FTC's Appeal Against Microsoft-Activision Merger Approval

Table of Contents

Main Points: Unpacking the FTC's Appeal and Microsoft's Defense

The FTC's appeal hinges on several key arguments, while Microsoft counters with its own compelling defense. Let's examine both sides of this complex legal battle.

2.1 The FTC's Core Arguments Against the Merger

The FTC's opposition to the Microsoft-Activision merger stems from concerns about its potential to stifle competition and harm consumers.

H3: Anti-competitive Concerns:

The FTC argues that the merger would significantly reduce competition in several key areas of the gaming market:

- Console Market: Microsoft could leverage its ownership of Activision Blizzard to make popular titles like Call of Duty exclusive to its Xbox ecosystem, potentially harming competitors like Sony PlayStation and Nintendo Switch.

- Subscription Services: The combined entity could create a dominant subscription service (like Game Pass) by bundling Activision Blizzard's extensive game catalog, potentially pushing out rival subscription services and limiting consumer choice.

- Cloud Gaming: Microsoft's cloud gaming ambitions could be significantly strengthened by acquiring Activision Blizzard's vast library of games, potentially creating a near-monopoly in the burgeoning cloud gaming market.

These concerns are backed by references to previous antitrust cases and precedents, such as the US vs. AT&T case, demonstrating a historical pattern of regulatory intervention against mergers that could significantly reduce competition.

H3: Impact on Game Developers and Publishers:

The FTC further argues that the merger could negatively impact smaller game developers and publishers.

- Reduced Competition: A larger, more powerful Microsoft could leverage its market position to negotiate unfair terms with smaller developers and publishers, potentially squeezing them out of the market.

- Limited Innovation: The absence of competition could lead to reduced innovation, with fewer incentives for Microsoft to develop new and creative gaming experiences.

H3: The Role of Call of Duty:

The FTC emphasizes the critical role of Call of Duty in the gaming industry. Its massive popularity and significant market share make it a key piece in the puzzle. The FTC worries that making Call of Duty exclusive to Xbox would significantly harm PlayStation and other competitors, potentially driving up prices or reducing the quality of competing games.

2.2 Microsoft's Defense and Counterarguments

Microsoft vehemently denies the FTC's claims, arguing that the merger would actually benefit consumers and foster innovation.

H3: Microsoft's Commitment to Fair Competition:

Microsoft has repeatedly pledged to maintain Call of Duty on PlayStation and other platforms, even signing legally binding agreements to ensure its availability.

- Long-Term Agreements: These agreements guarantee Call of Duty will remain available on rival platforms for an extended period, addressing the FTC's key concern.

- Public Statements: Microsoft executives have made numerous public statements reaffirming their commitment to fair competition and providing assurances to regulators.

H3: The Benefits of the Merger:

Microsoft highlights several benefits of the merger, including:

- Increased Investment in Game Development: Microsoft promises to invest heavily in developing new and innovative games, benefiting both developers and consumers.

- Expanded Game Library: The merger would lead to a significantly larger and more diverse gaming library, providing more choices for players.

- Technological Advancements: Microsoft argues the merger would accelerate advancements in gaming technology, enhancing player experiences.

H3: Legal Precedent and Regulatory Context:

Microsoft points to the approval of similar mergers in the tech industry and emphasizes the differing stances taken by regulatory bodies worldwide. While the FTC opposes the merger, regulatory bodies in other regions, including the European Union, have approved the deal after concessions.

2.3 Potential Outcomes and Future Implications

The FTC's appeal could have several potential outcomes, each with significant ramifications.

H3: Possible Court Decisions:

The court could:

- Reverse the initial approval, effectively blocking the merger.

- Uphold the original ruling, allowing the merger to proceed as planned.

- Modify the merger agreement, requiring Microsoft to make further concessions to address the FTC's concerns.

H3: Impact on the Gaming Industry:

The court's decision will have a profound impact on the gaming industry, affecting:

- Game Prices: The outcome could influence the pricing of games and subscriptions.

- Innovation: The level of competition will significantly impact the pace of innovation.

- Consumer Choice: The availability of games across different platforms will be impacted.

H3: Implications for Future Mergers and Acquisitions:

This case sets a crucial precedent for future mergers and acquisitions in the tech and gaming industries. It will heavily influence how regulatory bodies approach similar deals in the future.

Conclusion: The FTC's Appeal and the Future of Gaming Mergers

The FTC's appeal against the Microsoft-Activision merger is a pivotal moment for the gaming industry. The FTC’s concerns about anti-competitive practices and the potential harm to smaller developers are substantial. However, Microsoft's counterarguments regarding innovation and its commitment to maintaining Call of Duty on competing platforms are equally compelling. The court's decision will not only determine the fate of this specific merger but also set a precedent for future mergers and acquisitions within the gaming industry. Stay informed about the ongoing legal proceedings and their implications for the future of gaming by following reputable news sources and legal updates concerning the FTC's Appeal Against Microsoft-Activision Merger. The outcome will significantly shape the competitive landscape of the gaming world for years to come.

Featured Posts

-

Record Gold Prices Understanding The Trade War Impact On Bullion Investment

Apr 26, 2025

Record Gold Prices Understanding The Trade War Impact On Bullion Investment

Apr 26, 2025 -

Discover 7 Exciting New Orlando Restaurants In 2025 Beyond Disney

Apr 26, 2025

Discover 7 Exciting New Orlando Restaurants In 2025 Beyond Disney

Apr 26, 2025 -

Nfl Draft Green Bay Prepares For First Round Action

Apr 26, 2025

Nfl Draft Green Bay Prepares For First Round Action

Apr 26, 2025 -

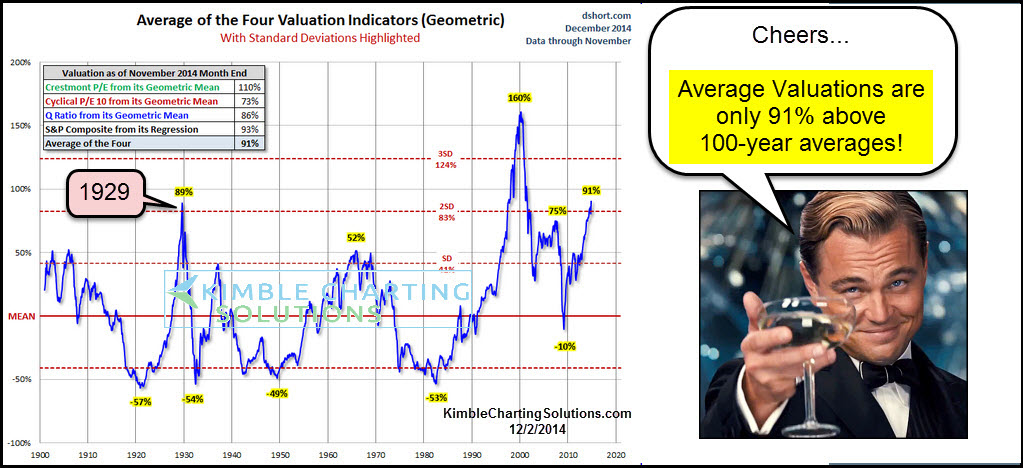

Stock Market Valuations Bof As Reassurance For Investors

Apr 26, 2025

Stock Market Valuations Bof As Reassurance For Investors

Apr 26, 2025 -

Colgate Cl Stock Sales And Profitability Affected By Increased Tariffs

Apr 26, 2025

Colgate Cl Stock Sales And Profitability Affected By Increased Tariffs

Apr 26, 2025