Conservative Party's Economic Policy: Tax Cuts And Balanced Budget

Table of Contents

Tax Cut Proposals

The Conservative Party's approach to economic policy frequently involves proposals for significant tax cuts, aiming to stimulate economic activity and boost private sector investment. Let's examine the specifics:

Income Tax Cuts

Conservative manifestos often include plans to reduce income tax rates for various income brackets. Specific proposals vary depending on the election cycle, but common themes include:

- Percentage reductions in the basic, higher, and additional rates of income tax.

- Adjustments to income thresholds for each tax bracket, potentially affecting a larger segment of the population.

- Changes to personal allowances, aiming to provide more disposable income for lower-income earners.

The impact of such cuts varies greatly depending on the size and scope of the reductions. Lower-income households might benefit from increased disposable income, potentially stimulating consumer spending. However, higher-income households would typically see a more significant reduction in their tax burden. The overall effect on income inequality requires careful consideration and analysis.

Corporation Tax Cuts

Lowering corporation tax is another cornerstone of many Conservative economic plans. The stated aim is to attract foreign investment, enhance the UK's competitiveness on the global stage, and incentivize domestic businesses to invest and expand, thus boosting job creation.

- Proposed reductions in corporation tax rates are often pitched as a way to make the UK more attractive to multinational corporations.

- The potential impact on government revenue needs careful consideration, as lower rates mean less tax collected.

- A comparison with corporation tax rates in other developed nations is crucial to assess the UK's competitiveness.

- Specific incentives for small and medium-sized enterprises (SMEs) are often included, aiming to support business growth at a crucial level of the economy.

Other Tax Measures

Beyond income and corporation tax, Conservative economic policies often address other taxes. These can include:

- Capital Gains Tax (CGT): Changes to CGT rates and allowances can impact investment decisions and wealth distribution.

- Inheritance Tax (IHT): Adjustments to IHT thresholds or rates can affect wealth transfer between generations.

- Value Added Tax (VAT): While generally considered less likely to be altered significantly due to its widespread impact, adjustments to VAT rates or exemptions can have profound implications for various sectors.

Each of these measures has potential consequences, both intended and unintended, requiring careful analysis. For example, cutting CGT could boost investment but might also exacerbate wealth inequality.

Achieving a Balanced Budget

A key objective within the Conservative Party economic policy is often the achievement of a balanced budget, reflecting a commitment to fiscal responsibility. This usually entails a two-pronged approach: spending cuts and economic growth strategies.

Spending Cuts

Balancing the budget often involves identifying areas for government spending reductions. Potential targets may include:

- Welfare programs: Proposed reforms to welfare benefits aim to reduce expenditure while maintaining a safety net.

- Public services: Cuts in public sector spending might impact areas like healthcare, education, and infrastructure.

The potential impact on the quality and accessibility of public services is a critical consideration. The feasibility of such cuts and their wider societal implications are often subject to extensive public debate.

Economic Growth Strategies

The Conservative Party usually outlines strategies to boost economic growth as a means to increase tax revenue and reduce the need for drastic spending cuts. These often involve:

- Stimulating private sector investment through tax breaks and deregulation.

- Investing in infrastructure projects to boost productivity and create jobs.

- Supporting specific industries or sectors deemed crucial for economic growth.

The success of these strategies depends heavily on broader economic conditions and the effectiveness of government intervention.

Debt Reduction Strategies

Reducing national debt is another crucial aspect of the Conservative Party's commitment to fiscal responsibility. This often involves:

- Fiscal consolidation: Implementing measures to reduce the budget deficit through a combination of spending cuts and tax increases (or freezes).

- Reviewing the effectiveness of previous debt reduction strategies and learning from past successes and failures.

- Assessing the potential risks associated with overly aggressive debt reduction, recognizing the potential negative impacts on economic growth.

Potential Economic Impacts

The Conservative Party's economic policies, with their emphasis on tax cuts and balanced budgets, have significant potential impacts across various areas:

Impact on Inequality

The combination of tax cuts (which disproportionately benefit higher earners) and spending cuts (potentially affecting low-income households more severely) could exacerbate income inequality. Careful analysis is needed to assess the extent and mitigate the potential negative consequences.

Impact on Economic Growth

The impact on economic growth is a key area of debate. While tax cuts are intended to stimulate investment and consumer spending, the effects of spending cuts could be counterproductive, leading to lower overall demand. The net effect is highly dependent on various factors.

Impact on Public Services

Spending cuts can lead to reductions in the quality and accessibility of public services such as healthcare and education. This trade-off between fiscal responsibility and public service provision is a central consideration.

Conclusion

The Conservative Party's economic policy of tax cuts and balanced budgets presents a complex picture with potential benefits and drawbacks. Achieving both goals simultaneously often requires careful balancing and potentially difficult choices, leading to significant trade-offs between tax cuts, public services, and debt reduction. The actual impact on the UK economy depends on various factors, including the global economic climate, the specific details of policy implementation, and unforeseen circumstances. Understanding the implications of the Conservative Party's economic policy of tax cuts and balanced budgets for the UK economy requires ongoing monitoring and further research. Learn more about the intricacies of the Conservative Party's economic policy and its potential impact on your future by conducting further research on [link to relevant resource].

Featured Posts

-

Cassidy Hutchinsons Memoir Key Witness To January 6th Testimony To Be Published This Fall

Apr 24, 2025

Cassidy Hutchinsons Memoir Key Witness To January 6th Testimony To Be Published This Fall

Apr 24, 2025 -

Missing Swimmer Found Dead Near Israeli Beach Known For Sharks

Apr 24, 2025

Missing Swimmer Found Dead Near Israeli Beach Known For Sharks

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Jan 6 Figure Ray Epps

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Jan 6 Figure Ray Epps

Apr 24, 2025 -

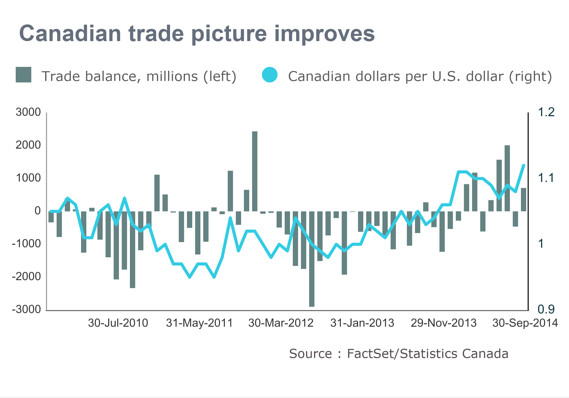

Loonie Falls Despite Greenback Strength Currency Market Analysis

Apr 24, 2025

Loonie Falls Despite Greenback Strength Currency Market Analysis

Apr 24, 2025 -

Wednesday April 9th The Bold And The Beautiful Recap Icu Crisis And Family Conflicts

Apr 24, 2025

Wednesday April 9th The Bold And The Beautiful Recap Icu Crisis And Family Conflicts

Apr 24, 2025