Colgate's Financial Performance: Tariff Impact And Q[Quarter Number] Results

![Colgate's Financial Performance: Tariff Impact And Q[Quarter Number] Results Colgate's Financial Performance: Tariff Impact And Q[Quarter Number] Results](https://glienickergruppe.de/image/colgates-financial-performance-tariff-impact-and-q-quarter-number-results.jpeg)

Table of Contents

Overall Financial Performance in Q3 2023:

Colgate's Q3 2023 financial results presented a mixed bag. While the company demonstrated resilience in the face of economic headwinds, certain challenges remain. Let's examine the key financial metrics:

-

Revenue: Colgate reported a total revenue of [Insert Actual Revenue Figure], representing a [Insert Percentage]% increase/decrease compared to Q3 2022. This growth/decline can be attributed to [Explain reasons – e.g., increased pricing, volume changes, market share shifts].

-

Net Income: Net income for Q3 2023 reached [Insert Actual Net Income Figure], showing a [Insert Percentage]% increase/decrease year-over-year. [Explain contributing factors, e.g., cost-cutting measures, changes in tax rates].

-

Earnings Per Share (EPS): Colgate's EPS stood at [Insert Actual EPS Figure], indicating a [Insert Percentage]% increase/decrease compared to the same period last year. This reflects [Explain the factors influencing EPS, e.g., share buybacks, changes in net income].

-

Operating Margin: The operating margin for Q3 2023 was [Insert Actual Operating Margin Figure]%, [Insert Percentage Points]% higher/lower than Q3 2022. This change reflects [Explain factors impacting the operating margin, e.g., increased raw material costs, pricing strategies].

-

Sales Growth: Significant sales growth was observed in [Mention specific high-performing regions or product categories], while challenges were faced in [Mention specific underperforming areas].

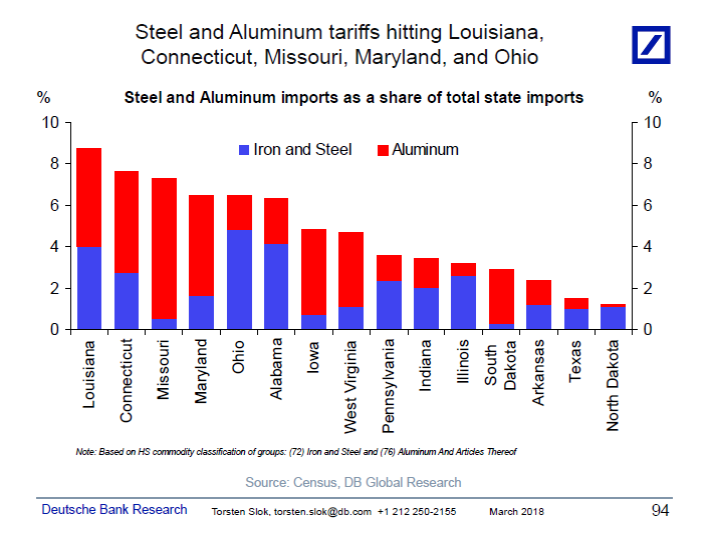

Impact of Tariffs on Colgate's Profitability:

The ongoing trade tensions and resulting tariffs have undoubtedly impacted Colgate's profitability. Increased import costs for raw materials and finished goods have squeezed margins. To mitigate this, Colgate has implemented several strategies:

-

Pricing Adjustments: Colgate has carefully adjusted pricing on certain products to offset rising input costs. The effectiveness of this strategy is evident in [Explain the impact of price adjustments on revenue and margins].

-

Cost Optimization: The company has undertaken significant cost-cutting initiatives, focusing on streamlining operations and improving supply chain efficiency. This has helped to [Quantify the impact of cost optimization on profitability].

-

Supply Chain Diversification: Colgate is actively exploring ways to diversify its supply chain to reduce its reliance on regions impacted by tariffs. This long-term strategy will likely yield benefits in [Explain the potential long-term impact].

The full impact of tariffs on Colgate's future performance remains to be seen, and the company continues to monitor the geopolitical landscape closely.

Regional Performance and Market Share Analysis:

Colgate's regional performance varied significantly in Q3 2023.

-

North America: The North American market showed [Insert Growth Percentage]% growth/decline, driven primarily by [Explain contributing factors, e.g., strong performance in specific product categories, competitive landscape].

-

Asia: The Asia-Pacific region experienced [Insert Growth Percentage]% growth/decline, influenced by [Explain contributing factors, e.g., economic conditions in key markets, competitive pressures].

-

Europe: Sales in Europe grew/declined by [Insert Growth Percentage]%, reflecting [Explain contributing factors, e.g., consumer demand, market saturation].

-

Latin America: Latin America demonstrated [Insert Growth Percentage]% growth/decline, attributable to [Explain contributing factors, e.g., economic volatility, changing consumer preferences].

Colgate's market share in various regions also saw fluctuations, with [mention specific changes and the reasons behind them]. Emerging markets remain a key focus for growth, while maintaining a strong position in developed markets is crucial.

Specific Product Category Performance:

Analyzing Colgate's product portfolio reveals some interesting trends:

-

Toothpaste: This core category showed [Insert Growth Percentage]% growth/decline, largely influenced by [Explain reasons, e.g., new product launches, marketing campaigns, competitive dynamics].

-

Toothbrushes: Toothbrush sales experienced [Insert Growth Percentage]% growth/decline, attributed to [Explain reasons, e.g., innovative product features, pricing strategies].

-

Mouthwash: The mouthwash segment demonstrated [Insert Growth Percentage]% growth/decline, impacted by [Explain reasons, e.g., changing consumer habits, competitive landscape].

Conclusion:

Colgate's Q3 2023 results demonstrate a mixed performance, reflecting the complex interplay of economic factors and company strategies. While the impact of tariffs presented significant challenges, Colgate's proactive cost management and pricing adjustments helped to mitigate some of the negative consequences. Regional performance varied, highlighting the need for a nuanced approach to market strategies. Close monitoring of tariff implications and continued focus on innovation and cost efficiency will be crucial for Colgate's future success in the dynamic oral care industry. Stay informed about Colgate's ongoing financial performance by following our regular updates on Colgate's financial performance, including future quarter results and relevant industry news. Subscribe to our newsletter for in-depth analysis on Colgate and the broader consumer staples sector.

![Colgate's Financial Performance: Tariff Impact And Q[Quarter Number] Results Colgate's Financial Performance: Tariff Impact And Q[Quarter Number] Results](https://glienickergruppe.de/image/colgates-financial-performance-tariff-impact-and-q-quarter-number-results.jpeg)

Featured Posts

-

Blue Origin Rocket Launch Cancelled Details On Subsystem Failure

Apr 26, 2025

Blue Origin Rocket Launch Cancelled Details On Subsystem Failure

Apr 26, 2025 -

Trumps Tariffs Ceos Cite Negative Impact On Economy And Consumer Confidence

Apr 26, 2025

Trumps Tariffs Ceos Cite Negative Impact On Economy And Consumer Confidence

Apr 26, 2025 -

Chinese Cars A Comprehensive Analysis Of Their Potential

Apr 26, 2025

Chinese Cars A Comprehensive Analysis Of Their Potential

Apr 26, 2025 -

Stock Market Analysis Dow Futures Chinas Economic Policies And Tariff Impacts

Apr 26, 2025

Stock Market Analysis Dow Futures Chinas Economic Policies And Tariff Impacts

Apr 26, 2025 -

The 2700 Mile Divide Examining The Effects Of Trumps Policies On Rural Education

Apr 26, 2025

The 2700 Mile Divide Examining The Effects Of Trumps Policies On Rural Education

Apr 26, 2025