The Changing Face Of X: Financial Implications Of Musk's Debt Sale

Table of Contents

The Scale of Musk's Debt and its Acquisition of X

The acquisition of X was a monumental undertaking, fueled by a substantial amount of debt. While precise figures fluctuate depending on the source and accounting methods, reports suggest a debt burden exceeding tens of billions of dollars. This funding was secured through a combination of sources, including leveraged loans, high-yield bonds, and potentially equity contributions from Musk himself. Crucially, much of this debt carries high-interest rates, creating a significant financial pressure on the platform. The refinancing of this debt in the future presents a considerable risk, especially in a volatile economic climate.

- Debt Figures: Estimates place the total debt incurred at over $40 billion, though the exact amount remains somewhat opaque.

- Key Lenders/Investors: A consortium of banks and investment firms participated in the financing, with details of their individual contributions varying in public disclosure.

- Maturity Dates: The maturity dates of these loans and bonds are spread over several years, representing a continuous financial obligation for X.

Impact on X's Operational Strategies and Spending

Servicing this substantial debt significantly impacts X's operational strategies and budget allocation. The hefty interest payments alone consume a considerable portion of X's revenue, leaving less for investment in other vital areas. This has led to, and will likely continue to lead to, cutbacks in various departments. Research and development efforts may be curtailed, marketing budgets slashed, and employee compensation potentially impacted. This could slow down product innovation and the development of new features, potentially affecting user experience and engagement.

- Cost-Cutting Measures: Examples include layoffs, reduced marketing campaigns, and potentially a decreased focus on content moderation improvements.

- Impact on User Experience: Reduced investment in infrastructure and features could lead to slower speeds, increased downtime, and a less polished user experience.

- Content Moderation: Budgetary constraints could affect X's ability to effectively monitor and moderate content, potentially impacting user safety and the platform's overall reputation.

The Effect on X's Valuation and Investor Sentiment

The massive debt load has undeniably impacted X's valuation and investor sentiment. The increased financial risk associated with the high debt burden has likely lowered X's perceived value in the market. Although X is privately held, this debt would impact its credit rating and overall investor confidence. Future fundraising efforts, should they become necessary, could prove more challenging given this significant financial liability.

- Stock Price (if applicable): While X is not publicly traded, the debt load would negatively influence its hypothetical valuation in a hypothetical IPO scenario.

- Credit Rating Downgrades: Credit rating agencies may downgrade X's rating, increasing borrowing costs and making future financing more difficult.

- Investor Confidence: The massive debt burden and uncertainty around its repayment could significantly decrease investor confidence and deter potential future investors.

Long-Term Financial Sustainability and Potential Risks

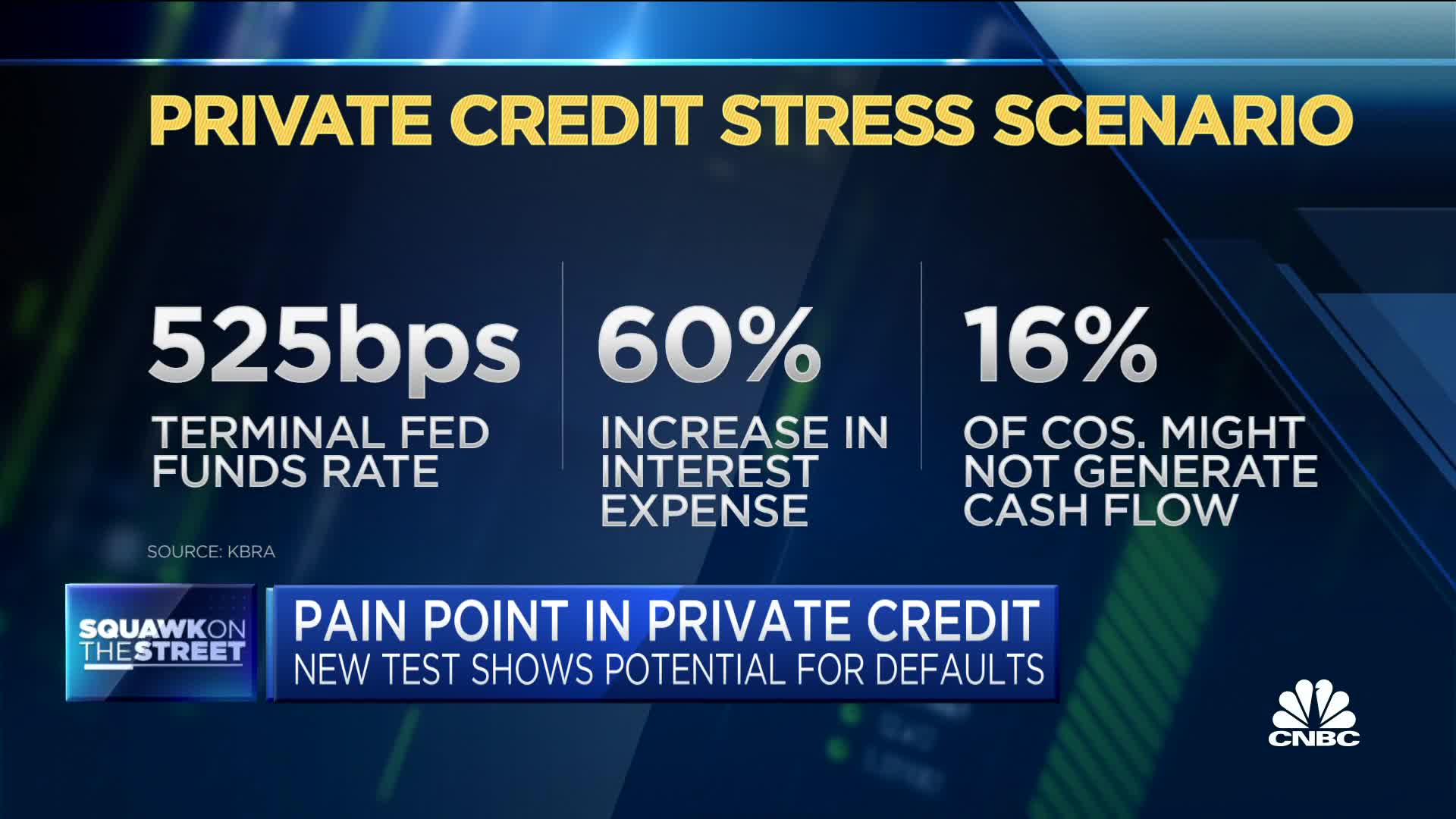

The long-term financial sustainability of X under this debt burden remains a significant concern. Two key scenarios are possible: successful debt repayment or default. Successfully navigating the debt requires disciplined financial management, robust revenue generation, and potentially strategic asset sales or cost-cutting measures far beyond what has already been undertaken. Failure to manage the debt could lead to severe consequences, including bankruptcy or a forced sale of the company. Balancing debt repayments with the need for continued growth and innovation will be a constant challenge. High-interest rates and potential economic downturns add further complexity to this already precarious situation.

- Potential Scenarios: The likelihood of successful debt repayment versus default depends largely on X's ability to increase revenue, manage costs effectively, and navigate macroeconomic headwinds.

- Risk Mitigation Strategies: These could include asset sales, cost-cutting measures beyond those already employed, and potentially seeking further funding or strategic partnerships.

- Long-Term Competitive Position: X's long-term competitive position hinges on its ability to address its financial challenges while continuing to innovate and compete effectively in a rapidly evolving market.

Conclusion: Assessing the Future of X After the Debt Sale

The financial implications of Musk's debt sale on X are far-reaching and complex. The massive debt burden presents significant risks, impacting X's operational strategies, valuation, and long-term sustainability. While opportunities exist for growth and innovation, successfully navigating this financial challenge will require skillful management, strategic planning, and a bit of luck in a volatile economic climate. The ability to increase revenue, cut costs, and secure additional funding will be crucial for X's long-term success.

Stay updated on the evolving financial landscape of X and the ongoing implications of Musk's debt by following our future analyses. Understanding the intricacies of Musk's debt and its impact on X's financial future is key to comprehending the platform's trajectory and the broader financial implications of X in the years to come.

Featured Posts

-

Yankees Judge And Goldschmidt Deliver In Must Win Game

Apr 28, 2025

Yankees Judge And Goldschmidt Deliver In Must Win Game

Apr 28, 2025 -

Phoenix Race Bubba Wallaces Crash Attributed To Brake System Malfunction

Apr 28, 2025

Phoenix Race Bubba Wallaces Crash Attributed To Brake System Malfunction

Apr 28, 2025 -

5 Key Actions To Secure A Role In The Private Credit Boom

Apr 28, 2025

5 Key Actions To Secure A Role In The Private Credit Boom

Apr 28, 2025 -

Identifying Emerging Business Hubs A Country Wide Overview

Apr 28, 2025

Identifying Emerging Business Hubs A Country Wide Overview

Apr 28, 2025 -

Final Restart Gamble Fails For Bubba Wallace At Martinsville

Apr 28, 2025

Final Restart Gamble Fails For Bubba Wallace At Martinsville

Apr 28, 2025