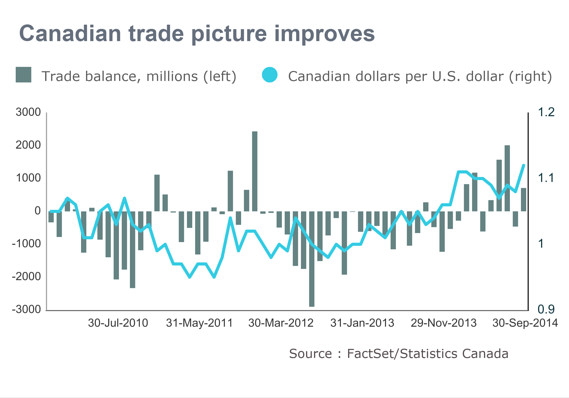

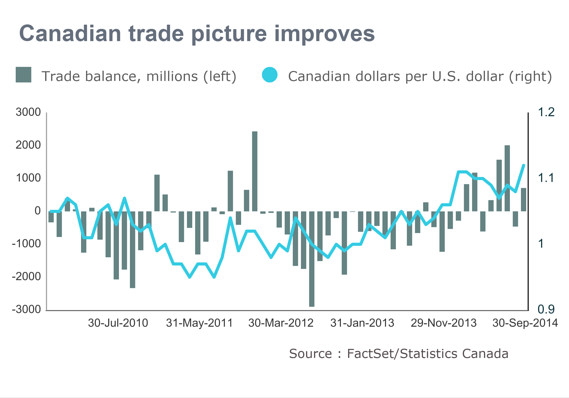

Loonie Falls Despite Greenback Strength: Currency Market Analysis

Table of Contents

Weakening Canadian Economic Indicators

Several weakening Canadian economic indicators have contributed to the Loonie's recent decline. Understanding these factors is crucial for navigating the currency market and making informed decisions about forex trading.

Lower-than-Expected GDP Growth

- Canada's GDP growth has recently fallen below expectations, impacting investor confidence and putting downward pressure on the Loonie. For example, Q2 2024 saw a growth rate of only 1.2%, significantly lower than the projected 2%.

- Contributing factors include a global economic slowdown, impacting Canadian exports, and domestic challenges such as supply chain disruptions and labor shortages.

- A lower GDP generally indicates a weaker economy, making the currency less attractive to investors, thus leading to a decrease in its value against stronger currencies like the USD.

Inflation Concerns

- Persistent inflation in Canada remains a significant concern. While inflation rates have begun to moderate, they still remain above the Bank of Canada's target rate. For instance, the current inflation rate stands at 3.5%, whereas the target is 2%.

- Compared to the US inflation rate, which is currently at 3%, Canada's relatively higher inflation erodes the purchasing power of the Loonie, making it less desirable in the forex market.

- The Bank of Canada's response to inflation, including potential interest rate hikes, impacts investor sentiment and influences the Loonie's value against the Greenback. Higher interest rates can attract foreign investment, but aggressive hikes can also signal economic weakness.

Commodity Price Fluctuations

- Canada's economy is heavily reliant on commodity exports, particularly oil and natural gas. Fluctuations in these commodity prices directly impact the Canadian economy and, consequently, the Loonie.

- Recent declines in oil prices, for example, have negatively impacted export revenues and dampened economic growth, further weakening the Loonie.

- The correlation between commodity prices and the CAD's value is strong: when commodity prices rise, the Loonie tends to strengthen, and vice versa.

Strength of the US Dollar (Greenback)

The strength of the US dollar is another significant factor contributing to the Loonie's fall. Understanding the USD's role as a safe-haven currency and the impact of US interest rates is essential.

Safe-Haven Status

- The US dollar often acts as a safe-haven currency during times of global economic uncertainty or geopolitical instability. Investors tend to move their assets to the USD, considered a relatively stable currency, reducing demand for other currencies, including the CAD.

- Recent geopolitical events, such as escalating tensions in Eastern Europe, have increased investor demand for the USD, further strengthening it against the Loonie.

- Market volatility and uncertainty often drive investors towards the perceived safety of the Greenback, leading to a stronger USD and a weaker Loonie.

Higher US Interest Rates

- Higher interest rates in the US attract foreign investment, increasing demand for the USD and strengthening its value relative to other currencies, including the CAD.

- The current interest rate differential between the US and Canada is significant, with US rates exceeding Canadian rates. This makes US investments more attractive to international investors, strengthening the Greenback and weakening the Loonie.

- This capital inflow strengthens the USD as investors seek higher returns on their investments.

Other Contributing Factors

Several other factors play a role in influencing the CAD/USD exchange rate.

Geopolitical Risks

- Geopolitical risks and uncertainties, such as trade disputes or international conflicts, can negatively impact investor confidence in the Canadian economy and weaken the Loonie.

- For example, escalating trade tensions between Canada and other major trading partners can lead to decreased export demand and consequently affect the Loonie's value.

Trade Relations

- The state of Canada's trade relations with its key trading partners, particularly the US and China, significantly influences the Canadian economy and the Loonie's value.

- Any disruptions or uncertainties in these trade relationships can lead to decreased export revenues and negatively impact the Canadian economy, ultimately weakening the Loonie.

Conclusion

The recent fall of the Loonie, despite the strong Greenback, is a result of a complex interplay of factors. Weakening Canadian economic indicators, including slower-than-expected GDP growth, persistent inflation concerns, and fluctuating commodity prices, have contributed to a weaker Loonie. Simultaneously, the strength of the US dollar, driven by its safe-haven status and higher interest rates, has further exacerbated the situation. Geopolitical risks and trade relations also play a role. Understanding these dynamics is key to navigating the complexities of the currency market. Stay informed about fluctuations in the Loonie and the USD by regularly reviewing currency market analysis. Understanding the dynamics of the Loonie and the Greenback is crucial for navigating the complexities of the currency market. Continue learning about factors affecting the Loonie/USD exchange rate to make informed decisions in currency trading and investment strategies.

Featured Posts

-

Canadas Economic Outlook The Importance Of Fiscal Prudence

Apr 24, 2025

Canadas Economic Outlook The Importance Of Fiscal Prudence

Apr 24, 2025 -

Tarantino I Travolta Jedno Filmsko Djelo Koje Je Proslo Nezapazeno

Apr 24, 2025

Tarantino I Travolta Jedno Filmsko Djelo Koje Je Proslo Nezapazeno

Apr 24, 2025 -

Potential Sale Of Chip Tester Utac By Chinese Buyout Firm

Apr 24, 2025

Potential Sale Of Chip Tester Utac By Chinese Buyout Firm

Apr 24, 2025 -

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025 -

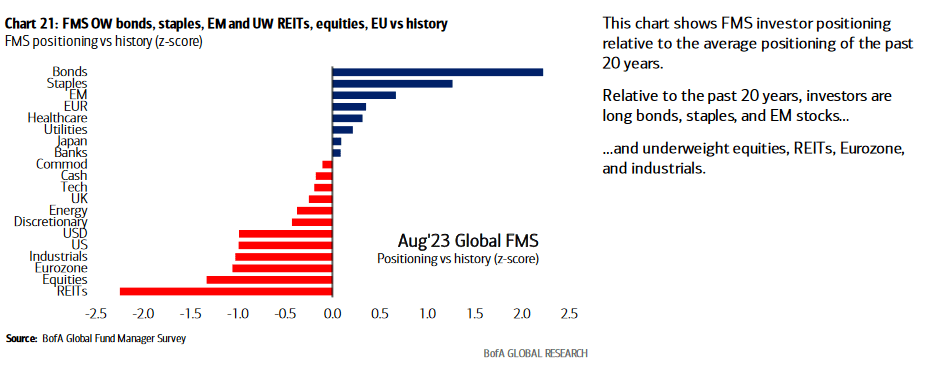

Are High Stock Market Valuations Justified Bof As Analysis For Investors

Apr 24, 2025

Are High Stock Market Valuations Justified Bof As Analysis For Investors

Apr 24, 2025