Wildfire Speculation: Examining The Market For Los Angeles Disaster Bets

Table of Contents

The Growing Risk of Wildfires in Los Angeles

The risk of devastating wildfires in Los Angeles is not merely a hypothetical concern; it's a rapidly escalating reality. Several factors contribute to this heightened vulnerability, creating a fertile ground for wildfire speculation.

Climate Change and Increased Fire Danger

Climate change is undeniably exacerbating the wildfire threat in Los Angeles. Scientific data overwhelmingly supports this conclusion. We are witnessing:

- Rising temperatures: Prolonged periods of extreme heat dry out vegetation, creating abundant fuel for wildfires.

- Prolonged droughts: Droughts stress vegetation, making it far more susceptible to ignition and rapid spread.

- Increased Santa Ana winds: These powerful, dry winds fan flames and accelerate the spread of wildfires, making containment incredibly difficult.

- Fuel buildup in dry vegetation: Years of drought and inadequate forest management have resulted in a significant buildup of dry brush and trees, providing ample fuel for intense and widespread fires.

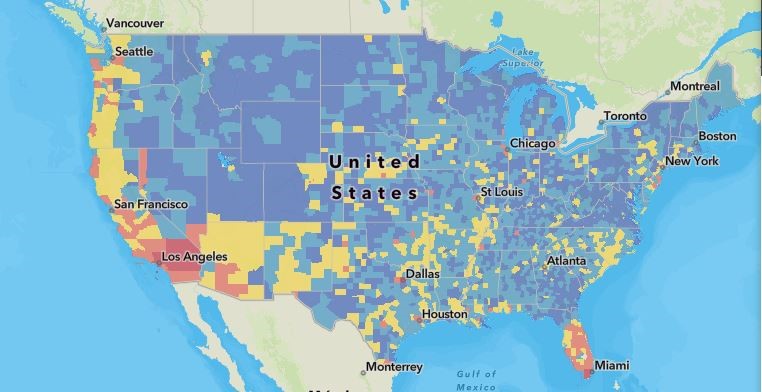

Statistics paint a grim picture. Recent years have witnessed a dramatic increase in the number and intensity of wildfires in Southern California, with the acreage burned reaching record levels. This tangible increase in wildfire activity fuels the wildfire speculation market.

Urban-Wildland Interface and Development

Los Angeles' unique geography, characterized by a significant urban-wildland interface, exacerbates the risk. The close proximity of densely populated areas to undeveloped, fire-prone land creates a dangerous and volatile situation. Key vulnerabilities include:

- Increased housing density in fire-prone areas: Development continues to push further into areas with high wildfire risk, increasing potential losses.

- Inadequate firebreaks: Insufficient firebreaks and poorly maintained defensible spaces around homes leave communities vulnerable.

- Building materials: Many homes in fire-prone areas lack fire-resistant building materials, increasing the likelihood of complete destruction.

- Lack of wildfire preparedness: Insufficient community awareness and preparedness programs leave residents ill-equipped to deal with the threat.

Specific neighborhoods like Sylmar, Calabasas, and Malibu are consistently identified as being at particularly high risk, making them focal points for both wildfire insurance and speculation.

Forms of Wildfire Speculation in the Los Angeles Market

The market for wildfire speculation in Los Angeles manifests in several forms, ranging from sophisticated financial instruments to less regulated and ethically ambiguous practices.

Insurance Derivatives and Catastrophe Bonds

Sophisticated investors utilize insurance derivatives and catastrophe bonds to manage and profit from wildfire risk.

- Mechanism of catastrophe bonds: These bonds pay out only if a predetermined level of wildfire damage occurs, transferring risk from insurers to investors.

- Pricing of wildfire risk: The pricing of these instruments reflects the assessed probability of a major wildfire event in Los Angeles, driven by factors like climate models and historical data.

- Role of reinsurers: Reinsurers play a crucial role in managing wildfire risk by providing a layer of insurance for primary insurers.

- Investor appetite for wildfire risk: Investor interest in wildfire risk is influenced by the perceived return versus the potential for catastrophic losses.

Direct Property Market Speculation

The real estate market itself reflects elements of wildfire speculation.

- Real estate investment in high-risk zones: Some investors may purchase properties in high-risk areas at discounted prices, hoping to profit from rebuilding after a wildfire.

- Impact of wildfire risk on property valuations: Wildfire risk significantly influences property valuations, leading to price fluctuations and opportunities for speculation.

- The role of disclosure in real estate transactions: Accurate and transparent disclosure of wildfire risk is crucial for ethical and informed real estate transactions.

Informal Betting and Prediction Markets

Informal betting and prediction markets represent a less regulated – and arguably less ethical – aspect of wildfire speculation.

- Online prediction markets: Platforms allow individuals to bet on the likelihood of wildfires reaching certain areas or exceeding certain levels of intensity.

- Social media speculation: Social media platforms contribute to the spread of speculation, sometimes amplified by inaccurate predictions and misinformation.

- The limitations of accurate wildfire prediction: Predicting the exact location and intensity of wildfires remains challenging, making these bets inherently risky.

Ethical and Social Implications of Wildfire Speculation

The market for wildfire speculation raises significant ethical and social concerns that demand careful consideration.

Moral Hazard and Risk Mitigation

Speculation can create a moral hazard, potentially discouraging proactive wildfire prevention and mitigation efforts.

- Impact on insurance premiums: High premiums may deter homeowners from investing in wildfire-protective measures.

- Investment in fire prevention infrastructure: A focus on speculative gains might divert resources away from critical fire prevention infrastructure.

- Community preparedness programs: Reduced investment in community education and preparedness programs could lead to higher losses during a wildfire event.

Potential for Price Manipulation and Market Instability

A poorly regulated market for disaster bets is vulnerable to price manipulation and market instability.

- Influence of large investors: Large investors can influence the pricing of wildfire risk, potentially distorting the market.

- Transparency issues: Lack of transparency in certain markets can lead to unfair pricing and potentially unethical behavior.

- Regulatory oversight: The need for robust regulatory oversight to ensure fair and transparent pricing of wildfire risk is crucial.

Conclusion

Wildfire speculation in Los Angeles presents a complex interplay of financial opportunity and ethical challenges. The escalating wildfire risk, coupled with the emergence of innovative financial instruments and less regulated betting markets, creates a volatile and potentially unstable situation. Understanding the multifaceted nature of wildfire speculation and its potential consequences is paramount for investors, policymakers, and the community at large. Further research and responsible regulation are crucial to navigate this complex landscape and safeguard Los Angeles from the devastating financial and social repercussions of future wildfires. Learn more about managing the risks associated with Los Angeles wildfire speculation and explore alternative strategies for mitigating your exposure.

Featured Posts

-

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 27, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings

Apr 27, 2025 -

Pne Group Adds Two Wind Farms Boosting Renewable Energy Capacity

Apr 27, 2025

Pne Group Adds Two Wind Farms Boosting Renewable Energy Capacity

Apr 27, 2025 -

Top Seeded Pegula Claims Charleston Championship After Collins Match

Apr 27, 2025

Top Seeded Pegula Claims Charleston Championship After Collins Match

Apr 27, 2025 -

Un Ano De Salario La Wta Establece Un Nuevo Estandar En Licencias De Maternidad

Apr 27, 2025

Un Ano De Salario La Wta Establece Un Nuevo Estandar En Licencias De Maternidad

Apr 27, 2025 -

How Ariana Grande Achieved Her New Look Professional Hair And Tattoo Expertise

Apr 27, 2025

How Ariana Grande Achieved Her New Look Professional Hair And Tattoo Expertise

Apr 27, 2025