Navigate The Private Credit Boom: 5 Essential Do's And Don'ts

Table of Contents

Do's of Navigating the Private Credit Boom

Do Your Due Diligence

Thoroughly researching potential investments or lenders is paramount in the private credit market. This isn't simply a matter of reviewing a prospectus; it requires a deep dive into the specifics of the deal and the players involved. Cutting corners here can have severe consequences.

- Verify the lender's/sponsor's track record and experience in private credit. Look beyond marketing materials. Investigate their past performance, focusing on returns, defaults, and overall management style. Independent reviews and industry reputation are invaluable.

- Analyze the financial health and risk profile of the borrower. Examine their financial statements, credit history, and business model. Assess their debt-to-equity ratio, cash flow projections, and sensitivity to economic downturns. This is crucial for assessing the likelihood of repayment.

- Independently assess the collateral and its value. Don't rely solely on appraisals provided by the lender. Engage your own valuation experts to ensure the collateral's worth accurately reflects the loan's risk. Understanding the liquidation value of the collateral is critical.

- Scrutinize the terms of the loan agreement, including interest rates, fees, and covenants. Understand the implications of each clause. Seek clarification on any ambiguous language. A thorough understanding of the legal document is vital to protect your interests.

- Seek professional advice from financial experts specializing in private credit. Engaging experienced legal and financial advisors can provide invaluable insights and help mitigate potential risks. Their expertise can save you from costly mistakes.

Diversify Your Portfolio

Diversification is key to mitigating risk in any investment strategy, and private credit is no exception. Spreading your investments across various borrowers and loan types can significantly reduce the impact of potential losses.

- Don't put all your eggs in one basket. Invest in a mix of senior and subordinated debt to balance risk and return. Senior debt typically carries less risk but offers lower returns, while subordinated debt offers higher returns but comes with increased risk.

- Consider investing in various sectors and geographies to reduce concentration risk. Don't overexpose your portfolio to any single industry or region, as this increases your vulnerability to sector-specific or geographic downturns. A well-diversified portfolio is more resilient.

- Utilize different investment vehicles like funds or direct lending to diversify access. Private credit funds offer access to a broader range of investments, while direct lending provides more control but requires greater due diligence. Each approach offers unique diversification opportunities.

- Regularly rebalance your portfolio to maintain your desired risk profile. Market conditions change, and your portfolio needs to adapt. Rebalancing ensures your allocation remains aligned with your investment goals and risk tolerance.

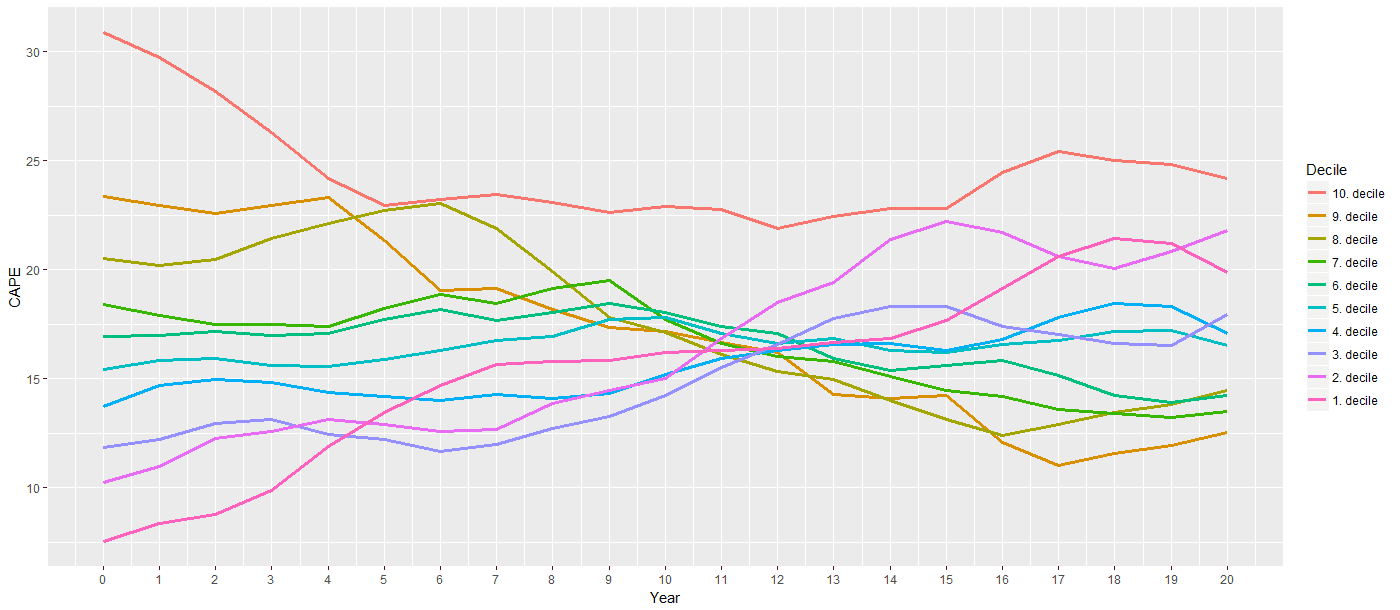

Understand the Market Cycle

The private credit market, like any other financial market, is cyclical. Understanding where we are in the cycle and anticipating future shifts is crucial for successful investing.

- Stay informed about interest rate changes and their effects on borrowing costs. Rising interest rates can increase borrowing costs, potentially impacting borrowers' ability to repay their loans. Conversely, falling rates can stimulate borrowing.

- Monitor economic indicators to anticipate potential market shifts. Key indicators like GDP growth, inflation, and unemployment rates provide clues about the direction of the economy and, consequently, the private credit market.

- Consider the impact of inflation and deflation on private credit investments. Inflation erodes the purchasing power of returns, while deflation can create a challenging environment for borrowers. Understanding these impacts is critical for risk assessment.

- Consult economic forecasts and industry reports to make informed decisions. Staying informed about market trends and expert opinions allows you to anticipate and adapt to potential changes.

Don'ts of Navigating the Private Credit Boom

Don't Overlook Risk Management

Private credit inherently involves significant risk. Ignoring this reality can have devastating consequences. Robust risk management is non-negotiable.

- Never invest more than you can afford to lose. This fundamental principle applies to all investments, especially those in the higher-risk private credit arena.

- Thoroughly assess the creditworthiness of borrowers before lending. Don't rely solely on the borrower's representation; conduct your own independent credit assessment.

- Establish clear risk tolerance levels and stick to them. Define your risk appetite upfront and don't deviate from it, even under pressure to chase higher returns.

- Implement robust monitoring and reporting mechanisms. Regularly track your investments' performance and any potential red flags. This allows you to react quickly to emerging risks.

Don't Neglect Legal and Regulatory Compliance

Navigating the legal and regulatory landscape of private credit is critical. Non-compliance can lead to significant financial penalties and reputational damage.

- Ensure compliance with securities laws and regulations. Understanding and adhering to these laws is vital, particularly for investments involving securities.

- Understand the implications of relevant tax laws. Proper tax planning is crucial to maximize returns and minimize tax liabilities.

- Maintain accurate and complete records. Detailed record-keeping is essential for compliance and transparency.

- Seek legal counsel when necessary. Don't hesitate to seek expert legal advice when dealing with complex legal issues.

Don't Rush into Investments

Patience and thorough due diligence are vital in the private credit market. Avoid the temptation to jump on seemingly lucrative opportunities without proper research.

- Don't be swayed by hype or pressure to invest quickly. High-pressure sales tactics often mask underlying risks.

- Conduct thorough due diligence before committing capital. This cannot be stressed enough. Thorough investigation is paramount.

- Compare multiple investment options before making a decision. Don't settle for the first opportunity that comes along. Consider various options to find the best fit for your portfolio.

- Seek second opinions from trusted advisors. Seeking multiple perspectives can provide a more balanced and informed view.

Conclusion

The private credit market offers significant potential for investors, but success requires careful navigation. By following these five essential do's and don'ts – conducting thorough due diligence, diversifying your portfolio, understanding market cycles, managing risk effectively, and ensuring legal compliance – you can significantly improve your chances of thriving in this dynamic environment. Remember, thorough research and a cautious approach are key to successfully navigating the private credit boom. Don't hesitate to seek professional guidance to leverage the opportunities in the private credit sector responsibly and profitably. Understanding and effectively managing the risks associated with private credit investments is crucial for long-term success.

Featured Posts

-

Millions Stolen Inside The Office365 Executive Email Hack

Apr 22, 2025

Millions Stolen Inside The Office365 Executive Email Hack

Apr 22, 2025 -

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025 -

Fp Video Deconstructing The Bank Of Canadas Decision To Hold Rates

Apr 22, 2025

Fp Video Deconstructing The Bank Of Canadas Decision To Hold Rates

Apr 22, 2025 -

Hollywood At A Standstill The Impact Of The Actors And Writers Strike

Apr 22, 2025

Hollywood At A Standstill The Impact Of The Actors And Writers Strike

Apr 22, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025