Understanding High Stock Market Valuations: A BofA Investor's Guide

Table of Contents

Key Valuation Metrics: Decoding the Numbers

Understanding whether the stock market is overvalued requires analyzing key valuation metrics. These metrics provide insights into the relationship between a company's price and its underlying fundamentals. For BofA investors, mastering these tools is crucial for making sound investment choices.

-

Price-to-Earnings ratio (P/E): This classic metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio might suggest the stock is overvalued, while a low P/E ratio could indicate undervaluation. However, it's crucial to compare P/E ratios within the same industry, as different sectors have different typical ranges. For example, a high-growth technology company might have a higher P/E ratio than a utility company. Understanding industry benchmarks is critical when interpreting P/E ratios for your BofA portfolio.

-

Price-to-Sales ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies that are not yet profitable, as it focuses on revenue generation. A high P/S ratio might suggest the market anticipates significant future growth, but it also carries greater risk. BofA clients often utilize P/S ratios when considering investments in high-growth sectors.

-

Price-to-Book ratio (P/B): The P/B ratio compares a company's market value to its book value (assets minus liabilities). A low P/B ratio might suggest undervaluation, particularly if the company possesses significant undervalued assets. Conversely, a high P/B ratio could indicate overvaluation. Careful analysis of a company's balance sheet is essential when using this metric within your BofA investment strategy.

-

PEG ratio: This metric combines the P/E ratio with the company's expected earnings growth rate. It provides a more nuanced valuation picture than the P/E ratio alone by accounting for future growth potential. A lower PEG ratio generally suggests a more attractive investment opportunity. BofA advisors often incorporate PEG ratios into their assessments of growth stocks.

Using these metrics in conjunction allows for a more comprehensive assessment of whether a stock or the overall market is overvalued. Remember that no single metric provides a definitive answer; a holistic approach is necessary.

Factors Contributing to High Stock Market Valuations

Several factors can contribute to high stock market valuations. Understanding these factors is crucial for a BofA investor to make informed decisions and manage risk effectively.

-

Low interest rates: Low interest rates make borrowing cheaper, encouraging companies to invest and expand. This increased investment activity can boost corporate earnings and drive up stock prices. Additionally, low yields on bonds make equities a more attractive investment option, increasing demand.

-

Quantitative easing (QE): QE programs inject liquidity into the financial system, increasing the money supply and potentially driving up asset prices, including stocks. The impact of QE on market valuations can be significant and needs careful consideration for any long-term investment strategy with BofA.

-

Strong corporate earnings: When companies report strong and consistently growing profits, investors are more likely to bid up stock prices, leading to higher valuations. This positive feedback loop is a key driver of bull markets. Analyzing corporate earnings reports is a critical component of understanding current market valuations.

-

Investor sentiment and market psychology: Market psychology plays a significant role. Periods of optimism and exuberance can lead to inflated valuations, while fear and pessimism can cause sharp market corrections. Understanding the prevailing market sentiment is key to navigating periods of high valuations.

-

Speculative bubbles: Sometimes, investor enthusiasm can create speculative bubbles where asset prices are driven far beyond their fundamental value. Identifying potential speculative bubbles is challenging but crucial for mitigating risk.

Risks Associated with High Valuations

High stock market valuations inherently carry increased risk. BofA investors need to be aware of these potential downsides.

-

Market corrections: High valuations are often followed by market corrections – sharp declines in asset prices. These corrections can be triggered by various factors, including rising interest rates, economic slowdowns, or shifts in investor sentiment. Historical examples show that these corrections can be substantial and impact portfolios significantly.

-

Volatility: A market with high valuations tends to exhibit increased volatility. This means that stock prices can fluctuate more dramatically in both directions, increasing the risk of short-term losses. Understanding volatility is crucial for managing risk within your BofA investment account.

-

Risk of capital loss: During periods of high valuations, the risk of capital loss is elevated. If the market corrects, investors who bought at high prices could experience significant losses. Having a well-defined risk tolerance is essential in such market conditions.

-

Protecting your portfolio during a downturn: Implementing strategies like diversification and defensive investing can help mitigate the impact of a market downturn. Regularly rebalancing your portfolio can also help manage risk effectively.

Strategies for BofA Investors in a High-Valuation Market

Navigating a high-valuation market requires a strategic approach. BofA offers a range of options to help investors manage risk and potentially capitalize on opportunities.

-

Diversification: Spreading your investments across various asset classes (stocks, bonds, real estate, etc.) is a fundamental risk management strategy. Diversification can help reduce the impact of losses in any single asset class. BofA provides a wide range of investment options to facilitate diversification.

-

Value investing: This strategy involves identifying undervalued companies whose stock prices don't fully reflect their intrinsic worth. Thorough fundamental analysis is crucial for successful value investing. BofA advisors can provide guidance on identifying such opportunities.

-

Defensive investing: This approach prioritizes capital preservation over high returns. It typically involves investing in less volatile assets, such as high-quality bonds or dividend-paying stocks. BofA offers several defensive investment options suitable for risk-averse investors.

-

Rebalancing your portfolio: Regularly reviewing and rebalancing your portfolio to maintain your target asset allocation can help you manage risk and take advantage of market fluctuations. BofA offers tools and resources to assist with portfolio rebalancing.

-

Considering BofA's investment options: BofA provides a variety of investment products and services tailored to different risk profiles and investment goals. Consulting with a BofA financial advisor can help you identify the best options for your specific situation.

Conclusion

High stock market valuations present both opportunities and risks. Understanding key valuation metrics, contributing factors, and potential risks is crucial for making informed investment decisions. By employing appropriate strategies like diversification and value investing, BofA investors can navigate these challenging market conditions effectively. Remember to regularly review your portfolio and adjust your strategy as needed.

Call to Action: Learn more about managing your portfolio during periods of high stock market valuations. Contact your BofA financial advisor today to discuss your investment strategy and explore tailored solutions for your specific financial goals. Understanding high stock market valuations is key to successful long-term investing with BofA.

Featured Posts

-

Double Strike Cripples Hollywood Writers And Actors Demand Fair Contracts

Apr 24, 2025

Double Strike Cripples Hollywood Writers And Actors Demand Fair Contracts

Apr 24, 2025 -

B And B April 9 Recap Steffy Blames Bill Finns Icu Visit And Liams Demand For Confidentiality

Apr 24, 2025

B And B April 9 Recap Steffy Blames Bill Finns Icu Visit And Liams Demand For Confidentiality

Apr 24, 2025 -

The Future Of Birth Control Otc Access In A Post Roe World

Apr 24, 2025

The Future Of Birth Control Otc Access In A Post Roe World

Apr 24, 2025 -

Easing Trade Tensions Boost Chinese Stocks In Hong Kong

Apr 24, 2025

Easing Trade Tensions Boost Chinese Stocks In Hong Kong

Apr 24, 2025 -

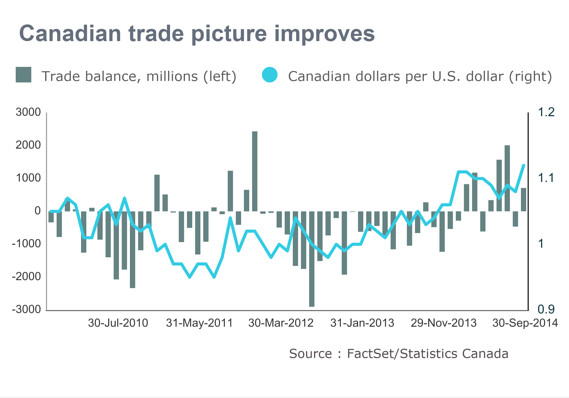

Loonie Falls Despite Greenback Strength Currency Market Analysis

Apr 24, 2025

Loonie Falls Despite Greenback Strength Currency Market Analysis

Apr 24, 2025