Colgate's $200 Million Tariff Hit: Impact On Sales And Profitability

Table of Contents

H2: Direct Impact on Colgate's Sales

The $200 million tariff hit directly impacted Colgate's sales through two primary channels: reduced consumer demand and supply chain disruptions.

H3: Reduced Consumer Demand

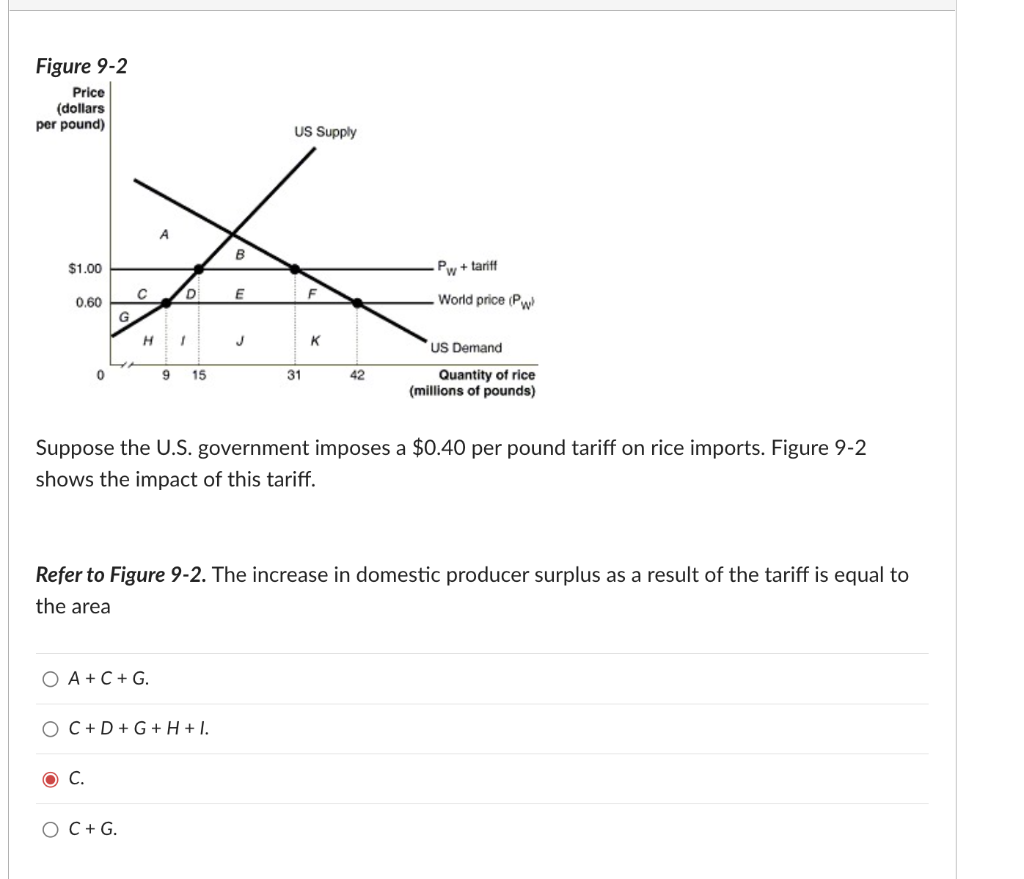

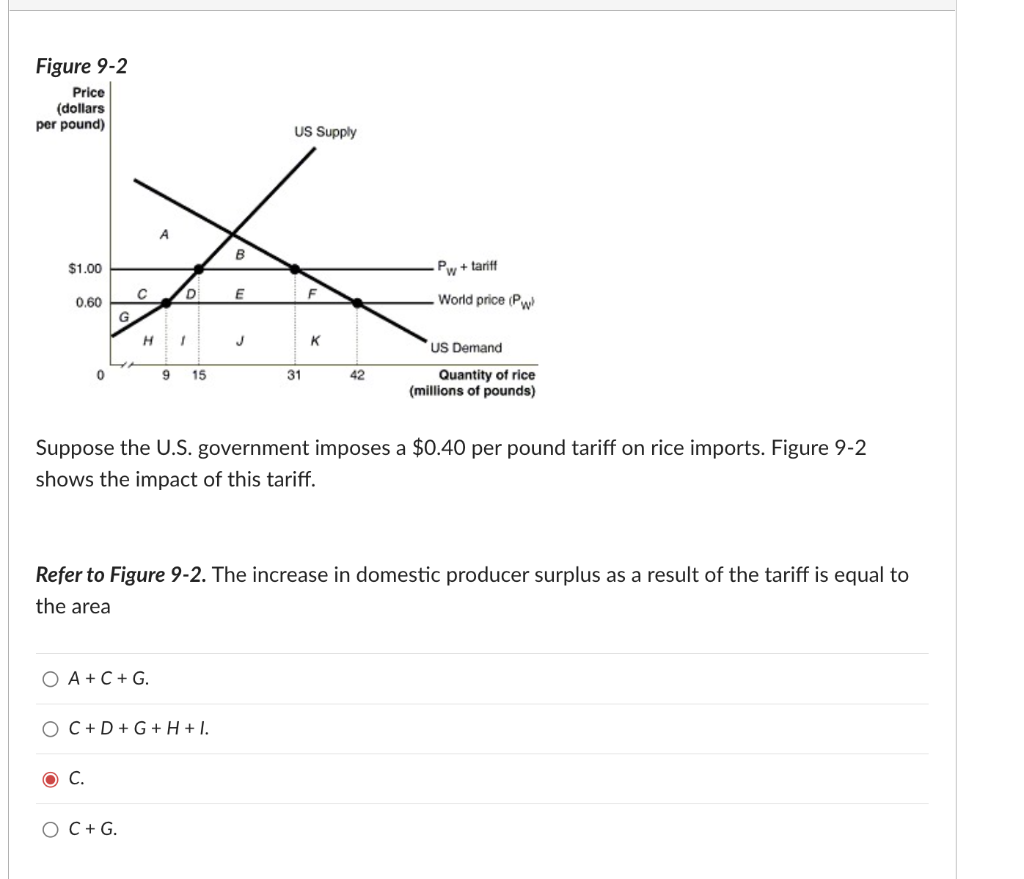

Increased product prices, a direct consequence of tariffs, significantly reduced consumer purchasing power. This led to several observable effects:

- Increased prices: Tariffs forced Colgate to raise prices on many of its products, including toothpaste and toothbrushes, making them less affordable for consumers.

- Shift in consumer preferences: Faced with higher prices, consumers began shifting towards cheaper, often private-label, alternatives. This resulted in a decline in market share for Colgate products.

- Reduced sales volume: The combined effect of price increases and shifting consumer preferences led to a significant reduction in sales volume across various product categories. This impact was particularly pronounced in regions most heavily affected by tariff increases.

- Regional variations: The impact of reduced consumer demand wasn't uniform globally. Regions with higher tariff rates experienced more significant sales declines than those with lower rates. This points to the uneven impact of protectionist trade policies on multinational corporations.

The price increases directly impacted Colgate's sales figures. For instance, if we assume a 10% price increase across the board (a simplification, but illustrative), and a pre-tariff annual revenue of X billion dollars, a significant portion of that revenue would be lost due to reduced sales volume. Further research into Colgate's financial reports is needed for precise figures.

H3: Supply Chain Disruptions

Tariffs and trade restrictions introduced considerable challenges to Colgate's supply chain, creating significant disruptions:

- Increased shipping costs: Tariffs added to the cost of importing and exporting goods, significantly impacting transportation expenses.

- Shipping delays: Trade restrictions led to longer shipping times and increased uncertainty in delivery schedules.

- Raw material sourcing: The tariffs impacted the cost and availability of raw materials, making it difficult to source materials at competitive prices.

- Production capacity limitations: The combined effects of higher raw material costs and supply chain bottlenecks led to reduced production capacity and longer lead times.

- Manufacturing relocation: To mitigate the ongoing impact of tariffs, Colgate may consider – or already be – relocating some of its manufacturing facilities to regions with more favorable trade policies. This represents a substantial long-term investment and logistical undertaking.

These supply chain disruptions affected the production and distribution of Colgate products, further compounding the impact on sales and profitability. The increased costs associated with shipping, sourcing, and potential manufacturing relocation significantly reduced the company's operational efficiency.

H2: Effect on Colgate's Profitability

The $200 million tariff hit significantly affected Colgate's profitability in several ways.

H3: Reduced Profit Margins

The increased costs associated with raw materials, shipping, and other tariff-related expenses directly compressed Colgate's profit margins.

- Increased costs: A detailed analysis of Colgate's financial statements would reveal the exact breakdown of increased costs, but it's safe to assume a significant portion is attributed to tariffs.

- Price adjustments: Colgate likely implemented price adjustments to partially offset the increased costs, but these adjustments had to be carefully balanced against the risk of further reducing consumer demand.

- Cost-cutting measures: The company probably employed various cost-cutting measures, but the effectiveness of these measures in compensating for the tariff-related losses remains to be seen.

- Profit margin comparison: Comparing Colgate's profit margins before and after the tariff imposition would clearly illustrate the negative impact.

The financial impact on profit margins is significant, with specific areas like manufacturing, distribution, and marketing being heavily impacted.

H3: Investor Confidence and Stock Performance

The tariff announcement undoubtedly impacted investor sentiment and caused fluctuations in Colgate's stock price.

- Investor sentiment: Negative news regarding tariffs and their impact on profitability generally negatively influences investor confidence.

- Stock price fluctuations: Analysis of Colgate's stock performance following the tariff announcement would reveal the extent of price volatility.

- Analyst predictions: Financial analysts would have likely revised their predictions for Colgate's future performance after the tariff announcement.

- Competitor performance: Comparing Colgate's performance to that of its competitors, who might have been similarly affected by tariffs, offers a valuable perspective.

The long-term outlook for investor confidence depends heavily on Colgate's ability to successfully mitigate the negative impacts of these tariffs through effective strategies and diversification.

H2: Colgate's Response and Future Strategies

Colgate's response to the $200 million tariff hit involved both short-term and long-term strategies.

H3: Price Adjustments and Cost-Cutting Measures

Colgate has likely implemented a combination of price adjustments and cost-cutting measures to offset the impact of tariffs.

- Price adjustments: Raising prices is a common response to increased costs, but it risks alienating price-sensitive consumers.

- Cost-cutting measures: These measures may involve streamlining operations, negotiating better deals with suppliers, and reducing marketing expenses.

- Effectiveness assessment: The long-term effectiveness of these strategies needs careful evaluation. They may negatively impact brand perception if done too aggressively.

The balance between price adjustments and cost-cutting is crucial, as aggressive measures could harm the brand's image and customer loyalty in the long run.

H3: Diversification and Supply Chain Restructuring

To mitigate the vulnerability to future trade disputes, Colgate is likely exploring diversification strategies and supply chain restructuring.

- Geographic diversification: Reducing reliance on tariff-affected regions by diversifying manufacturing and sourcing locations.

- Supply chain restructuring: This involves enhancing supply chain resilience by diversifying suppliers and exploring alternative logistics solutions.

- Long-term plans: Investing in long-term strategies to mitigate future tariff impacts requires a strategic shift towards a more diversified and robust supply chain.

These long-term strategies aim to reduce the company’s reliance on single sources of supply and specific geographic locations, thus enhancing its resilience to future trade disputes.

3. Conclusion

The $200 million tariff hit dealt a significant blow to Colgate's sales and profitability, highlighting the vulnerability of multinational corporations to global trade policies. The company's response, involving price adjustments, cost-cutting, and longer-term strategies focused on diversification and supply chain restructuring, demonstrate the complex challenges facing global consumer goods companies. Understanding the ramifications of these Colgate tariffs illuminates the broader impact of trade disputes on multinational corporations and global markets.

Call to Action: Understand the complexities of global trade and its direct impact on major consumer goods companies like Colgate. Further research into the effects of tariffs on various industries will reveal the far-reaching consequences of trade policies. Stay informed about the latest developments in global trade to understand the future implications for businesses and consumers alike. Learn more about the impact of Colgate tariffs and other trade disputes on the global economy.

Featured Posts

-

Sinners Cinematographer Captures Mississippi Deltas Vastness

Apr 26, 2025

Sinners Cinematographer Captures Mississippi Deltas Vastness

Apr 26, 2025 -

The Improbable Journey Of Ahmed Hassanein An Nfl Draft Hopeful

Apr 26, 2025

The Improbable Journey Of Ahmed Hassanein An Nfl Draft Hopeful

Apr 26, 2025 -

Zuckerberg And The Trump Administration A New Era For Facebook

Apr 26, 2025

Zuckerberg And The Trump Administration A New Era For Facebook

Apr 26, 2025 -

Will Ukraine Join Nato Trumps View

Apr 26, 2025

Will Ukraine Join Nato Trumps View

Apr 26, 2025 -

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Options Post Roe

Apr 26, 2025