The Urgent Need For Fiscal Responsibility In Canada's Economic Plan

Table of Contents

The Mounting National Debt and its Consequences

Canada's national debt continues to rise, exceeding [Insert current statistic on Canada's national debt and debt-to-GDP ratio]. This trajectory is unsustainable and poses several serious risks:

- Impact on future generations: The burden of repaying this debt will fall heavily on future Canadians, limiting their access to essential public services like healthcare and education. A large national debt essentially mortgages the future prosperity of the country.

- Increased interest payments crowding out other spending: A significant portion of government revenue is already dedicated to servicing the debt, leaving less money available for crucial investments in infrastructure, healthcare, and education. This "crowding out" effect severely restricts government's ability to address pressing societal needs.

- Risk of a credit rating downgrade and higher borrowing costs: Continued high levels of debt increase the risk of a credit rating downgrade, leading to higher borrowing costs for the government and making it even more expensive to manage the debt. This could create a vicious cycle of increasing debt and higher interest payments.

- Reduced government flexibility to respond to crises: A heavily indebted government has less fiscal room to maneuver in responding to unexpected economic shocks or crises, such as recessions or pandemics. This lack of flexibility compromises Canada's economic resilience.

These consequences highlight the critical need for immediate action to address Canada's escalating national debt and improve fiscal sustainability. Keywords: Canadian national debt, fiscal deficit, government spending, economic sustainability, credit rating

Inefficient Government Spending and Waste

While increased revenue through taxation might seem like a solution, addressing inefficient government spending and waste is equally crucial for achieving fiscal responsibility. Significant improvements can be made in the following areas:

- Examples of wasteful spending or programs with low returns on investment: [Provide specific examples of government programs or spending areas identified as inefficient or wasteful by independent audits or reports. Include links to reputable sources if possible]. A thorough review and evaluation of government programs are essential to identify areas ripe for reform and cost-saving measures.

- The need for greater transparency and accountability in government spending: Increased transparency in government budgeting and spending is vital to ensure public funds are used effectively and efficiently. Independent audits and public access to financial data are key components of accountability.

- Potential for cost-saving measures through improved procurement and administrative processes: Streamlining procurement processes and improving administrative efficiency can lead to significant cost savings. Implementing modern technologies and best practices in these areas can contribute significantly to fiscal responsibility.

By eliminating wasteful spending and improving efficiency, the government can free up resources for essential services and reduce the overall fiscal burden. Keywords: Government efficiency, public spending, waste reduction, fiscal accountability, program evaluation

The Importance of Long-Term Fiscal Planning

Reactive fiscal management is insufficient; Canada needs a proactive and strategic approach to long-term fiscal planning. This involves:

- Developing realistic budget forecasts and projections: Accurate and realistic budget forecasts are fundamental to sound fiscal planning. These should consider potential economic shocks and incorporate contingency plans to manage unforeseen circumstances.

- Implementing sustainable fiscal policies for long-term economic stability: Long-term fiscal planning requires the implementation of sustainable policies that prioritize economic stability and growth. This includes managing debt levels, controlling spending, and ensuring that government revenue keeps pace with expenses.

- Prioritizing investments in infrastructure and human capital: Strategic investments in infrastructure (transportation, communication, energy) and human capital (education, skills development) are crucial for long-term economic growth and competitiveness.

- The need for a multi-year fiscal plan that transcends political cycles: A long-term fiscal plan should be designed to transcend short-term political cycles, ensuring the implementation of sustainable fiscal policies for the long-term benefit of the country.

These measures are vital for fostering economic stability and creating a foundation for sustained economic growth. Keywords: Fiscal planning, long-term budgeting, economic stability, infrastructure investment, human capital

Potential Solutions for Improved Fiscal Responsibility

Achieving fiscal responsibility requires a multi-pronged approach encompassing several key strategies:

- Implementing tax reforms to broaden the tax base or increase efficiency: Reviewing the existing tax system to identify areas for improvement and exploring options to broaden the tax base or enhance tax collection efficiency can increase government revenue without necessarily increasing the tax burden on individuals or businesses.

- Controlling the growth of government spending: Careful examination and prioritization of government spending are essential for controlling growth and ensuring that resources are allocated effectively and efficiently.

- Prioritizing investments that deliver the highest social and economic returns: Focus should be placed on investments with the greatest potential for positive social and economic outcomes, maximizing the return on investment for public funds.

- Strengthening independent fiscal oversight and accountability mechanisms: Independent bodies should play a vital role in monitoring government spending, conducting audits, and providing objective assessments of the government's fiscal performance.

These solutions require political will and a commitment to long-term vision, but are crucial for securing Canada's economic future. Keywords: Tax reform, spending cuts, fiscal consolidation, economic growth, responsible government

Conclusion: A Call for Fiscal Responsibility in Canada's Future

Canada's fiscal challenges are significant, but not insurmountable. The arguments presented above clearly demonstrate the urgent need for fiscal responsibility in Canada. Failure to address the mounting national debt, inefficient spending, and lack of long-term planning will have dire consequences for future generations. We must demand responsible fiscal management from our government, embracing sustainable fiscal planning and sound fiscal policies to ensure a secure economic future for Canada. Let's engage in informed discussions and hold our elected officials accountable for implementing the necessary reforms to ensure Canada's long-term economic prosperity. The time for action is now.

Featured Posts

-

Kci Johna Travolte Ella I Njezina Zapanjujuca Transformacija

Apr 24, 2025

Kci Johna Travolte Ella I Njezina Zapanjujuca Transformacija

Apr 24, 2025 -

A Comprehensive Guide To The Countrys Newest Business Hotspots

Apr 24, 2025

A Comprehensive Guide To The Countrys Newest Business Hotspots

Apr 24, 2025 -

Hudsons Bay Reports High Demand For 65 Leases

Apr 24, 2025

Hudsons Bay Reports High Demand For 65 Leases

Apr 24, 2025 -

A Fathers Remembrance John Travoltas Birthday Post For His Late Son Jett

Apr 24, 2025

A Fathers Remembrance John Travoltas Birthday Post For His Late Son Jett

Apr 24, 2025 -

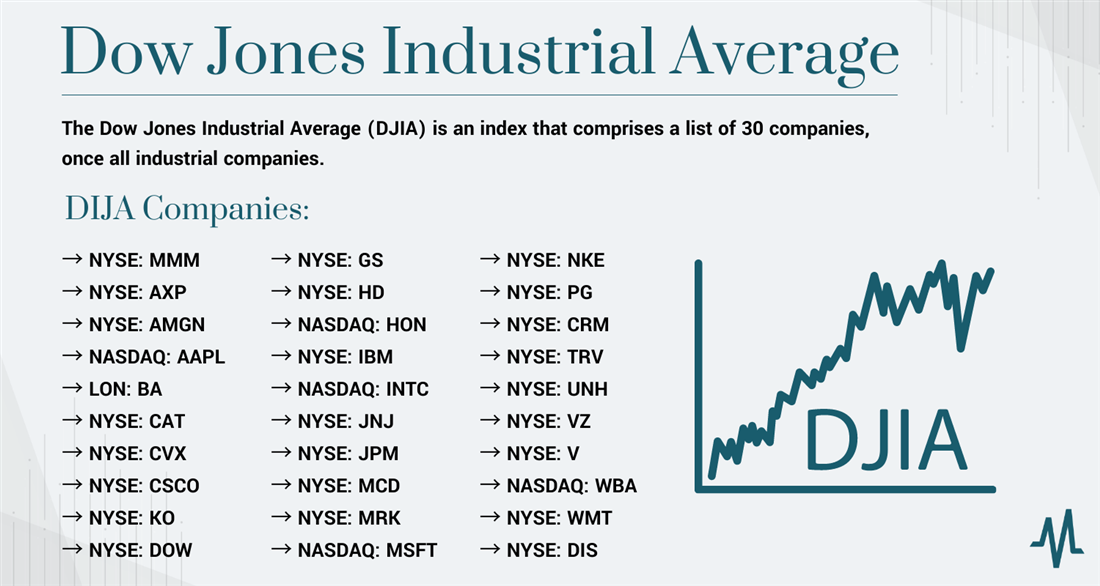

Todays Stock Market Dow S And P 500 April 23rd Analysis

Apr 24, 2025

Todays Stock Market Dow S And P 500 April 23rd Analysis

Apr 24, 2025