How Bundestag Elections Impact The Dax Index

Table of Contents

Government Policy Changes and Their Influence on the DAX

Different political parties in Germany hold varying economic philosophies. Their manifestos often propose distinct policies impacting business confidence and, ultimately, the DAX. For example, a party advocating for significant increases in social spending might lead to higher taxes on corporations, potentially dampening business investment and negatively affecting the DAX. Conversely, a party focused on deregulation and tax cuts could boost investor confidence and stimulate economic growth, positively impacting the index.

- Taxation: Changes in corporate tax rates directly impact company profits and investor returns. Lower rates generally encourage investment, while higher rates can stifle growth.

- Regulation: Stringent environmental regulations, for instance, can significantly impact sectors like the automotive industry (a major component of the DAX). While environmentally beneficial, these regulations can lead to short-term costs for companies.

- Social Spending: Increased social spending, while beneficial socially, can necessitate higher taxes or increased government borrowing, potentially impacting investor confidence and market stability.

The short-term effects of policy changes can be volatile, with the DAX reacting swiftly to announcements. However, the long-term effects often depend on the overall effectiveness and implementation of the new government's economic strategy. Keywords: Economic policies, fiscal policy, monetary policy, regulation, taxation, business confidence.

Investor Sentiment and Market Volatility Around Election Time

Uncertainty surrounding election outcomes significantly impacts investor behavior. The period leading up to and immediately following a Bundestag election is often characterized by increased market volatility. This stems from the "political risk" associated with potential changes in government and economic policy. Investors become hesitant, leading to increased trading activity and price fluctuations.

- 2017 Election: The 2017 election, resulting in a coalition government, saw a period of initial uncertainty followed by relative stability in the DAX once the coalition was formed and its policies outlined.

- 2021 Election: The 2021 election showed similar trends, with increased volatility during the campaign period, followed by a settling of the market after the formation of the new government. (Specific statistical data on DAX performance around these elections would strengthen this point.)

Media coverage and expert analysis play a crucial role in shaping investor sentiment. Negative media narratives about potential policy changes can amplify investor concerns, while positive narratives can increase confidence. Keywords: Investor sentiment, market volatility, political risk, election uncertainty, stock market prediction.

Economic Forecasts and Post-Election Market Reactions

Pre-election economic forecasts significantly influence investor expectations. Positive forecasts generally lead to a more optimistic market outlook, while negative forecasts can create apprehension. The composition of the post-election government and its announced policies heavily influence the subsequent market reaction.

- Coalition Governments: Coalition governments often lead to compromise on economic policies, potentially resulting in less dramatic market movements compared to single-party majority governments.

- Single-Party Governments: Single-party governments can implement their agendas more swiftly, potentially leading to more significant, and potentially more volatile, market reactions, both positive or negative, depending on the policies implemented.

The effectiveness of the new government's economic plans is reflected in the DAX’s long-term performance. A government that successfully stimulates economic growth will likely see the DAX perform well, while a government that struggles with economic management might see a negative impact on the index. Keywords: Economic forecast, government formation, policy announcements, market reaction, post-election analysis.

Conclusion: Understanding the Bundestag Elections' Impact on the DAX – A Summary and Call to Action

Bundestag elections demonstrably influence the DAX index. Investor confidence, government policies, and pre- and post-election economic forecasts all play a significant role in shaping market reactions. Understanding the political landscape is crucial for investors seeking to navigate the German market successfully. Continuous monitoring of political developments and economic forecasts is essential for making informed investment decisions regarding the DAX.

To stay ahead of the curve and effectively analyze the impact of future Bundestag elections on the DAX, subscribe to our newsletter for in-depth market analysis and insights. Understand the political climate, monitor economic indicators, and invest wisely in the German market. Analyze the potential consequences of upcoming Bundestag elections and protect your DAX index investments by making informed decisions.

Featured Posts

-

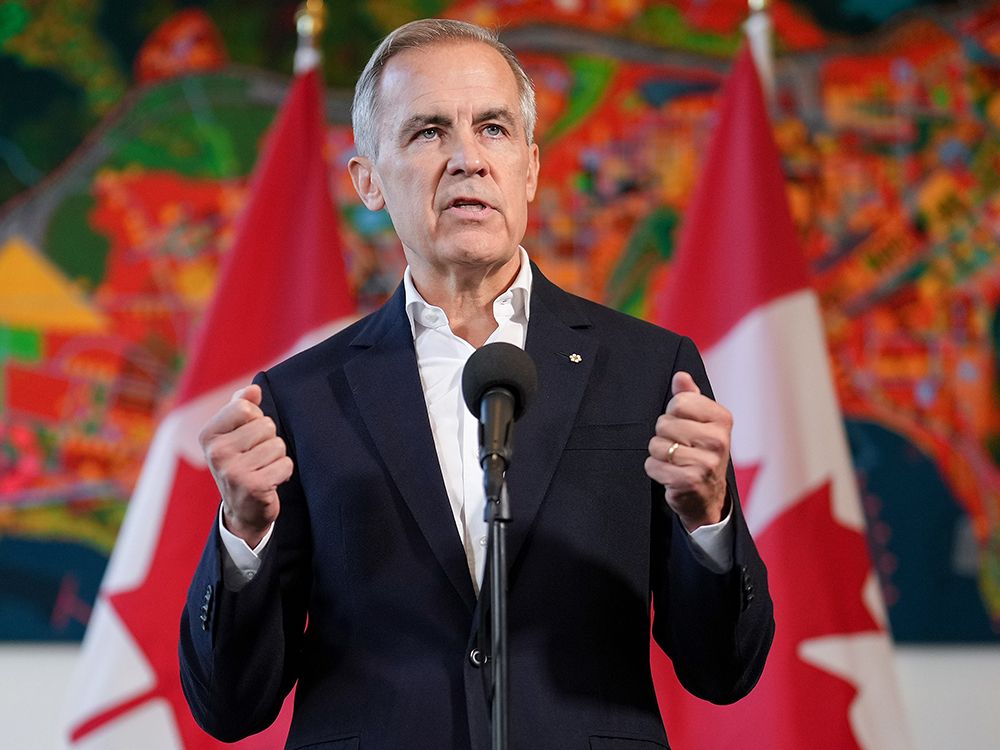

Trumps Trade Pressure Carneys Urgent Message To Canadian Voters

Apr 27, 2025

Trumps Trade Pressure Carneys Urgent Message To Canadian Voters

Apr 27, 2025 -

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 27, 2025

Chainalysis Acquires Alterya Blockchain Meets Ai

Apr 27, 2025 -

Film News Juliette Binoches Cannes Jury Presidency Announced For 2025

Apr 27, 2025

Film News Juliette Binoches Cannes Jury Presidency Announced For 2025

Apr 27, 2025 -

Get Her Look Ariana Grandes Professional Hair And Tattoo Styling

Apr 27, 2025

Get Her Look Ariana Grandes Professional Hair And Tattoo Styling

Apr 27, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

Apr 27, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

Apr 27, 2025