US-China Trade War: Ackman's Timely Insight

Table of Contents

Ackman's Early Warnings on Trade Tensions

Identifying Emerging Risks

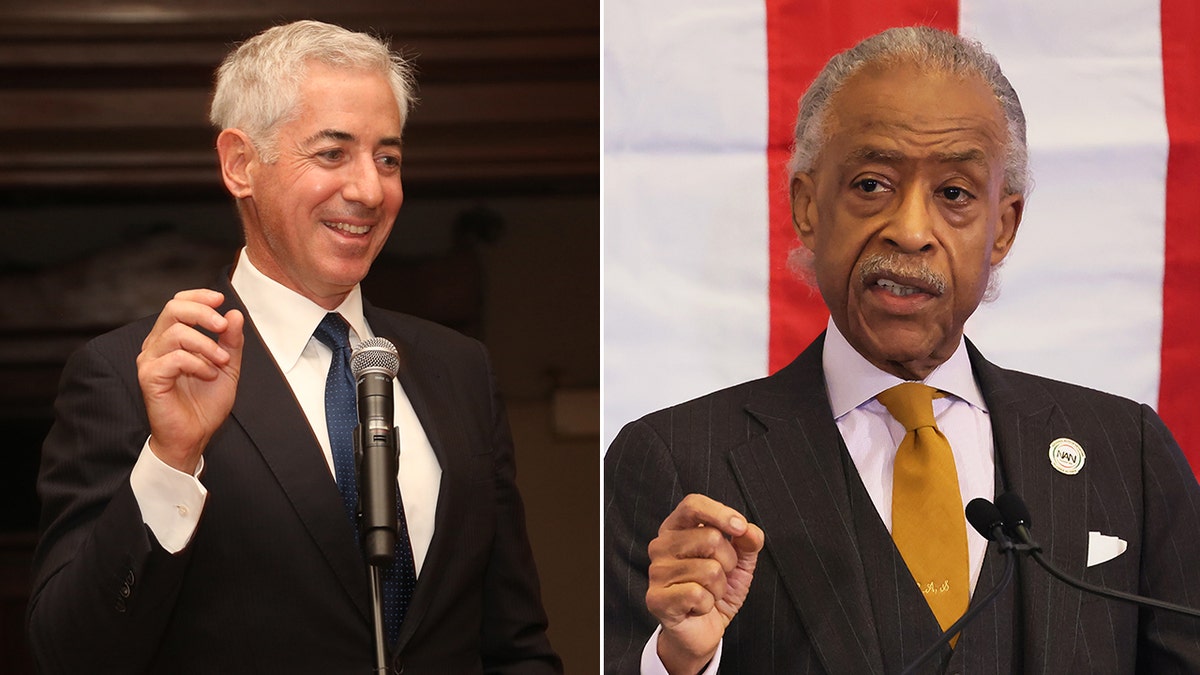

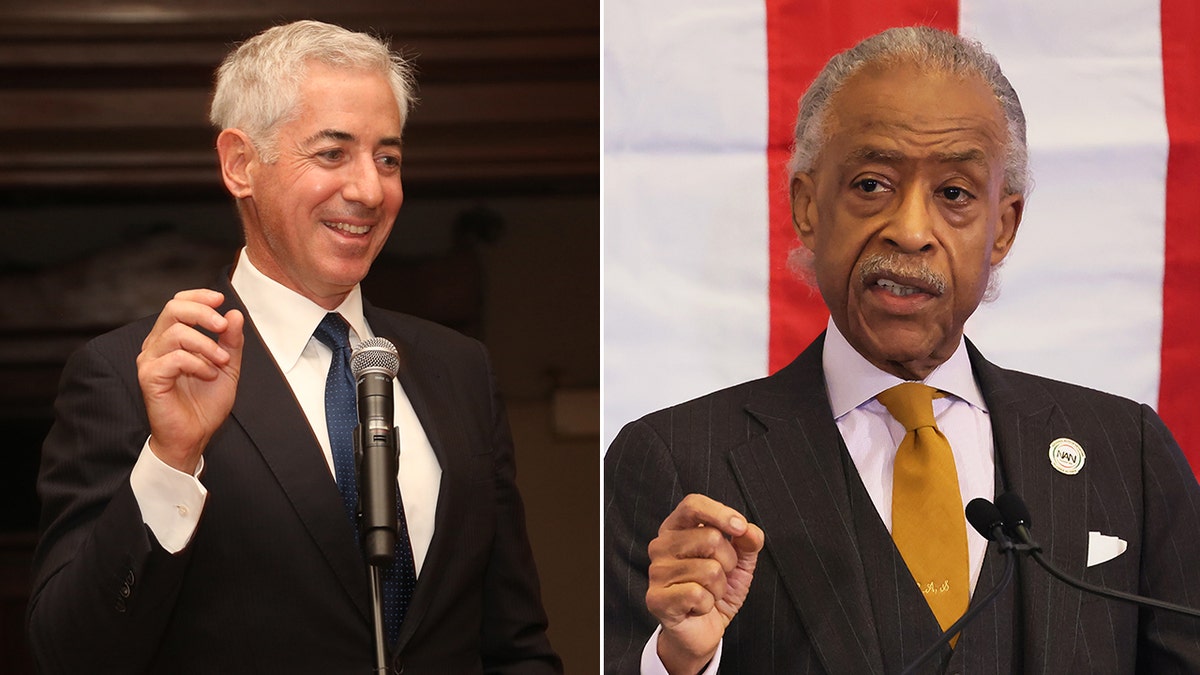

Bill Ackman, through Pershing Square Capital Management, demonstrated an early understanding of the escalating US-China trade tensions. He wasn't simply reacting to headlines; he was proactively identifying emerging risks long before they became mainstream concerns.

- Public Statements and Interviews: Ackman frequently voiced concerns about the potential negative consequences of a protracted trade war in various public forums, including interviews and investor letters. He didn't shy away from expressing his bearish outlook on certain sectors heavily reliant on trade between the two superpowers.

- Predicting Market Consequences: He accurately predicted increased market volatility and negative impacts on specific sectors, particularly technology. His analysis went beyond simple observation; he connected the geopolitical tensions to their direct impact on corporate earnings and investor sentiment. For example, he foresaw challenges for companies heavily reliant on Chinese manufacturing and supply chains.

Analyzing the Underlying Causes

Ackman's analysis extended beyond surface-level observations. He delved into the fundamental issues driving the trade conflict, providing insightful commentary on:

- Intellectual Property Theft: He consistently highlighted the concerns surrounding intellectual property theft by Chinese companies as a major catalyst for the trade war. This was not just a matter of trade imbalances; it was about the fundamental fairness and protection of American innovation.

- Trade Imbalances: Ackman also acknowledged the significant trade imbalances between the US and China, arguing that these imbalances needed to be addressed through fair trade practices. He used economic data to support his views, demonstrating a deep understanding of the complexities of international trade. He incorporated this data into his investment strategy, anticipating shifts in the global economic landscape.

Ackman's Investment Strategies During the Trade War

Defensive Positioning

During the height of the US-China trade war, Ackman adopted a primarily defensive investment strategy. His approach prioritized risk mitigation in a highly uncertain environment.

- Portfolio Adjustments: He actively adjusted his portfolio to reduce exposure to sectors particularly vulnerable to the trade war's negative consequences. This included carefully analyzing supply chains and identifying potential disruptions.

- Increased Diversification: To mitigate risk, Ackman likely increased the diversification of his portfolio, spreading investments across various sectors and asset classes to reduce the overall impact of potential losses in any single area. This is a classic risk management strategy in times of heightened uncertainty.

Opportunities Amidst Uncertainty

While primarily focused on defense, Ackman likely also sought opportunities to profit from market fluctuations. The trade war created both winners and losers, and shrewd investors could potentially capitalize on these shifts.

- Undervalued Assets: The trade war could have created opportunities to invest in undervalued assets in sectors temporarily impacted by the trade disputes. Ackman's deep fundamental analysis might have allowed him to identify companies whose valuations were unfairly depressed by short-term market reactions.

- Strategic Investments: He may have made strategic investments in companies well-positioned to benefit from shifts in global supply chains or increased domestic manufacturing in response to trade tariffs.

Assessing the Accuracy of Ackman's Predictions

Evaluating the Outcomes

Assessing the accuracy of Ackman's predictions requires a careful comparison to the actual outcomes of the US-China trade war.

- Successful Predictions: Many of his concerns regarding market volatility and the negative impact on specific sectors proved to be largely accurate. The market reacted significantly to the escalating trade tensions, reflecting the uncertainty he predicted.

- Areas for Refinement: While his overall assessment was largely accurate, specific timing and the precise magnitude of the impacts might have differed from his initial predictions. This highlights the inherent challenges of predicting the exact outcomes of complex geopolitical events.

Lessons Learned for Investors

Ackman's experience offers valuable lessons for other investors:

- Fundamental Analysis: His success underscores the importance of rigorous fundamental analysis and understanding the underlying drivers of market movements, particularly geopolitical factors.

- Long-Term Perspective: Navigating events like the US-China trade war requires a long-term investment horizon and the patience to weather short-term volatility.

- Diversification and Risk Management: A well-diversified portfolio and proactive risk management are crucial during periods of geopolitical uncertainty.

Conclusion

Bill Ackman's insights into the US-China trade war demonstrate his exceptional ability to anticipate and navigate complex geopolitical risks. His early warnings, defensive investment strategies, and largely accurate predictions provide valuable lessons for investors. The key takeaways emphasize the significance of fundamental analysis, long-term thinking, and robust risk management in navigating uncertain markets. Understanding the intricacies of the US-China trade war, as analyzed by experts like Ackman, is crucial for informed investment decisions. Further research into Ackman's investment strategies and a similar level of critical analysis will better prepare investors for future global trade conflicts and the ongoing impact of the US-China relationship.

Featured Posts

-

Indian Wells 2024 Eliminacion De Favorita Genera Controversia

Apr 27, 2025

Indian Wells 2024 Eliminacion De Favorita Genera Controversia

Apr 27, 2025 -

Politics And Religion Collide Trumps Role At Pope Benedicts Funeral Mass

Apr 27, 2025

Politics And Religion Collide Trumps Role At Pope Benedicts Funeral Mass

Apr 27, 2025 -

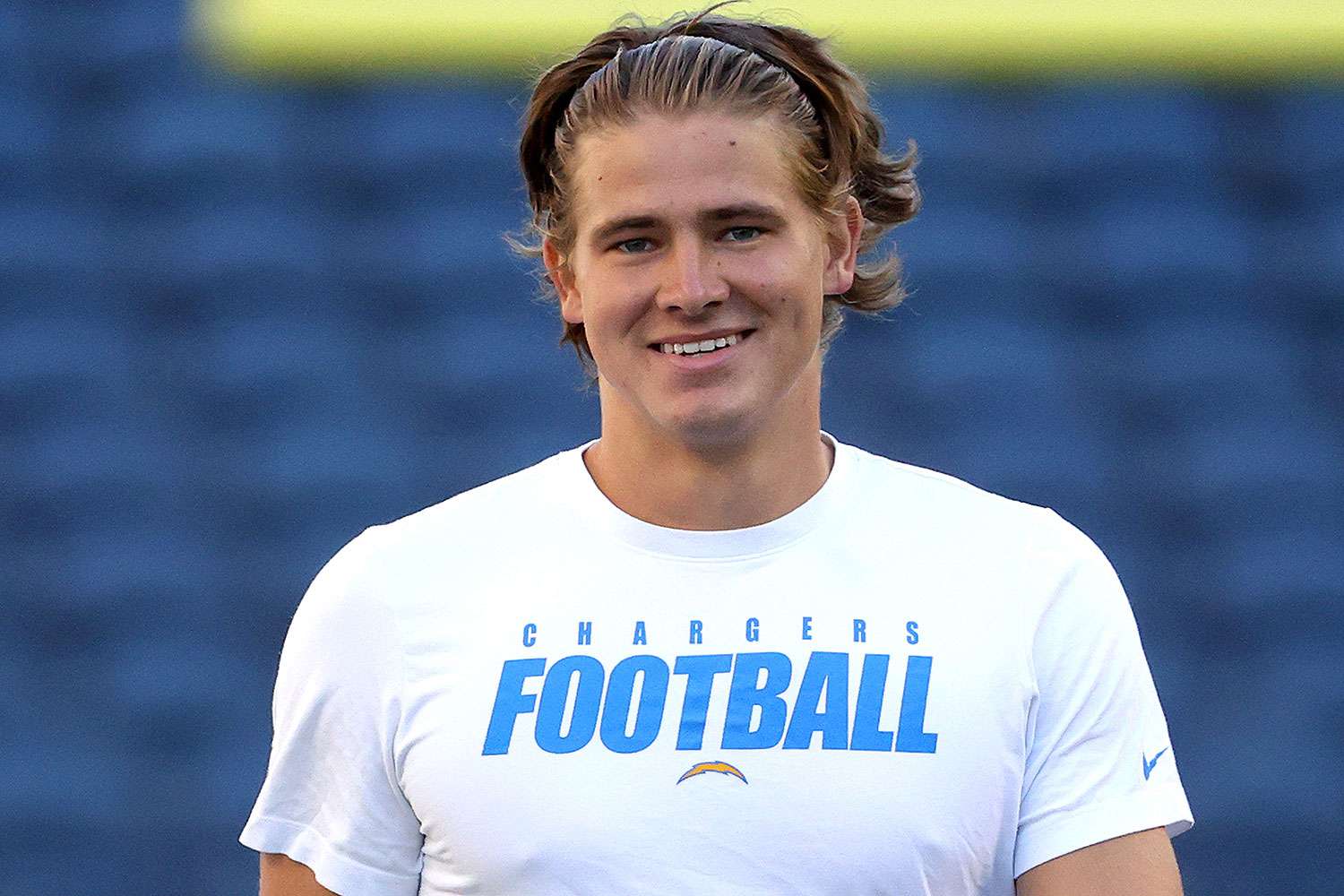

2025 Nfl Season Chargers To Play In Brazil With Justin Herbert

Apr 27, 2025

2025 Nfl Season Chargers To Play In Brazil With Justin Herbert

Apr 27, 2025 -

Revolucionario Wta Ofrece Licencia De Maternidad Pagada A Sus Jugadoras Por Un Ano

Apr 27, 2025

Revolucionario Wta Ofrece Licencia De Maternidad Pagada A Sus Jugadoras Por Un Ano

Apr 27, 2025 -

The Toll Of The Grand National Horse Deaths Ahead Of The 2025 Race

Apr 27, 2025

The Toll Of The Grand National Horse Deaths Ahead Of The 2025 Race

Apr 27, 2025