Understanding Market Reactions: Professional Vs. Individual Investor Response

Table of Contents

Professional Investor Response to Market Reactions

Professional investors, such as fund managers, hedge fund managers, and institutional investors, approach market reactions with a fundamentally different mindset than individual investors. Their strategies are built on rigorous analysis, risk mitigation, and a long-term perspective.

Disciplined Approach and Risk Management

Professionals rely heavily on data-driven decision-making. They utilize sophisticated tools and methodologies to analyze market trends, predict potential risks, and make informed investment choices. This disciplined approach forms the bedrock of their response to market reactions.

- Utilize sophisticated algorithms: These algorithms analyze vast datasets to identify patterns and predict future price movements, allowing for proactive adjustments to portfolios.

- Employ hedging strategies: Hedging involves taking offsetting positions to reduce the impact of adverse market movements, limiting potential losses during periods of volatility.

- Diversify across asset classes (stocks, bonds, real estate, etc.): Diversification is a cornerstone of professional risk management, spreading investments across different asset classes to minimize the impact of losses in any single sector.

- Conduct thorough due diligence: Before investing, professionals undertake extensive research and analysis of companies, industries, and macroeconomic conditions to assess risk and potential returns.

Long-Term Perspective and Strategic Allocation

Unlike many individual investors, professionals typically adopt a long-term investment horizon. They focus on achieving consistent, sustainable growth over the long term, rather than chasing short-term gains. This long-term view allows them to weather short-term market reactions more effectively.

- Focus on fundamental analysis: They delve into the intrinsic value of assets, assessing factors like company earnings, management quality, and industry trends to make informed investment decisions.

- Adjust asset allocation based on market cycles: They strategically shift their portfolio allocations between asset classes based on prevailing economic conditions and market forecasts. This dynamic allocation helps them capitalize on opportunities and mitigate risks.

- Maintain a disciplined rebalancing strategy: Regularly rebalancing their portfolios ensures they stay aligned with their long-term investment objectives, even during periods of significant market volatility.

Access to Information and Resources

Professional investors enjoy access to a wealth of information and resources unavailable to the average individual. This advantage allows them to make better-informed decisions and react more effectively to market reactions.

- Access to Bloomberg terminals: These sophisticated data terminals provide real-time market data, news, and analytical tools, giving professionals a significant informational edge.

- In-depth market research reports: Professional investors often subscribe to premium research services that offer detailed analysis and forecasts on various market sectors and investment opportunities.

- Connections with industry experts: They often have extensive networks of contacts, providing valuable insights and perspectives on market trends and potential investment opportunities.

- Ability to invest in alternative assets: Professionals have access to a wider range of investment vehicles, including hedge funds, private equity, and other alternative assets, providing greater diversification options.

Individual Investor Response to Market Reactions

Individual investors, on the other hand, often approach the markets with a different set of considerations, influenced by emotions, limited resources, and a shorter-term focus. Understanding their typical response to market reactions is crucial for navigating the investment landscape effectively.

Emotional Influence and Behavioral Biases

Individual investors are frequently swayed by emotions such as fear and greed, leading to impulsive decisions and potentially poor investment outcomes. Behavioral biases further exacerbate these emotional responses.

- Prone to panic selling during market downturns: Fear often drives individual investors to sell their assets at the worst possible time, locking in losses and missing out on potential recovery.

- Likely to chase hot stocks: The allure of quick profits can lead to investing in overvalued assets, increasing the risk of significant losses.

- Susceptible to market manipulation and hype: Individual investors are often more vulnerable to market manipulation and misleading information, leading to ill-informed investment decisions.

Limited Resources and Information

Individual investors typically have more limited resources and access to information compared to professionals. This can significantly impact their ability to effectively react to market reactions.

- Reliance on news articles and social media: They may rely on readily available information from news sources and social media, which can be biased, incomplete, or even misleading.

- Limited access to sophisticated investment tools: Individual investors may lack the access to advanced analytical tools and resources that professionals utilize to assess risk and make informed investment decisions.

- Difficulty in understanding complex financial products: The complexity of certain financial instruments can make it difficult for individual investors to understand the associated risks and potential returns.

Short-Term Focus and Speculative Trading

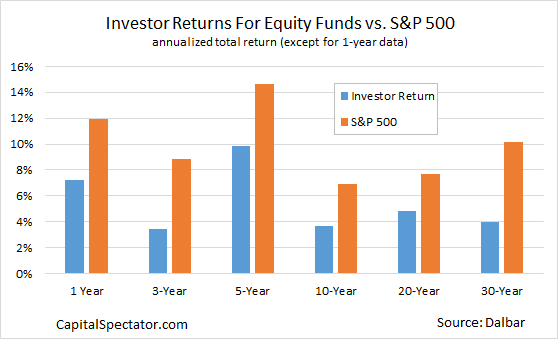

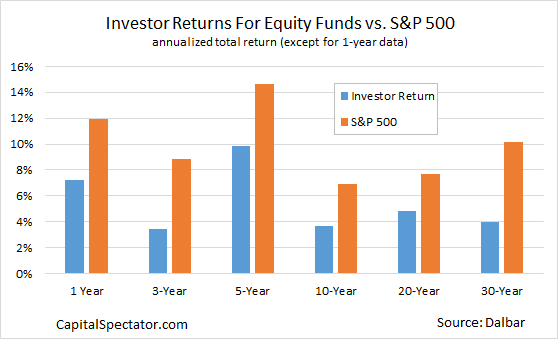

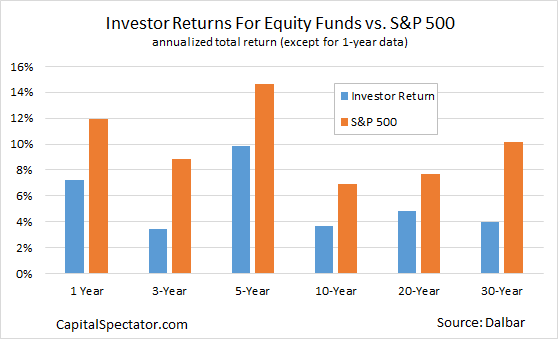

Many individual investors prioritize short-term gains and speculative trading, which significantly increases their exposure to market volatility. This approach often contrasts sharply with the long-term focus of professional investors.

- Day trading: Frequent buying and selling of securities within a single day exposes investors to significant risks and high transaction costs.

- Frequent buying and selling: A high turnover rate in a portfolio can lead to substantial transaction costs and erode investment returns.

- Higher susceptibility to market volatility: Short-term focused strategies make individual investors more vulnerable to the negative impacts of market fluctuations.

Conclusion

Understanding the differences in how professional and individual investors react to market reactions is essential for informed decision-making. Professionals tend to exhibit a more disciplined, long-term approach, while individual investors are more susceptible to emotional biases and short-term market fluctuations. Recognizing these distinctions can help both professional and individual investors refine their strategies and improve their investment outcomes. To learn more about navigating market reactions effectively, explore additional resources on risk management and investment strategies. Mastering the art of understanding market reactions is key to successful investing.

Featured Posts

-

Understanding Market Reactions Professional Vs Individual Investor Response

Apr 28, 2025

Understanding Market Reactions Professional Vs Individual Investor Response

Apr 28, 2025 -

Harvard Researchers Deportation Hearing In Louisiana

Apr 28, 2025

Harvard Researchers Deportation Hearing In Louisiana

Apr 28, 2025 -

Mets Rotation Battle How A Key Change Gave One Pitcher The Advantage

Apr 28, 2025

Mets Rotation Battle How A Key Change Gave One Pitcher The Advantage

Apr 28, 2025 -

Evaluating Pitchers Name S Chances For A Mets Starting Role

Apr 28, 2025

Evaluating Pitchers Name S Chances For A Mets Starting Role

Apr 28, 2025 -

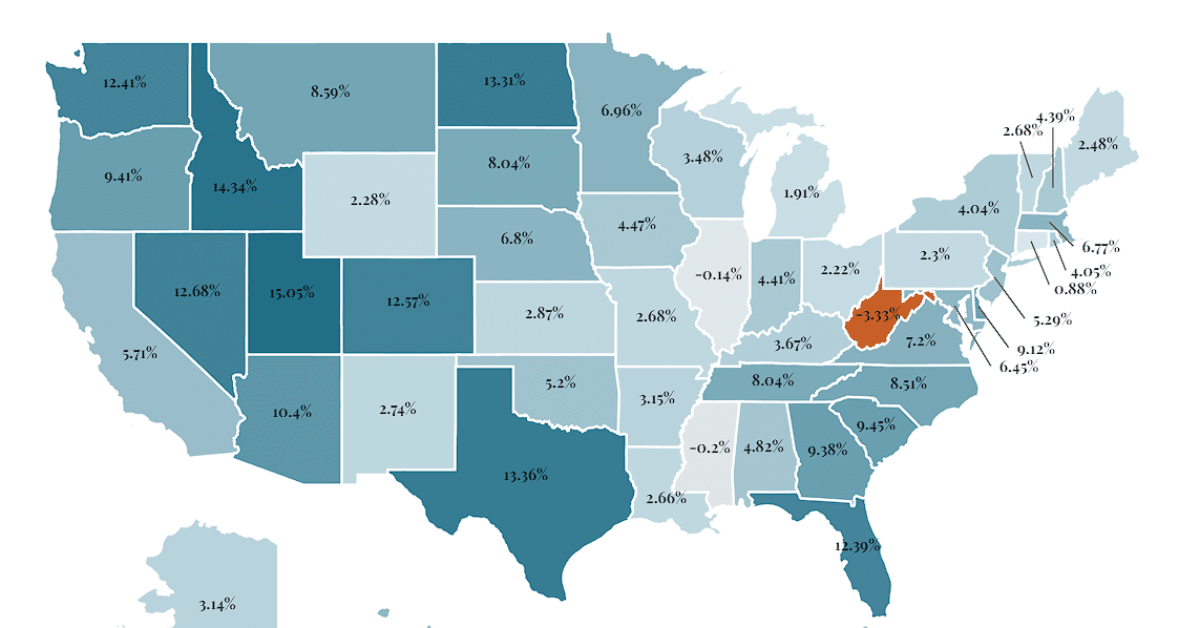

Where To Invest Mapping The Countrys Fastest Growing Business Areas

Apr 28, 2025

Where To Invest Mapping The Countrys Fastest Growing Business Areas

Apr 28, 2025