Future Of Microsoft-Activision Merger Uncertain After FTC Appeal

Table of Contents

The FTC's Appeal and its Implications

The Federal Trade Commission (FTC) filed an appeal challenging the Microsoft-Activision merger, expressing serious concerns about its potential anti-competitive effects. The FTC's primary argument centers on the potential for Microsoft to leverage its control over Activision Blizzard's vast portfolio of games to stifle competition and harm consumers.

-

Concerns about Microsoft's market dominance in gaming: The FTC argues that the merger would significantly increase Microsoft's already substantial market share in the gaming industry, potentially leading to monopolistic practices. This includes dominance in console gaming, PC gaming, and cloud gaming.

-

Potential exclusion of competing platforms from accessing Activision Blizzard titles: A key concern revolves around the potential for Microsoft to make Activision Blizzard titles, particularly Call of Duty, exclusive to its Xbox ecosystem or its Game Pass subscription service. This could significantly harm competitors like Sony's PlayStation and Nintendo Switch.

-

Impact on pricing and innovation in the gaming industry: The FTC worries that reduced competition could lead to higher prices for games, less innovation, and a decline in the quality of gaming experiences for consumers.

-

Details on the legal arguments presented by the FTC: The FTC's legal arguments are multifaceted, citing numerous instances of past anti-competitive behavior by large tech companies and presenting detailed economic models illustrating the potential negative consequences of the merger.

Microsoft's Defense and Counterarguments

Microsoft has vigorously defended the merger, arguing that it will bring significant benefits to gamers and the industry as a whole. They've presented counterarguments to address the FTC's concerns.

-

Microsoft's plans to maintain Call of Duty on PlayStation: A central point of Microsoft's defense is their commitment to keeping Call of Duty available on PlayStation for at least the next 10 years, addressing a major concern raised by Sony and the FTC. They've even proposed binding agreements to solidify this commitment.

-

Arguments about increased competition and innovation through the merger: Microsoft contends that the merger will foster innovation and competition by creating a more diverse and robust gaming ecosystem. They highlight potential synergies between Activision Blizzard's franchises and Microsoft's technologies.

-

Details on Microsoft's concessions and proposed remedies: To appease regulatory concerns, Microsoft has offered various concessions, including licensing agreements and commitments to maintain fair pricing and access to Activision Blizzard's titles.

-

Mentioning the support (or opposition) from other major players in the gaming industry: The opinions of other gaming companies have varied widely, with some expressing support for the merger and others raising concerns similar to the FTC’s. This division further complicates the regulatory landscape.

The Role of International Regulatory Bodies

The Microsoft-Activision merger is not just a U.S. issue. Regulatory bodies worldwide are scrutinizing the deal, leading to a complex, multi-jurisdictional approval process.

-

Comparison of regulatory stances across different jurisdictions: The European Union (EU), the UK's Competition and Markets Authority (CMA), and other international bodies are reviewing the deal with varying degrees of scrutiny, resulting in potentially divergent outcomes.

-

Potential for differing outcomes in various countries: A key aspect of this international review is the possibility that the merger could be approved in some countries but blocked in others. This creates uncertainty for Microsoft and Activision Blizzard.

-

The influence of these international decisions on the overall future of the merger: Even if the FTC appeal fails, a rejection in a major market like the EU could jeopardize the entire deal.

The UK's CMA Decision and its Significance

The UK's Competition and Markets Authority (CMA) initially blocked the merger, citing concerns about Microsoft's potential to dominate the cloud gaming market. This decision carries significant weight.

-

Detail the CMA's reasoning behind their ruling: The CMA's detailed report highlighted concerns over Microsoft's market power and its potential to harm competition in the rapidly growing cloud gaming sector.

-

Explain how the CMA's decision interacts with other regulatory bodies: The CMA's decision adds pressure on other regulatory bodies and strengthens the FTC’s arguments.

-

Discuss potential legal challenges to the CMA's decision: Microsoft is likely to appeal the CMA's ruling, adding another layer of complexity and uncertainty to the already intricate legal battle surrounding the Microsoft-Activision merger.

Potential Outcomes and Their Market Implications

Several scenarios are possible, each with substantial market implications.

-

Impact on game prices and availability: If the merger is blocked, prices may stay relatively stable. However, approval without sufficient concessions might lead to increased prices and reduced availability of certain titles.

-

Influence on game development and innovation: A blocked merger could stifle innovation, while an approved merger could potentially lead to both increased and decreased innovation, depending on Microsoft's actions.

-

Changes in the competitive landscape of the gaming market: The outcome will dramatically shift the competitive landscape, possibly creating new market leaders or altering the balance of power among existing giants.

-

Potential for increased subscription services or cloud gaming adoption: The merger's outcome may influence the trajectory of subscription services like Xbox Game Pass and cloud gaming adoption rates.

Conclusion

The future of the Microsoft-Activision merger remains highly uncertain, with the FTC's appeal significantly impacting the deal's timeline and potential outcome. The interplay between competing interests, regulatory decisions across multiple jurisdictions, and the arguments presented by both parties creates a complex and dynamic situation. The ultimate resolution will have profound implications for the gaming industry's competitive landscape, pricing models, and the availability of popular titles. Stay informed about the ongoing developments in the Microsoft-Activision merger to understand its potential impact on the future of gaming. Follow further news on the Microsoft-Activision merger for updates on this significant legal battle. Understanding the implications of this Microsoft-Activision deal is crucial for anyone involved in or interested in the gaming industry.

Featured Posts

-

Renewed Opposition To Electric Vehicle Quotas From Car Dealerships

Apr 28, 2025

Renewed Opposition To Electric Vehicle Quotas From Car Dealerships

Apr 28, 2025 -

Red Sox Breakout Star Unexpected Player Fuels Championship Contention

Apr 28, 2025

Red Sox Breakout Star Unexpected Player Fuels Championship Contention

Apr 28, 2025 -

This Red Sox Player Is Ready For A Breakout Season

Apr 28, 2025

This Red Sox Player Is Ready For A Breakout Season

Apr 28, 2025 -

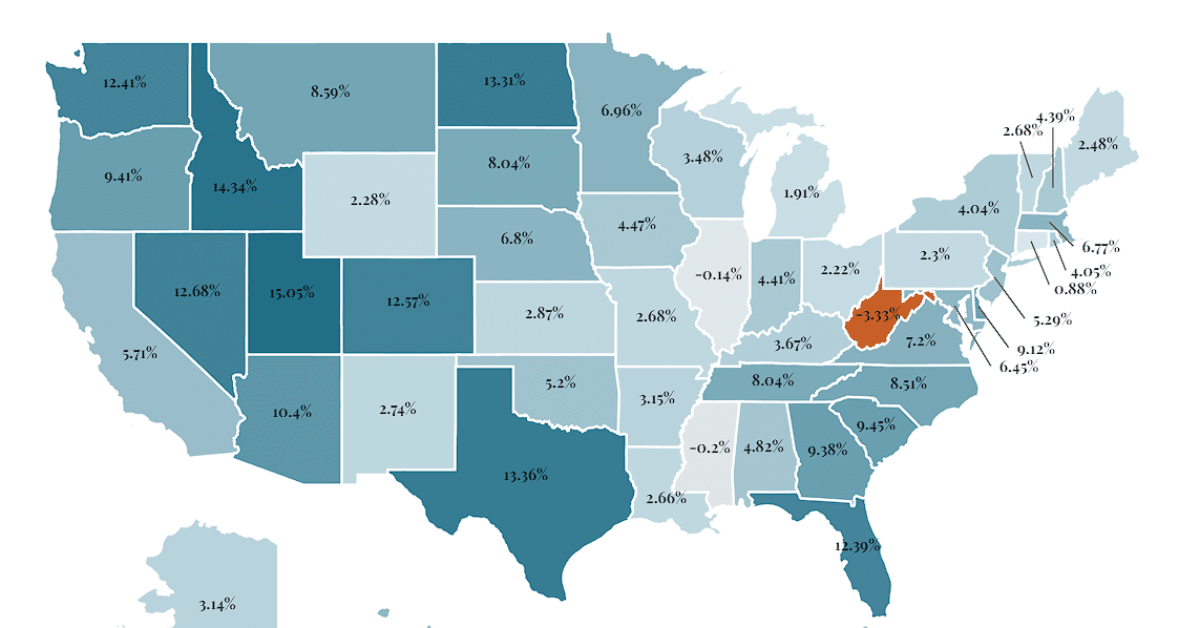

Where To Invest Mapping The Countrys Fastest Growing Business Areas

Apr 28, 2025

Where To Invest Mapping The Countrys Fastest Growing Business Areas

Apr 28, 2025 -

Tiga Warna Baru Jetour Dashing Debut Di Iims 2025

Apr 28, 2025

Tiga Warna Baru Jetour Dashing Debut Di Iims 2025

Apr 28, 2025