Colgate (CL) Stock: Sales And Profitability Affected By Increased Tariffs

Table of Contents

Tariff Impact on Colgate's Sales

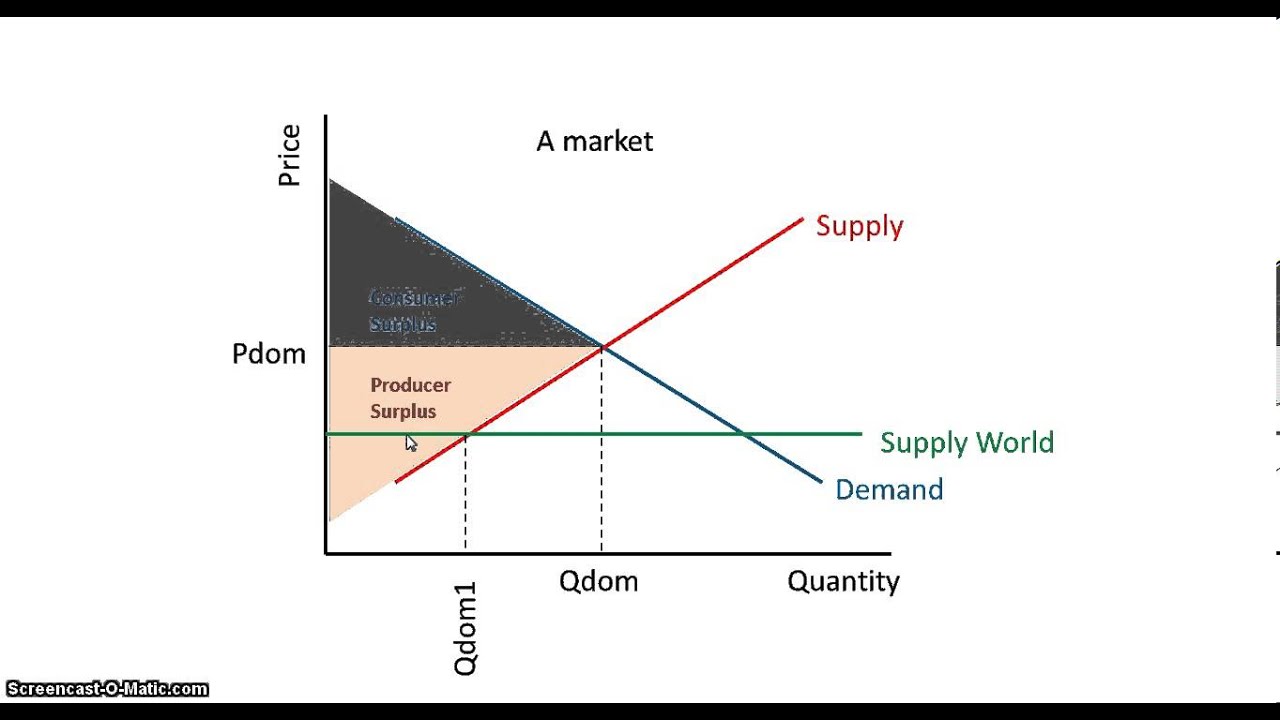

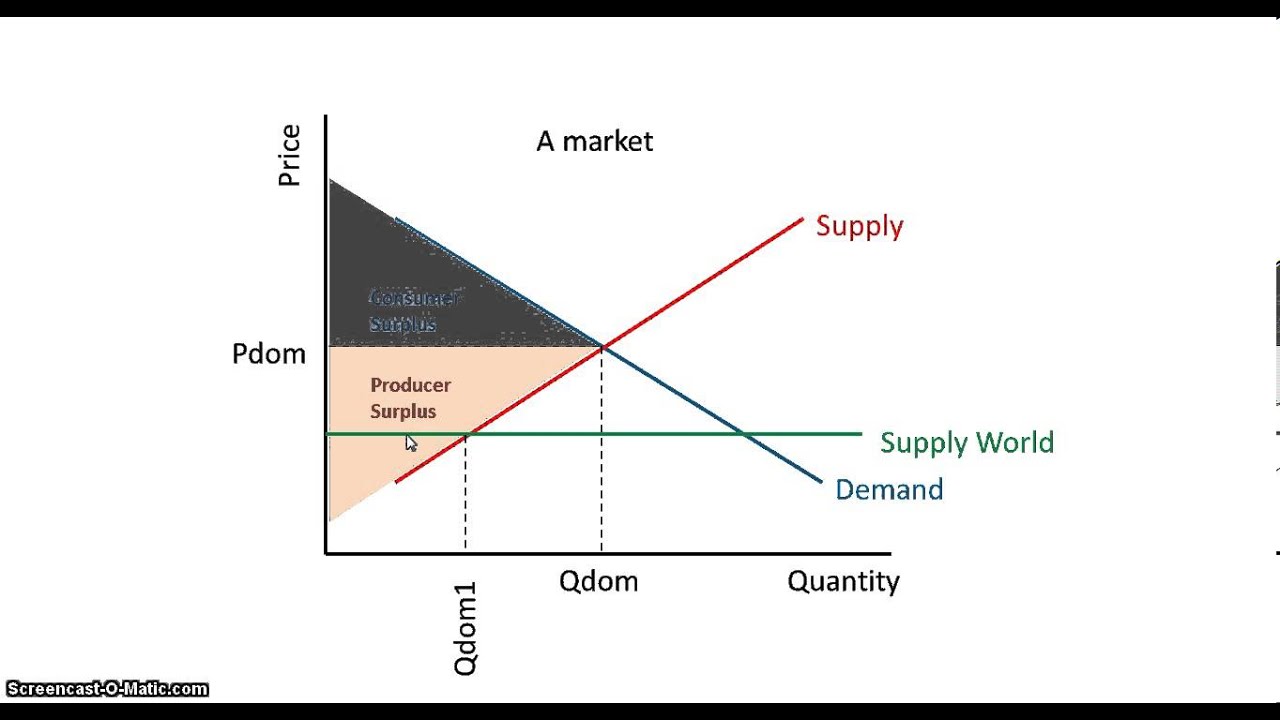

Increased tariffs significantly impact Colgate's sales in several crucial ways. The resulting higher prices directly affect consumer purchasing power, particularly in developing markets heavily reliant on imported goods.

Reduced Consumer Spending

Tariffs translate directly into higher prices for consumers. This price increase, often passed directly onto the end user, reduces consumer spending, impacting sales volume across Colgate's product lines.

- Specific Product Lines Affected: While all product categories are affected to some degree, those with a larger imported component, such as certain specialty oral care products or those with significant packaging costs, see more pronounced price increases and sales reductions.

- Geographical Regions: Developing markets in Asia and Latin America, where Colgate has a significant presence, are particularly vulnerable due to higher import reliance and lower consumer disposable income. Sales data from these regions often reflects the most substantial decline following tariff increases. For example, Q[insert quarter] [insert year] showed a [insert percentage]% decrease in sales in [insert region] compared to the same period in [insert previous year].

- Price Increases: Colgate often tries to absorb some of the tariff-related costs, but eventually needs to pass some price increases onto the consumer. This impacts consumer demand, leading to reduced sales volumes and potentially market share losses. The average price increase for [insert product category] was [insert percentage]% following the latest tariff hike.

Increased Production Costs

Tariffs don't just affect the final consumer price; they significantly impact Colgate's production costs. Tariffs on raw materials and imported components directly increase the manufacturing cost of Colgate's products, squeezing profit margins.

- Raw Materials Affected: Many raw materials, such as specialized packaging materials and specific chemical ingredients used in toothpaste and other products, are imported and thus subject to tariffs. The increased cost of these materials directly affects production expenses.

- Impact on Production Efficiency: Higher raw material costs make production less efficient, potentially forcing Colgate to look at cost-cutting measures that could have longer-term consequences, impacting quality and consumer perception.

- Cost Mitigation Strategies: Colgate employs various cost-mitigation strategies including:

- Diversification of sourcing: Seeking alternative suppliers in different regions to lessen reliance on tariff-affected areas.

- Price adjustments: Carefully adjusting prices to maintain profitability while remaining competitive.

- Operational efficiency improvements: Streamlining internal processes to reduce overall production expenses.

Profitability Challenges for Colgate (CL)

The combined impact of reduced sales and increased production costs creates significant challenges for Colgate's profitability.

Margin Compression

The increased costs and potentially lower sales volume directly lead to a compression of Colgate's operating margins and net income.

- Financial Performance Data: Colgate's quarterly earnings reports often reflect this impact, showcasing a decline in profit margin percentages and net income compared to previous periods when tariffs were lower. For example, [insert specific data from recent earnings reports, percentages and amounts].

- Impact on Investor Confidence: Declining profitability naturally impacts investor confidence, potentially leading to lower stock prices and reduced market capitalization.

Strategic Responses to Tariff Pressures

Colgate has actively implemented several strategic responses to mitigate the negative effects of tariffs.

- Diversification of Sourcing: Shifting sourcing of raw materials to countries with more favorable trade agreements.

- Price Adjustments: Carefully increasing prices on some products to offset increased costs while also considering price elasticity of demand.

- Cost-Cutting Measures: Implementing various operational efficiencies across its global supply chain and manufacturing processes.

- Lobbying Efforts: Participating in industry lobbying efforts to advocate for trade policies more favorable to the company's interests. This could involve engaging with policymakers and trade associations.

Conclusion

Increased tariffs have demonstrably negatively impacted Colgate (CL) stock performance, presenting considerable challenges to both sales and profitability. The effects are evident in reduced consumer spending, higher production costs, and overall margin compression. Colgate's strategic responses, including diversification and cost-cutting, are crucial in navigating these challenges. However, the ultimate impact on Colgate (CL) stock remains tied to the broader global trade landscape and the effectiveness of the company’s mitigation strategies.

Stay informed about the latest developments impacting Colgate (CL) stock and its response to ongoing tariff challenges to make informed investment decisions. Continue researching Colgate (CL) stock and monitor future earnings reports and news related to tariffs for a comprehensive understanding of its financial outlook.

Featured Posts

-

The Trump Administration And Ukraines Nato Membership

Apr 26, 2025

The Trump Administration And Ukraines Nato Membership

Apr 26, 2025 -

A Strategic Military Base The Epicenter Of Us China Influence

Apr 26, 2025

A Strategic Military Base The Epicenter Of Us China Influence

Apr 26, 2025 -

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025 -

Is Gold A Safe Haven Asset During Trade Wars A Look At The Recent Price Rally

Apr 26, 2025

Is Gold A Safe Haven Asset During Trade Wars A Look At The Recent Price Rally

Apr 26, 2025 -

Chinas Automotive Industry A Disruptive Force

Apr 26, 2025

Chinas Automotive Industry A Disruptive Force

Apr 26, 2025