USD Strengthens: Dollar Gains Ground Against Major Currencies As Trump Softens Stance On Fed

Table of Contents

Trump's Softened Stance on the Fed and its Impact on the USD

Historically, President Trump's relationship with the Federal Reserve has been marked by considerable tension. His frequent criticisms of the Fed's interest rate policies, often perceived as attempts to influence the central bank's independence, created significant market uncertainty. However, a noticeable shift in his rhetoric has emerged recently, characterized by a more supportive and less confrontational tone towards the Fed's actions.

This change in attitude has had a demonstrably positive impact on investor confidence. The reduced uncertainty surrounding potential political interference in monetary policy has boosted the appeal of the USD, leading to increased demand and a subsequent strengthening of the currency.

- Examples of Trump's previous criticisms: Public statements urging interest rate cuts, labeling the Fed as "loco" for raising rates.

- Specific instances of his recent softened stance: More measured comments on Fed policy, avoiding direct criticism of interest rate decisions.

- Impact on market sentiment and USD trading: Increased investor confidence, leading to higher demand for USD-denominated assets and a stronger USD exchange rate.

This newfound stability contributes to a more predictable and less volatile investment environment, making the USD a more attractive asset for both domestic and international investors.

Global Economic Factors Fueling USD Strength

The recent strengthening of the USD isn't solely attributable to domestic factors. Global economic uncertainty, characterized by escalating trade wars, geopolitical tensions, and diverging monetary policies across major economies, has played a significant role. Investors often flock to the USD as a safe-haven currency during times of global instability, driving up demand and pushing the value higher.

The divergence in monetary policies between the US and other major economies further contributes to the USD's rise. The US currently maintains relatively higher interest rates compared to countries like those in the Eurozone and Japan. This interest rate differential makes USD-denominated assets more attractive to international investors seeking higher returns, thereby increasing demand for the dollar.

- Impact of trade tensions on global markets and USD demand: Uncertainty surrounding trade policies leads investors to seek safety in the USD, increasing its value.

- Comparison of US interest rates with those of other major economies: The higher US interest rates incentivize capital inflows, boosting USD demand.

- The role of the US dollar as a safe-haven currency during times of global uncertainty: Investors perceive the USD as a stable and reliable store of value during periods of global risk aversion.

Implications of a Stronger USD for the US and Global Economy

A strong USD has both positive and negative consequences for the US and the global economy. For US consumers, a stronger dollar translates to cheaper imports, potentially lowering inflation and increasing purchasing power. However, it presents significant challenges for US exporters, as their products become more expensive in foreign markets, reducing their competitiveness and potentially impacting their profitability.

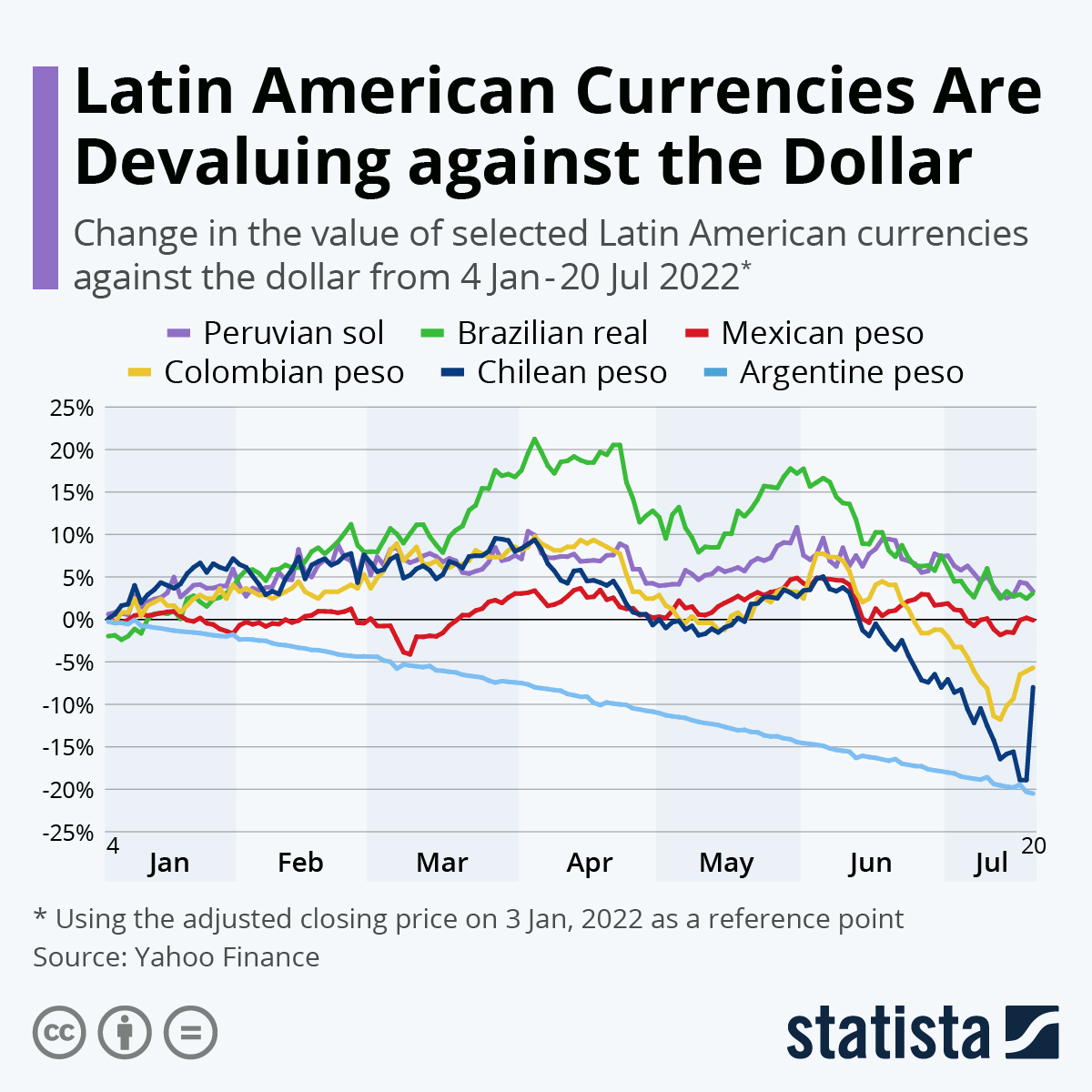

The global implications are equally complex. Emerging market economies with significant USD-denominated debt face increased debt servicing burdens as the value of their local currencies falls against the USD. This can strain their balance of payments and potentially trigger financial instability. International trade is also affected, with a stronger dollar potentially dampening global trade volumes.

- Impact of a strong USD on inflation: Lower import prices can contribute to lower inflation in the US.

- Effect on US trade balance: Increased imports and reduced exports can widen the US trade deficit.

- Consequences for developing economies reliant on USD-denominated debt: Increased debt servicing costs can lead to financial stress and potential crises.

Navigating the Strengthening USD – What's Next?

In conclusion, the recent strengthening of the USD is a multifaceted phenomenon driven by a confluence of factors. President Trump's softened stance on the Federal Reserve has reduced market uncertainty, while global economic instability has fueled the USD's safe-haven appeal. The implications of a stronger USD are far-reaching, impacting US consumers, exporters, and the global economy. The future trajectory of the USD will depend on the interplay of these domestic and global economic forces.

To effectively navigate the changing dynamics of the USD, it's crucial to stay informed about current events and their potential impact on investments and businesses. Regularly check for updates on USD strengthening and related economic news, and consider subscribing to a reputable financial newsletter for deeper insights into USD fluctuations and their broader implications. Understanding the forces behind USD strengthening is key to making informed financial decisions.

Featured Posts

-

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs New Chapter Navigating The Trump Presidency

Apr 24, 2025 -

Dow Jones And S And P 500 Stock Market Report April 23rd

Apr 24, 2025

Dow Jones And S And P 500 Stock Market Report April 23rd

Apr 24, 2025 -

Ray Epps Vs Fox News A Defamation Lawsuit Over Jan 6th Claims

Apr 24, 2025

Ray Epps Vs Fox News A Defamation Lawsuit Over Jan 6th Claims

Apr 24, 2025 -

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025

Remembering Jett Travolta John Travolta Shares Emotional Photo On What Would Have Been His Sons 33rd Birthday

Apr 24, 2025 -

Bitcoin Btc Rises Amidst Easing Trade Tensions And Fed Concerns

Apr 24, 2025

Bitcoin Btc Rises Amidst Easing Trade Tensions And Fed Concerns

Apr 24, 2025