Professional And Individual Investor Behavior During Market Swings

Table of Contents

Professional Investor Behavior During Market Swings

Professional investors, such as fund managers and portfolio specialists, approach market swings with a calculated and disciplined strategy. Their actions are largely driven by data analysis and a long-term perspective, significantly differing from the often emotional responses of individual investors.

Risk Management Strategies Employed by Professionals

Professionals prioritize risk management above all else. Their strategies are built on a foundation of:

-

Focus on long-term investment strategies: Professional investors typically focus on the long-term growth potential of their investments, weathering short-term market fluctuations. They understand that market timing is nearly impossible to master consistently.

-

Diversification across asset classes: Diversification is a cornerstone of professional risk management. They spread investments across various asset classes, including stocks, bonds, real estate, commodities, and alternative investments, to reduce the impact of any single market downturn. This approach reduces portfolio volatility and protects capital.

-

Utilizing hedging techniques to mitigate risk: Sophisticated hedging strategies are employed to protect against potential losses. This might involve using derivatives or options to offset potential declines in specific assets or the overall market.

-

Employing quantitative analysis and sophisticated modeling: Professional investors leverage advanced analytical tools, including econometric models and statistical analysis, to predict market trends and assess risk. This data-driven approach informs their investment decisions.

-

Active portfolio rebalancing based on market conditions: Portfolios are actively managed and rebalanced to maintain the desired asset allocation. This involves selling some assets that have performed well and buying assets that have underperformed to ensure the portfolio remains aligned with the investor's risk profile and investment goals.

-

Stress testing portfolios to assess resilience to various market scenarios: Professionals regularly test their portfolios' resilience under various adverse market conditions (e.g., recessions, geopolitical crises) to ensure they can withstand significant market downturns.

Professional Reactions to Market Volatility

When market volatility strikes, professionals generally:

-

Maintain a calm and rational approach: Panic selling is avoided. Professionals understand that market corrections are a normal part of the investment cycle.

-

Avoid impulsive decisions based on short-term market fluctuations: They stick to their long-term investment plans, resisting the urge to make hasty changes based on short-term market noise.

-

Utilize fundamental analysis to identify undervalued assets: Market downturns often create opportunities to acquire high-quality assets at discounted prices. Professionals use fundamental analysis to identify undervalued companies with strong long-term prospects.

-

Take advantage of market corrections to buy low and sell high: Market corrections are viewed as buying opportunities. They strategically allocate capital to undervalued assets, aiming to capitalize on price rebounds.

-

Reliance on data-driven insights and rigorous research: Decisions are based on thorough research, data analysis, and a comprehensive understanding of market dynamics. Gut feelings play a minimal role.

-

Seeking opportunities during market downturns: Professionals actively search for opportunities arising from market volatility, recognizing that periods of uncertainty often present lucrative investment prospects.

Individual Investor Behavior During Market Swings

Individual investors often react differently to market swings, frequently driven by emotions and a lack of long-term perspective. Their behavior can be significantly influenced by factors outside of rational investment principles.

Emotional Responses to Market Volatility

Individual investors are more susceptible to emotional biases, leading to:

-

Prone to panic selling during market declines ("fear"): Fear often drives investors to sell assets at the worst possible time, locking in losses and missing out on potential recovery.

-

Susceptibility to herd mentality and market fads: Individuals may follow the crowd, making investment decisions based on popular trends rather than sound analysis, leading to poor investment outcomes.

-

Difficulty in assessing risk and making rational investment decisions: A lack of financial literacy and experience can lead to poor risk assessment and impulsive decision-making.

-

Overconfidence during bull markets ("greed"): In bull markets, overconfidence can lead to excessive risk-taking and investments in speculative assets, exposing individuals to significant losses when the market corrects.

-

Influence of media and market sentiment: Individual investors are often swayed by media headlines and market sentiment, leading to emotional reactions rather than reasoned investment choices.

-

Limited understanding of sophisticated investment strategies: Lack of knowledge regarding hedging, diversification, and other advanced investment techniques exposes individuals to greater risk.

Individual Investor Strategies (or lack thereof)

Many individual investors:

-

Often lack a well-defined investment plan: Without a clear plan, it's easy to react emotionally to market changes rather than sticking to a pre-determined strategy.

-

Higher propensity for short-term trading and speculation: A focus on short-term gains often leads to higher trading costs and increased susceptibility to market manipulation.

-

Less diversification in their investment portfolios: Concentrated holdings in a few assets increase risk exposure and limit potential returns.

-

Limited access to professional financial advice: Many individuals lack access to professional financial advisors, missing out on valuable guidance.

-

More reactive to market news and events: Individuals often react quickly to news headlines without considering the long-term implications for their investments.

-

Greater susceptibility to market manipulation: Lack of knowledge and experience makes them more vulnerable to market manipulation and fraudulent schemes.

Key Differences in Approach: Professional vs. Individual

The contrasting approaches of professional and individual investors are stark. Professionals prioritize long-term strategies, data-driven analysis, and risk management, while individual investors are often swayed by emotions and market sentiment.

-

Risk Tolerance: Professionals have higher risk tolerance, based on diversification and hedging strategies. Individuals often have lower risk tolerance and are more susceptible to emotional reactions to market volatility.

-

Investment Horizons: Professionals focus on long-term investment horizons, while individuals often have shorter time horizons, leading to impulsive decisions.

-

Decision-Making Processes: Professionals rely on quantitative analysis and rigorous research. Individual investors may rely more on intuition, hearsay, and emotion.

-

Importance of financial literacy for individual investors: Improving financial literacy is crucial for mitigating emotional biases and making informed investment decisions.

-

The role of professional financial advisors in guiding individual investor behavior: Seeking professional guidance can provide valuable support in developing a sound investment strategy and managing emotional responses to market swings.

Conclusion

This article highlighted the contrasting investor behavior patterns of professionals and individuals during market swings. Professionals typically demonstrate a more disciplined and data-driven approach, while individuals are often influenced by emotions and market sentiment. Understanding these differences is crucial for navigating market volatility successfully. Learning to recognize and manage your own investor behavior during market swings is key to long-term investment success. Enhance your financial literacy and consider seeking professional guidance to optimize your investment strategies amidst market swings. Take control of your financial future by understanding investor behavior and its impact on your portfolio.

Featured Posts

-

Analyzing The Mets Week 1 Spring Training Performance Roster Projections

Apr 28, 2025

Analyzing The Mets Week 1 Spring Training Performance Roster Projections

Apr 28, 2025 -

The Luigi Mangione Movement Understanding Its Core Beliefs

Apr 28, 2025

The Luigi Mangione Movement Understanding Its Core Beliefs

Apr 28, 2025 -

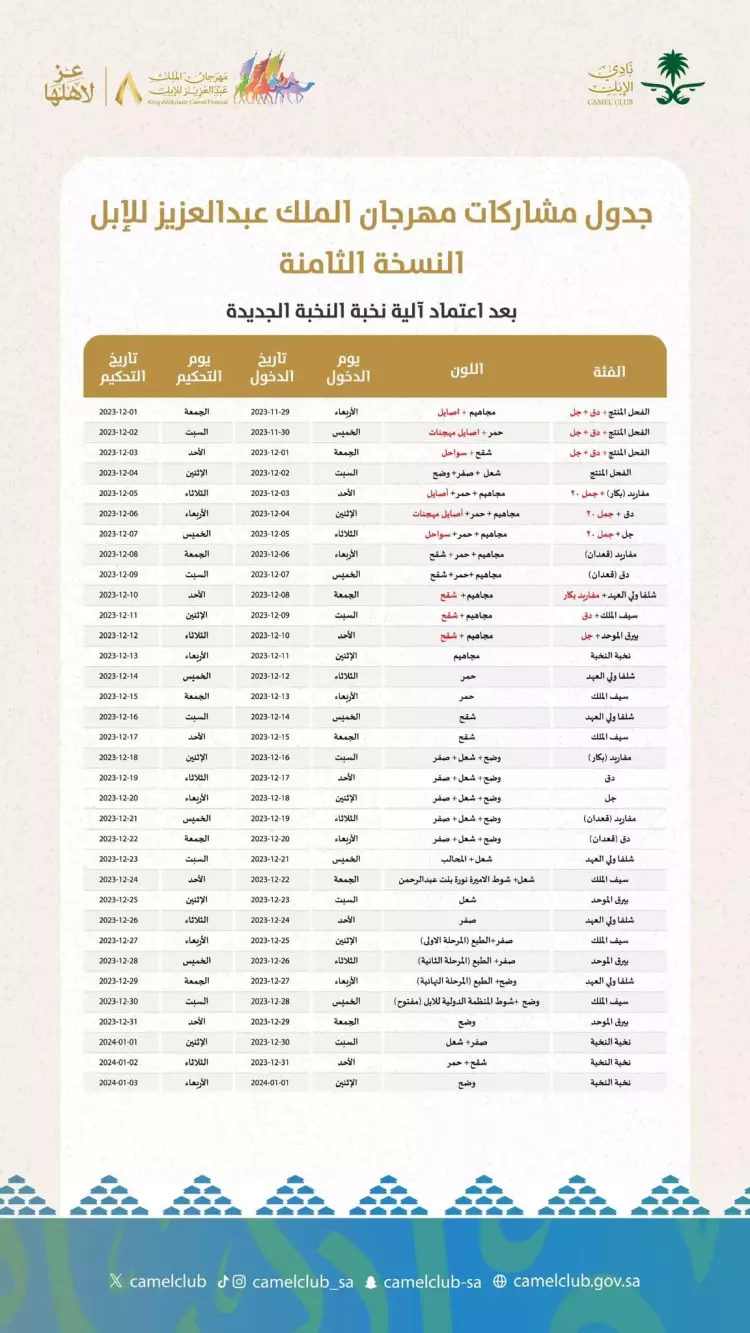

Alnskht Althanyt Waleshrwn Mn Mhrjan Abwzby Brnamj Hafl Balnjwm

Apr 28, 2025

Alnskht Althanyt Waleshrwn Mn Mhrjan Abwzby Brnamj Hafl Balnjwm

Apr 28, 2025 -

Michael Jordans Support For Denny Hamlin You Boo Him That Makes Him Better

Apr 28, 2025

Michael Jordans Support For Denny Hamlin You Boo Him That Makes Him Better

Apr 28, 2025 -

Exploring The Countrys Newest Business Centers A Comprehensive Guide

Apr 28, 2025

Exploring The Countrys Newest Business Centers A Comprehensive Guide

Apr 28, 2025