Are High Stock Market Valuations Justified? BofA's Analysis For Investors

Table of Contents

BofA's Key Arguments for High Valuations

BofA's analysis presents several arguments supporting the current high stock market valuations. While some skepticism remains, understanding these arguments is crucial for any investor.

Strong Corporate Earnings

BofA highlights robust corporate earnings as a key justification for high stock market valuations. Their analysis points to impressive revenue growth and healthy profit margins across various sectors.

- Technology Sector Strength: BofA cites a significant year-over-year increase in profits within the technology sector, driven by strong demand for software, cloud services, and semiconductors. Specific data points from their report, while unavailable publicly here, would strengthen this claim further.

- Healthcare Sector Resilience: The healthcare sector also demonstrates robust growth, fueled by advancements in biotechnology and increasing healthcare spending. Again, access to BofA's specific data would provide greater detail.

- Counterarguments: It's essential to acknowledge counterarguments. While current earnings are strong, some argue this growth is unsustainable in the long term and may be partially cyclical, driven by temporary factors. A deeper dive into BofA's analysis would clarify their view on the sustainability of this growth.

Low Interest Rates and Monetary Policy

The low interest rate environment significantly impacts stock valuations. BofA's analysis underscores the Federal Reserve's monetary policy's influence on investor behavior.

- Attractive Returns: Low interest rates make bonds and other fixed-income investments less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand drives up stock prices.

- Stimulative Effect: BofA likely emphasizes the stimulative effect of low interest rates on economic growth, potentially leading to increased corporate earnings and justifying higher stock valuations.

- Risk Assessment: However, the prolonged period of low interest rates presents risks. BofA may highlight concerns about potential future inflation or the limitations of this policy's long-term effectiveness.

Technological Innovation and Growth

BofA emphasizes the transformative potential of technological advancements in driving long-term market growth and justifying higher valuations.

- AI and Automation: The rapid advancements in artificial intelligence (AI) and automation are cited as key drivers of productivity growth and increased corporate earnings, supporting high valuations.

- Sustainable Technologies: Investments in sustainable and renewable energy technologies also contribute positively to long-term market growth and attract investors seeking environmentally responsible investments.

- Challenges and Limitations: It's crucial to acknowledge that the reliance on technological innovation alone to justify high valuations presents challenges. Unforeseen technological disruptions or slower-than-expected adoption rates could impact these projections.

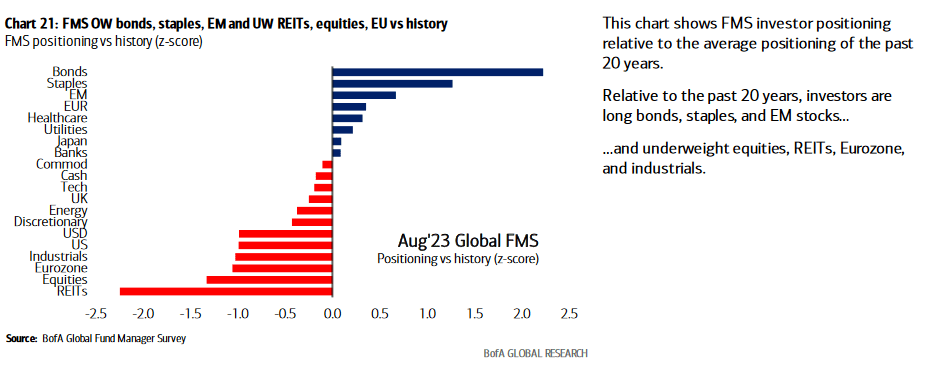

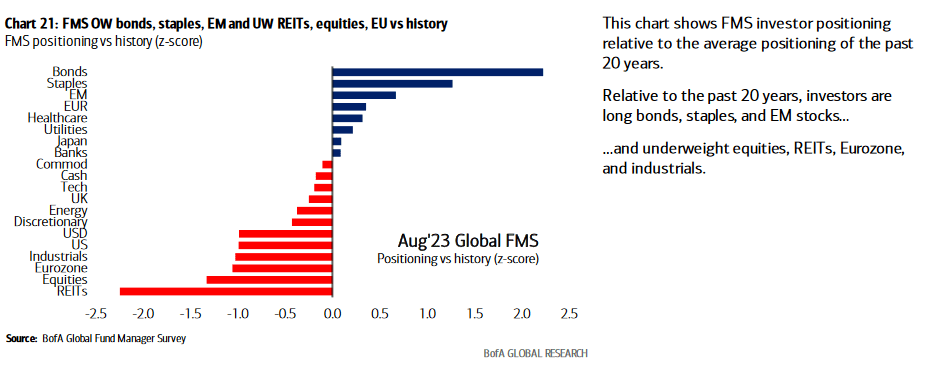

BofA's Concerns Regarding High Valuations

While BofA identifies factors supporting high stock market valuations, they also acknowledge potential risks and concerns.

High Price-to-Earnings Ratios (P/E)

BofA's assessment likely includes an examination of current P/E ratios across various sectors. High P/E ratios can signal an overvalued market.

- Sector-Specific Variations: BofA may point to specific sectors with exceptionally high P/E ratios, suggesting a higher risk of correction in those areas.

- Risk Mitigation: BofA might recommend strategies to mitigate this risk, such as diversifying investments across different sectors or focusing on undervalued companies with lower P/E ratios.

- Historical Comparisons: A comparison of current P/E ratios to historical averages would provide valuable context for evaluating market valuation levels.

Geopolitical and Economic Uncertainty

Geopolitical risks and global economic uncertainty significantly impact stock market valuations.

- Global Trade Tensions: BofA's analysis likely considers the potential impact of ongoing geopolitical tensions, such as trade disputes and political instability, on market confidence and valuations.

- Inflationary Pressures: Rising inflation poses a threat to corporate profitability and could lead to a reassessment of stock market valuations.

- Market Corrections: BofA might foresee the potential for market corrections or downturns due to these uncertainties.

Potential for Inflation

Rising inflation erodes corporate profit margins and investor sentiment, impacting stock valuations.

- Impact on Earnings: BofA's analysis would likely explore the potential for inflation to squeeze profit margins, reducing the justification for high stock valuations.

- Interest Rate Hikes: The potential for the Federal Reserve to raise interest rates to combat inflation would further impact stock market valuations.

- Inflation-Hedging Strategies: BofA may suggest strategies for mitigating inflation risk, such as investing in inflation-protected securities or companies with pricing power.

BofA's Recommendations for Investors

BofA's recommendations are likely to emphasize a balanced and cautious approach given the current market conditions.

- Diversification: A diversified portfolio across various sectors and asset classes is likely recommended to mitigate risk.

- Value Investing: Focus on undervalued companies or sectors with strong fundamentals and reasonable P/E ratios could be suggested.

- Active Management: BofA might advocate for active portfolio management to adjust holdings based on ongoing market developments.

Conclusion

This article examined BofA's analysis of high stock market valuations, exploring both supporting arguments (strong earnings, low interest rates, technological innovation) and concerns (high P/E ratios, economic uncertainty, inflation). Understanding whether high stock market valuations are justified is crucial for informed investment decisions. To make the best decisions in this dynamic market, carefully consider BofA's insights and tailor your investment strategy accordingly. Continue researching and seeking expert advice to further your understanding of high stock market valuations and their implications for your portfolio. Remember, navigating the complexities of high stock market valuations requires diligent research and a well-defined investment strategy.

Featured Posts

-

Powell Job Secure Stock Futures React Positively To Trumps Remarks

Apr 24, 2025

Powell Job Secure Stock Futures React Positively To Trumps Remarks

Apr 24, 2025 -

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute A Moving Photo Marks Jett Travoltas 33rd Birthday

Apr 24, 2025 -

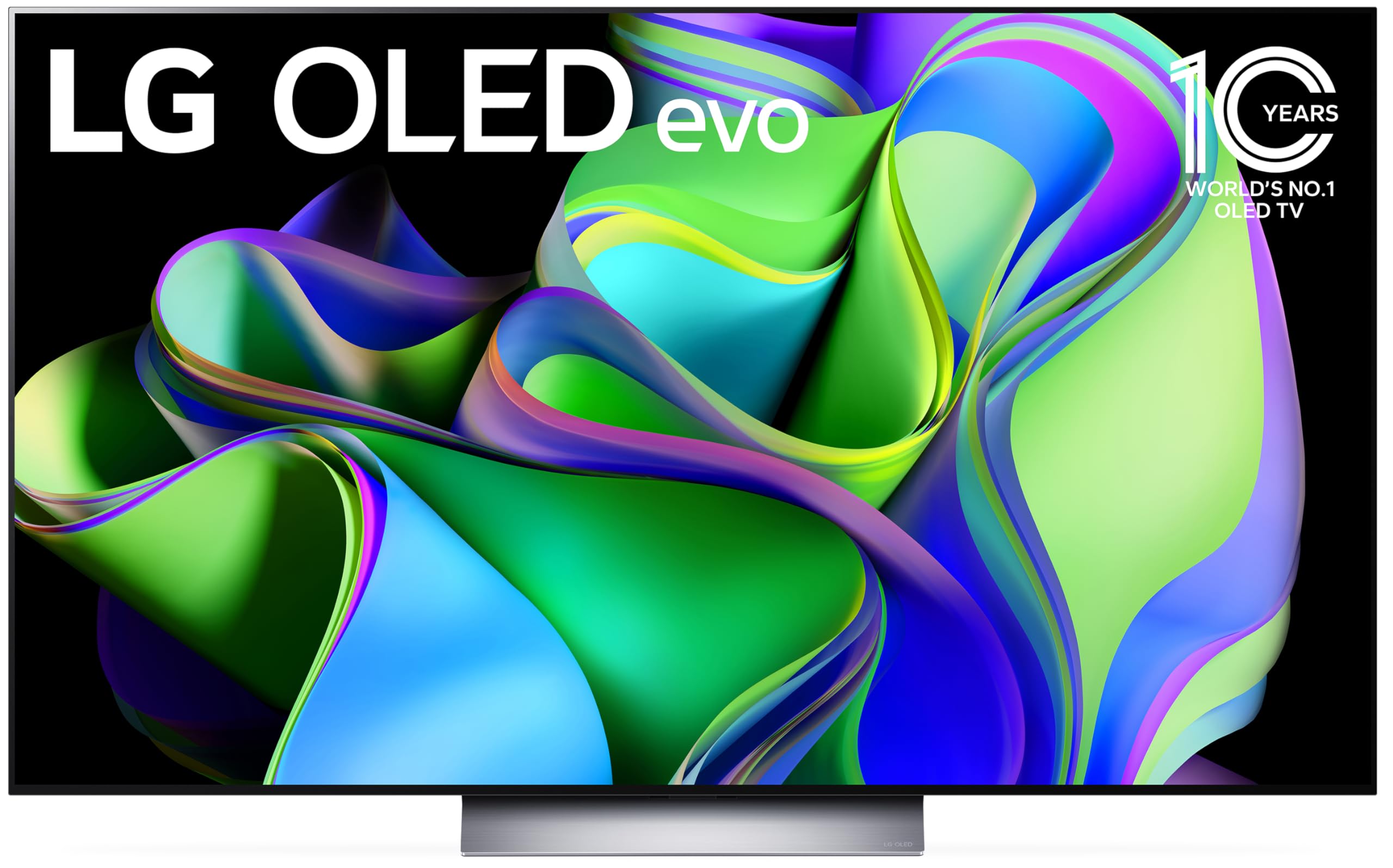

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025

My 77 Inch Lg C3 Oled Tv A Detailed Review

Apr 24, 2025 -

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025 -

The Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Impact Next 2 Weeks Preview

Apr 24, 2025

The Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Impact Next 2 Weeks Preview

Apr 24, 2025