Are High Stock Market Valuations A Concern? BofA Says No. Here's Why.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's optimistic stance on high stock market valuations rests on several key pillars. They argue that traditional valuation metrics, when viewed within the broader economic context and alongside current market dynamics, don't necessarily signal an imminent downturn. Instead, they highlight several factors that justify, in their view, the current elevated valuations.

-

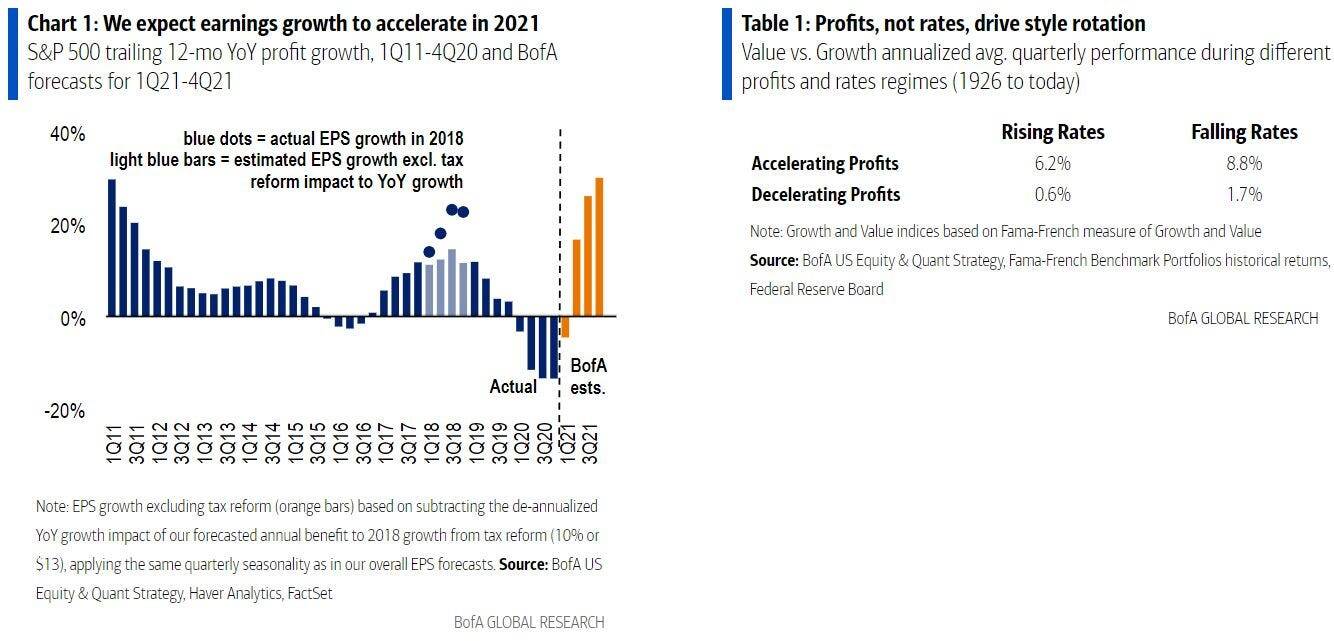

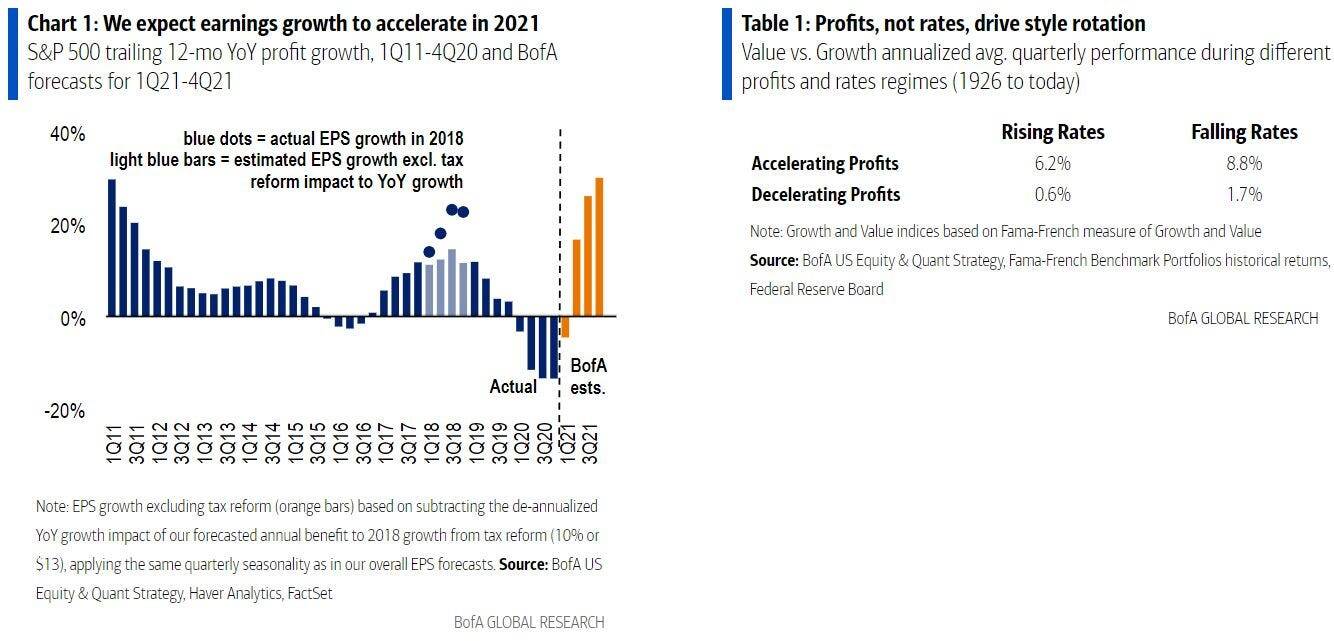

Strong Corporate Earnings Growth: Despite high valuations, many companies are reporting robust earnings growth. This suggests that the market's pricing reflects not just speculation, but also a genuine expectation of future profitability. The strength of corporate earnings is a crucial counter-argument to concerns about overvaluation.

-

Low Interest Rates: Persistently low interest rates, a key component of accommodative monetary policy, continue to support higher valuations. Low borrowing costs encourage investment and reduce the discount rate used in many valuation models, making future earnings streams more valuable.

-

Technological Advancements Driving Future Growth: BofA points to ongoing technological innovation as a catalyst for future growth. Disruptive technologies across various sectors are expected to create new opportunities and drive further corporate earnings growth, justifying premium valuations.

-

Resilience of the US Economy: The resilience of the US economy, despite global uncertainties, provides a solid foundation for continued market strength. Indicators such as consumer spending and employment figures support the view of a robust economy capable of sustaining high valuations.

-

Sector-Specific Analysis: BofA's optimism isn't blanket; they conduct sector-specific analyses. While some sectors may indeed be overvalued, they identify others – such as certain technology sub-sectors or specific growth companies – as either fairly valued or even potentially undervalued, offering selective investment opportunities.

Analyzing Key Valuation Metrics: A Deeper Dive

Understanding how to assess stock market valuations requires analyzing various metrics. Key metrics include the Price-to-Earnings ratio (P/E ratio), the Cyclically Adjusted Price-to-Earnings ratio (Shiller PE), and others that provide different perspectives on market valuation.

-

P/E Ratio: This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially reflecting high growth expectations or market optimism. However, the P/E ratio can be influenced by accounting practices and industry-specific factors.

-

Shiller PE (CAPE Ratio): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a potentially more robust measure of valuation, less susceptible to short-term market volatility. However, it might not accurately capture the dynamics of rapidly changing sectors.

-

Comparative Analysis: BofA likely compares current valuation metrics to historical averages and considers the context of broader economic conditions. A high P/E ratio might not be alarming if interest rates are low and corporate earnings growth is strong.

-

Limitations of Metrics: It's crucial to remember that valuation metrics are just tools; they don't offer definitive answers. Their interpretation requires understanding their limitations and considering broader economic and market factors.

Factors Supporting Continued Market Growth Despite High Valuations

Despite concerns about high stock market valuations, BofA identifies several factors that they believe will continue to support market growth.

-

Innovation and Technological Disruption: Ongoing technological advancements continue to fuel innovation and create new industries and market opportunities, driving economic growth.

-

Government Stimulus and Infrastructure Spending: Government investments in infrastructure and stimulus packages can boost economic activity and support corporate growth.

-

Global Economic Recovery: A recovering global economy, particularly in certain key regions, contributes to increased demand and corporate earnings.

-

Strong Consumer Spending: Robust consumer spending indicates economic confidence and fuels demand for goods and services, further supporting market growth.

Potential Risks and Caveats: A Balanced Perspective

While BofA maintains an optimistic outlook, it’s crucial to acknowledge potential risks. High valuations don't guarantee continued growth, and several factors could negatively impact the market.

-

Inflationary Pressures: Rising inflation can erode corporate profits and reduce investor confidence, potentially leading to market corrections.

-

Geopolitical Uncertainties: Geopolitical events and international conflicts can introduce significant uncertainty and volatility into the market.

-

Potential Interest Rate Hikes: Future interest rate increases by central banks, aimed at controlling inflation, could impact corporate borrowing costs and potentially reduce market valuations.

-

Unexpected Economic Downturns: Unexpected economic downturns, such as recessions, can significantly impact stock prices and lead to market corrections.

Navigating High Stock Market Valuations – A Call to Action

BofA's optimistic outlook on high stock market valuations is based on strong corporate earnings, low interest rates, technological innovation, and a resilient US economy. While they acknowledge potential risks such as inflation and geopolitical uncertainties, they believe these factors are outweighed by the positive drivers of continued growth. However, investors should remember that this is just one perspective. It is crucial to conduct your own thorough research, understand the nuances of various valuation metrics, and consider your own risk tolerance before making any investment decisions. Consider exploring resources like financial news websites, investment analysis reports, and consulting with a financial advisor to gain a comprehensive understanding of high stock market valuations and develop a long-term investment strategy suited to your individual circumstances. Careful consideration of high stock market valuations is essential for sound financial planning.

Featured Posts

-

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025

Trumps Legacy A Herculean Task For The Next Federal Reserve Chair

Apr 26, 2025 -

Trump On Congressional Stock Trading Full Transcript And Analysis From Time Interview

Apr 26, 2025

Trump On Congressional Stock Trading Full Transcript And Analysis From Time Interview

Apr 26, 2025 -

Colgates 200 Million Tariff Hit Impact On Sales And Profitability

Apr 26, 2025

Colgates 200 Million Tariff Hit Impact On Sales And Profitability

Apr 26, 2025 -

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025

The Next Fed Chair Inheriting Trumps Economic Challenges

Apr 26, 2025 -

Thursday Night Football Nfl Draft Begins In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Draft Begins In Green Bay

Apr 26, 2025