Creditor's Demand For Bank Statements In Denise Richards' Husband's Case

Table of Contents

The Legal Basis for Demanding Bank Statements

Creditors employ several legal avenues to obtain an individual's financial records, including bank statements, to determine their financial solvency and ability to repay outstanding debts. These methods often involve subpoenas, contracts, or bankruptcy proceedings.

Subpoenas and Court Orders

A subpoena is a legal order compelling an individual or entity to produce specific documents or information. Creditors often use subpoenas to obtain bank statements directly from financial institutions.

- Obtaining a Subpoena: The process involves filing a motion with the court, outlining the reasons for needing the bank statements and demonstrating their relevance to the case.

- Requirements for a Valid Subpoena: A valid subpoena must be properly served, clearly state the required information, and be issued by a court with jurisdiction.

- Legal Recourse: If a subpoena is improperly served or the request is deemed overly broad or irrelevant, the recipient can challenge it in court. A judge plays a critical role in evaluating the validity and scope of such requests, ensuring they are proportional to the case's needs.

Contracts and Agreements

Some contracts explicitly grant creditors the right to access an individual's financial information, including bank statements. These clauses are often included in loan agreements or credit applications.

- Examples of Financial Disclosure Clauses: Clauses might stipulate that borrowers must provide updated bank statements regularly or upon request from the lender. They may also include stipulations for penalties for non-compliance.

- Importance of Careful Contract Review: Individuals should carefully review all contracts before signing, paying close attention to clauses related to financial disclosure. Understanding the implications of these clauses is crucial to protect financial privacy.

Bankruptcy Proceedings

In bankruptcy cases, the disclosure of financial information, including bank statements, is essential for asset discovery and debt assessment.

- Debtor's Obligations: Debtors have a legal obligation to disclose all assets and liabilities accurately and completely during bankruptcy proceedings. This includes providing detailed bank statements to illustrate their financial situation.

- Consequences of Non-Disclosure: Failure to fully disclose financial information in bankruptcy can lead to serious consequences, including penalties, sanctions, and even criminal charges in certain instances.

Privacy Concerns and Protecting Financial Information

The demand for bank statements raises significant privacy concerns. Individuals have a right to protect their financial information, and several legal protections exist to safeguard this privacy.

Legal Protections

Several laws and regulations aim to protect the confidentiality of personal financial data.

- Relevant Laws and Regulations: Depending on the jurisdiction, laws like the Fair Credit Reporting Act (FCRA) in the United States (and similar legislation in other countries) regulate the collection, use, and disclosure of consumer credit information. These laws generally require creditors to have a legitimate business purpose for accessing such information.

- Data Protection Regulations: Regulations like GDPR (in Europe) also place significant emphasis on protecting personal data, including financial information, and outline stringent requirements for processing such data.

Strategies for Challenging a Demand

Individuals who believe a request for their bank statements is unwarranted or excessive can employ several strategies.

- Challenging Subpoenas: Individuals can challenge subpoenas in court if they believe the request is overly broad, irrelevant, or violates their privacy rights.

- Negotiating with Creditors: Negotiating with creditors to reach an agreement that limits the scope of information requested might be possible.

- Seeking Legal Counsel: Consulting with an attorney is crucial to understand legal rights and options for protecting financial information during legal disputes.

The Specifics of Aaron Phypers' Case (If Publicly Available)

Unfortunately, specifics of Aaron Phypers’ case may not be widely available to the public due to confidentiality concerns. However, should details emerge through official court filings or news reports, this section would provide an update on the nature of the debt, the creditor's claims, and the potential legal outcomes.

Nature of the Debt

(This section would be filled with information if publicly available, detailing the type of debt, the amount owed, and the creditor involved).

Potential Outcomes

(This section would speculate on potential settlements, court rulings, and their implications for both parties, maintaining a neutral and objective tone based on any available public information).

Conclusion

This legal deep dive into creditor demands for bank statements, illustrated by the case involving Denise Richards' husband, Aaron Phypers, highlights the crucial tension between creditors' rights to recover debts and individuals' rights to financial privacy. We've explored the legal basis for such demands, including subpoenas, contractual agreements, and bankruptcy proceedings. We've also emphasized the importance of understanding legal protections and strategies for safeguarding financial information. The specific details of Aaron Phypers' case remain largely undisclosed, but this analysis provides a framework for understanding the broader legal and ethical considerations.

Call to Action: Protecting your financial information is paramount. If you face a creditor's demand for your bank statements, understand your rights and seek legal counsel to protect yourself. Don't hesitate to secure legal advice to navigate the complex legal landscape surrounding creditor demands for bank statements and ensure your financial privacy is upheld. [Link to relevant legal resources or financial advice websites].

Featured Posts

-

New Business Hot Spots A National Map And Analysis

Apr 28, 2025

New Business Hot Spots A National Map And Analysis

Apr 28, 2025 -

V Mware Costs To Skyrocket At And T Reports 1050 Price Increase From Broadcom

Apr 28, 2025

V Mware Costs To Skyrocket At And T Reports 1050 Price Increase From Broadcom

Apr 28, 2025 -

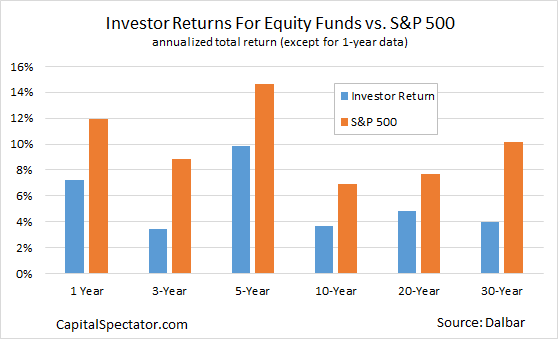

Understanding Market Reactions Professional Vs Individual Investor Response

Apr 28, 2025

Understanding Market Reactions Professional Vs Individual Investor Response

Apr 28, 2025 -

Ftc To Appeal Activision Blizzard Acquisition Decision

Apr 28, 2025

Ftc To Appeal Activision Blizzard Acquisition Decision

Apr 28, 2025 -

Bubba Wallace Balancing Racing And Fatherhood

Apr 28, 2025

Bubba Wallace Balancing Racing And Fatherhood

Apr 28, 2025