The Economic Fallout Of Trump's Policies: Who Gets Hurt?

Table of Contents

The Impact of Tariffs and Trade Wars

The Trump administration's aggressive use of tariffs and its initiation of trade wars had a profound and multifaceted impact on the American economy. While the stated goal was to protect American industries and jobs, the reality was far more nuanced, with both benefits and significant drawbacks.

Increased Prices for Consumers

The imposition of tariffs on imported goods, notably steel, aluminum, and washing machines, directly increased the prices consumers paid for these products and many others relying on those inputs. This led to a rise in the cost of living, disproportionately affecting low- and middle-income families who spend a larger portion of their income on essential goods.

- Example: Tariffs on imported steel led to higher prices for automobiles, appliances, and construction materials, impacting various sectors of the economy.

- Statistics: Studies have shown a direct correlation between tariff increases and inflation in affected sectors. For example, [cite a relevant study showing price increases due to tariffs]. This increase in the cost of living squeezed household budgets and reduced disposable income.

- Keywords: tariffs, trade wars, consumer prices, inflation, cost of living, import taxes

Damage to American Businesses and Farmers

Retaliatory tariffs imposed by other countries in response to Trump's trade actions inflicted significant damage on American businesses, particularly in the agricultural and manufacturing sectors. These retaliatory measures essentially closed off crucial export markets for many American producers.

- Example: The trade war with China severely impacted American farmers, leading to decreased exports of soybeans and other agricultural products. Many farmers faced bankruptcies and financial hardship as a result.

- Example: Manufacturing businesses reliant on imported materials faced higher input costs, reducing their competitiveness and profitability. Some were forced to lay off workers or even close down.

- Keywords: retaliatory tariffs, business losses, farm bankruptcies, trade disputes, agricultural impact

The Tax Cuts and Jobs Act of 2017: Winners and Losers

The Tax Cuts and Jobs Act of 2017, a cornerstone of Trump's economic policy, significantly reduced corporate and individual income tax rates. However, the benefits were not evenly distributed across the population.

Benefits for Corporations and the Wealthy

The tax cuts disproportionately benefited corporations and high-income earners. The reduction in the corporate tax rate from 35% to 21% led to a substantial increase in corporate profits. This windfall, however, did not translate into widespread wage increases for workers.

- Data: [Cite data showing the increase in corporate profits post-tax cuts]. This increase in corporate profits often led to increased shareholder returns rather than investments in employee wages or job creation.

- Keywords: Tax Cuts and Jobs Act, corporate tax cuts, income inequality, wealth gap, tax benefits

Limited Benefits for the Middle Class and Low-Income Individuals

While the tax cuts provided some temporary tax relief to the middle class through a slightly reduced individual tax rate, the benefits were often limited and short-lived. Many middle- and low-income individuals saw only marginal changes in their tax burdens.

- Analysis: The temporary nature of certain tax provisions meant that the benefits for many families were not sustainable in the long term. Additionally, many low-income individuals did not benefit significantly, as their tax liabilities were already low.

- Keywords: middle class tax relief, low-income tax benefits, temporary tax cuts, tax burden

Deregulation and its Economic Consequences

The Trump administration pursued a policy of significant deregulation across various sectors, aiming to reduce government oversight and stimulate economic growth. However, this approach had both positive and negative implications.

Environmental Damage and its Economic Costs

The rollback of environmental regulations resulted in increased pollution and environmental damage. This, in turn, generated significant economic costs in terms of healthcare expenses, environmental cleanup, and the loss of natural resources.

- Examples: Weakening of clean air and water standards, leading to increased healthcare costs due to respiratory illnesses and water contamination. Reduced protection of endangered species, threatening biodiversity and ecosystem services.

- Keywords: deregulation, environmental regulations, environmental damage, economic costs, pollution

Increased Inequality and Financial Risk

Deregulation in various sectors, including finance, potentially increased financial risk and contributed to economic inequality. Reduced consumer and worker protections left many vulnerable to exploitation and financial hardship.

- Analysis: Relaxed financial regulations could lead to increased risk of financial crises. Weakened worker protections could result in lower wages and poorer working conditions, exacerbating income inequality.

- Keywords: financial risk, deregulation risks, consumer protection, worker protection, economic inequality

Conclusion

The Trump administration's economic policies resulted in a complex and uneven distribution of economic benefits and costs. While some sectors and individuals benefited, many others experienced significant hardship due to increased prices, job losses, and widening inequality. The impact of tariffs, tax cuts, and deregulation continues to be debated, but the evidence suggests a clear disproportionate impact on different segments of society.

Understanding the economic fallout of Trump's policies is crucial for informed discussions about future economic strategies. Further research and analysis of the long-term effects of these policies are needed to ensure a more equitable and sustainable economic future. Continue to explore the complex effects of Trump's economic policies and their lasting impact.

Featured Posts

-

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 22, 2025

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 22, 2025 -

A Timeline Of Karen Reads Murder Trials And Their Impact

Apr 22, 2025

A Timeline Of Karen Reads Murder Trials And Their Impact

Apr 22, 2025 -

Trumps Trade Wars A Threat To Us Financial Leadership

Apr 22, 2025

Trumps Trade Wars A Threat To Us Financial Leadership

Apr 22, 2025 -

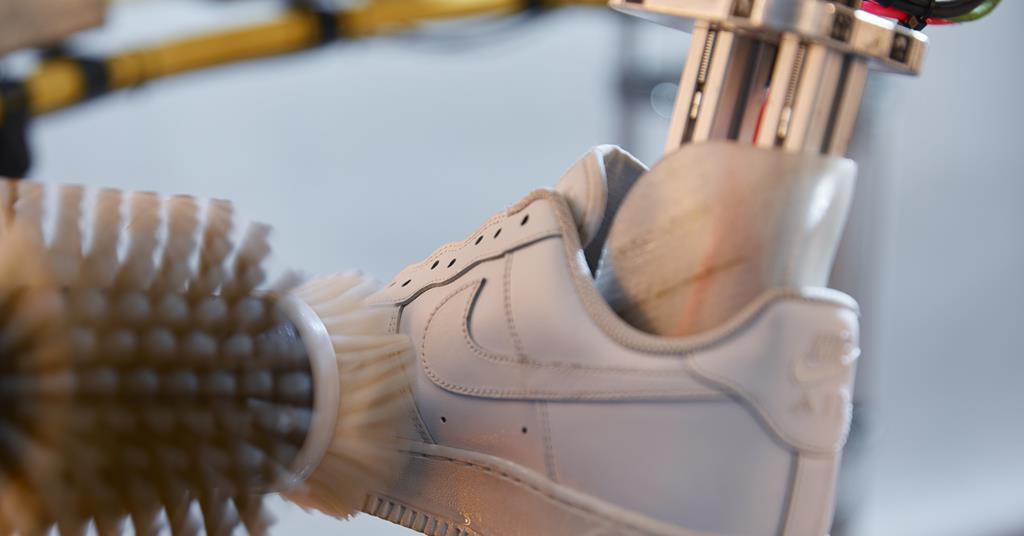

The Technological Challenges In Robotic Nike Shoe Production

Apr 22, 2025

The Technological Challenges In Robotic Nike Shoe Production

Apr 22, 2025 -

Putin Ends Ukraine Truce Renewed Conflict Erupts

Apr 22, 2025

Putin Ends Ukraine Truce Renewed Conflict Erupts

Apr 22, 2025