Stock Market Valuations: BofA's Reassurance For Investors

Table of Contents

BofA's Current Market Assessment and Valuation Metrics

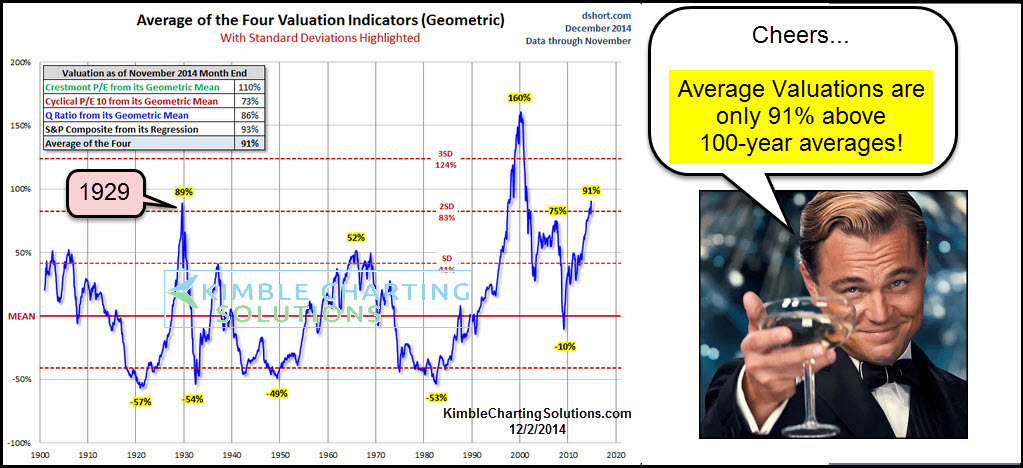

BofA Global Research employs a rigorous methodology for assessing stock market valuations, relying on several key metrics to paint a comprehensive picture. They don't simply look at one number, but consider a range of factors to get a holistic view. Key metrics utilized include the Price-to-earnings ratio (P/E), the Cyclically Adjusted Price-to-Earnings Ratio (CAPE), market capitalization, and various other valuation multiples.

-

BofA's assessment of the current P/E ratio compared to historical averages: BofA often compares the current P/E ratio to its historical average, considering factors like economic growth and interest rates to contextualize the current level. A high P/E ratio might indicate overvaluation, but only when compared to historical norms and adjusted for prevailing economic conditions.

-

Analysis of sector-specific valuations and potential outperformers: BofA's research goes beyond broad market indices, examining valuations across different sectors. They identify sectors potentially undervalued or poised for outperformance based on their individual earnings growth prospects and relative valuations. This granular analysis provides investors with opportunities to fine-tune their portfolios.

-

Discussion of the impact of interest rates on valuation multiples: Interest rates significantly impact valuation multiples. Rising interest rates typically lead to lower valuations as the discount rate used in valuation models increases, making future earnings less valuable today. BofA analyzes the relationship between interest rate movements and the resulting shifts in valuation multiples.

Addressing Investor Concerns Regarding High Valuations

Many investors harbor concerns about potentially high valuations, fearing a market correction or even a bear market. Recession fears and the impact of inflation further fuel these anxieties. However, BofA's analysis offers counterarguments:

-

Addressing concerns about potential overvaluation in specific sectors: BofA acknowledges that some sectors might be more richly valued than others. However, they emphasize the need for a nuanced assessment, considering factors like future growth prospects and competitive advantages within each sector.

-

Explanation of factors that might support current valuations: BofA points to several factors that could justify current valuations. Strong corporate earnings, driven by robust consumer spending and technological advancements, can support higher price-to-earnings ratios. Furthermore, innovation and the potential for future growth in specific sectors can justify seemingly high valuations.

-

Discussion of strategies for mitigating risk in a potentially volatile market: BofA advocates for a diversified investment strategy to mitigate risk. This includes diversifying across asset classes (stocks, bonds, real estate, etc.), sectors, and geographies to reduce the impact of any single market downturn.

The Role of Interest Rates in Shaping Stock Market Valuations

Interest rate hikes and monetary policy implemented by the Federal Reserve (and other central banks) profoundly affect stock market valuations. This is a crucial aspect of BofA's analysis:

-

How rising interest rates affect the discount rate used in valuation models: Higher interest rates increase the discount rate used in discounted cash flow (DCF) models, reducing the present value of future earnings and thus lowering stock valuations.

-

The relationship between bond yields and equity valuations: Rising bond yields often lead to lower equity valuations as investors shift towards the perceived safety of bonds offering higher returns. This dynamic is central to BofA's understanding of market valuation.

-

BofA's projections for interest rates and their potential influence on future valuations: BofA provides projections for future interest rates and their expected impact on valuations. This forward-looking perspective is vital for investors in formulating their investment strategies.

BofA's Investment Recommendations and Strategic Advice for Investors

Based on their valuation analysis, BofA offers actionable recommendations for investors:

-

Suggested asset allocation strategies for different risk tolerance levels: BofA tailors their asset allocation recommendations to individual investor risk profiles. Conservative investors might be advised to hold a larger proportion of bonds, while more aggressive investors might favor a higher allocation to equities.

-

Recommendations for specific sectors or asset classes: BofA highlights specific sectors or asset classes that appear undervalued or poised for growth based on their valuation metrics and future outlook.

-

Advice on long-term versus short-term investment horizons: BofA emphasizes the importance of a long-term investment horizon for weathering market volatility and achieving long-term financial goals. They advise against making impulsive decisions based on short-term market fluctuations.

Conclusion

BofA's analysis suggests that while market volatility exists, current stock market valuations aren't necessarily cause for extreme alarm. Understanding valuation metrics like P/E ratios and CAPE, considering the influence of interest rates, and adopting a well-diversified, long-term investment strategy are crucial for navigating the market. Remember, understanding stock market valuations is a continuous process. Conduct thorough research, consider consulting with a financial advisor to analyze your investment portfolio, and make informed investment decisions based on your risk tolerance and financial goals. Staying informed about stock market valuations and the insights offered by reputable financial institutions like BofA is key to successful long-term investing.

Featured Posts

-

The Ftcs Investigation Of Open Ai And Chat Gpt Key Questions Answered

Apr 26, 2025

The Ftcs Investigation Of Open Ai And Chat Gpt Key Questions Answered

Apr 26, 2025 -

Trump On Congressional Stock Trading Full Transcript And Analysis From Time Interview

Apr 26, 2025

Trump On Congressional Stock Trading Full Transcript And Analysis From Time Interview

Apr 26, 2025 -

The Rise Of Chinese Automakers A Look At The Future Of Cars

Apr 26, 2025

The Rise Of Chinese Automakers A Look At The Future Of Cars

Apr 26, 2025 -

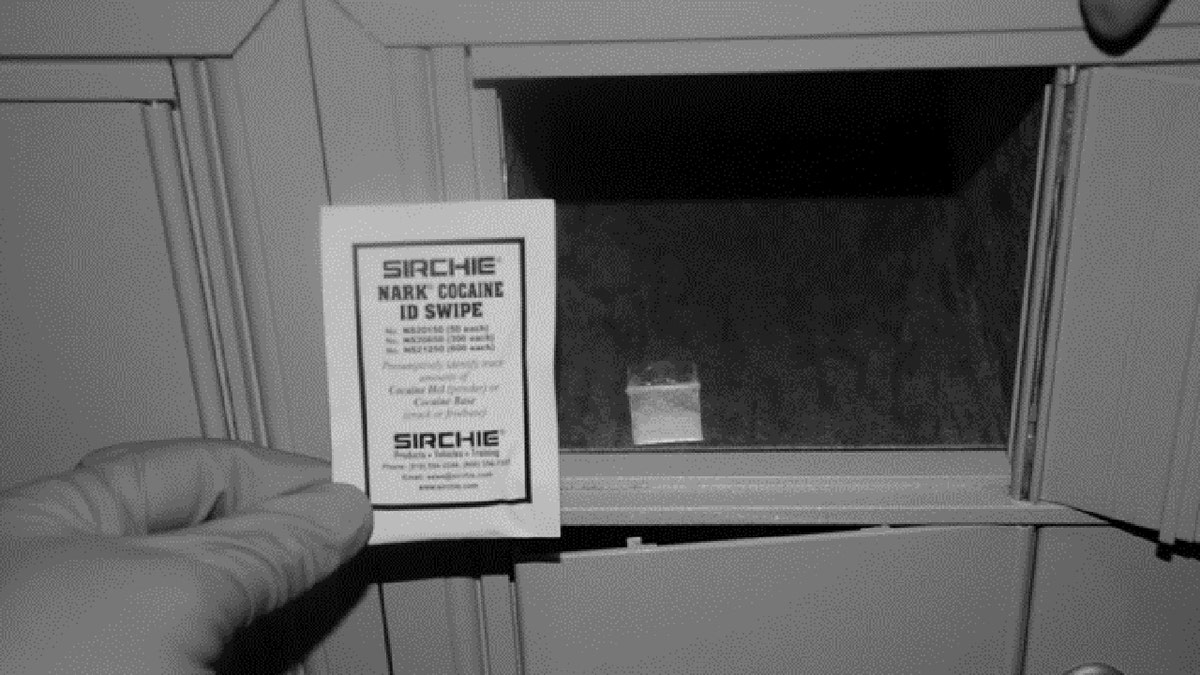

White House Cocaine Found Secret Service Investigation Concludes

Apr 26, 2025

White House Cocaine Found Secret Service Investigation Concludes

Apr 26, 2025 -

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 26, 2025

End Of Ryujinx Nintendo Contact Forces Emulator Shutdown

Apr 26, 2025