Where To Invest: Mapping The Country's Fastest-Growing Business Areas

Table of Contents

Booming Tech Hubs: Opportunities in the Digital Economy

The digital economy continues its explosive growth, creating unparalleled investment opportunities. Identifying the right tech hub is paramount for maximizing your ROI in this sector.

Silicon Valley South: Analyzing Emerging Tech Clusters

Several regions are emerging as significant tech centers, mirroring the success of Silicon Valley. These "Silicon Valleys South" attract substantial investment and boast a rapidly expanding talent pool.

- Specific city examples: Austin, Texas; Denver, Colorado; Raleigh-Durham, North Carolina.

- Reasons for growth: These areas offer a skilled workforce, a significant influx of venture capital, and supportive government policies promoting technological innovation. Lower costs of living compared to traditional tech hubs, like San Francisco, also attract businesses and talent.

- Key tech sectors: Artificial intelligence (AI), Software as a Service (SaaS), and Fintech (financial technology) are particularly vibrant in these areas.

- Statistics: Austin, for example, experienced a 15% increase in tech jobs in the last year, with over $10 billion in venture capital funding. Companies like Tesla and Oracle have significantly contributed to Austin's growth. Denver has seen similar growth fueled by the expansion of companies like Palantir and Guild Education.

Beyond the Coast: Discovering Hidden Tech Gems in Smaller Cities

While major metropolitan areas dominate the headlines, smaller cities are quietly becoming tech powerhouses.

- Examples: Boise, Idaho; Madison, Wisconsin; Chattanooga, Tennessee.

- Reasons for appeal: These cities often offer a lower cost of living for both businesses and employees, while still providing access to talented graduates from nearby universities and strong local support initiatives designed to attract tech companies.

- Advantages and disadvantages: Smaller tech hubs might offer lower initial investment costs and less competition, but they may also lack the same level of infrastructure and established networks as larger cities.

- Statistics and examples: Boise, Idaho, has seen a significant influx of tech companies due to its affordable housing and a growing talent pool from nearby universities. Success stories in these smaller cities often showcase the potential for high growth and significant ROI.

Renewable Energy and Sustainable Investments: A Growing Sector

The transition to a sustainable future is driving massive investment in renewable energy and green technologies.

Green Energy Boomtowns: Capitalizing on the Clean Energy Transition

Several states and regions are leading the way in renewable energy production and adoption.

- Leading regions: California, Texas, Iowa (wind); Nevada, Arizona, Utah (solar).

- Government incentives and regulations: Federal and state governments offer substantial tax credits, grants, and other incentives to support renewable energy development. Stricter environmental regulations are also pushing the adoption of cleaner energy sources.

- Investment opportunities: Investment opportunities abound in renewable energy infrastructure (solar farms, wind turbines), smart grid technologies, and green technology companies developing innovative solutions.

- Statistics: The renewable energy sector is projected to create millions of jobs in the coming decades, with billions of dollars in investment flowing into the industry annually.

Investing in Sustainability: Beyond Energy—Opportunities in Green Technologies

The push for sustainability extends beyond energy, creating opportunities across various sectors.

- Related sectors: Sustainable agriculture, green building materials (e.g., bamboo, recycled materials), and waste management are experiencing rapid growth.

- ESG investing: Environmental, Social, and Governance (ESG) investing is gaining traction, with investors increasingly considering the environmental and social impact of their investments. This trend is driving capital towards sustainable businesses.

- Statistics: The global market for green building materials is expected to grow exponentially in the coming years, while sustainable agriculture is increasingly important in food security.

Healthcare and Biotech: Investing in Innovation and Growth

The healthcare and biotechnology sectors are consistently strong areas for investment, driven by technological advancements and an aging global population.

Biotech Clusters: Hotspots for Medical Innovation and Investment

Major research universities and well-funded research institutions fuel the growth of Biotech clusters.

- Location of key biotech hubs: Boston, San Francisco, San Diego, Raleigh-Durham.

- Reasons for growth: These areas benefit from a concentration of research universities, access to significant funding from venture capitalists and government grants, and a highly skilled workforce.

- Investment opportunities: Pharmaceutical companies, medical device manufacturers, and biotech startups represent attractive investment possibilities.

- Statistics: Biotech funding reached record highs in recent years, highlighting the immense growth potential within this sector.

Aging Population and Healthcare Needs: Opportunities in Senior Care and Related Services

The aging global population presents significant opportunities in the senior care sector.

- Growth of the senior population: The number of people aged 65 and older is rapidly increasing worldwide, creating a high demand for senior care services.

- Investment opportunities: Investment opportunities exist in senior care facilities, home healthcare services, assistive technologies, and related support services.

- Statistics: The market for senior care services is projected to grow significantly in the coming decades, driven by the expanding elderly population.

Real Estate: Analyzing Emerging Market Trends

Real estate remains a cornerstone investment, and understanding emerging trends is critical for success.

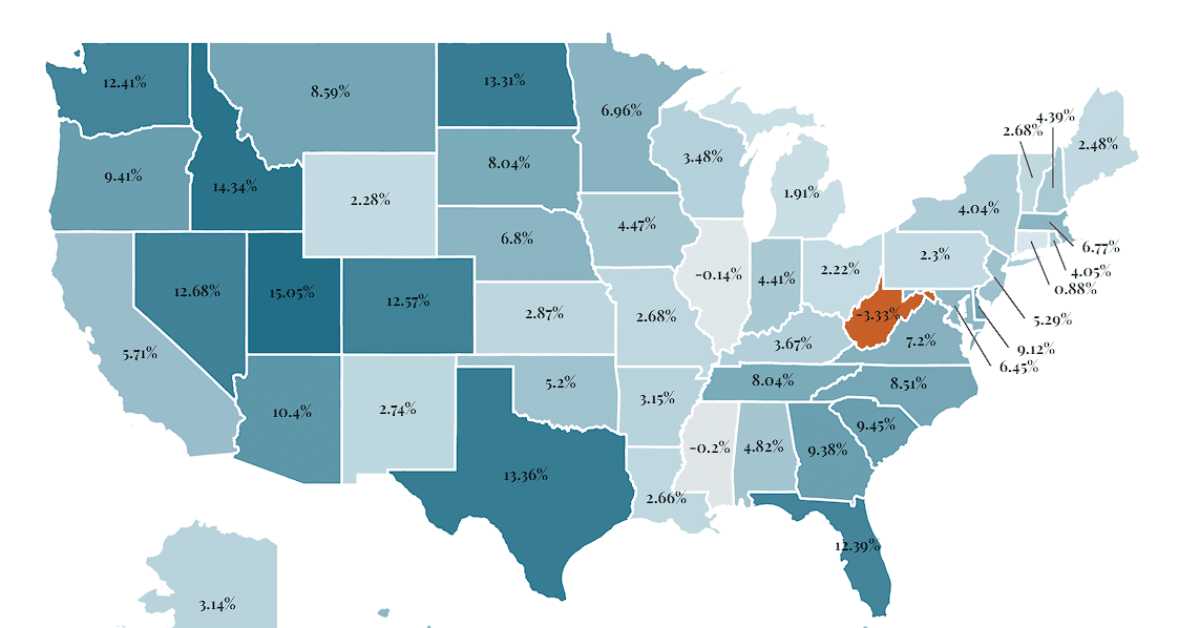

High-Growth Housing Markets: Identifying Regions with Strong Demand

Population growth and job creation drive demand in specific housing markets.

- Areas with strong demand: Cities with robust job markets and desirable lifestyles generally experience high housing demand.

- Factors influencing demand: Job growth, affordability relative to income, lifestyle factors (access to amenities, outdoor recreation), and population growth significantly impact housing demand.

- Types of real estate investment opportunities: Residential (single-family homes, apartments), and commercial real estate offer various investment avenues.

- Data: Analyzing population growth data, housing price indices, and rental rates is crucial for identifying high-growth housing markets.

Commercial Real Estate Opportunities: Targeting High-Demand Spaces

Changes in how we work and live shape demand for commercial real estate.

- Emerging trends: Flexible workspaces (co-working spaces), data centers (supporting the digital economy), and logistics facilities (e-commerce fulfillment) are experiencing high demand.

- Location analysis: Focus on areas with robust job growth, strong economic activity, and proximity to transportation networks.

- Market data and analysis: Thorough market research, including vacancy rates, rental rates, and property values, is essential for informed investment decisions.

Conclusion

This guide has highlighted key sectors and regions experiencing rapid growth, offering a roadmap for strategic investment decisions. From booming tech hubs to the burgeoning renewable energy sector and healthcare innovation, there are numerous opportunities to capitalize on the country's economic expansion. By carefully considering these factors and conducting thorough due diligence, investors can significantly increase their chances of success. Understanding the nuances of each sector and location is crucial for maximizing your ROI.

Call to Action: Ready to discover more about the country's fastest-growing business areas and identify prime investment opportunities? Start your research today and find the perfect place to invest! Use this information to further analyze specific areas and make informed investment choices in the country's most promising sectors. Don't miss out on the chance to capitalize on these high-growth areas – begin your investment journey now!

Featured Posts

-

Early Offense Rodons Pitching Secure Yankees Victory

Apr 28, 2025

Early Offense Rodons Pitching Secure Yankees Victory

Apr 28, 2025 -

Tech Giants Boost U S Stocks Tesla Leads The Charge

Apr 28, 2025

Tech Giants Boost U S Stocks Tesla Leads The Charge

Apr 28, 2025 -

The 2000 Yankees Recalling Their Triumph Over The Royals

Apr 28, 2025

The 2000 Yankees Recalling Their Triumph Over The Royals

Apr 28, 2025 -

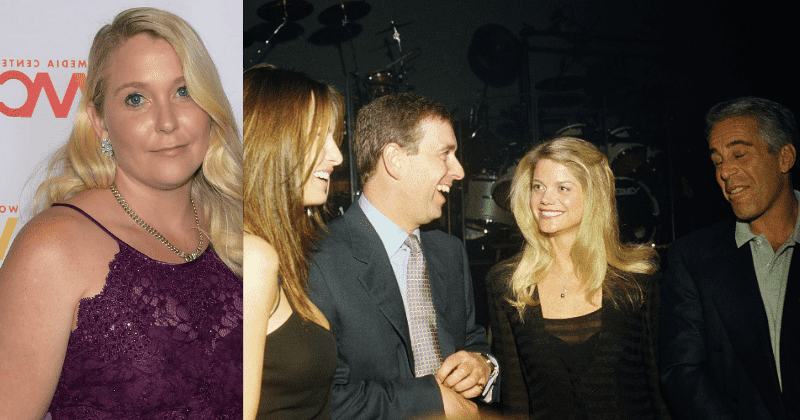

Death Of Virginia Giuffre Impact On Prince Andrew Case

Apr 28, 2025

Death Of Virginia Giuffre Impact On Prince Andrew Case

Apr 28, 2025 -

Boosting Canadian Energy Exports The Southeast Asia Trade Mission

Apr 28, 2025

Boosting Canadian Energy Exports The Southeast Asia Trade Mission

Apr 28, 2025