The Dax And Bundestag Elections: Analyzing The Correlation

Table of Contents

Historical Performance of the DAX Around Bundestag Elections

Pre-Election Volatility

The months leading up to previous Bundestagswahlen have often witnessed significant fluctuations in the DAX. Investor uncertainty surrounding potential policy changes under different governing coalitions contributes to this volatility. Political campaigning, with its inherent uncertainty and potential for unexpected events, further amplifies this effect.

- 2017 Bundestag Election: The DAX experienced a period of relative stability in the months leading up to the election, followed by a slight dip immediately afterward.

- 2013 Bundestag Election: The period leading up to the 2013 election saw more pronounced volatility, with significant gains and losses in the DAX reflecting the changing political landscape and shifting public opinion.

- 2009 Bundestag Election: The global financial crisis significantly impacted the DAX in the lead-up to and following the 2009 election, making it difficult to isolate the election's specific influence.

[Insert chart/graph visualizing DAX performance around election periods here]

Post-Election Market Reactions

The DAX's reaction to election results has varied considerably depending on the winning party and its proposed economic policies. Clear wins by parties with predictable economic platforms tend to lead to less market volatility compared to close elections or coalition negotiations with uncertain outcomes.

- Coalition Governments: Formation of coalition governments often introduces a period of uncertainty as the details of their economic programs are worked out. This uncertainty can be reflected in DAX fluctuations.

- Clear Mandate: Elections resulting in a clear mandate for a single party often lead to more predictable market reactions, either positive or negative, depending on investor sentiment regarding the winning party's economic platform.

- Economic Policy Implications: A party promising significant tax cuts or deregulation might see a positive DAX reaction, while a party advocating for increased regulation or higher taxes may see a negative reaction.

Factors Influencing the DAX-Bundestagswahlen Correlation

Economic Policy Uncertainty

Uncertainty surrounding the economic policies of different parties significantly impacts investor confidence and the DAX. The potential for changes in taxation, environmental regulations, social welfare programs, and labor laws can lead to market volatility.

- Tax Policy: Proposed changes to corporate tax rates, capital gains taxes, or other tax policies can significantly impact business investment and investor sentiment.

- Environmental Regulations: Stricter environmental regulations might lead to increased costs for businesses and uncertainty about future investments.

- Social Welfare Programs: Changes in social welfare programs can impact consumer spending and the overall economic outlook.

"The level of uncertainty surrounding policy changes is a key driver of market volatility around election periods," says Dr. [Name], an economist specializing in German finance.

Global Market Conditions

Global economic factors can significantly influence the DAX's behavior, irrespective of the Bundestagswahlen. Global recessions, geopolitical instability, and changes in global commodity prices can all overshadow domestic political factors.

- Global Recessions: During global recessions, domestic political factors often take a backseat to concerns about the global economy.

- Geopolitical Instability: Geopolitical events such as wars or major international conflicts can have a significant and immediate impact on market sentiment.

- Commodity Prices: Fluctuations in the prices of key commodities, like oil, can significantly impact the German economy and, consequently, the DAX.

Investor Sentiment and Speculation

Investor sentiment and speculative trading activities around election time heavily influence the DAX. Media coverage, political polls, and expert predictions shape investor behavior, leading to buying or selling frenzies.

- Media Coverage: Negative media coverage of a particular party's economic platform may lead to a sell-off, while positive coverage might lead to buying.

- Political Polls: Close polls leading up to an election can create considerable uncertainty, driving market volatility.

- Expert Predictions: Predictions from financial analysts and economists about the potential economic impact of different election outcomes influence investor decisions.

Analyzing the Correlation: Statistical Methods and Limitations

Statistical Analysis Techniques

Statistical methods such as correlation coefficients and regression analysis can be used to quantify the relationship between DAX performance and Bundestag election outcomes. However, these methods require careful consideration of various factors to ensure reliable results.

Limitations of Correlation Analysis

It's crucial to remember that correlation doesn't equal causation. While statistical analysis can reveal correlations, it's difficult to definitively establish a direct causal link between DAX performance and election results. Many confounding factors can influence both the stock market and the election outcome.

- Confounding Factors: Global economic events, unexpected shocks, and other unforeseen circumstances can significantly influence both DAX performance and election results, making it difficult to isolate the election's impact.

- Complexity of the Relationship: The relationship between the DAX and Bundestagswahlen is complex and multifaceted, influenced by multiple interconnected factors.

Conclusion: Understanding the DAX and Bundestag Elections Interplay

The relationship between DAX performance and Bundestag elections is complex, influenced by economic policy uncertainty, global market conditions, and investor sentiment. While a direct causal link is difficult to establish, historical data reveals a clear correlation between election-related uncertainty and market volatility. Understanding this interplay is essential for investors seeking to navigate the German stock market around election periods. By understanding the complex interplay between the DAX and Bundestag elections, investors can better navigate market volatility and make informed decisions. Continue your research into the correlation between the DAX and German elections for a more comprehensive understanding of DAX performance and Bundestagswahlen impact.

Featured Posts

-

Neuer Atlas Zeigt Amphibien Und Reptilien Thueringens

Apr 27, 2025

Neuer Atlas Zeigt Amphibien Und Reptilien Thueringens

Apr 27, 2025 -

Thueringens Reptilien Und Amphibien Der Neue Atlas

Apr 27, 2025

Thueringens Reptilien Und Amphibien Der Neue Atlas

Apr 27, 2025 -

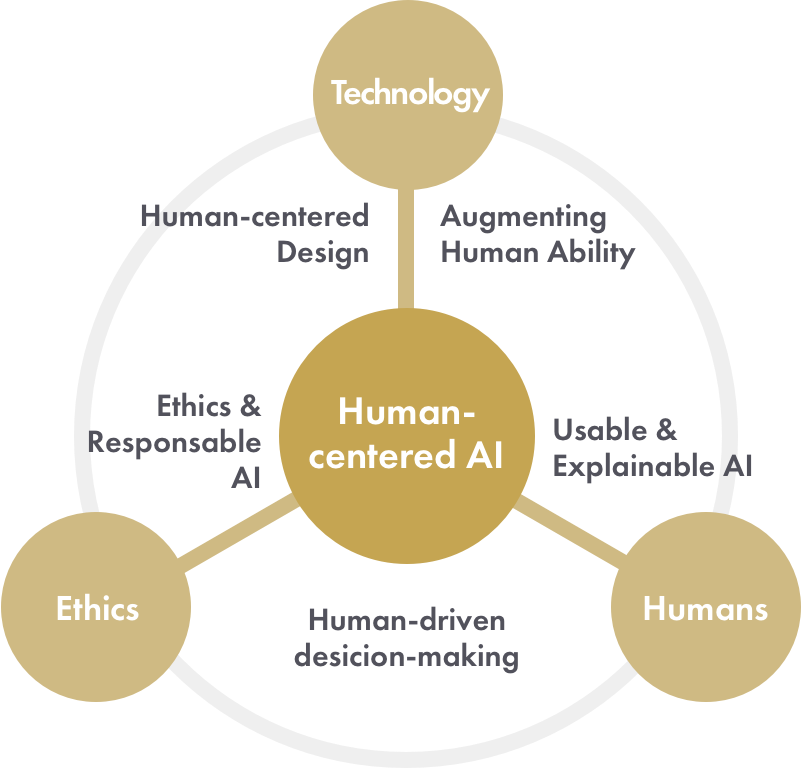

Ai Design At Microsoft A Focus On Human Centered Innovation

Apr 27, 2025

Ai Design At Microsoft A Focus On Human Centered Innovation

Apr 27, 2025 -

Is A Fifth Champions League Spot For The Premier League Now Inevitable

Apr 27, 2025

Is A Fifth Champions League Spot For The Premier League Now Inevitable

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025