China's Shift To Middle Eastern LPG: A Response To US Tariff Hikes

Table of Contents

The Impact of US Tariffs on China's LPG Market

The US tariffs on imported LPG dealt a heavy blow to Chinese importers, significantly increasing costs and reducing competitiveness.

Increased Costs and Reduced Competitiveness

The tariffs imposed resulted in a substantial price increase for Chinese importers. While precise figures vary depending on the specific tariff schedule and time period, estimates suggest increases ranging from 15% to 25% on LPG imports from the US. This directly translated into higher LPG prices for Chinese consumers and industries. Industries relying heavily on LPG, such as the petrochemical sector and residential heating, faced substantial cost pressures, impacting profitability and potentially leading to job losses. Keywords: US LPG tariff impact, China LPG price, import costs.

- Quantifiable Impact: Specific data on the percentage increase in LPG prices in China following the tariff imposition would strengthen this section.

- Case Studies: Examples of specific Chinese industries affected by the price increase would provide concrete evidence.

Shifting Trade Dynamics

The tariffs triggered a significant shift in China's LPG import sources. Imports from the US plummeted, dramatically altering the balance of trade. Data illustrating this decline – showing the volume of LPG imports from the US before and after the tariff imposition – would strengthen this argument. This trade diversion represents a clear consequence of the US trade policy. Keywords: China-US trade, LPG trade imbalance, trade war impact.

- Statistical Data: Including charts or graphs depicting the change in import volumes from the US and other sources would enhance the analysis.

- Alternative Sources: Mentioning the exploration of alternative LPG sources before the Middle East's emergence would provide a complete picture.

The Rise of Middle Eastern LPG Suppliers

The void left by reduced US LPG imports was swiftly filled by increased supply from Middle Eastern countries.

Increased Supply from the Middle East

Countries like Saudi Arabia and Qatar significantly boosted their LPG exports to China, capitalizing on the increased demand. Their proximity to China, combined with existing production capacity, allowed them to efficiently meet the growing needs. Keywords: Saudi Arabia LPG, Qatar LPG, Middle East LPG export.

- Specific Export Figures: Including concrete data on the increase in LPG exports from specific Middle Eastern countries to China would strengthen this section.

- Infrastructure: Discussion of the existing LPG infrastructure in the Middle East and its role in facilitating the increased exports would add depth.

New Trade Agreements and Partnerships

The increased reliance on Middle Eastern LPG has led to the formation of new trade agreements and partnerships between China and Middle Eastern nations. These agreements aim to secure long-term energy supplies for China, contributing to its energy security goals. Keywords: China-Middle East energy cooperation, bilateral trade agreements, LPG supply chain.

- Examples of Agreements: Mentioning specific trade agreements or memorandums of understanding would enhance credibility.

- Long-Term Implications: Discussing the potential long-term implications of these partnerships on both China's and the Middle East's economies would be beneficial.

Geopolitical Implications of China's LPG Shift

China's reduced reliance on US LPG carries significant geopolitical implications.

Reduced Reliance on US Energy

This shift represents a strategic move by China to diversify its energy sources, reducing its dependence on the US. This has implications for US-China relations, potentially impacting broader trade negotiations and overall geopolitical dynamics. The impact on global energy markets – potentially influencing prices and supply chains – also needs consideration. Keywords: energy independence, geopolitical risks, US-China energy relations.

- Analysis of US Response: Analyzing the US's response to China's shift away from US LPG would provide a complete picture.

- Long-term implications on global energy prices: This would add depth and context to the discussion.

Increased Middle East Influence

The increased trade with the Middle East strengthens their influence in global energy markets. This shift has potential economic and political consequences, impacting regional stability and power dynamics. Keywords: Middle East energy dominance, global energy security, geopolitical power shift.

- Potential Risks: Highlighting potential risks associated with increased dependence on the Middle East, such as political instability or price volatility, would provide a balanced perspective.

- Alternative Perspectives: Including different perspectives on the implications of this shift would enhance the analysis.

Conclusion: Navigating the New Landscape of China's LPG Imports

US tariffs have profoundly impacted China's LPG import strategy, leading to a significant shift toward Middle Eastern suppliers. This strategic move reflects China's efforts to enhance energy security and reduce reliance on the US. The resulting geopolitical implications are far-reaching, influencing global energy markets and reshaping relationships between major players. Learn more about the future of China's LPG imports and stay updated on the latest developments in China's Middle Eastern LPG strategy. Keywords: China LPG market outlook, future of LPG trade, Middle East energy investment.

Featured Posts

-

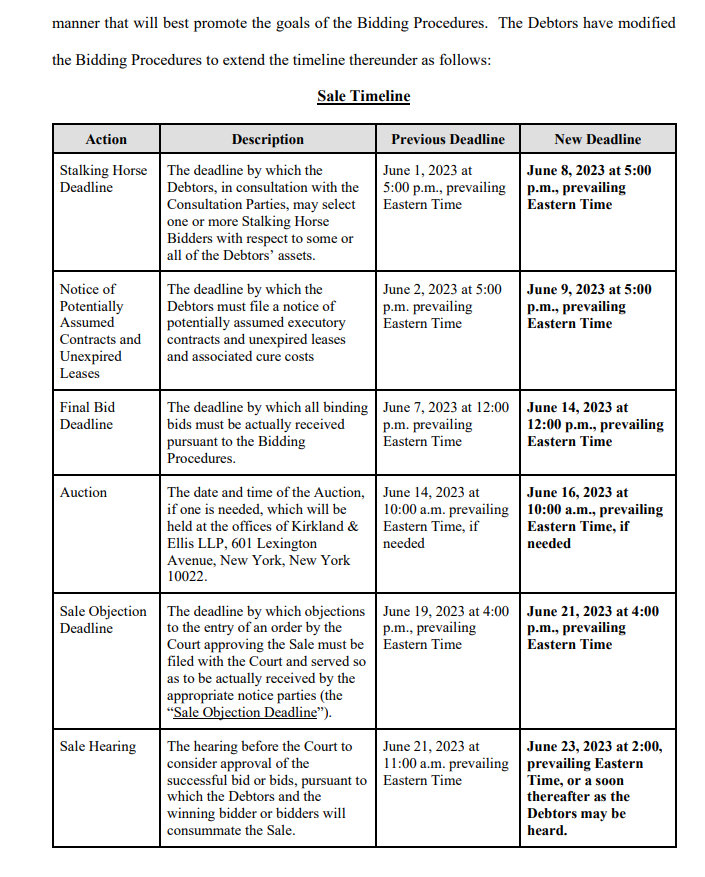

Village Roadshow Acquisition Complete Alcons Stalking Horse Bid Successful

Apr 24, 2025

Village Roadshow Acquisition Complete Alcons Stalking Horse Bid Successful

Apr 24, 2025 -

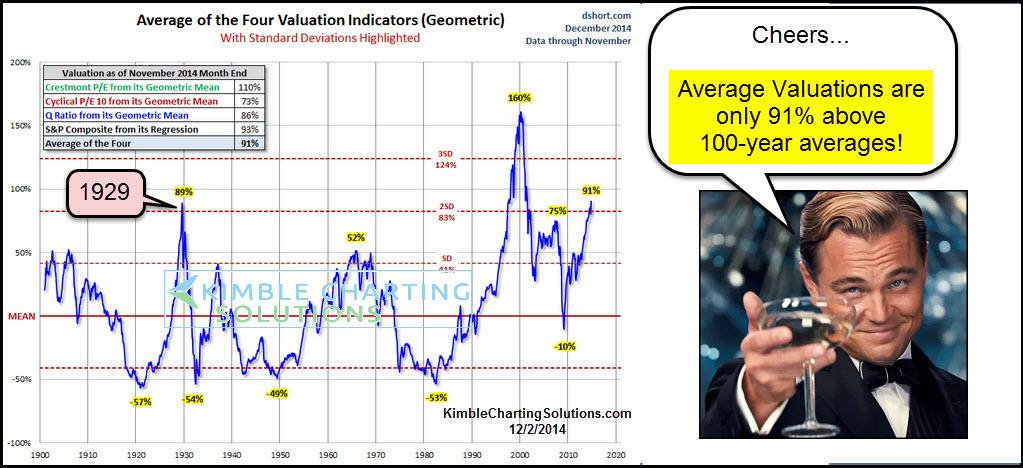

High Valuations In The Stock Market Bof As Rationale For Investors

Apr 24, 2025

High Valuations In The Stock Market Bof As Rationale For Investors

Apr 24, 2025 -

Large Scale Office365 Executive Account Hack Results In Multi Million Dollar Loss

Apr 24, 2025

Large Scale Office365 Executive Account Hack Results In Multi Million Dollar Loss

Apr 24, 2025 -

Did Sk Hynix Surpass Samsung In Dram Production The Role Of Ai

Apr 24, 2025

Did Sk Hynix Surpass Samsung In Dram Production The Role Of Ai

Apr 24, 2025 -

Is Open Ai Buying Google Chrome Speculation Following Chat Gpt Ceo Comments

Apr 24, 2025

Is Open Ai Buying Google Chrome Speculation Following Chat Gpt Ceo Comments

Apr 24, 2025