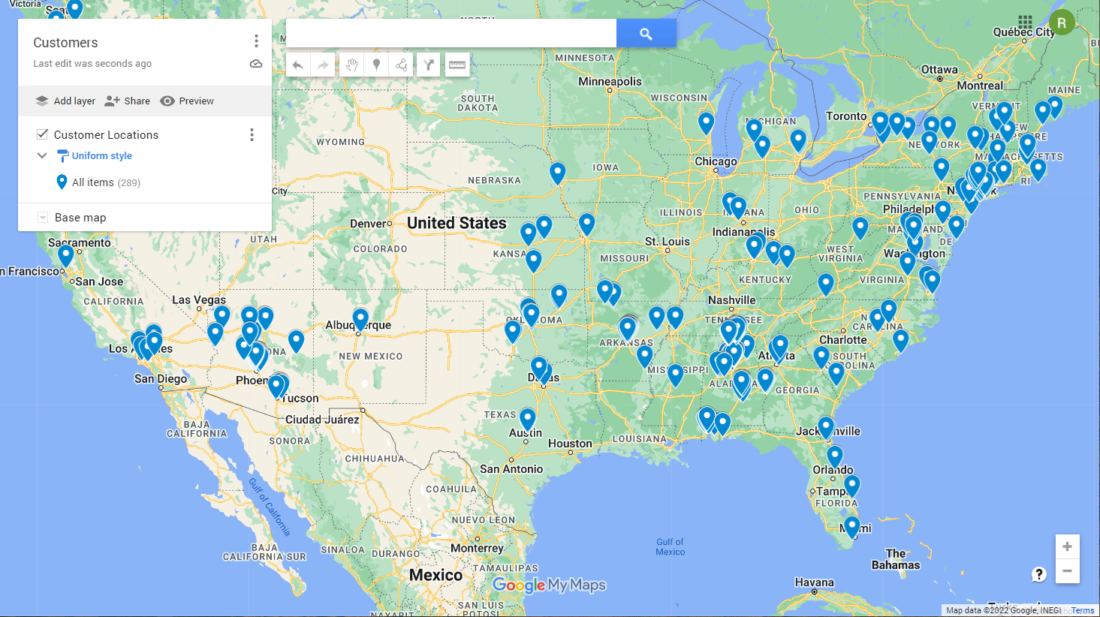

Where To Invest: A Map Of The Country's Best New Business Locations

Table of Contents

Top Metropolitan Areas for Investment

Major metropolitan areas often present the most attractive investment opportunities due to their robust infrastructure, diverse economies, and access to a skilled workforce. These urban investment hubs offer a concentration of resources and talent, fostering significant city growth. Let's examine some key players:

-

City 1 (e.g., New York City): New York City's strength lies in its diverse economy, particularly its dominance in finance, technology, and media. With a job growth rate of X% in the last year and an average salary of $Y, it offers high returns but also comes with higher costs. Excellent transportation infrastructure and access to a vast pool of skilled labor are significant advantages.

-

City 2 (e.g., Austin, TX): Austin boasts a thriving tech sector, attracting numerous startups and established tech giants. Its strengths also include a robust education system, a growing tourism industry, and a relatively lower cost of living compared to other major tech hubs. The city’s rapid population growth indicates a strong economy with significant potential for future expansion.

-

City 3 (e.g., Seattle, WA): Seattle’s unique selling proposition is its concentration in aerospace and technology, coupled with substantial government support for startups and significant tax incentives. The presence of major corporations like Boeing and Amazon, along with a strong university system, creates a fertile ground for innovation and growth.

Emerging Markets with High Growth Potential

While metropolitan areas offer established infrastructure, many smaller cities and regions are experiencing rapid economic expansion, presenting exciting opportunities for those seeking higher potential returns in emerging markets. These areas offer untapped potential and often come with lower investment costs.

-

Region 1 (e.g., The Silicon Slopes of Utah): This region is experiencing explosive growth in the tech sector, driven by a strong entrepreneurial spirit, a highly educated workforce, and a supportive business environment. The focus on renewable energy and sustainable technologies further adds to its allure.

-

Region 2 (e.g., Parts of the Midwest): Several areas in the Midwest offer affordable land and resources, making them attractive for manufacturing and agricultural businesses. The lower cost of living can also be a significant advantage when it comes to workforce recruitment and retention.

-

Region 3 (e.g., Specific counties with government incentives): Certain regions benefit from government initiatives designed to boost economic development and attract investment. These initiatives often include tax breaks, infrastructure improvements, and streamlined regulatory processes. Thorough research into these government programs is crucial.

Factors to Consider When Choosing a Location

While economic growth is a critical factor, several other considerations are essential for successful investment. Performing thorough due diligence and a comprehensive location analysis is vital. Remember to perform a solid market analysis and risk assessment. Key investment criteria include:

-

Market Demand: Before investing, thoroughly analyze the target market size, its growth potential, and the level of competition. Is there a real demand for your product or service in this specific location?

-

Infrastructure: Assess the quality and availability of essential infrastructure, including transportation networks (roads, railways, airports), utilities (electricity, water, gas), and communication networks (internet access).

-

Labor Costs and Availability: Research local workforce demographics, skill levels, and prevailing wage rates. Can you find the skilled labor you need at a competitive price?

-

Regulatory Environment: Understand local taxes, permits, regulations, and the overall ease of doing business. A favorable regulatory environment can significantly reduce your operational costs and streamline your business operations.

-

Cost of Living: The cost of living significantly impacts employee recruitment and retention. A high cost of living may require higher salaries, impacting your profitability.

Resources for Further Investment Research

Conducting thorough research is paramount before making any investment decisions. The following resources can provide valuable insights:

-

Government Websites: Explore websites of relevant government agencies like the [Name of relevant government agency] for economic development data, census data, and industry reports.

-

Market Research Firms: Several reputable market research firms offer in-depth reports on various industries and geographic locations. Examples include [Name of relevant market research firms].

-

Industry Associations: Industry-specific associations often publish reports and offer insights into market trends and best practices.

Conclusion: Making Informed Investment Decisions: Where to Invest

This guide has highlighted several key locations and factors to consider when deciding where to invest. Remember, success depends not only on economic growth but also on a thorough assessment of market demand, infrastructure, labor costs, and the regulatory environment. By carefully weighing these factors, you can significantly increase your chances of success. Start your investment journey today by researching the top locations highlighted in this guide. Finding the right place to invest is crucial for success – use this map to navigate your path to prosperity.

Featured Posts

-

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 24, 2025

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 24, 2025 -

Potential 3 Billion Crypto Spac Deal Cantor Tether And Soft Bank In Discussions

Apr 24, 2025

Potential 3 Billion Crypto Spac Deal Cantor Tether And Soft Bank In Discussions

Apr 24, 2025 -

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025 -

3 Billion Crypto Spac Cantor Tether And Soft Bank Explore Merger

Apr 24, 2025

3 Billion Crypto Spac Cantor Tether And Soft Bank Explore Merger

Apr 24, 2025 -

Open Ais Interest In Google Chrome A Chat Gpt Ceos Perspective

Apr 24, 2025

Open Ais Interest In Google Chrome A Chat Gpt Ceos Perspective

Apr 24, 2025