Is Gold A Safe Haven Asset During Trade Wars? A Look At The Recent Price Rally

Table of Contents

H2: Gold's Historical Performance During Times of Geopolitical Uncertainty

Gold has a long history as a safe haven asset, particularly during times of geopolitical instability and economic uncertainty. Its appeal stems from its inherent properties as a tangible, scarce commodity, relatively uncorrelated with other asset classes.

H3: The Role of Gold as a Hedge Against Inflation

Trade wars often lead to inflationary pressures. Increased tariffs inflate the prices of imported goods, while retaliatory measures can disrupt supply chains, further fueling price increases. Historically, gold has served as a hedge against inflation because its value tends to rise when the purchasing power of fiat currencies declines.

- Example 1: The inflationary period of the 1970s, marked by significant geopolitical tensions, saw a dramatic increase in gold prices.

- Example 2: The oil crises of the 1970s and the subsequent inflationary pressures also saw a strong correlation with rising gold prices.

- Increased money supply to stimulate economies during crises often leads to currency devaluation, increasing the relative value of gold.

[Insert chart showing historical correlation between inflation and gold prices]

H3: Gold's Behavior During Currency Crises

Trade disputes can destabilize currencies. When countries engage in retaliatory trade actions, it can create uncertainty in the foreign exchange markets, leading to currency fluctuations. Gold, as a store of value independent of any single currency, offers stability during these periods.

- Example 1: The Asian financial crisis of 1997-98 saw investors flock to gold as regional currencies plummeted.

- Example 2: The Eurozone debt crisis of 2010-2012 also witnessed increased demand for gold as investors sought refuge from the uncertainty in the Euro.

[Insert chart showing gold price movements during past currency crises]

H2: The Recent Gold Price Rally: A Direct Result of Trade War Concerns?

The recent surge in gold prices coincides with the intensification of trade tensions between major global economies. This raises the question of whether the gold price rally is a direct consequence of these trade war anxieties.

H3: Analyzing the Correlation Between Trade Tensions and Gold Prices

A clear correlation can be observed between escalating trade tensions and gold price increases in recent years.

- Example 1: The imposition of tariffs on steel and aluminum by the US in 2018 was followed by a noticeable rise in gold prices.

- Example 2: Each new round of trade negotiations and threats of further tariffs has often been accompanied by a spike in gold's value.

[Insert chart showing gold price movements alongside a trade tension index or specific tariff announcements]

H3: Other Factors Influencing Gold Prices

While trade wars are a significant factor, other elements influence gold prices.

- Interest Rates: Lower interest rates typically boost gold prices as they reduce the opportunity cost of holding a non-yielding asset like gold.

- Investor Sentiment: Fear and uncertainty in the broader market often drive investors towards gold as a safe haven.

- Supply and Demand: Physical gold supply is relatively limited, influencing prices based on investor demand.

These factors interact with trade war anxieties to create a complex interplay of influences on the gold market.

H2: Assessing Gold's Effectiveness as a Safe Haven Asset in the Current Climate

While gold has shown resilience during trade wars, it's crucial to compare its performance with other safe havens and acknowledge its limitations.

H3: Comparing Gold's Performance to Other Safe Havens

During recent trade disputes, gold's performance has often outpaced that of other traditional safe havens such as the US dollar or the Japanese yen.

[Insert chart comparing gold's performance against other safe haven assets during recent trade disputes]

H3: The Limitations of Gold as a Safe Haven

Gold does have limitations:

- Lack of Yield: Gold doesn't generate income like bonds or dividend-paying stocks.

- Price Volatility: Though generally considered a safe haven, gold's price is still subject to fluctuations.

Diversification is key. Relying solely on gold for protection against trade war risks is not advisable. A well-diversified portfolio encompassing a range of assets is a more robust risk management strategy.

3. Conclusion

This analysis suggests that while gold doesn't always perfectly insulate against all economic downturns, it has historically shown a tendency to act as a safe haven asset during periods of trade war uncertainty and geopolitical instability. Its effectiveness is enhanced during inflationary periods and currency crises often associated with such conflicts. However, it's crucial to remember that gold is not without its limitations and should be considered as part of a broader risk management strategy. The question, "Is gold a safe haven asset during trade wars?" is answered with a qualified "yes," but strategic diversification remains crucial.

Learn more about incorporating gold into your investment strategy to mitigate trade war risks and build a secure financial future. Explore your options for gold investments to better navigate uncertain global markets.

Featured Posts

-

Mississippi Deltas Immense Scale A Cinematographers Perspective In Sinners

Apr 26, 2025

Mississippi Deltas Immense Scale A Cinematographers Perspective In Sinners

Apr 26, 2025 -

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025 -

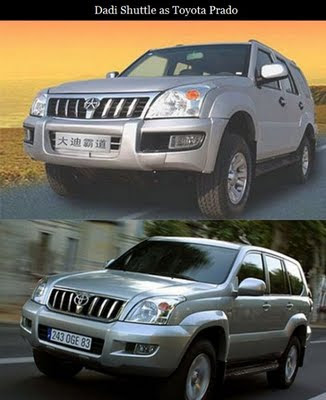

The Rise Of Chinese Automakers A Look At The Future Of Cars

Apr 26, 2025

The Rise Of Chinese Automakers A Look At The Future Of Cars

Apr 26, 2025 -

Abb Vie Abbv Stock Rises On Exceeding Sales Expectations And Revised Profit Guidance

Apr 26, 2025

Abb Vie Abbv Stock Rises On Exceeding Sales Expectations And Revised Profit Guidance

Apr 26, 2025 -

The Closure Of Anchor Brewing Company What Happened And Whats Next

Apr 26, 2025

The Closure Of Anchor Brewing Company What Happened And Whats Next

Apr 26, 2025