The Widening Cracks In Private Credit: A Credit Weekly Report

Table of Contents

Rising Default Rates in Private Credit Markets

The rise in default rates within the private credit market is a significant concern. Several factors are contributing to this worrying trend, impacting both investors and the broader economy.

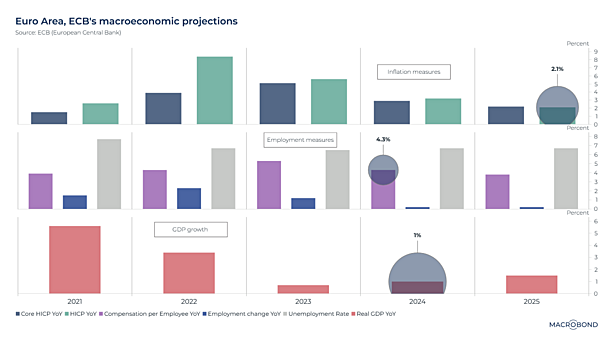

Impact of Rising Interest Rates

The significant increase in interest rates orchestrated by central banks globally is having a profound impact on borrowers' ability to service their debt. This is leading to a noticeable rise in defaults across various sectors.

- Increased borrowing costs directly impacting profitability: Higher interest payments eat into profit margins, leaving businesses with less cash flow to meet their obligations.

- Refinancing difficulties for existing loans: Borrowers facing maturing loans are finding it increasingly difficult to refinance at affordable rates, pushing them closer to default.

- Higher risk premiums demanded by lenders: Lenders are demanding higher risk premiums to compensate for the increased uncertainty, making borrowing even more expensive.

- Focus on specific sectors experiencing high default rates (e.g., real estate, leveraged buyouts): Certain sectors, particularly those heavily leveraged, are particularly vulnerable to rising interest rates and are experiencing disproportionately high default rates. The real estate market, for instance, is showing signs of significant stress.

Underestimation of Credit Risk

Another contributing factor to the rising default rates is the argument that initial underwriting may have underestimated the inherent risks in certain private credit investments. This oversight is now leading to significant vulnerabilities.

- Inadequate due diligence on borrower financials: In the pursuit of high returns, some lenders may have cut corners on due diligence, failing to fully assess the financial health of borrowers.

- Overreliance on collateral value in a volatile market: Collateral values, once considered a safety net, are proving volatile in the current economic climate, diminishing their effectiveness as a risk mitigation tool.

- Insufficient stress testing of loan portfolios: Many lenders failed to adequately stress test their loan portfolios against various economic scenarios, leaving them unprepared for the current market downturn.

- Lack of transparency in loan structures: Complex loan structures and a lack of transparency can obscure underlying risks, making it difficult to accurately assess the true creditworthiness of borrowers.

Decreased Liquidity in the Private Credit Market

The decreased liquidity in the private credit market is exacerbating the challenges. This illiquidity stems from reduced investor appetite and its impact on secondary market transactions.

Reduced Investor Appetite

Uncertainty in the broader economic climate and concerns about defaults are significantly reducing investor appetite for private credit investments. This has far-reaching consequences.

- Difficulty selling existing private credit assets: Investors are finding it increasingly challenging to sell their private credit holdings, trapping capital.

- Limited secondary market trading activity: The volume of trades in the secondary market for private credit has fallen dramatically, further reducing liquidity.

- Increased spreads between bid and ask prices: The gap between the price buyers are willing to pay and the price sellers are willing to accept has widened significantly, reflecting the lack of liquidity.

- Impact on fund managers' ability to meet redemption requests: Fund managers are struggling to meet redemption requests from investors due to the illiquidity of the market.

Impact on Secondary Market Transactions

The decreased liquidity is severely impacting secondary market transactions, leading to further market instability and valuation issues.

- Fewer buyers, resulting in lower prices for private credit assets: The scarcity of buyers is forcing sellers to accept lower prices for their assets, depressing overall valuations.

- Increased difficulty in finding buyers for distressed assets: Distressed assets are particularly difficult to sell, leading to potential write-downs for investors.

- Potential for forced fire sales of assets: Lenders facing liquidity constraints may be forced to sell assets at fire-sale prices, further depressing market values.

- Impact on overall market pricing and valuation: The decreased liquidity is distorting market pricing and valuations, making it difficult to accurately assess the true worth of private credit assets.

Tightening Lending Standards and Reduced Availability of Private Credit

In response to the increased risks, lenders are tightening their lending standards, making it harder for businesses to secure financing.

Increased Due Diligence & Stricter Underwriting

Lenders are becoming considerably more cautious, implementing stricter underwriting criteria and performing significantly more rigorous due diligence.

- Higher credit scores required for borrowers: Lenders are demanding higher credit scores from borrowers to mitigate the risk of default.

- Increased collateral requirements: Borrowers are now required to provide more collateral to secure loans, increasing the overall cost of borrowing.

- More stringent covenants in loan agreements: Loan agreements are becoming more restrictive, with lenders imposing stricter covenants to protect their interests.

- Longer approval times for loan applications: The increased scrutiny is leading to longer approval times for loan applications, delaying projects and impacting businesses’ ability to access capital quickly.

Impact on Businesses Seeking Financing

The tightening lending standards are creating significant challenges for businesses seeking financing through private credit channels.

- Reduced availability of capital for expansion: Businesses are finding it more difficult to secure capital for expansion projects, hindering growth.

- Increased cost of borrowing: Even when businesses can secure financing, the cost of borrowing has increased significantly, impacting profitability.

- Potential for businesses to delay or cancel projects: The difficulty and expense of securing financing may force businesses to delay or cancel projects altogether.

- Shift towards alternative financing sources: Businesses are increasingly turning to alternative financing sources, such as venture capital or crowdfunding, to meet their funding needs.

Conclusion

The private credit market is facing significant headwinds, with rising default rates, decreased liquidity, and tightening lending standards creating a challenging environment. Investors and borrowers need to carefully analyze these “widening cracks” and adapt their strategies accordingly. Understanding the current dynamics of the private credit market is crucial for navigating this period of uncertainty. Stay informed about these developing trends by regularly checking our Credit Weekly Report for the latest insights on private credit and related market dynamics. Don't miss our next report for further analysis on the evolving landscape of private credit and how to manage risk effectively in this changing market.

Featured Posts

-

Happy Day Celebrating February 20 2025

Apr 27, 2025

Happy Day Celebrating February 20 2025

Apr 27, 2025 -

Political Polarization In Canada The Case Of Alberta And Anti Trump Sentiment

Apr 27, 2025

Political Polarization In Canada The Case Of Alberta And Anti Trump Sentiment

Apr 27, 2025 -

Djokovics Monte Carlo Masters 2025 Upset Straight Sets Loss To Tabilo

Apr 27, 2025

Djokovics Monte Carlo Masters 2025 Upset Straight Sets Loss To Tabilo

Apr 27, 2025 -

Economic Slowdown Prompts Simkus To Suggest Two More Ecb Rate Cuts

Apr 27, 2025

Economic Slowdown Prompts Simkus To Suggest Two More Ecb Rate Cuts

Apr 27, 2025 -

Canada Vs Us The Rise Of Canadian Tourism

Apr 27, 2025

Canada Vs Us The Rise Of Canadian Tourism

Apr 27, 2025