Canada's Fiscal Future: A Vision For Responsible Spending

Table of Contents

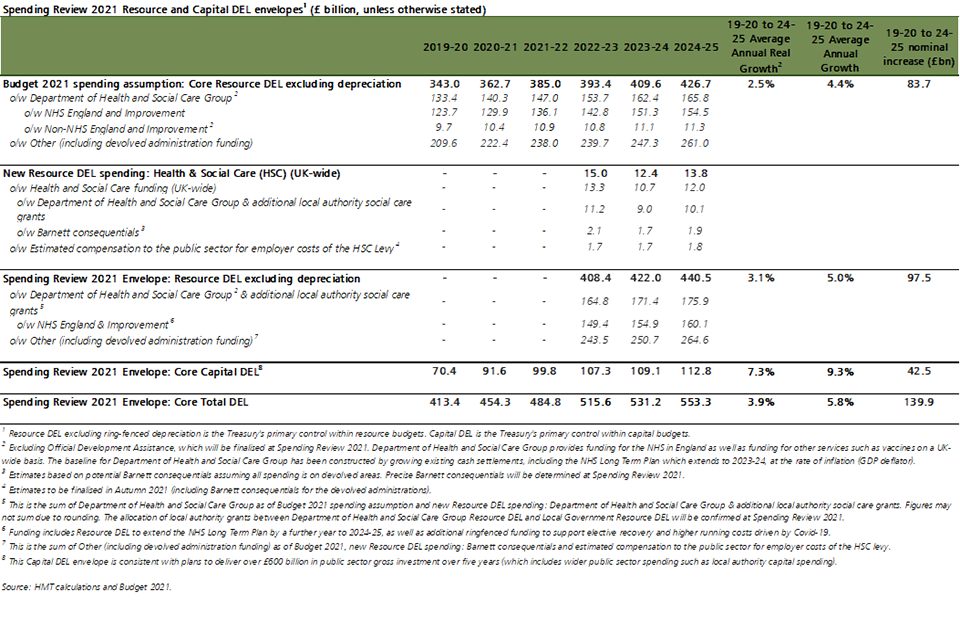

The Current State of Canada's Finances

Government Debt and Deficit

Canada's government debt continues to grow, impacting our fiscal sustainability. The recent economic downturns, exacerbated by the COVID-19 pandemic, have significantly increased the budget deficit Canada faces. This, coupled with the rising costs associated with an aging population and escalating healthcare expenditures, presents a formidable challenge.

- Impact of Past Economic Downturns: Recessions necessitate increased government spending on social programs and economic stimulus, leading to larger deficits and accumulating debt.

- Aging Population: The increasing proportion of seniors requires greater investment in healthcare, pensions, and social services, placing further strain on government finances.

- Rising Healthcare Costs: The cost of healthcare in Canada is consistently rising, driven by technological advancements, an aging population, and increased demand for services. This necessitates significant and ongoing budgetary allocations. Effective management of Canadian government debt is crucial to address these challenges.

These factors contribute to concerns regarding Canada's fiscal sustainability and necessitate a strategic approach to managing the Canadian government debt.

Revenue Generation and Tax Policy

Current Canadian tax policy needs careful evaluation. While various taxes contribute to government revenue, optimizing revenue generation requires a multi-pronged approach. Exploring avenues for revenue enhancement is crucial for achieving fiscal responsibility.

- Tax Reforms: Targeted tax reforms could improve efficiency and equity, ensuring a fairer distribution of the tax burden while maximizing revenue collection.

- Closing Tax Loopholes: Identifying and closing loopholes in the tax system can significantly increase government revenue without imposing additional taxes on individuals or businesses.

- Exploring New Revenue Streams: The government should explore new revenue streams, such as carbon taxes or levies on environmentally damaging practices, while carefully considering their potential economic and social impact. Effective Canadian tax policy is vital for long-term fiscal health.

Prioritizing Essential Public Services

Healthcare Spending

Canada's healthcare system faces numerous challenges, including long wait times, regional disparities in access, and escalating costs. Efficient and effective resource allocation is critical to ensuring the sustainability of Canadian healthcare spending.

- Improving Healthcare Technology: Investing in advanced medical technology can enhance efficiency, improve diagnostic accuracy, and ultimately reduce costs in the long run.

- Streamlining Administrative Processes: Reducing administrative burdens on healthcare professionals can free up resources and improve the overall efficiency of the healthcare system.

- Investing in Preventative Care: A proactive approach to preventative care can reduce the incidence of chronic diseases and lower healthcare costs in the long term. This requires strategic investment in public health programs and education initiatives. Efficient management of Canadian healthcare spending is crucial for ensuring accessible and high-quality healthcare for all citizens.

Infrastructure Investment

Strategic infrastructure investment is vital for long-term economic growth and prosperity in Canada. Investing in modern and efficient infrastructure is crucial for enhancing productivity, creating jobs, and attracting foreign investment.

- Transportation Networks: Investments in roads, bridges, railways, and public transit are crucial for facilitating trade, connecting communities, and improving the overall efficiency of the economy.

- Communication Networks: Upgrading communication networks, including broadband internet access, is essential for supporting economic activity, education, and healthcare delivery.

- Renewable Energy Infrastructure: Investments in renewable energy infrastructure are essential for mitigating climate change and creating a sustainable energy future. Public-private partnerships can play a significant role in funding and managing large-scale infrastructure projects. Careful planning of Canadian infrastructure spending is essential for building a resilient and sustainable economy.

Strategies for Fiscal Responsibility

Spending Efficiency and Accountability

Improving government spending efficiency and enhancing accountability mechanisms is paramount for responsible fiscal management. This requires a commitment to transparency, effective oversight, and performance-based budgeting.

- Performance-Based Budgeting: Shifting from a focus on input to outcomes can improve the efficiency and effectiveness of government programs.

- Independent Audits: Regular independent audits of government spending can help identify areas for improvement and ensure accountability.

- Transparency Initiatives: Making government spending data publicly available promotes transparency and encourages public scrutiny, leading to greater accountability. Improving government spending efficiency in Canada is essential for building public trust and ensuring responsible use of taxpayer money.

Long-Term Fiscal Planning

Long-term fiscal planning is crucial for mitigating future risks and ensuring Canada's fiscal sustainability. This requires proactive adaptation to economic changes and careful consideration of demographic trends.

- Multi-Year Budgeting: Adopting multi-year budgeting allows for better long-term planning and resource allocation.

- Scenario Planning: Developing various scenarios to anticipate potential future challenges allows for proactive adjustments to fiscal policy.

- Proactive Adaptation to Economic Changes: Continuously monitoring economic conditions and adapting fiscal policies accordingly is crucial for navigating unexpected economic shocks. Long-term fiscal planning in Canada is vital for building a resilient and stable economy.

Conclusion

Canada's fiscal future requires a proactive and responsible approach to managing government finances. Addressing the challenges of rising debt, an aging population, and increasing demands on public services necessitates a concerted effort to improve spending efficiency, enhance accountability, and prioritize essential public services. By implementing the strategies outlined above, including strategic infrastructure investment, effective tax policies, and long-term fiscal planning, Canada can secure its fiscal future and build a more prosperous and sustainable nation. Understanding Canada's fiscal future is crucial for every Canadian. Let's work together to ensure responsible spending and build a sustainable economic future for our nation, securing Canada's fiscal outlook for generations to come.

Featured Posts

-

Understanding High Stock Market Valuations A Bof A Investors Guide

Apr 24, 2025

Understanding High Stock Market Valuations A Bof A Investors Guide

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Thursday February 20 Steffy Liam And Finns Fate

Apr 24, 2025

The Bold And The Beautiful Spoilers Thursday February 20 Steffy Liam And Finns Fate

Apr 24, 2025 -

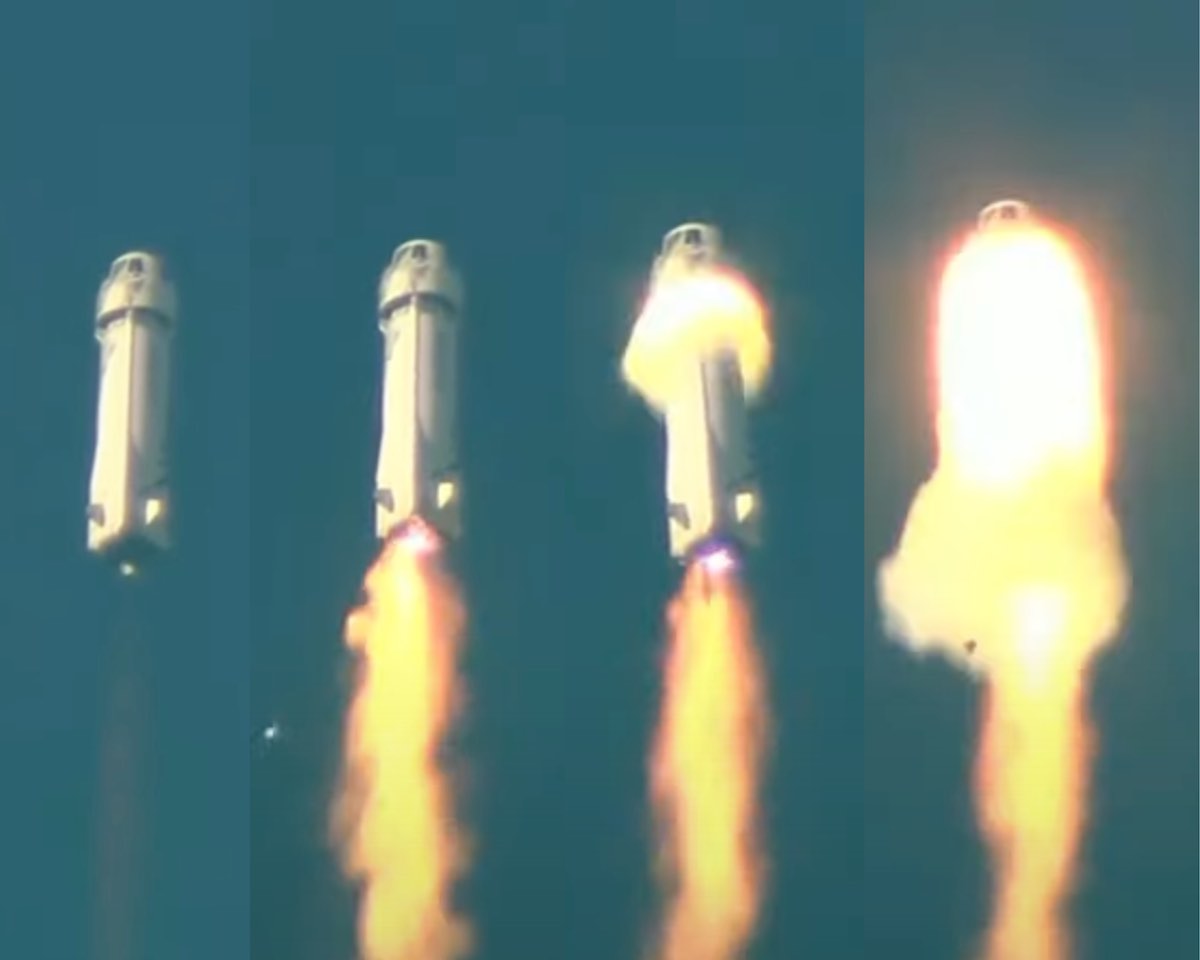

Vehicle Subsystem Issue Halts Blue Origin Rocket Launch

Apr 24, 2025

Vehicle Subsystem Issue Halts Blue Origin Rocket Launch

Apr 24, 2025 -

Us Trade War Canadian Auto Dealers Strategic Response

Apr 24, 2025

Us Trade War Canadian Auto Dealers Strategic Response

Apr 24, 2025