Trump Attacks Fed Chair Powell: Calls For Termination

Table of Contents

Trump's Criticism of Powell's Monetary Policy

Trump's criticism of Jerome Powell stemmed primarily from disagreements over monetary policy, particularly regarding interest rate hikes and their perceived impact on economic growth.

Interest Rate Hikes

Trump vehemently opposed the interest rate increases implemented by Powell throughout his presidency. He believed these hikes, intended to curb inflation, were stifling economic growth and harming his administration's economic agenda.

- July 2018: The Fed raised interest rates for the second time that year, prompting Trump to publicly express his displeasure, tweeting criticisms about Powell's actions and their potential negative effects on the economy.

- September 2018: Following another rate hike, Trump again criticized Powell, stating that the Fed was "going loco" and making a "terrible mistake."

- November 2018: Trump openly expressed his wish for lower interest rates, further escalating the tension between the White House and the Federal Reserve.

Powell, however, maintained that the rate hikes were necessary to prevent runaway inflation and maintain the long-term health of the US economy. This difference in perspective fueled the ongoing conflict and fueled debates over the appropriate response to economic indicators.

Economic Growth Concerns

Trump consistently expressed concern over slowing economic growth, frequently attributing it to Powell's monetary policies. He argued that the rate hikes were dampening business investment and slowing job creation.

- Trump frequently pointed to slowing GDP growth figures as evidence of Powell's failings.

- He cited concerns about the stock market's performance, linking its fluctuations directly to the Fed's actions.

- He also expressed worry about the potential impact of higher interest rates on consumer spending.

However, economists offered alternative explanations for the economic slowdown, citing factors such as global trade tensions and other macroeconomic trends beyond the Fed's direct control. The debate over the effectiveness of Powell's policies remains a subject of ongoing discussion among economists.

The Constitutional Implications of Removing a Fed Chair

The controversy surrounding "Trump Attacks Fed Chair Powell" extended beyond mere policy disagreements, raising crucial questions about the independence of the Federal Reserve and the potential for unconstitutional interference in its operations.

Independence of the Federal Reserve

The Federal Reserve's independence from political influence is a cornerstone of its effectiveness. This autonomy ensures that monetary policy decisions are made based on economic considerations, not political expediency.

- The Federal Reserve Act of 1913 established the Fed's structure and largely protects its independence from direct political control.

- The Chair of the Federal Reserve is appointed by the President, but serves a four-year term, providing a degree of insulation from immediate political pressure.

- The Fed's actions are not subject to direct Congressional oversight in the same way that other governmental agencies are.

Political interference could undermine the Fed's credibility and potentially lead to destabilizing economic consequences.

Trump's Attempts to Influence the Fed

Trump's public criticism and repeated calls for Powell's dismissal represented a direct attempt to influence the Fed's decision-making process, raising concerns about potential breaches of established norms and the sanctity of the Federal Reserve's independence.

- Trump's frequent public attacks on Powell could be interpreted as an attempt to pressure the Fed into adopting policies favorable to his administration.

- His repeated calls for lower interest rates, irrespective of economic conditions, raised concerns about political interference in monetary policy.

- The sheer volume and intensity of Trump's criticism were unprecedented and caused significant uncertainty in the financial markets.

These actions sparked debate about the boundaries of presidential authority and the importance of protecting the Fed's independence from political pressure.

The Impact of the Conflict on Financial Markets and Public Confidence

The intense public clash between Trump and Powell had a tangible impact on financial markets and public confidence in key institutions.

Market Volatility

Trump's attacks on Powell contributed to market volatility. Investors reacted nervously to the uncertainty created by the conflict, leading to fluctuations in stock prices and other financial instruments.

- Periods of heightened tension between Trump and Powell were often correlated with increased market volatility.

- Investors worried that Trump's attempts to influence the Fed could undermine the predictability and stability of monetary policy.

- This uncertainty made it harder for businesses to plan for the future and invest confidently.

Erosion of Public Trust

The highly publicized conflict between the President and the Fed Chair had the potential to erode public trust in both institutions. The constant stream of criticism and accusations undermined the perceived neutrality and objectivity of both the Federal Reserve and the Presidency.

- Public opinion polls might have reflected a decline in trust in either the Federal Reserve or the presidency during periods of heightened conflict.

- The perception of political interference in economic policy-making could lead to a loss of faith in the integrity of governmental institutions.

- Maintaining public trust is crucial for the effective functioning of both the Federal Reserve and the presidency.

Conclusion: Trump Attacks Fed Chair Powell: Lasting Effects and Future Implications

Trump's sustained criticisms of Jerome Powell, culminating in calls for his termination, represent a significant event in recent US economic history. This conflict highlighted the inherent tension between political leadership and the need for an independent central bank. The constitutional implications of attempting to influence the Federal Reserve, the resulting market volatility, and the erosion of public trust all underscore the importance of safeguarding the Fed's autonomy. Understanding the complexities of "Trump Attacks Fed Chair Powell" is crucial for informed civic engagement. Continue learning about the Federal Reserve's role and the importance of its independence from political pressures. The lasting effects of this conflict serve as a potent reminder of the delicate balance between political influence and the essential independence of central banks.

Featured Posts

-

Understanding Michael Lorenzens Pitching Style And Success

Apr 23, 2025

Understanding Michael Lorenzens Pitching Style And Success

Apr 23, 2025 -

Flores And Lee Giants Keys To Victory Against Brewers

Apr 23, 2025

Flores And Lee Giants Keys To Victory Against Brewers

Apr 23, 2025 -

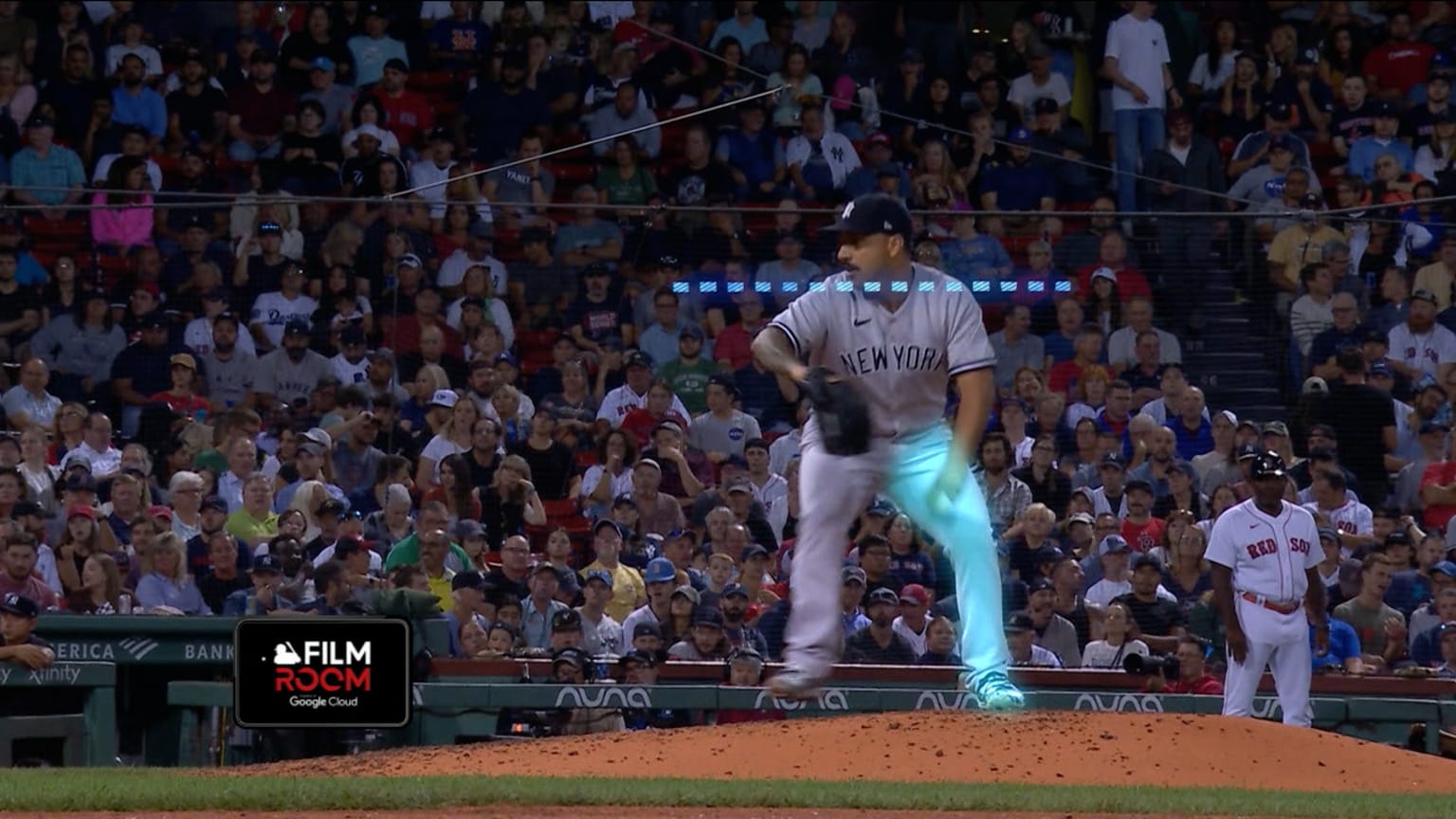

Yankees Cortes Rebounds With Impressive Shutout Vs Reds

Apr 23, 2025

Yankees Cortes Rebounds With Impressive Shutout Vs Reds

Apr 23, 2025 -

Brewers Path To The Playoffs Overcoming Early Season Challenges

Apr 23, 2025

Brewers Path To The Playoffs Overcoming Early Season Challenges

Apr 23, 2025 -

Aaron Judges Historic Home Run Show Yankees Explode For 9 Home Runs

Apr 23, 2025

Aaron Judges Historic Home Run Show Yankees Explode For 9 Home Runs

Apr 23, 2025