Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

The stock market has seen periods of historically high valuations, leaving many investors understandably concerned. This article delves into the insights offered by Bank of America (BofA) to help understand these elevated valuations and navigate the current market landscape. We'll explore the factors contributing to high stock prices and consider how these valuations might impact your investment strategy.

BofA's Perspective on Current Market Valuations

Bank of America's recent reports and analyses have provided valuable insights into the current state of high stock market valuations. Their research consistently emphasizes the need for caution and careful consideration of risk in the current environment.

-

Key Findings on Market Sentiment: BofA's analysts often point to a combination of factors driving current market sentiment, including optimism about future corporate earnings, sustained low interest rates, and continued injections of liquidity into the markets. However, they also acknowledge the potential for a shift in sentiment, depending on economic data and geopolitical developments.

-

Valuation Metrics Used: BofA utilizes a range of valuation metrics to assess the market, including the widely followed Price-to-Earnings ratio (P/E), and the cyclically adjusted price-to-earnings ratio (Shiller PE), a measure that smooths out earnings fluctuations over a longer period. These metrics, when analyzed in conjunction with other economic indicators, help provide a more comprehensive picture of market valuation.

-

Predictions for Future Market Performance: BofA's predictions for future market performance tend to be cautious, acknowledging the inherent uncertainty in high-valuation environments. While they may highlight potential for continued growth in certain sectors, they generally advise investors to maintain a balanced and diversified portfolio, prepared for potential market corrections.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute significantly to the current high stock market valuations. Understanding these factors is crucial for making informed investment decisions.

-

Low Interest Rates and Their Impact: Historically low interest rates have a significant impact on valuations. Lower borrowing costs encourage companies to invest and expand, boosting earnings and making equities more attractive relative to bonds. This reduces the cost of capital and inflates asset prices, including stocks.

-

The Role of Quantitative Easing (QE) and Monetary Policy: Central banks' use of quantitative easing (QE) programs, which involve injecting liquidity into the markets by purchasing assets, has played a significant role in supporting asset prices, including stocks. This injection of liquidity increases the money supply, pushing down interest rates and driving up asset prices.

-

Strong Corporate Earnings Growth: While not universally consistent across all sectors, many companies have experienced strong corporate earnings growth, supporting the high valuations of their stocks. This growth fuels investor confidence and pushes stock prices upwards. Expectations of future earnings also play a major role.

-

Technological Innovation and Growth Sectors: Rapid technological advancements and the growth of innovative sectors like technology and renewable energy have attracted substantial investment, driving up valuations in these areas. The expectation of further growth in these sectors contributes further to the overall high valuations.

Assessing Risk in a High-Valuation Environment

Investing in a market with high valuations presents inherent risks that investors must carefully consider.

-

Increased Market Volatility and Potential for Corrections: High-valuation markets tend to be more volatile and susceptible to sharp corrections. Small shifts in investor sentiment or unexpected economic news can trigger significant price swings. Understanding this volatility is key for risk management.

-

The Risk of Overvaluation and Potential Bubbles: The potential for overvaluation and the formation of speculative bubbles is a real concern in high-valuation markets. Certain sectors or individual stocks might be dramatically overvalued, rendering them vulnerable to rapid price declines.

-

Strategies for Mitigating Risk: Investors can mitigate risk in a high-valuation environment through diversification, careful stock selection, and a focus on value investing. Diversification across different asset classes and sectors helps reduce the impact of any single market downturn. Value investing focuses on identifying undervalued assets offering higher potential returns for their risk.

Investment Strategies in a High-Valuation Market

Based on BofA's insights and the current market conditions, several investment strategies can help investors navigate this challenging landscape.

-

Focusing on Value Stocks and Sector Rotation: Identifying undervalued stocks within sectors that are less exposed to the overall market exuberance can provide a more defensive approach. Sector rotation – moving investments from overvalued to potentially undervalued sectors – is also a viable strategy.

-

Long-Term Investment Horizons: Maintaining a long-term investment horizon is crucial in any market, but especially so in high-valuation environments. Short-term market fluctuations are less impactful for long-term investors who can ride out the volatility.

-

Considering Alternative Asset Classes: Diversifying portfolios by incorporating alternative asset classes such as real estate, infrastructure, or commodities can reduce overall portfolio risk and potentially offer better returns compared to solely relying on stocks in an overvalued market.

Conclusion

This article has examined BofA's perspective on current high stock market valuations, exploring contributing factors and associated risks. Understanding these dynamics is crucial for developing a sound investment strategy. BofA's analysis highlights the need for careful consideration of risk and diversification in the current market. While growth opportunities exist, the potential for market corrections remains.

Call to Action: Stay informed about evolving market conditions and consult with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals. Continue learning about high stock market valuations and their implications for your portfolio. Understanding the nuances of high stock market valuations is essential for making intelligent investment decisions.

Featured Posts

-

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025 -

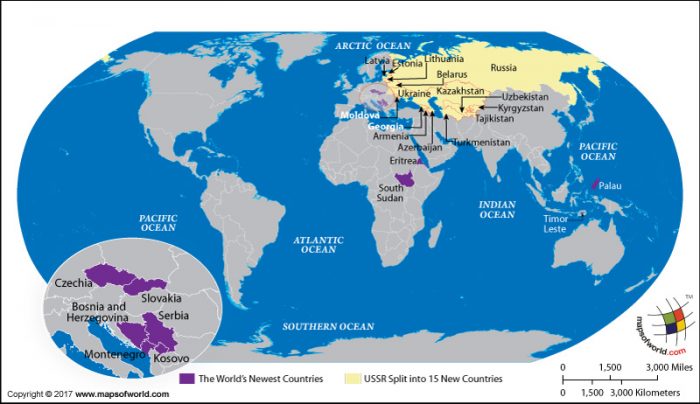

Growth Areas A Map Of The Countrys Newest Business Hotspots

Apr 22, 2025

Growth Areas A Map Of The Countrys Newest Business Hotspots

Apr 22, 2025 -

Closer Security Collaboration Between China And Indonesia

Apr 22, 2025

Closer Security Collaboration Between China And Indonesia

Apr 22, 2025 -

Trump Administration To Withdraw 1 Billion More In Funding From Harvard

Apr 22, 2025

Trump Administration To Withdraw 1 Billion More In Funding From Harvard

Apr 22, 2025 -

Joint Security Initiatives China And Indonesia Collaborate

Apr 22, 2025

Joint Security Initiatives China And Indonesia Collaborate

Apr 22, 2025