$3 Billion Crypto SPAC: Cantor, Tether, And SoftBank Explore Merger

Table of Contents

The Players Involved: Cantor, Tether, and SoftBank

This proposed $3 billion crypto SPAC merger brings together three powerful entities, each bringing unique strengths and expertise to the table. Understanding their individual roles is crucial to grasping the potential implications of this deal.

-

Cantor Fitzgerald: A leading global financial services firm, Cantor Fitzgerald offers extensive experience in navigating complex financial markets and regulatory landscapes. Their involvement provides a crucial layer of legitimacy and expertise in financial structuring, crucial for a successful SPAC merger. Their understanding of traditional financial markets could facilitate the integration of crypto assets into mainstream finance.

-

Tether: The issuer of USDT, the largest stablecoin by market capitalization, Tether's involvement is perhaps the most controversial aspect of this potential $3 Billion Crypto SPAC. While USDT enjoys widespread use, it has also faced scrutiny regarding its reserves and transparency. A successful merger could significantly enhance Tether's legitimacy and potentially lead to greater mainstream adoption of its stablecoin.

-

SoftBank: A prominent technology investment firm with a history of high-profile investments in innovative companies, SoftBank's participation brings substantial financial backing and strategic investment acumen to the table. Their vast resources and network could prove instrumental in driving growth and expansion for the merged entity.

The synergies between these three players are significant. Cantor’s financial expertise and regulatory knowledge could help navigate the complexities of the crypto market, while Tether’s established presence provides a substantial asset base. SoftBank's investment power offers the capital needed for expansion and market penetration. However, the risks are equally significant, particularly concerning Tether's regulatory challenges.

The Proposed $3 Billion Crypto SPAC Deal: Structure and Implications

The proposed deal would follow the typical structure of a SPAC merger. A blank-check company (SPAC) would merge with a privately held crypto company, likely a newly formed entity comprising elements of Cantor, Tether, and SoftBank’s existing operations. This would result in a publicly traded company listed on a major stock exchange.

-

SPAC Mechanics: The SPAC would raise capital through an initial public offering (IPO), then use those funds to acquire the crypto entity. Shareholders would vote on the merger, and upon approval, the combined entity would begin trading on the exchange.

-

Valuation: The $3 billion valuation represents the combined value of the SPAC and the target crypto company after the merger. This valuation will, of course, be subject to market conditions and the final terms of the deal.

-

Listing: A successful merger would likely lead to a listing on a major US exchange such as the NASDAQ or NYSE, significantly increasing the liquidity and accessibility of Tether and associated assets.

The implications for the cryptocurrency market are vast. A successful merger could signal increased legitimacy for cryptocurrencies within the traditional financial system and potentially lead to greater institutional investment. However, it could also attract increased regulatory scrutiny and potential legal challenges.

Market Reaction and Analysis: Experts Weigh In on the $3 Billion Crypto SPAC

The news of this potential $3 Billion Crypto SPAC has generated a mixed market reaction. While some view it as a positive development indicating increased institutional acceptance of cryptocurrencies, others express concern over the complexities and potential risks involved.

-

Positive Impacts: Increased legitimacy within traditional finance, potential for significant market capitalization growth, and the potential to accelerate innovation within the cryptocurrency space.

-

Negative Impacts: Increased regulatory scrutiny, potential for market manipulation, and potential dilution of existing investments in Tether and related projects.

-

Neutral Perspectives: A "wait-and-see" approach prevails among many analysts, reflecting the inherent uncertainty associated with any such large-scale merger in a volatile market.

Financial analysts and crypto experts are divided in their assessments. Some highlight the potential benefits of bringing together such powerful entities, while others warn of the potential pitfalls. The impact on the price of Tether and other cryptocurrencies remains uncertain, depending heavily on the final terms of the deal and the market's reaction.

Potential Risks and Challenges of the $3 Billion Crypto SPAC Merger

Several significant risks and challenges could hinder the success of this ambitious $3 Billion Crypto SPAC merger.

-

Regulatory Uncertainty: The cryptocurrency industry faces considerable regulatory uncertainty, with differing regulations across jurisdictions. Navigating these complex legal landscapes will be crucial for the success of the merger.

-

Legal Challenges: Tether's past controversies could lead to lawsuits or investigations, potentially delaying or derailing the merger process.

-

Integration Challenges: Combining the distinct corporate cultures and operational styles of Cantor, Tether, and SoftBank will require careful planning and execution.

Conclusion

The proposed $3 billion crypto SPAC merger involving Cantor, Tether, and SoftBank presents a potentially transformative event for the cryptocurrency market. While it offers the possibility of increased legitimacy, market growth, and innovation, significant risks and challenges remain, including regulatory hurdles and the lingering controversies surrounding Tether. The success of this ambitious deal will depend on navigating these complexities effectively.

Call to Action: Stay informed about the latest developments surrounding this potentially groundbreaking $3 billion crypto SPAC deal. Follow our website for ongoing updates and further analysis of this pivotal merger and its impact on the future of the cryptocurrency landscape. Keep a close watch on the news regarding this significant $3 Billion Crypto SPAC and how it shapes the future of crypto investments.

Featured Posts

-

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025 -

Did Sk Hynix Surpass Samsung In Dram Production The Role Of Ai

Apr 24, 2025

Did Sk Hynix Surpass Samsung In Dram Production The Role Of Ai

Apr 24, 2025 -

Price Gouging Allegations Rock La Rental Market Post Fires

Apr 24, 2025

Price Gouging Allegations Rock La Rental Market Post Fires

Apr 24, 2025 -

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025

417 5 Million Deal Alcon Acquires Village Roadshow

Apr 24, 2025 -

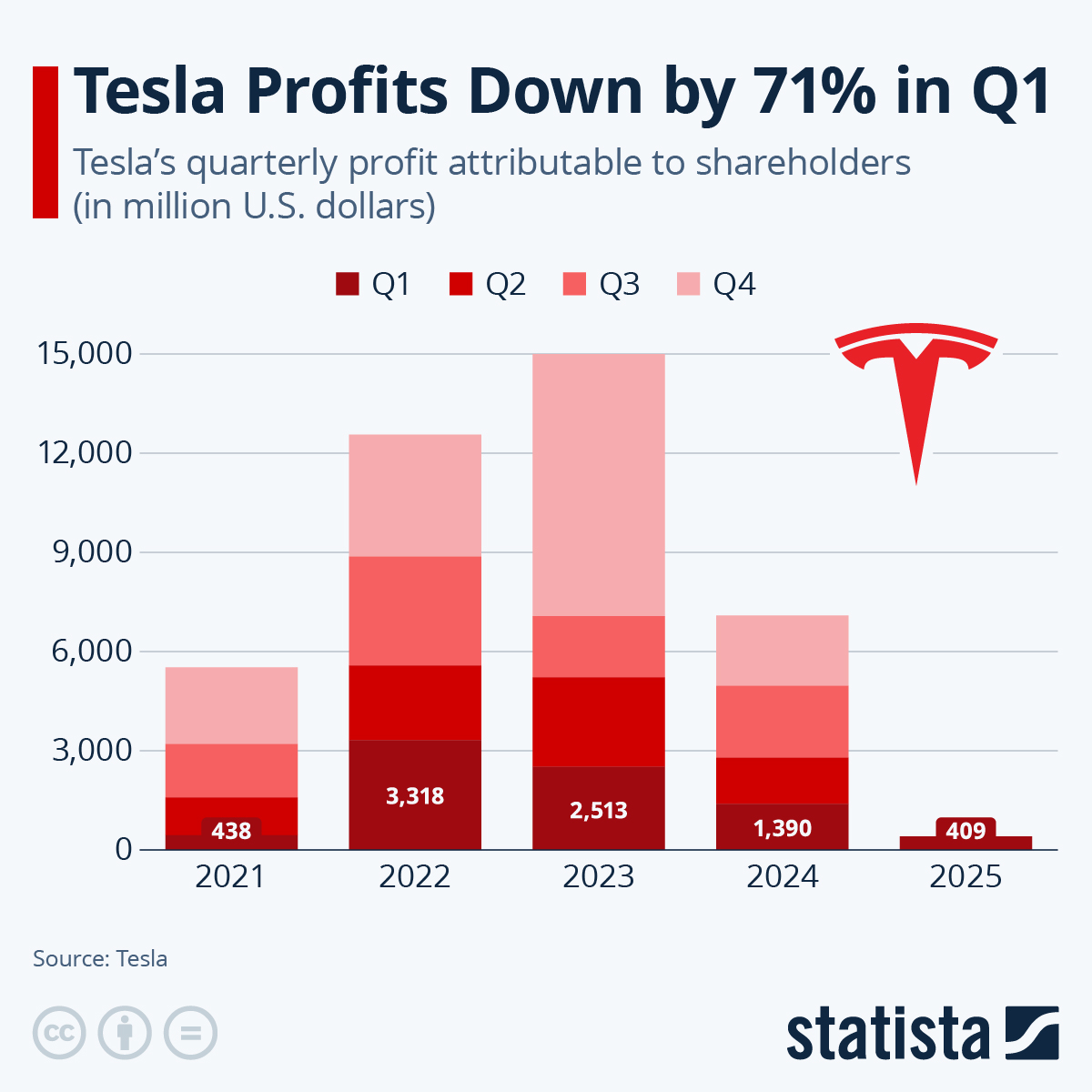

Tesla Earnings Decline Political Backlash Impacts Q1 Net Income

Apr 24, 2025

Tesla Earnings Decline Political Backlash Impacts Q1 Net Income

Apr 24, 2025