Economic Slowdown Prompts Simkus To Suggest Two More ECB Rate Cuts

Table of Contents

The Eurozone economy is facing a significant slowdown, raising concerns amongst economists and policymakers. The severity of this weakening economy has prompted a bold suggestion from ECB council member Gediminas Šimkus: two more interest rate cuts. This proposal, involving significant ECB rate cuts, is a direct response to the increasingly gloomy economic outlook and carries with it both potential benefits and considerable risks for the Eurozone economy. This article will delve into the rationale behind Šimkus's recommendation, exploring its potential impacts and examining alternative policy options the ECB might consider.

Simkus's Rationale Behind the Proposed ECB Rate Cuts

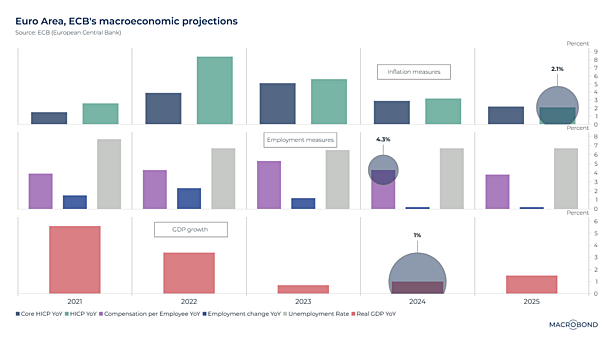

Šimkus's call for further interest rate reduction is rooted in several key economic indicators pointing to a weakening Eurozone. The current economic slowdown is characterized by several troubling trends: weakening GDP growth, falling inflation, and rising unemployment. These factors combine to paint a picture of a struggling economy in need of stimulus.

- Weakening GDP Growth: Recent Eurozone GDP figures have fallen short of expectations, signaling a significant slowdown in economic activity. Preliminary estimates for Q[insert quarter] [insert year] show a growth rate of only [insert percentage]%, significantly lower than previous quarters and below the ECB's target.

- Falling Inflation: Inflation remains stubbornly low, well below the ECB's target of 2%. This indicates weak consumer demand and a lack of price pressure, further supporting the need for stimulus. Current inflation is hovering around [insert percentage]%.

- Rising Unemployment: Unemployment rates across the Eurozone are rising, indicating a decline in employment opportunities and economic activity. The current unemployment rate stands at [insert percentage]%, a concerning increase from [insert previous percentage]%.

- Negative Economic Forecasts: Several leading economic forecasting organizations have issued revised forecasts predicting continued slow growth or even recession for the Eurozone in the coming quarters. These projections solidify the urgency of the situation.

The combined impact of these negative trends threatens to deepen the economic slowdown, potentially leading to a prolonged period of low growth and high unemployment across the Eurozone.

Potential Impacts of Further ECB Rate Cuts

Lower interest rates, achieved through further ECB rate cuts, could offer several positive effects on the Eurozone economy:

- Increased Borrowing and Investment: Reduced borrowing costs incentivize businesses to invest more in expansion, equipment, and job creation. This can lead to increased economic activity and job growth.

- Stimulation of Consumer Spending: Lower interest rates reduce the cost of borrowing for consumers, encouraging increased spending on durable goods and services. This increased consumer demand can boost economic activity.

- Potential Boost to Economic Growth: The combined effects of increased borrowing, investment, and consumer spending can lead to a significant boost in overall economic growth.

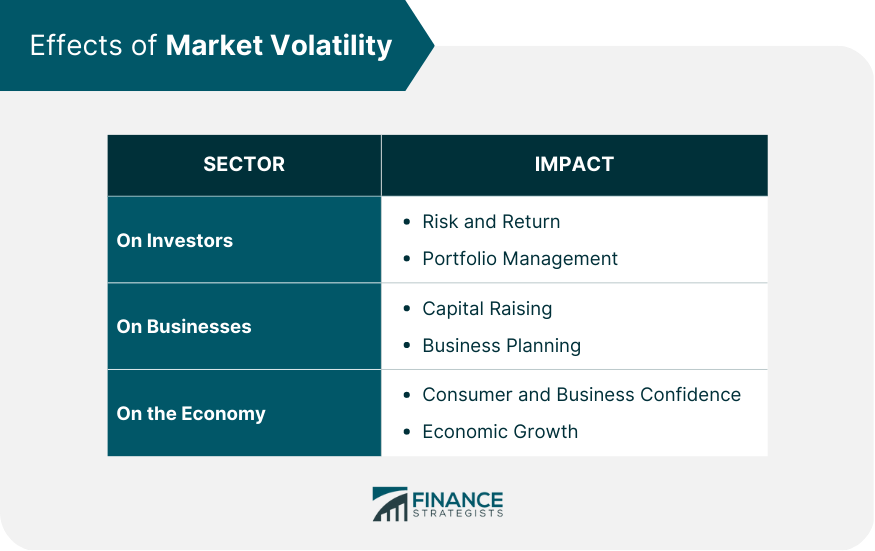

However, further ECB rate cuts also carry potential negative consequences:

- Risk of Fueling Inflation: While currently low, significantly lowering interest rates could potentially lead to higher inflation in the longer term, eroding purchasing power.

- Potential Impact on the Euro's Exchange Rate: Lower interest rates can make the Euro less attractive to foreign investors, potentially leading to a depreciation of the currency. This could impact import prices and exacerbate inflation.

- Concerns about Increased Government Debt: Lower interest rates can make it easier for governments to borrow money, potentially leading to increased government debt levels. Managing this debt sustainably becomes more challenging.

Market Reactions and Expert Opinions on Simkus's Proposal

The initial market reaction to Šimkus's proposal was mixed. Stock markets showed [insert type of reaction, e.g., a modest increase/a slight dip], while bond yields [insert type of reaction, e.g., fell/rose].

Expert opinions are similarly divided. Some economists believe that further ECB rate cuts are necessary to prevent a deeper economic downturn and stimulate growth. "The current economic climate demands proactive measures," argues Professor [insert name and affiliation], emphasizing the need for decisive action.

Others, however, express concern about the potential negative consequences, particularly the risk of fueling inflation down the line. “[Insert quote from a dissenting economist expressing concerns],” stated [insert name and affiliation]. Several members within the ECB itself have also voiced concerns about the potential long-term implications of further rate cuts.

Alternative Policy Options Considered by the ECB

Besides interest rate cuts, the ECB has several other policy tools at its disposal to combat the economic slowdown:

- Quantitative Easing (QE): The ECB could launch or expand a QE program, purchasing government bonds and other assets to inject liquidity into the financial system.

- Targeted Lending Programs: The ECB could introduce or expand programs offering subsidized loans to specific sectors of the economy, such as small and medium-sized enterprises (SMEs).

These alternative policies each have their own advantages and disadvantages compared to further interest rate cuts. While QE can inject liquidity, it might not effectively target specific sectors. Targeted lending programs can be more effective in stimulating specific areas, but require careful implementation to avoid distortions in the market.

Conclusion

Šimkus's proposal for two more ECB rate cuts reflects the serious concerns surrounding the current Eurozone economic slowdown. The weakening GDP growth, low inflation, and rising unemployment create a compelling case for stimulus. However, the potential risks associated with further rate cuts, including the long-term implications for inflation and government debt, must be carefully weighed. The ECB will need to consider alternative policy options and carefully assess the potential consequences before making a final decision. Stay tuned for updates on ECB rate cuts and further developments concerning the Eurozone economy. Follow our coverage for in-depth analysis of the impact of ECB rate cuts on the Eurozone and global markets.

Featured Posts

-

Ariana Grandes Bold New Look Professional Insights On Hair And Tattoos

Apr 27, 2025

Ariana Grandes Bold New Look Professional Insights On Hair And Tattoos

Apr 27, 2025 -

Sinners Doping Case A Definitive Conclusion

Apr 27, 2025

Sinners Doping Case A Definitive Conclusion

Apr 27, 2025 -

Microsoft On Ai Prioritizing Human Experience In Design

Apr 27, 2025

Microsoft On Ai Prioritizing Human Experience In Design

Apr 27, 2025 -

Top Seed Pegula Claims Charleston Victory Against Collins

Apr 27, 2025

Top Seed Pegula Claims Charleston Victory Against Collins

Apr 27, 2025 -

Nbc Chicago Hhss Controversial Choice To Examine Autism Vaccine Link

Apr 27, 2025

Nbc Chicago Hhss Controversial Choice To Examine Autism Vaccine Link

Apr 27, 2025

Latest Posts

-

Professional And Individual Investor Behavior During Market Swings

Apr 28, 2025

Professional And Individual Investor Behavior During Market Swings

Apr 28, 2025 -

The Recent Market Decline Professional Selling And Retail Buying Trends

Apr 28, 2025

The Recent Market Decline Professional Selling And Retail Buying Trends

Apr 28, 2025 -

Market Volatility Examining The Actions Of Professionals And Individuals

Apr 28, 2025

Market Volatility Examining The Actions Of Professionals And Individuals

Apr 28, 2025 -

Senior Hamas Officials Hold Ceasefire Negotiations In Egypt

Apr 28, 2025

Senior Hamas Officials Hold Ceasefire Negotiations In Egypt

Apr 28, 2025 -

Nfl Draft 2024 Shedeur Sanders Selected By Cleveland Browns

Apr 28, 2025

Nfl Draft 2024 Shedeur Sanders Selected By Cleveland Browns

Apr 28, 2025