1,050% Price Hike: AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

AT&T's Concerns and the 1,050% Figure

AT&T's claim of a 1,050% price hike on VMware licensing following the Broadcom acquisition is not a minor issue; it's a potential game-changer for the entire industry. This staggering figure warrants a closer look.

The Specifics of the Price Increase

While the exact details of AT&T's calculations remain somewhat opaque, their assertion points towards a dramatic increase in VMware licensing costs for existing clients. The specific VMware products affected, and the exact contract details driving this immense percentage increase, have not been fully disclosed publicly. However, the sheer magnitude of the projected increase underscores AT&T's deep concern about the potential impact on their operations and bottom line.

- Methodology: AT&T's methodology for arriving at the 1,050% figure likely involves comparing current licensing costs under VMware's independent pricing structure with projected costs under Broadcom's control, factoring in potential consolidation, reduced competition, and the removal of existing pricing incentives.

- Products Affected: While not officially specified by AT&T, it's highly probable that core VMware products like vSphere, vSAN, and NSX are central to this calculation, given their widespread use by major enterprises.

- Financial Burden: A 1,050% increase would represent a massive financial burden not only for AT&T but for other large-scale users of VMware technology. This could force companies to reconsider their IT infrastructure investments and potentially impact their operating budgets significantly.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom-VMware merger is attracting considerable antitrust scrutiny due to the potential for creating a dominant player in the virtualization and cloud computing markets. This raises serious concerns about reduced competition and the stifling of innovation.

Potential Monopoly Concerns

The combined entity of Broadcom and VMware would control a significant portion of the market share in crucial areas of enterprise technology. This concentration of power could lead to a monopoly, limiting customer choice, potentially driving up prices across the board, and hindering the development of competing technologies.

- Regulatory Investigations: Several regulatory bodies, including the US Federal Trade Commission (FTC) and others globally, are currently conducting thorough reviews and investigations into the potential anti-competitive implications of this acquisition.

- Impact on Innovation: A lack of competition often leads to slower innovation. With reduced pressure to innovate, the merged entity might prioritize profit maximization over developing better, more affordable technologies for its customers.

- Arguments For and Against: Broadcom argues that the merger will lead to synergies and efficiencies, benefiting consumers. Opponents, including AT&T, highlight the potential for significantly reduced competition and the resulting harms.

Impact on Businesses and Consumers

The ripple effects of the potential Broadcom VMware acquisition extend far beyond AT&T and other large enterprises. The consequences will likely be felt by businesses of all sizes, as well as consumers who indirectly rely on VMware technology.

Rising Cloud Computing Costs

The merger could lead to a domino effect, driving up prices for cloud services and software licensing across the board. This is particularly concerning given the already high costs associated with cloud computing infrastructure.

- Impact on SMBs: Small and medium-sized businesses (SMBs), often with tighter budgets, would be disproportionately affected by significant price increases in essential virtualization and cloud services.

- Impact on Consumers: While indirect, the price increases could trickle down to consumers through higher prices for goods and services that rely on businesses using VMware technology.

- Mitigation Strategies: Businesses may need to explore alternative virtualization solutions, negotiate contracts more aggressively, or optimize their existing VMware deployments to mitigate potential cost increases.

The Future of VMware and Broadcom

The success or failure of the Broadcom-VMware merger remains uncertain, hinging heavily on the outcome of ongoing regulatory reviews and the overall market reaction.

Potential Outcomes of the Acquisition

Several scenarios are possible. The deal might be approved without significant changes, leading to the price increases feared by AT&T. Alternatively, regulators may demand significant concessions, such as the divestment of certain VMware assets, or even block the merger entirely.

- Divestment or Concessions: To appease regulators, Broadcom might be required to divest certain parts of VMware's business to address antitrust concerns and promote competition.

- Long-Term Implications: The merger's long-term impact will depend on its ultimate structure and the resulting competitive landscape. It could solidify Broadcom's dominance or lead to the emergence of new, competing technologies.

- Alternative Offers/Competing Technologies: The intense regulatory scrutiny and potential for price hikes might open the door for alternative acquisition offers or encourage the development of innovative, competing virtualization platforms.

Conclusion

AT&T's stark warning of a potential 1,050% price hike highlights the significant concerns surrounding the Broadcom-VMware merger. The potential for monopolies, reduced competition, and increased costs for businesses and consumers is undeniable. Antitrust reviews are crucial, and the outcomes will have profound implications for the future of the technology landscape.

Call to Action: Stay informed about the ongoing developments in the Broadcom-VMware merger. Monitor regulatory updates and consider alternative virtualization and cloud computing solutions to mitigate potential price increases resulting from the Broadcom VMware acquisition. Further research on the Broadcom VMware deal is crucial to understand its future implications and prepare for potential changes in the enterprise technology market.

Featured Posts

-

Patrick Schwarzeneggers Forgotten Ariana Grande Music Video Role A White Lotus Connection

Apr 27, 2025

Patrick Schwarzeneggers Forgotten Ariana Grande Music Video Role A White Lotus Connection

Apr 27, 2025 -

Imprevisibles Derrotas Paolini Y Pegula Se Despiden Del Wta 1000 De Dubai

Apr 27, 2025

Imprevisibles Derrotas Paolini Y Pegula Se Despiden Del Wta 1000 De Dubai

Apr 27, 2025 -

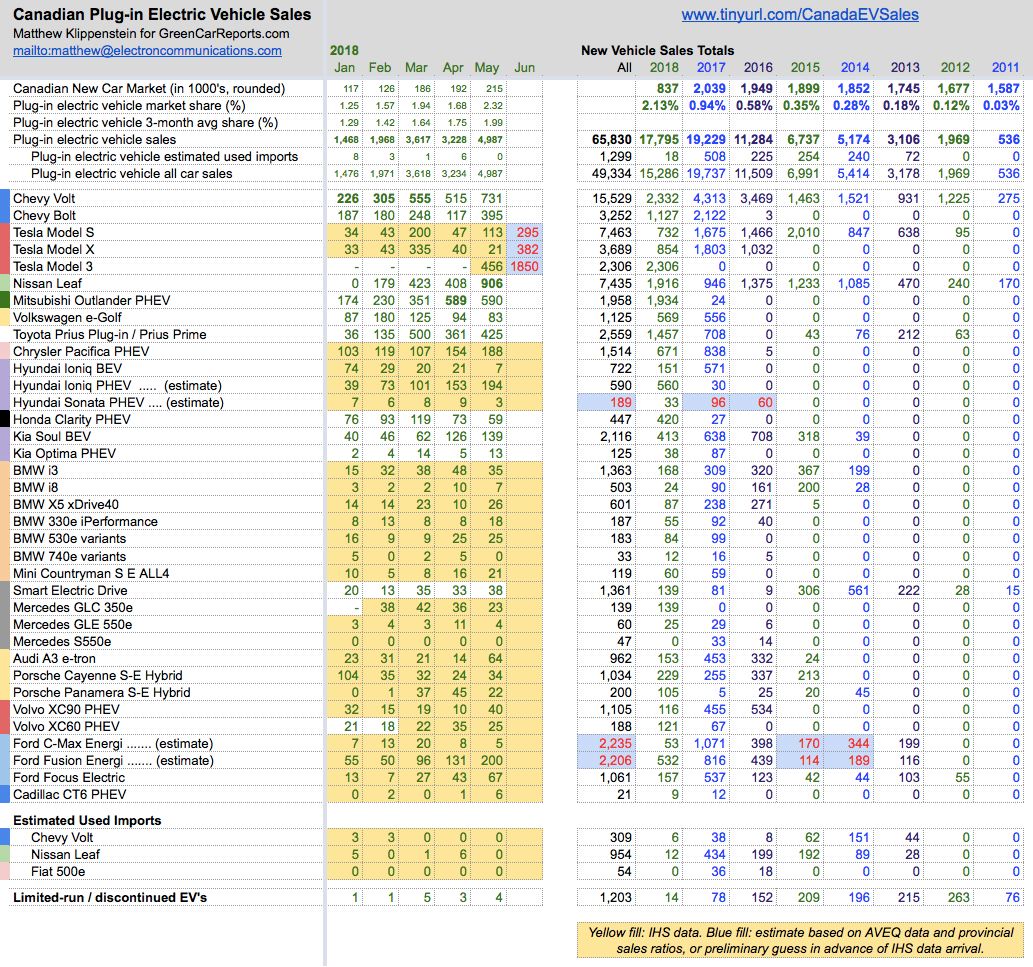

Tesla Raises Canadian Prices Accelerates Pre Tariff Vehicle Sales

Apr 27, 2025

Tesla Raises Canadian Prices Accelerates Pre Tariff Vehicle Sales

Apr 27, 2025 -

Ecbs New Task Force Streamlining Banking Regulations

Apr 27, 2025

Ecbs New Task Force Streamlining Banking Regulations

Apr 27, 2025 -

Us China Trade War Ackmans Timely Insight

Apr 27, 2025

Us China Trade War Ackmans Timely Insight

Apr 27, 2025