Stock Market Analysis: Dow Futures, China's Economic Policies, And Tariff Impacts

Table of Contents

Dow Futures: A Leading Indicator

Dow futures contracts are derivative instruments whose price is based on the expected future value of the Dow Jones Industrial Average (DJIA). They offer a glimpse into investor sentiment and anticipated market performance. Understanding Dow futures is key to proactive stock market analysis.

Understanding Dow Futures Contracts

- Investor Sentiment Reflection: Dow futures prices reflect the collective expectations of investors regarding the future performance of the DJIA. A rising futures price suggests optimism, while a falling price indicates pessimism. This sentiment analysis is a valuable tool in stock market analysis.

- DJIA Relationship: Dow futures and the actual DJIA are closely correlated, though not perfectly matched. Differences between the futures price and the current DJIA can signal potential market movements. Analyzing this spread enhances stock market analysis precision.

- Technical Indicator Use: Charts and technical indicators applied to Dow futures data can provide insights into potential short-term market trends. This short-term forecasting capability is useful for day traders and active investors.

Interpreting Dow Futures Data for Stock Market Analysis

- Gauging Market Volatility and Risk: Analyzing the volatility of Dow futures can help investors gauge the overall risk in the market. High volatility suggests increased uncertainty and potential for sharp price swings. This is crucial for risk management in stock market analysis.

- Hedging Strategies: Dow futures can be used as a hedging tool to protect against potential losses in a stock portfolio. Investors can use futures to offset potential declines in their stock holdings. This sophisticated application requires a deep understanding of stock market analysis techniques.

- Limitations: Relying solely on Dow futures for stock market analysis can be risky. Other factors, such as geopolitical events and company-specific news, can significantly impact stock prices, irrespective of Dow futures movements. A holistic stock market analysis approach is essential.

China's Economic Policies and Global Market Impact

China's economic policies have a profound and far-reaching impact on the global economy, significantly influencing the stock market. Analyzing these policies is crucial for any comprehensive stock market analysis.

China's Economic Growth and its Global Ripple Effect

- Commodity Price Impact: China's economic growth significantly influences demand for raw materials and commodities. Changes in its industrial output directly affect commodity prices worldwide. Understanding this relationship enhances commodity-focused stock market analysis.

- Multinational Corporation Influence: Chinese regulations and policies directly impact multinational corporations operating within China. These regulatory changes can create both opportunities and challenges for investors. This aspect demands careful consideration in international stock market analysis.

- Yuan Exchange Rate Significance: Fluctuations in the Chinese Yuan's exchange rate influence global currency markets and the pricing of goods and services. This impacts global trade and investor sentiment, playing a significant role in stock market analysis.

Navigating the Uncertainty: Implications for Stock Market Analysis

- Staying Informed: Staying abreast of Chinese economic news and announcements is paramount. This requires following reputable financial news sources and analyzing government publications. This information is critical for proactive stock market analysis.

- Diversification Strategies: Diversifying investments across various asset classes and geographies can mitigate risks associated with economic fluctuations in China. This risk management strategy is vital for any serious stock market analysis.

- Robust Risk Management: Portfolios with significant exposure to Chinese assets require robust risk management strategies to account for potential economic downturns. Such strategies are essential for responsible stock market analysis.

The Lingering Impact of Tariffs on Stock Market Performance

International tariffs significantly affect global trade, supply chains, and consequently, stock market performance. Understanding their influence is critical for effective stock market analysis.

Tariff Wars and Their Effect on Global Trade

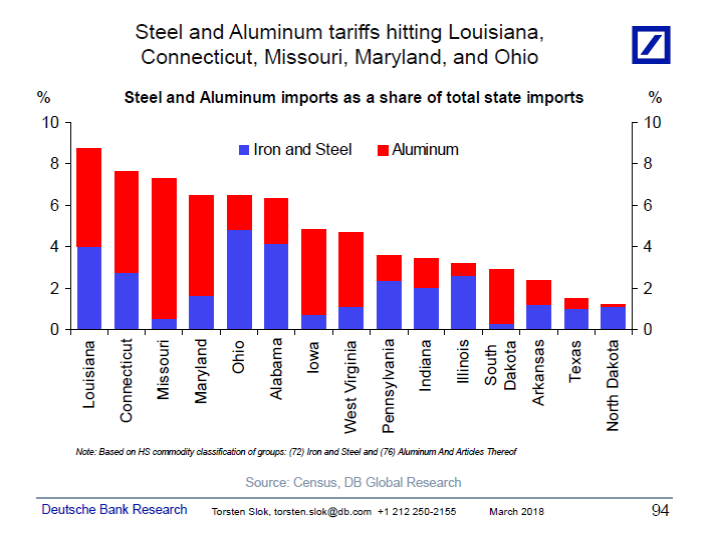

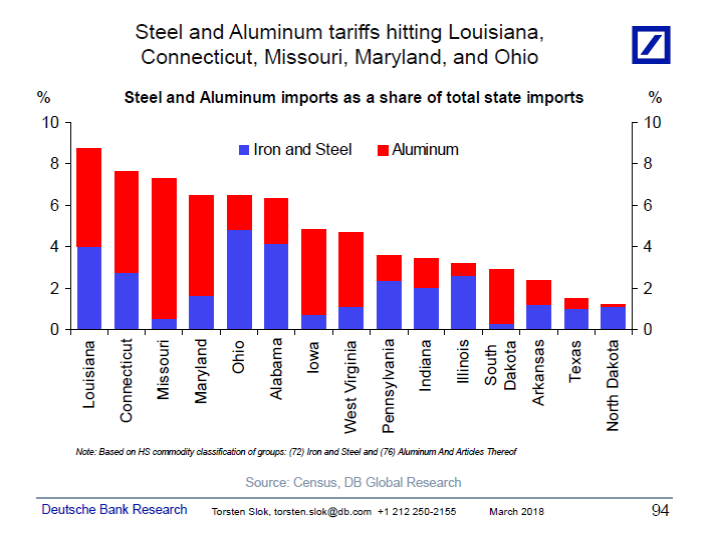

- Inflationary Pressure: Tariffs can lead to increased import costs, contributing to inflation and potentially impacting consumer spending. This macroeconomic factor influences stock market analysis significantly.

- Sectoral Impacts: The impact of tariffs varies considerably across different sectors and industries. Some sectors may benefit while others face challenges. Identifying these sector-specific effects is important for stock market analysis.

- Geopolitical Implications: Tariff disputes have significant geopolitical implications, potentially escalating tensions between nations and impacting global stability. This broader context is relevant to a complete stock market analysis.

Strategic Adjustments for Stock Market Analysis in a Tariffed World

- Identifying Less Vulnerable Companies: Investors can focus on companies less vulnerable to tariff impacts, such as those with diversified supply chains or domestic production. This targeted approach is crucial for efficient stock market analysis.

- Monitoring Trade Policy: Closely monitoring trade policy developments and their market implications is essential. This requires continuous analysis of news and policy updates for informed stock market analysis.

- Geographic Diversification: Diversifying investments across various sectors and geographies can help mitigate risks associated with tariff-related uncertainties. This is a cornerstone of robust stock market analysis.

Conclusion

This analysis of Dow futures, China's economic policies, and the impact of tariffs provides a framework for a more nuanced approach to stock market analysis. Understanding these interconnected factors is crucial for navigating the complexities of the global market and making informed investment decisions. By carefully considering these elements and staying updated on market trends, you can enhance your stock market analysis and potentially improve your investment outcomes. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions related to stock market analysis.

Featured Posts

-

The Ahmed Hassanein Story A Potential Nfl First For Egypt

Apr 26, 2025

The Ahmed Hassanein Story A Potential Nfl First For Egypt

Apr 26, 2025 -

Golds Safe Haven Status Strengthened Analyzing The Recent Price Rally Amidst Trade Tensions

Apr 26, 2025

Golds Safe Haven Status Strengthened Analyzing The Recent Price Rally Amidst Trade Tensions

Apr 26, 2025 -

Analysis Trumps Comments On A Congressional Stock Trading Ban In Time Interview

Apr 26, 2025

Analysis Trumps Comments On A Congressional Stock Trading Ban In Time Interview

Apr 26, 2025 -

Point72s Exit Strategy Emerging Markets Fund Closure

Apr 26, 2025

Point72s Exit Strategy Emerging Markets Fund Closure

Apr 26, 2025 -

Middle Managers The Bridge Between Leadership And Employees A Critical Role In Organizational Success

Apr 26, 2025

Middle Managers The Bridge Between Leadership And Employees A Critical Role In Organizational Success

Apr 26, 2025