High Valuations In The Stock Market: BofA's Rationale For Investors

Table of Contents

BofA's Justification for Current High Stock Market Valuations

BofA generally maintains a cautiously optimistic stance on current market valuations. While acknowledging the elevated levels, they argue that several factors justify a positive outlook, albeit one requiring careful risk management. Their perspective isn't simply bullish; it's a nuanced assessment considering various economic indicators and potential risks.

-

Key Arguments: BofA's justification often centers on the expectation of continued, albeit potentially slower, corporate earnings growth, supported by ongoing technological advancements and a resilient consumer base. They emphasize the importance of differentiating between broad market valuations and individual stock valuations, recommending a focus on specific sectors showing strong fundamentals.

-

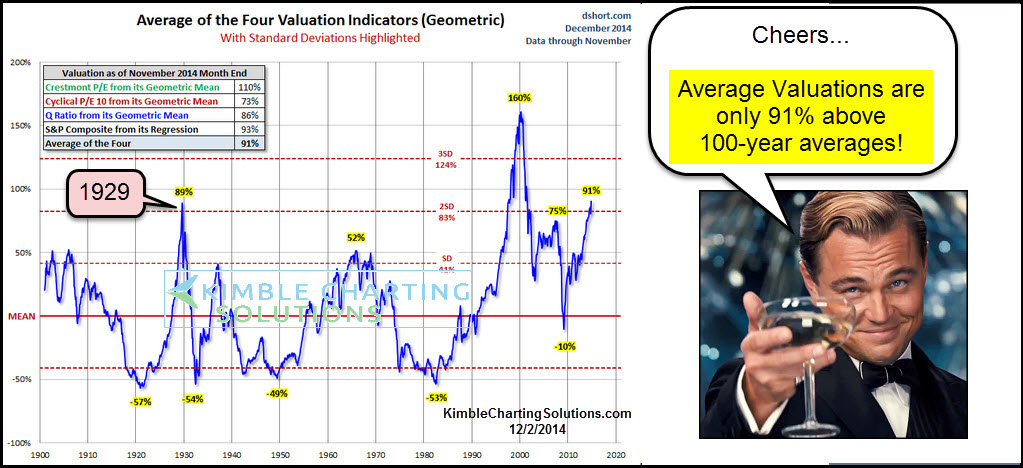

Economic Indicators: BofA cites factors like persistently low interest rates, robust corporate earnings (although potentially slowing), and a generally positive (though cautious) investor sentiment as key supports for their view. They often analyze data points such as the Shiller P/E ratio, but emphasize the need to consider the broader economic context, not simply rely on single valuation metrics.

-

Sector Focus: BofA's recommendations often highlight specific sectors believed to be less vulnerable to valuation corrections, frequently pointing to technology and healthcare as examples of growth sectors. However, this is subject to change based on their ongoing analysis.

-

Supporting Data: (Note: Specific data from BofA reports should be inserted here. This would require accessing and citing recent BofA research publications. For example, one might include a statement like: "BofA's latest report indicates that while the Shiller P/E ratio is elevated, projected earnings growth over the next 12-18 months suggests a potential justification for current levels, particularly within specific sectors.").

Analyzing the Factors Contributing to High Stock Valuations

Several interconnected factors fuel the current high stock valuations. Understanding these is critical for developing a sound investment strategy in this environment.

-

Low Interest Rates: Low interest rates make bonds less attractive, driving investors toward higher-yielding assets like stocks. This increased demand pushes stock prices upward, contributing to higher valuations.

-

Strong Corporate Earnings (Historically): Robust corporate earnings, particularly before recent economic slowdowns, have supported higher price-to-earnings ratios. This demonstrates that companies are profitable, justifying higher stock prices in the minds of many investors. However, this is a factor that bears close monitoring as economic conditions shift.

-

Investor Sentiment: Optimistic investor sentiment, although tempered somewhat in recent months, can significantly impact market valuations. High confidence in future economic growth and company performance fuels buying activity, further driving prices upwards.

-

Inflationary Pressures: Inflation, while potentially impacting earnings growth, also plays a role. Investors may seek to protect their capital from inflation by investing in stocks, potentially driving up valuations further. BofA's perspective on inflation is crucial to understanding their overall assessment of stock market valuations.

Mitigating Risks Associated with High Stock Market Valuations

Investing in a market with high stock valuations inherently involves risks. A potential correction could lead to significant losses. Therefore, implementing appropriate risk mitigation strategies is essential.

-

Diversification Strategies: Diversifying across asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to reduce portfolio volatility. This helps to limit losses should one sector underperform.

-

Value Investing: Value investing, focusing on companies trading below their intrinsic value, offers a potentially defensive approach in a high-valuation market. This approach seeks to identify undervalued companies that may offer better risk-adjusted returns.

-

Risk Management Techniques: Implementing stop-loss orders and regularly rebalancing your portfolio can help to manage risk effectively. These techniques can help protect against substantial losses during potential market downturns.

-

Monitoring Key Economic Indicators: Closely monitoring key economic indicators, such as inflation, interest rates, and GDP growth, is vital to assessing the overall market environment and adjusting investment strategies accordingly.

BofA's Suggested Investment Strategies for High Valuation Environments

BofA's suggested strategies for navigating high-valuation environments often involve a balanced approach.

-

Asset Allocation: They typically recommend a diversified portfolio, adjusting the asset allocation based on individual risk tolerance and investment goals. This could involve shifting some assets towards bonds or other less volatile investments.

-

Sector Recommendations: BofA's sector-specific recommendations frequently emphasize quality and growth in less-cyclical industries. They often advise investors to focus on companies with strong balance sheets and durable competitive advantages.

-

Alternative Investments: Depending on the market context and individual investor profile, BofA may suggest considering alternative investments such as infrastructure or certain types of real estate as a means of diversification.

Conclusion

BofA's rationale for a cautiously optimistic outlook on high stock valuations hinges on a careful assessment of several factors, including corporate earnings, interest rates, and investor sentiment. They acknowledge the inherent risks associated with high stock market valuations, emphasizing the need for diversification and robust risk management strategies. Understanding BofA's analysis and its implications is paramount to developing a well-informed investment strategy. To effectively manage high stock valuations and develop a resilient investment portfolio tailored to your needs, we encourage you to delve deeper into BofA's research and investment recommendations. Carefully consider their rationale and develop a well-informed investment strategy for navigating the complexities of managing high stock valuations and strategies for high market valuations.

Featured Posts

-

Teslas Q1 Earnings Fall Musks Political Backlash Takes Toll

Apr 24, 2025

Teslas Q1 Earnings Fall Musks Political Backlash Takes Toll

Apr 24, 2025 -

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 24, 2025

La Palisades Wildfires Which Celebrities Lost Their Homes

Apr 24, 2025 -

The Urgent Need For Fiscal Responsibility In Canadas Economic Plan

Apr 24, 2025

The Urgent Need For Fiscal Responsibility In Canadas Economic Plan

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Malfunction

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Subsystem Malfunction

Apr 24, 2025 -

Turning Poop Into Profit How Ai Digests Repetitive Scatological Documents For Podcast Success

Apr 24, 2025

Turning Poop Into Profit How Ai Digests Repetitive Scatological Documents For Podcast Success

Apr 24, 2025