interest rate decisions, publicly labeling them as too slow to lower rates or too quick to raise them, depending on the prevailing economic climate. This consistent barrage of criticism negatively impacted market sentiment and created considerable volatility in the forex market.

-

Examples of Trump's previous statements: Trump repeatedly referred to the Fed's actions as "crazy" and "ridiculous," expressing frustration over what he perceived as obstacles to economic growth. These statements were often made via Twitter, amplifying their impact and reach.

-

Market impact: The uncertainty generated by Trump's attacks led to significant fluctuations in the USD's value. Investors became hesitant, unsure of the long-term implications of the unpredictable political pressure on the central bank. This uncertainty directly fueled volatility in currency trading.

-

Data showing USD weakening: During periods of heightened criticism, the USD often experienced a decline against other major currencies like the Euro and the Yen. Data from this period clearly shows a correlation between Trump's negative statements and a weakening dollar.

-

Impact on investor confidence and foreign investment: The unpredictable nature of Trump's pronouncements discouraged foreign investment and eroded confidence in the stability of the US dollar as a safe-haven asset.

The Shift in Trump's Tone and its Market Implications

Recently, a noticeable shift has occurred in Trump's public statements regarding the Fed. His criticism, once a near-constant feature of his public pronouncements, has become significantly more muted. In some instances, he has even offered qualified praise for the Fed's actions.

-

Examples of more moderate comments: Instead of outright condemnation, Trump’s recent statements have focused on broader economic indicators, offering less direct criticism of the Fed's specific monetary policy decisions.

-

Reasons for the shift: Analysts suggest several reasons for this change, including the upcoming elections and growing concerns about the overall economic health of the nation. A more conciliatory approach may be seen as politically advantageous.

-

Immediate market reaction: The market reacted positively to this change in tone. The reduced uncertainty surrounding the Fed's independence led to an immediate surge in the USD, reflecting increased investor confidence.

-

Positive impact on investor sentiment: A more predictable political environment regarding monetary policy has fostered a calmer and more positive sentiment among investors, leading to a greater demand for USD-denominated assets.

Other Contributing Factors to the USD Rally

While Trump's altered rhetoric played a significant role in the USD rally, other factors also contributed to the dollar's strength. It's important to consider a holistic view of the market dynamics.

-

Global economic uncertainty and safe-haven status: Global economic uncertainty often drives investors toward the USD, seen as a relatively safe and stable currency during times of instability.

-

Interest rate differentials: Higher interest rates in the US compared to other major economies make USD-denominated assets more attractive to foreign investors, increasing demand for the dollar.

-

US economic data: Positive US economic data, such as strong employment numbers and GDP growth, further bolsters the USD's appeal.

-

Geopolitical events: Geopolitical events impacting other major economies can indirectly strengthen the USD's position as a safe haven.

Analyzing the Sustainability of the USD Rally

The sustainability of the current USD rally is a complex question, with both arguments for continuation and potential reversals.

-

Factors sustaining the rally: Continued positive US economic data, persistently higher US interest rates compared to other major economies, and ongoing global economic uncertainty could sustain the USD's strength.

-

Potential risks and challenges: A resurgence of Trump's previous criticisms, a weakening of the US economy, or unexpected geopolitical events could all trigger a reversal in the USD's upward trend.

-

Expert opinions and market forecasts: Market analysts offer diverse predictions, highlighting the inherent uncertainty in forecasting currency movements. Some believe the rally will continue, while others predict a correction.

-

Implications for investors and businesses: The USD's movement significantly impacts businesses involved in international trade and investors holding assets denominated in different currencies. Monitoring the USD rally is therefore critical for effective financial planning.

Conclusion:

The recent USD rally is largely attributable to a significant shift in President Trump's rhetoric towards the Federal Reserve. His toned-down criticism has reduced market uncertainty, boosting investor confidence and leading to increased demand for the US dollar. While other factors contributed, the impact of this change in tone is undeniable. Understanding the dynamics behind the USD rally is crucial for anyone involved in currency trading or international finance. Stay informed about the latest developments in US monetary policy and the evolving relationship between the President and the Federal Reserve to make informed decisions regarding your USD investments and trading strategies. Monitor future shifts in the USD rally for optimal investment opportunities.

Featured Posts

-

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025

South Carolina Voter Confronts Rep Nancy Mace A Heated Exchange

Apr 24, 2025 -

Tarantinov Prezir Film S Travoltom Kojeg Ne Zeli Vidjeti

Apr 24, 2025

Tarantinov Prezir Film S Travoltom Kojeg Ne Zeli Vidjeti

Apr 24, 2025 -

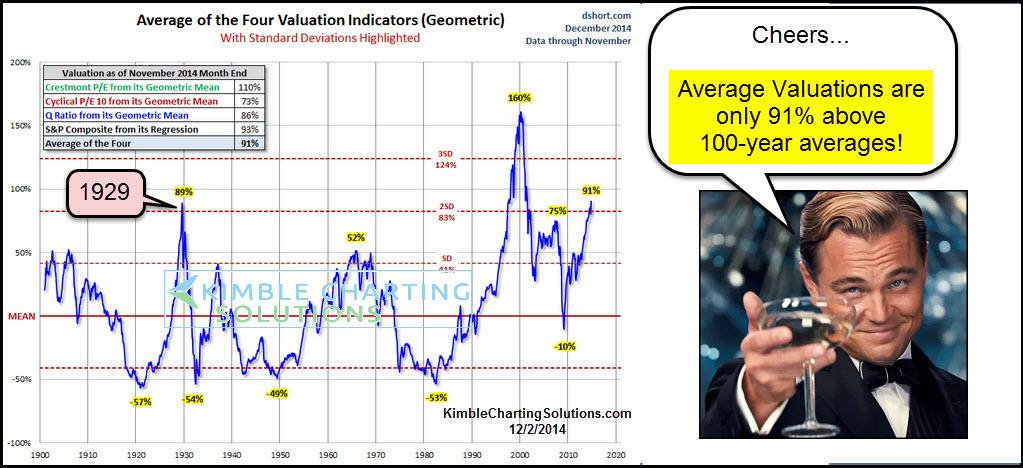

High Valuations In The Stock Market Bof As Rationale For Investors

Apr 24, 2025

High Valuations In The Stock Market Bof As Rationale For Investors

Apr 24, 2025 -

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025

Canadas Fiscal Future A Vision For Responsible Spending

Apr 24, 2025 -

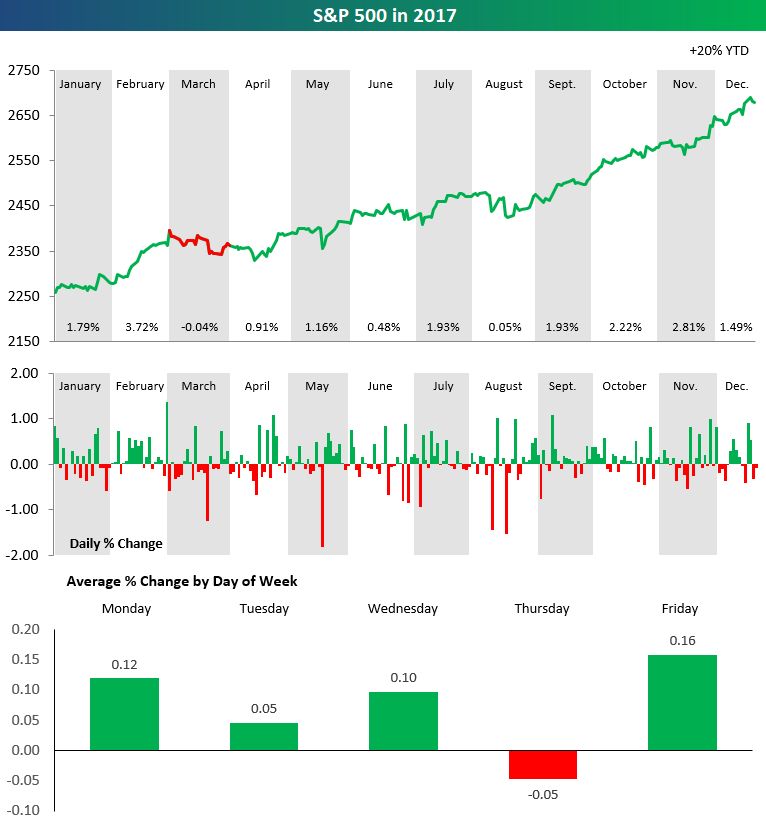

Dow Jones And S And P 500 Stock Market Report April 23rd

Apr 24, 2025

Dow Jones And S And P 500 Stock Market Report April 23rd

Apr 24, 2025