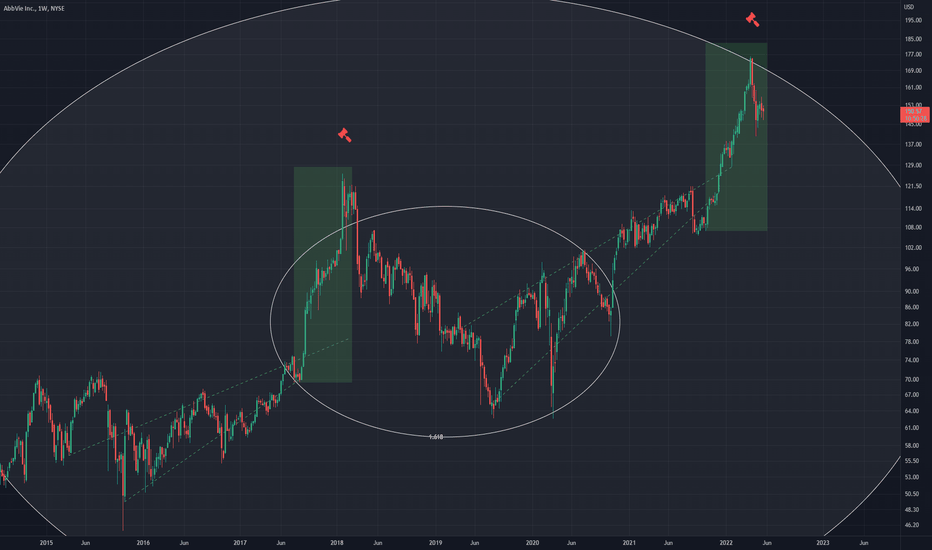

AbbVie (ABBV) Stock Rises On Exceeding Sales Expectations And Revised Profit Guidance

Table of Contents

AbbVie's Q[Quarter] 2024 Sales Exceed Expectations

AbbVie's Q[Quarter] 2024 sales figures significantly surpassed analyst predictions, demonstrating the company's robust growth and market dominance in key therapeutic areas. This success can be largely attributed to the exceptional performance of several key drugs within its portfolio.

Strong Performance of Key Drugs

Several key drugs played a crucial role in AbbVie's exceeding sales expectations.

- Humira: While facing biosimilar competition, Humira continued to generate substantial revenue, demonstrating its enduring market presence and strong brand loyalty. [Insert specific sales figures and comparison to previous quarters/years]. Unexpectedly strong sales were seen in [mention specific region].

- Rinvoq: This drug showed exceptional growth in [mention therapeutic area], exceeding expectations with sales figures of [Insert specific sales figures and comparison to previous quarters/years].

- Skyrizi: Skyrizi also contributed significantly to overall sales growth, demonstrating strong market penetration in [mention therapeutic area]. [Insert specific sales figures and comparison to previous quarters/years].

Market Share Gains

AbbVie demonstrated significant market share gains in key therapeutic areas such as immunology and oncology.

- Immunology: AbbVie's market share in the immunology space increased by [Percentage change] compared to [previous period], primarily driven by the strong performance of Rinvoq and Skyrizi and effective competition against biosimilars to Humira.

- Oncology: [Insert data on oncology market share gains, highlighting specific drugs and competitive advantages]. These gains reflect AbbVie's commitment to innovation and its ability to bring effective therapies to patients.

Upward Revision of AbbVie's Profit Guidance for 2024

The strong Q[Quarter] 2024 results led AbbVie to significantly revise its profit guidance for the full year 2024, boosting investor confidence.

Revised Earnings Per Share (EPS) Projections

AbbVie's previous EPS guidance was [Previous EPS guidance]. This has been revised upwards to [New EPS projection], representing an increase of [Quantify the increase]. This upward revision is primarily due to higher-than-expected sales and effective cost management strategies.

- Increased Sales Revenue: The robust sales performance of key drugs directly contributed to the increased EPS projection.

- Cost-Cutting Measures: AbbVie's strategic cost-cutting initiatives, focusing on [mention specific areas], further enhanced profitability.

Impact on Investor Sentiment

The market reacted positively to AbbVie's revised profit guidance, with the ABBV stock price showing a significant increase following the announcement.

- Stock Price Movement: The ABBV stock price increased by [Percentage] following the announcement.

- Analyst Ratings: Many analysts upgraded their ratings for AbbVie stock, citing the strong financial performance and positive outlook.

- Investor Confidence: Investor confidence in AbbVie's future prospects has significantly improved, reflecting the company's strong financial position and growth trajectory.

Factors Contributing to AbbVie's Success

AbbVie's remarkable success in Q[Quarter] 2024 can be attributed to a combination of factors, including successful product launches and effective cost management strategies.

Successful Product Launches and Pipeline

AbbVie's continued success is fueled by its robust pipeline and successful product launches.

- [Name of new drug/s]: This/These recent launches have expanded AbbVie’s reach in [Therapeutic area/s], contributing to increased revenue and market share.

- Pipeline Development: AbbVie’s promising drug pipeline continues to demonstrate its commitment to innovation and long-term growth in the biopharmaceutical sector.

Effective Cost Management Strategies

AbbVie's proactive approach to cost management also played a significant role in its improved profitability.

- Research and Development Efficiency: AbbVie has implemented strategies to optimize its R&D spending, ensuring efficient allocation of resources.

- Operational Efficiency: Improved operational efficiency across the company contributed to higher profit margins.

Future Outlook for AbbVie (ABBV) Stock

While the recent financial results are undeniably positive, it's crucial to consider both opportunities and potential risks when assessing the future outlook for AbbVie (ABBV) stock.

Analyst Predictions and Recommendations

Financial analysts have generally expressed a positive outlook for AbbVie, with many issuing buy or hold recommendations.

- Target Price Projections: Several analysts have set target prices for ABBV stock ranging from [Range of target prices].

- Buy/Sell/Hold Ratings: Major investment firms have largely issued buy or hold ratings for AbbVie, reflecting confidence in the company's future performance.

Potential Risks and Challenges

Despite the positive outlook, certain risks and challenges could potentially impact AbbVie's future growth.

- Competition: Increased competition in key therapeutic areas could affect market share and revenue growth.

- Patent Expirations: The expiration of key patents could impact future revenue streams.

- Regulatory Hurdles: Regulatory approvals for new drugs can sometimes be delayed or face challenges, potentially impacting the company's timeline.

Conclusion: Investing in AbbVie (ABBV) Stock: A Promising Opportunity?

AbbVie's Q[Quarter] 2024 results exceeded expectations, with strong sales growth, upwardly revised profit guidance, and positive market share gains. These results have significantly boosted investor sentiment and propelled a substantial increase in the ABBV stock price. While potential risks exist, the overall outlook for AbbVie remains positive, driven by its strong pipeline, successful product launches, and effective cost management strategies. Learn more about AbbVie (ABBV) stock and consider adding ABBV to your portfolio. Invest wisely in AbbVie's promising future.

Featured Posts

-

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025

Nfl Draft 2024 First Round Kicks Off In Green Bay

Apr 26, 2025 -

Nfl Draft Green Bay Prepares For First Round Action

Apr 26, 2025

Nfl Draft Green Bay Prepares For First Round Action

Apr 26, 2025 -

The Karen Read Trials A Chronological Overview

Apr 26, 2025

The Karen Read Trials A Chronological Overview

Apr 26, 2025 -

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 26, 2025

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 26, 2025 -

Analysis Trump Administrations Impact On European Ai Policy

Apr 26, 2025

Analysis Trump Administrations Impact On European Ai Policy

Apr 26, 2025