Trump's Economic Agenda: Who Pays The Price?

Table of Contents

Tax Cuts and Their Distributional Effects

The cornerstone of Trump's economic platform was the 2017 Tax Cuts and Jobs Act. This legislation significantly altered the US tax code, resulting in a complex web of winners and losers.

The 2017 Tax Cuts and Jobs Act

The Act dramatically reduced the corporate tax rate from 35% to 21%, while also making changes to individual income tax brackets. These changes were argued to stimulate economic growth through increased investment and job creation.

- Reduction in corporate tax rates: This provided a substantial tax break for corporations, potentially boosting profits and shareholder value.

- Individual income tax bracket changes: While some individual tax rates were lowered, the benefits were not evenly distributed. Higher-income earners generally received larger tax cuts than lower-income earners.

- Impact on national debt: The tax cuts significantly increased the national debt, raising concerns about long-term fiscal sustainability.

The argument that the benefits disproportionately favored corporations and high-income earners gained traction. Data revealed a widening gap between the wealthiest Americans and the rest of the population during this period. Keywords like "tax cuts for the rich," "corporate tax cuts," and "income inequality" became central to the debate surrounding the Act's efficacy.

Long-Term Implications of the Tax Cuts

The long-term effects of the 2017 tax cuts remain a subject of ongoing debate.

- Increased national debt: The substantial tax cuts contributed to a significant increase in the national debt, placing a burden on future generations.

- Impact on future government spending: The increased debt limited the government's capacity for future spending on social programs and infrastructure.

- Effect on economic stimulus: While proponents argued the tax cuts stimulated economic growth, critics pointed to the lack of substantial increases in wages or investment for lower and middle-income families.

Analyzing whether the tax cuts actually stimulated economic growth as intended, or simply exacerbated existing inequalities, requires a nuanced understanding of fiscal policy and its complex interactions with various economic indicators. Keywords like "national debt," "fiscal policy," and "economic growth" are vital to this analysis.

Trade Policies and Their Impact on Specific Sectors

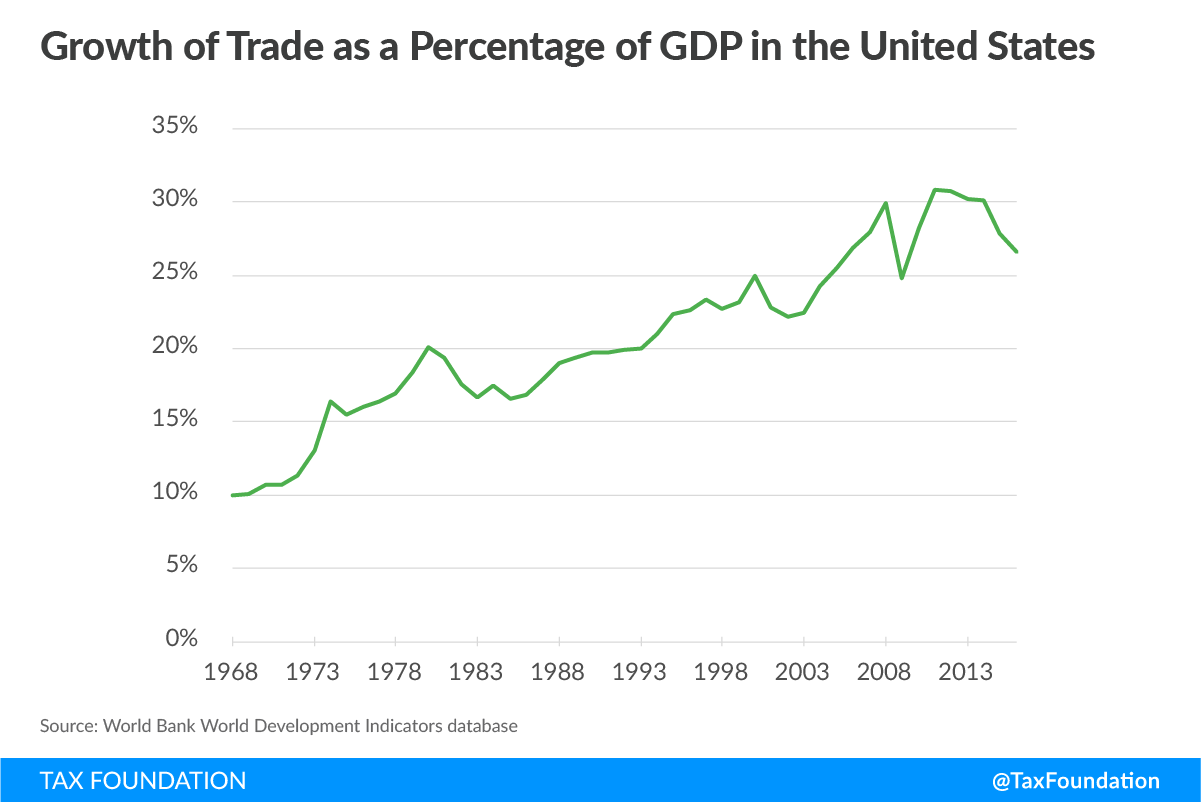

Trump's administration pursued a protectionist trade policy, characterized by increased tariffs and renegotiated trade agreements.

Tariffs and the Trade War with China

The imposition of tariffs on imported goods, particularly from China, had far-reaching consequences.

- Increased prices for imported goods: Tariffs increased the cost of goods for American consumers, leading to inflation.

- Impact on manufacturing and agriculture: Certain sectors, such as agriculture and manufacturing, were heavily impacted by retaliatory tariffs imposed by other countries.

- Retaliation from other countries: China and other trading partners retaliated with their own tariffs, creating a trade war that disrupted global supply chains.

The trade war had clear winners and losers. While some domestic industries benefited from increased protection, many others faced significant hardship due to reduced exports and higher input costs. Keywords such as "tariffs," "trade war," "protectionism," and "global trade" aptly describe this turbulent period.

NAFTA Replacement (USMCA)

The renegotiation of NAFTA, resulting in the USMCA (United States-Mexico-Canada Agreement), aimed to improve trade relations among the three countries.

- Changes to labor provisions: The USMCA included stronger labor provisions, aiming to improve working conditions in Mexico.

- Intellectual property rights: The agreement strengthened protections for intellectual property rights.

- Automotive industry regulations: Changes were made to regulations affecting the automotive industry, aimed at boosting domestic production.

While the USMCA aimed for fairer trade practices, its impact on various sectors remains a topic of ongoing debate. Some argue that it led to better trade deals for American workers and businesses, while others point to potential negative consequences for certain groups. Keywords like "USMCA," "NAFTA," "trade agreements," and "free trade" are essential for understanding this complex agreement.

Deregulation and Its Consequences

Trump's administration pursued a policy of deregulation across various sectors, with significant implications.

Environmental Regulations

The rollback of environmental regulations sparked considerable controversy.

- Impact on air and water quality: Relaxed regulations led to concerns about declining air and water quality.

- Effects on public health: Reduced environmental protections raised concerns about negative impacts on public health.

- Increased pollution: There was evidence suggesting increased pollution levels in certain areas.

The long-term economic and social costs associated with environmental deregulation are significant and far-reaching. Keywords such as "environmental deregulation," "climate change," "pollution," and "public health" highlight the severe consequences.

Financial Regulations

Changes in financial regulations also drew criticism.

- Loosening of banking regulations: Concerns were raised about the potential increased risk of financial crises due to relaxed banking oversight.

- Impact on consumer credit: Changes to consumer credit regulations had a mixed impact on consumers.

- Risk of financial crises: Reduced regulations increased the vulnerability of the financial system to shocks.

The debate surrounding deregulation in the financial sector highlights the complex trade-offs between economic growth and financial stability. Keywords like "financial regulation," "banking deregulation," "consumer protection," and "financial stability" capture the essence of this multifaceted issue.

Conclusion

Trump's economic policies, characterized by tax cuts, protectionist trade policies, and deregulation, had uneven impacts across various segments of American society. The 2017 tax cuts disproportionately benefited corporations and high-income earners, while simultaneously increasing the national debt. The trade war with China led to increased prices for consumers and disrupted global supply chains. Finally, deregulation raised concerns regarding environmental protection and financial stability. Understanding the true cost of Trump's economic agenda requires a thorough examination of its long-term implications for all Americans. Further research into the lasting impacts of Trump's economic policies is crucial to inform future economic policy decisions. Understanding the true cost of Trump's economic agenda requires critical analysis and consideration of the long-term economic impact for all.

Featured Posts

-

From Scatological Documents To Podcast Ai Driven Content Creation

Apr 22, 2025

From Scatological Documents To Podcast Ai Driven Content Creation

Apr 22, 2025 -

Trump Tariffs How Businesses Use Tik Tok To Find Solutions

Apr 22, 2025

Trump Tariffs How Businesses Use Tik Tok To Find Solutions

Apr 22, 2025 -

Fp Video Deconstructing The Bank Of Canadas Decision To Hold Rates

Apr 22, 2025

Fp Video Deconstructing The Bank Of Canadas Decision To Hold Rates

Apr 22, 2025 -

Chainalysis Expands Ai Capabilities With Alterya Acquisition

Apr 22, 2025

Chainalysis Expands Ai Capabilities With Alterya Acquisition

Apr 22, 2025 -

Doj Vs Google Another Court Showdown On Search Monopoly

Apr 22, 2025

Doj Vs Google Another Court Showdown On Search Monopoly

Apr 22, 2025