Stock Market Today: Dow Futures, Dollar, And Trade War Impact

Table of Contents

Dow Futures: A Glimpse into Today's Market Sentiment

Dow Futures are derivative contracts that track the expected performance of the Dow Jones Industrial Average. They provide a valuable pre-market indicator of overall market sentiment. Currently, Dow Futures are showing a slight downward trend, suggesting a potentially bearish market opening. This negative movement reflects investor concerns about rising inflation and its potential impact on corporate earnings.

- Current Dow Futures price: 34,000 (as of 9:00 AM EST - Note: This is a hypothetical example and should be replaced with actual data at the time of publishing)

- Percentage change from the previous day: -0.5%

- Key factors driving the current Dow Futures trend: Increased inflation concerns, weaker-than-expected economic data, and lingering uncertainty about future interest rate hikes by the Federal Reserve.

The US Dollar's Strength (or Weakness) and its Correlation with Stocks

The US Dollar's strength (or weakness) has a significant inverse correlation with the performance of US-based multinational companies. A strong dollar makes US exports more expensive, impacting the earnings of companies with significant international sales. Conversely, a weaker dollar boosts export competitiveness.

Today, the USD is showing a moderate decline against major currencies. This weakening dollar could potentially offer some support to US multinational companies, particularly those in export-oriented sectors.

- Current USD exchange rates against major currencies: EUR/USD: 1.10, GBP/USD: 1.25, JPY/USD: 145 (as of 9:00 AM EST - Note: These are hypothetical examples and should be replaced with actual data)

- Reasons behind the current USD movement: The unexpected inflation report has led to some profit-taking in the dollar, as investors reassess the outlook for US interest rates.

- Potential implications for different market sectors: The technology sector, often heavily reliant on international sales, could benefit from a weaker dollar, while domestic-focused sectors might see less impact.

The Lingering Shadow of Trade Wars: Ongoing Impacts on the Stock Market

Trade tensions continue to cast a shadow over the Stock Market Today. While some trade disputes have eased, uncertainty remains, particularly regarding future tariffs and trade policies. This uncertainty creates volatility and impacts investor confidence.

Companies heavily involved in sectors directly affected by trade disputes experience significant fluctuations in their stock prices. For example, companies in the agricultural and manufacturing sectors have been particularly sensitive to recent trade developments.

- Key trade disputes currently impacting the market: While specific disputes will change over time, it’s vital to mention current significant ones in the text.

- Companies most affected by these trade wars: Again, specific company examples relevant to the current situation are needed here.

- Potential future scenarios and their effects on the stock market: A resolution of trade disputes could lead to a market rally, while escalating tensions could trigger further sell-offs.

Conclusion

Today's Stock Market Today is characterized by a cautious sentiment, influenced by rising inflation, a weakening dollar, and ongoing trade uncertainties. Dow Futures point towards a potentially bearish opening, reflecting investor concerns. While a weaker dollar might offer some support to certain sectors, the lingering impact of trade wars continues to create volatility. To understand the Current Market Conditions, it’s crucial to monitor these factors closely. For a comprehensive Stock Market Analysis and to stay informed about the Today's Stock Market, regularly check for updates and consider subscribing to our newsletter for in-depth analysis and insights. Stay tuned for further updates on the evolving Stock Market Today situation.

Featured Posts

-

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025 -

Canadian Bread Price Fixing Case 500 Million Settlement Hearing Approaches

Apr 22, 2025

Canadian Bread Price Fixing Case 500 Million Settlement Hearing Approaches

Apr 22, 2025 -

Chainalysis Expands Ai Capabilities With Alterya Acquisition

Apr 22, 2025

Chainalysis Expands Ai Capabilities With Alterya Acquisition

Apr 22, 2025 -

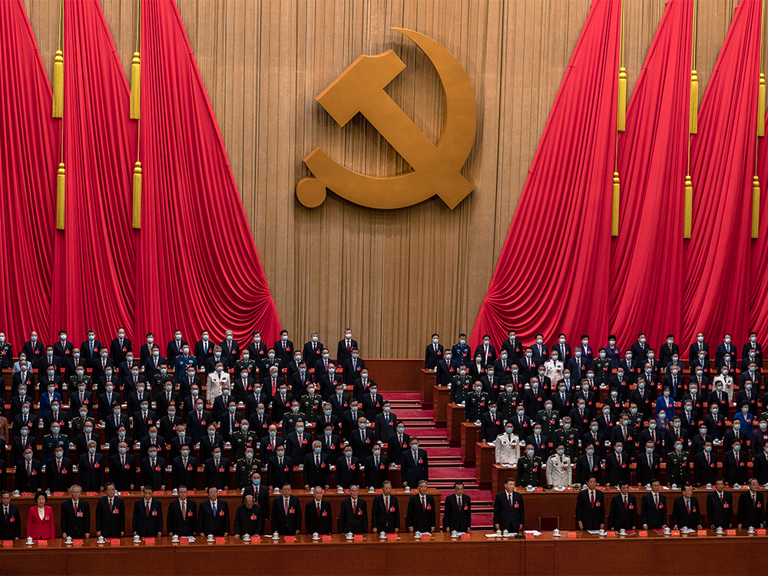

Chinas Growth Model At Risk Analyzing The Tariff Threat

Apr 22, 2025

Chinas Growth Model At Risk Analyzing The Tariff Threat

Apr 22, 2025 -

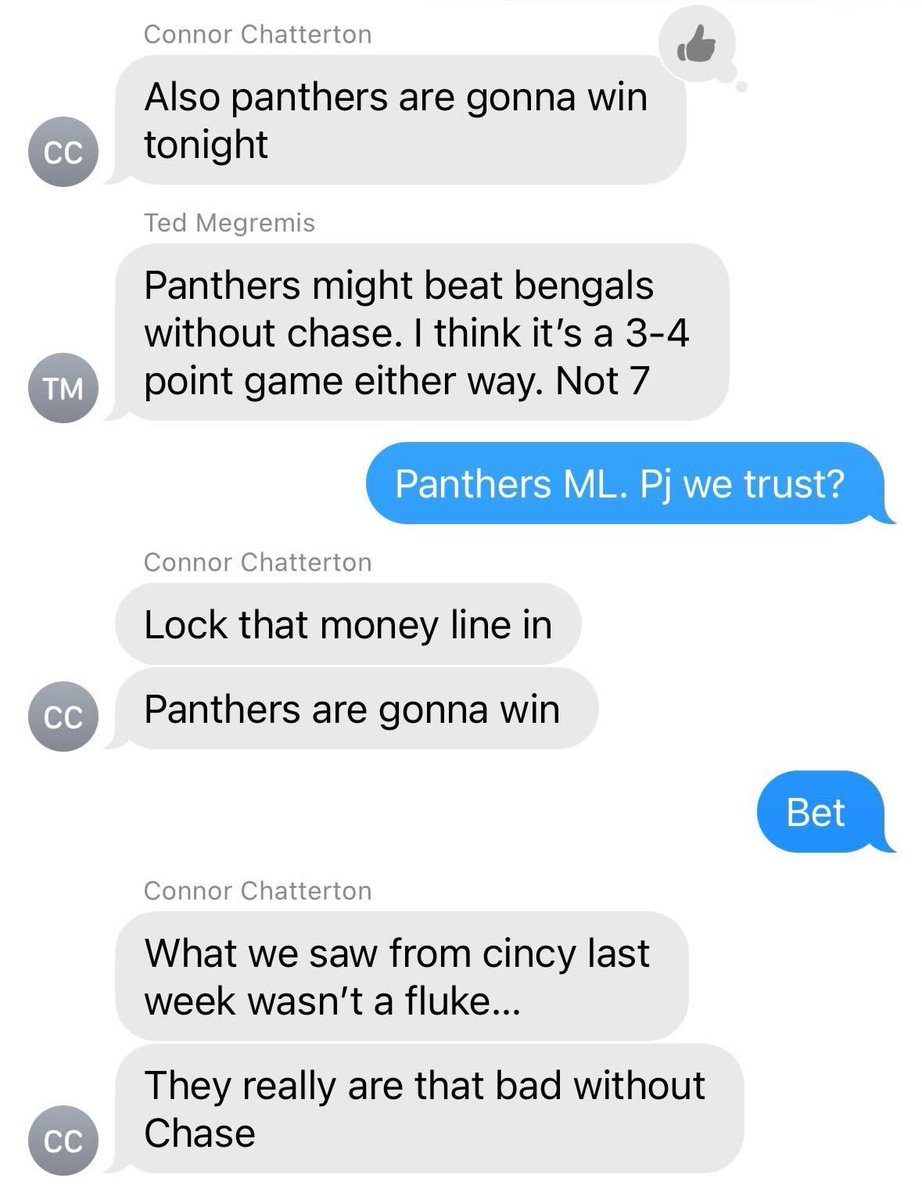

The Rise Of Disaster Betting Examining The Case Of The La Wildfires

Apr 22, 2025

The Rise Of Disaster Betting Examining The Case Of The La Wildfires

Apr 22, 2025