Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

BofA's Assessment of Current Market Conditions

Bank of America's analysts generally maintain a cautiously optimistic outlook on the current market, despite acknowledging the elevated stock market valuations. Their perspective considers several key economic indicators and long-term growth potential, suggesting that while valuations are high, they are not necessarily unsustainable or indicative of an imminent market crash.

-

Economic Indicators: BofA's analysis incorporates a range of economic indicators, including interest rates, inflation levels, and corporate earnings growth. They consider the interplay of these factors to gauge the overall health of the economy and its impact on stock prices. For example, while interest rates might influence borrowing costs and potentially dampen economic growth, BofA's analysis likely considers the counter-balancing effects of robust corporate earnings.

-

Supporting Reports and Publications: BofA regularly publishes research reports and market commentaries that detail their analysis and investment strategies. These publications provide insights into their assessment of the market and are valuable resources for investors seeking a deeper understanding of their perspective. Look for reports focusing on their equity strategy and macroeconomic forecasts for the most relevant information.

-

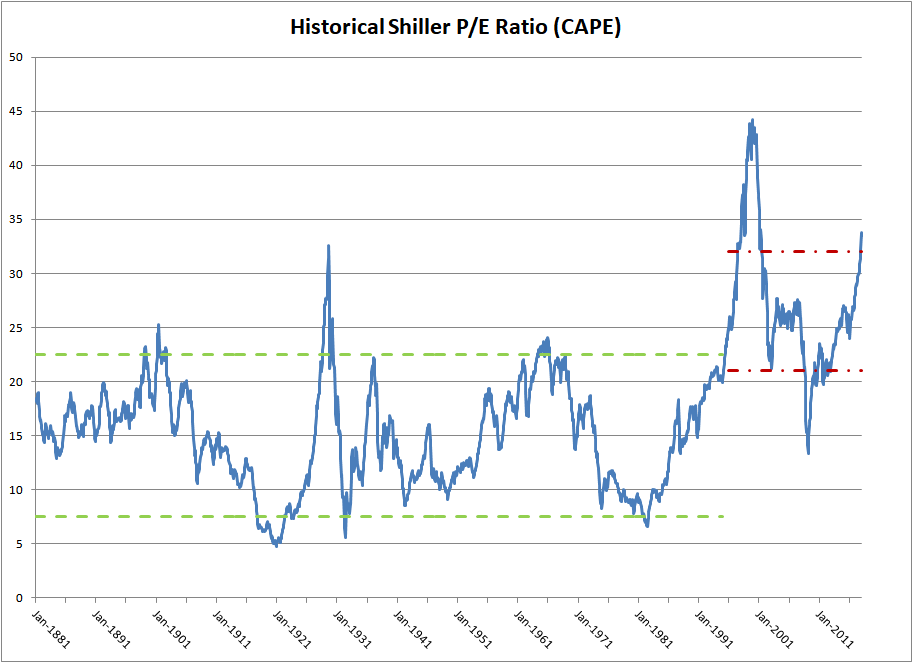

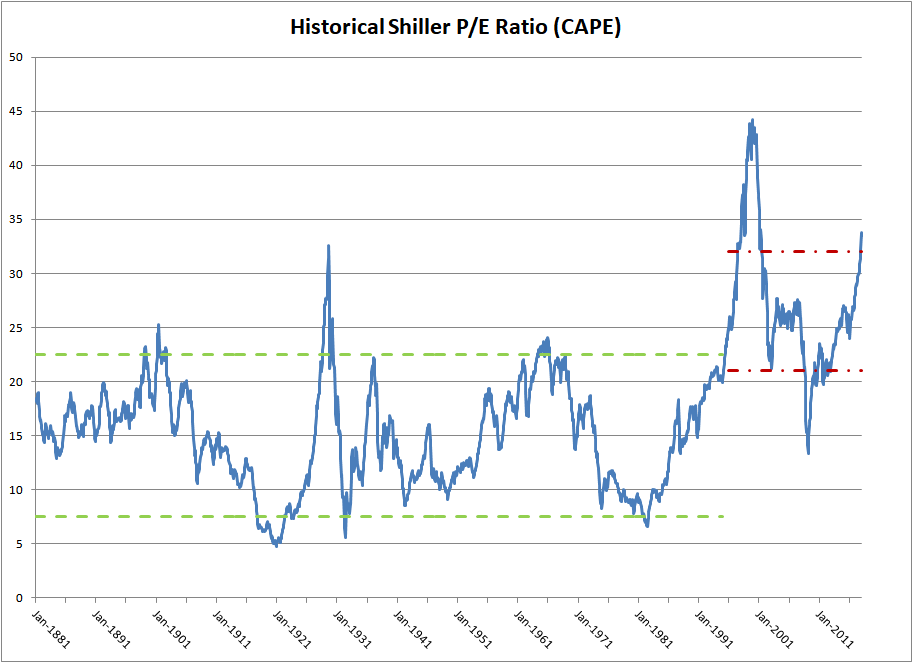

Key Data Points: BofA often references key data points such as price-to-earnings (P/E) ratios compared to historical averages. While acknowledging that current P/E ratios might be elevated, their analysis likely considers the context of these figures within a broader economic framework. They may compare current P/E ratios to those observed during periods of similar economic growth or technological disruption, demonstrating that high valuations aren't always indicative of a market bubble.

-

Economic Environment Assessment: BofA’s assessment of the current economic environment often takes into account factors like global growth prospects, geopolitical risks, and technological innovation. These factors collectively influence their outlook on stock market valuations and inform their investment recommendations.

Understanding the Drivers Behind High Valuations

Several factors contribute to the currently elevated stock market valuations. These are not necessarily signs of an overvalued market, but rather reflections of a complex interplay of economic forces.

-

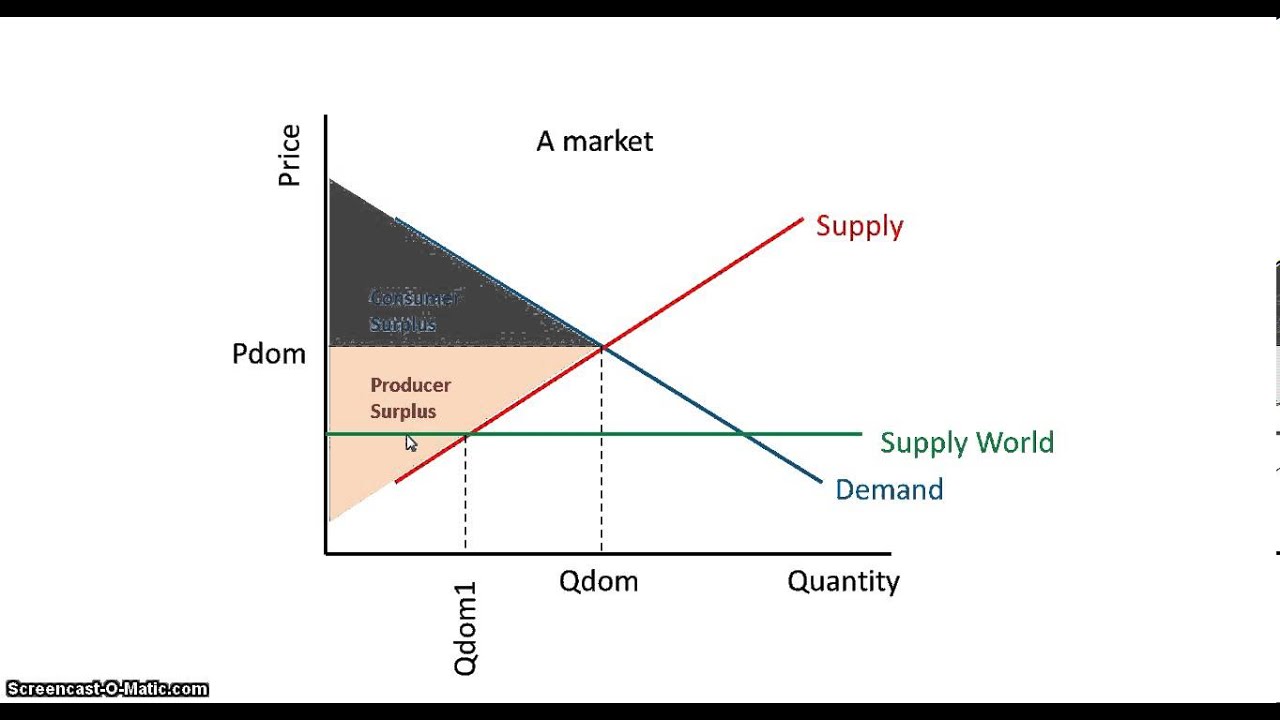

Low Interest Rates: Historically low interest rates make investments in the stock market more attractive relative to other asset classes such as bonds. This increased demand for stocks can drive prices higher, leading to higher valuations.

-

Strong Corporate Earnings Growth: Robust corporate earnings growth, particularly in specific sectors, fuels investor confidence and contributes to higher stock prices. Strong earnings justify higher valuations as investors anticipate continued growth and profitability.

-

Technological Advancements and Innovation: Technological breakthroughs and disruptive innovation in sectors such as technology, healthcare, and renewable energy often drive significant growth, leading to higher valuations for companies at the forefront of these trends.

-

Government Stimulus and Monetary Policy: Government stimulus packages and expansionary monetary policies can inject liquidity into the market, boosting stock prices and contributing to higher valuations. These actions can affect investor sentiment and overall market conditions.

The Importance of Long-Term Investment Strategies

The key to successfully navigating a market with high stock market valuations is adopting a long-term investment approach. Short-term market fluctuations should not dictate long-term investment decisions.

-

Market Fluctuations are Normal: Market volatility is a natural part of the investment cycle. Short-term drops are opportunities for long-term investors to accumulate assets at potentially lower prices.

-

Historical Market Performance: Historically, the stock market has delivered positive returns over the long term, despite periods of volatility and high valuations. Patience and a long-term outlook are essential.

-

The Power of Compounding: The power of compounding returns is maximized over longer time horizons. Consistent investment, even during periods of high valuations, can generate significant wealth over time.

-

Diversification: Diversifying investment portfolios across different asset classes and sectors can help mitigate risks associated with high valuations in specific sectors or markets.

BofA's Recommended Investment Strategies in a High-Valuation Market

BofA's recommended strategies for navigating a high-valuation market emphasize a balanced approach combining long-term vision with strategic asset allocation.

-

Sector Focus: BofA may recommend focusing on sectors projected to experience continued strong growth, even in a high-valuation environment. This might include sectors like technology, healthcare, or sustainable energy, depending on their analysis of future growth prospects.

-

Investment Vehicles: BofA might advise investors to utilize a mix of investment vehicles, including index funds and exchange-traded funds (ETFs), to achieve broad market exposure and diversification.

-

Rationale: The rationale behind these recommendations stems from BofA's in-depth analysis of the macroeconomic environment, corporate earnings, and sector-specific growth potential.

-

Risk Management: Employing risk management strategies, such as stop-loss orders and diversification, is crucial to protect against potential downsides while participating in the market's long-term growth potential.

Conclusion

While high stock market valuations are a reality, BofA's perspective suggests they aren't necessarily a cause for immediate alarm for long-term investors. Their analysis, encompassing macroeconomic factors and long-term growth potential, offers a nuanced view. The key takeaways are the importance of understanding the drivers behind these valuations, adopting a long-term investment strategy, and diversifying your portfolio.

Don't let fear of high stock market valuations paralyze your investment strategy. Learn more about BofA's insights and develop a well-informed, long-term investment plan to capitalize on market opportunities. Consider consulting with a financial advisor to discuss your individual circumstances and how to navigate high stock market valuations effectively. Remember that thorough research and a long-term perspective are vital for successful investing in any market environment, including those characterized by high stock market valuations.

Featured Posts

-

Colgate Cl Stock Sales And Profitability Affected By Increased Tariffs

Apr 26, 2025

Colgate Cl Stock Sales And Profitability Affected By Increased Tariffs

Apr 26, 2025 -

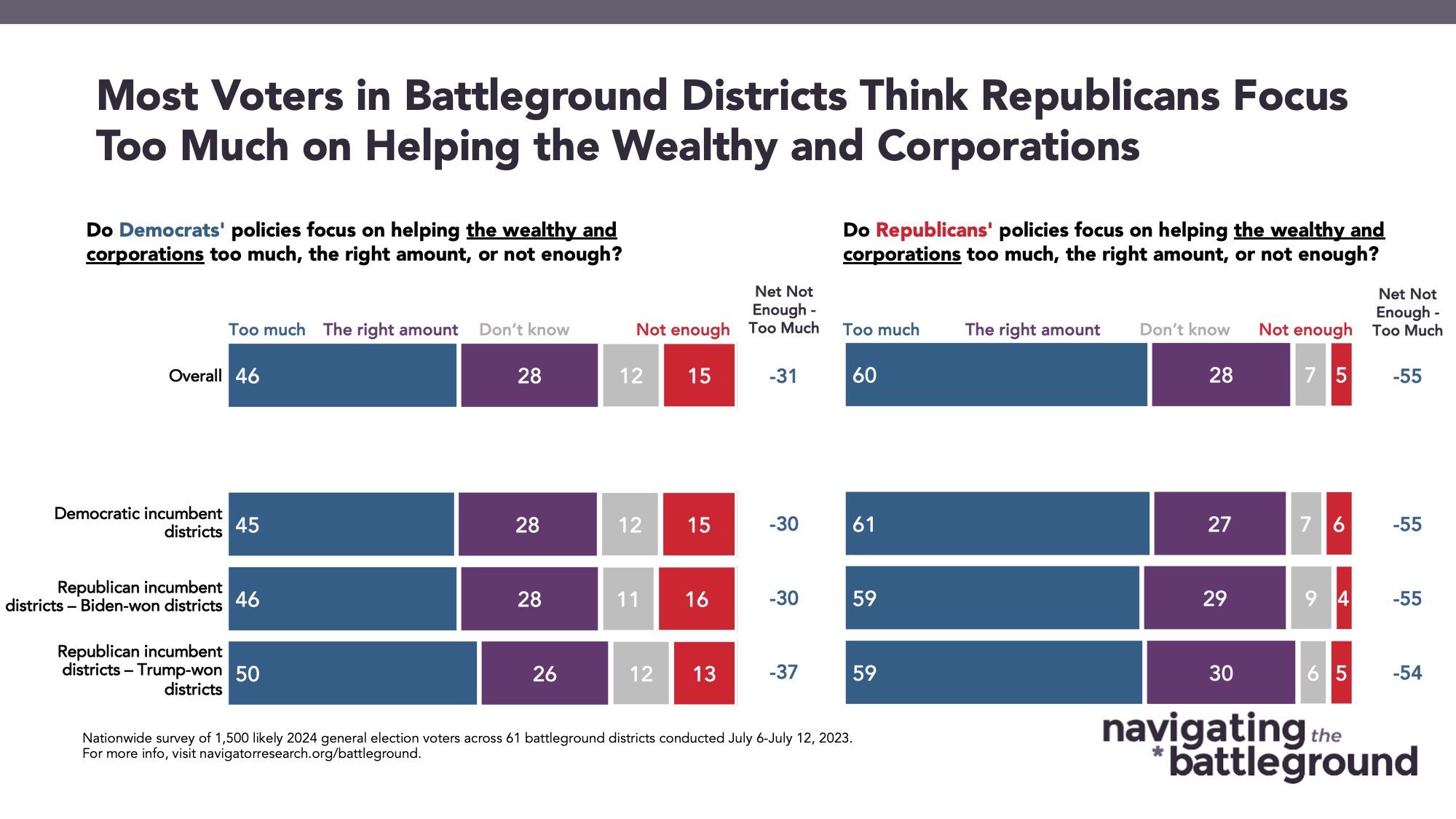

The American Battleground A Wealthy Opponent And The Fight For Justice

Apr 26, 2025

The American Battleground A Wealthy Opponent And The Fight For Justice

Apr 26, 2025 -

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025

Russias Disinformation Campaign False Greenland News Fuels Denmark Us Rift

Apr 26, 2025 -

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 26, 2025

Ftc Probe Into Open Ai Implications For Ai Development And Regulation

Apr 26, 2025 -

The China Factor How It Affects Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025

The China Factor How It Affects Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025