Los Angeles Wildfires And The Growing Market For Disaster-Related Wagers

Table of Contents

The Rising Frequency and Severity of Los Angeles Wildfires

Los Angeles has a long history of wildfires, but recent years have witnessed a dramatic increase in both frequency and intensity. The combination of dry conditions, strong winds, and expansive wildland-urban interfaces has created a perfect storm for catastrophic fire events. Climate change, with its contribution to prolonged droughts and higher temperatures, is significantly exacerbating the problem. The economic and human costs are staggering. Recent wildfires have resulted in billions of dollars in property damage, displacement of countless residents, and tragically, loss of life.

- Increased average acreage burned annually: Data shows a significant upward trend in the average area consumed by wildfires each year.

- Higher costs for wildfire suppression efforts: The sheer scale of recent wildfires has placed an immense strain on firefighting resources, leading to exponentially higher suppression costs.

- Growing number of homes destroyed or damaged: Thousands of homes have been lost or severely damaged in recent years, leading to widespread displacement and emotional trauma.

- Rising insurance premiums: The increased risk has forced insurance companies to raise premiums significantly in high-risk areas, making homeownership increasingly unaffordable for many.

The Insurance Industry and Disaster-Related Wagers

The insurance industry is on the front lines of wildfire devastation. Payouts for wildfire damage directly correlate with the severity and extent of the fire. Actuarial science plays a crucial role in assessing risk, setting premiums, and developing insurance products. However, accurately predicting wildfire risk remains a significant challenge, leading to difficulties in setting appropriate premiums and managing exposure. The potential for insurance fraud in the wake of large-scale disasters is also a serious concern.

- Increased insurance premiums in high-risk areas: Homeowners in areas prone to wildfires are facing dramatically higher insurance costs.

- Challenges faced by insurance companies in accurately assessing wildfire risk: Predicting the precise path and intensity of a wildfire remains incredibly difficult.

- Potential for increased litigation surrounding wildfire insurance claims: Disputes over coverage and payout amounts are likely to increase as wildfires become more frequent and destructive.

- The role of reinsurance in mitigating risk for insurance companies: Reinsurance provides a critical safety net for primary insurers, helping to spread the risk of catastrophic losses.

The Ethical Concerns Surrounding Disaster-Related Betting

The emergence of a market for disaster-related wagers raises serious ethical questions. Profiting from the suffering and devastation caused by natural disasters is morally questionable. This type of betting could potentially exploit vulnerable populations already struggling in the aftermath of a disaster. The psychological impact on victims is also a significant concern.

- The moral hazard of incentivizing disaster speculation: The existence of such markets could inadvertently encourage irresponsible behavior and potentially even increase the risk of disasters.

- The potential for market manipulation: The potential for manipulation of odds and outcomes raises further concerns about fairness and transparency.

- The need for stricter regulations in the gambling industry: Regulations are needed to prevent exploitation and ensure ethical practices.

The Emerging Market for Disaster-Related Wagers

While still relatively nascent, the market for disaster-related wagers is growing. Wagers might include predicting the severity of a wildfire, the total acreage burned, or even the number of structures destroyed. The potential growth of this market is significant, driven by increased media attention and the growing awareness of climate change's impact on natural disasters. However, the regulatory landscape surrounding this type of gambling is largely undefined.

- Examples of betting platforms offering disaster-related wagers: While specific examples are limited for privacy reasons, the existence of such platforms is a growing trend.

- Growth projections for the disaster-related wagering market: As wildfires become more frequent and intense, the market is poised for substantial growth.

- Current regulations and potential future legislation: Currently, regulations surrounding this niche are largely absent, necessitating the development of appropriate oversight.

Predicting Wildfire Risk and its Impact on the Wagering Market

Data analytics and predictive modeling are increasingly used to assess wildfire risk. This information heavily influences the odds offered by betting platforms. Factors such as weather patterns, fuel load, topography, and even human activity are incorporated into these models. The use of technology like satellite imagery and AI is improving the accuracy of predictions, but limitations remain.

- Factors considered in wildfire risk prediction models: Sophisticated models consider a multitude of variables to provide the most accurate predictions possible.

- The role of technology in improving wildfire prediction: Technological advancements are leading to better and more timely predictions.

- Limitations of current wildfire prediction models: Despite advances, predicting wildfire behavior with perfect accuracy remains a significant challenge.

Conclusion

The increasing frequency and severity of Los Angeles wildfires, coupled with the expanding insurance industry and the emergence of disaster-related wagers, create a complex and concerning landscape. While the market for these wagers presents opportunities for some, the ethical implications and potential for exploitation necessitate careful consideration and robust regulation. Understanding the interplay between wildfire risk, insurance payouts, and the burgeoning gambling industry is crucial for policymakers, insurers, and the public alike. It is imperative that we find a balance between responsible risk assessment and the prevention of harmful speculation surrounding these devastating events. Further research into the ethical implications and potential regulatory frameworks for disaster-related wagers, specifically those concerning Los Angeles wildfires, is critically needed.

Featured Posts

-

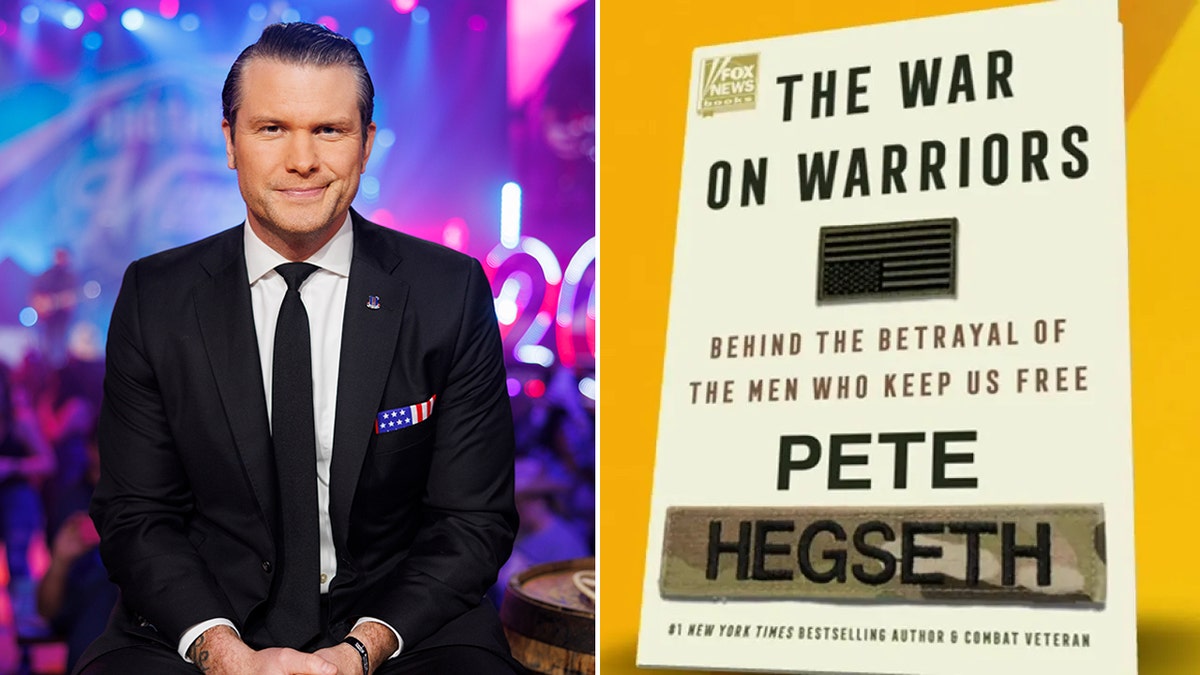

Signal Chat Controversy Hegseth Shares Military Plans With Relatives

Apr 22, 2025

Signal Chat Controversy Hegseth Shares Military Plans With Relatives

Apr 22, 2025 -

Robotic Automation In The Footwear Industry The Case Of Nike

Apr 22, 2025

Robotic Automation In The Footwear Industry The Case Of Nike

Apr 22, 2025 -

How Middle Management Contributes To A Thriving Organization And Engaged Workforce

Apr 22, 2025

How Middle Management Contributes To A Thriving Organization And Engaged Workforce

Apr 22, 2025 -

Military Strategy Disclosure Hegseths Signal Communication With Family

Apr 22, 2025

Military Strategy Disclosure Hegseths Signal Communication With Family

Apr 22, 2025 -

Enhanced Security Partnership China And Indonesia

Apr 22, 2025

Enhanced Security Partnership China And Indonesia

Apr 22, 2025