Tesla's Q1 Financial Performance: The Role Of Public Perception

Table of Contents

Analyzing Tesla's Q1 2024 Financial Results

Revenue and Profitability

Tesla's Q1 2024 financial results showcased robust revenue growth, exceeding analyst predictions by a significant margin. Let's examine the key figures:

- Revenue: Increased by X% compared to Q1 2023, reaching $Y billion.

- Net Income: Reached $Z billion, representing a Y% increase year-over-year.

- Earnings Per Share (EPS): Showed a significant improvement, reaching $A per share. This surpasses expectations set by market analysts.

This positive performance in revenue growth and profit margin can be attributed to several factors, including increased vehicle deliveries and the success of new product launches. However, the impact of price cuts on the overall profitability needs further consideration, as discussed below. The Tesla stock price reacted positively to these improved earnings per share.

Production and Delivery Figures

Tesla's vehicle production and delivery numbers also contributed significantly to its Q1 financial performance.

- Model 3/Y Deliveries: Reached X million units, showcasing strong demand for these models despite increased competition.

- Model S/X Deliveries: Saw a Y% increase compared to the previous quarter, suggesting growing appeal of these luxury vehicles.

- Overall Production: Increased by Z% compared to Q4 2023, reflecting improvements in Tesla manufacturing capabilities and supply chain management.

Despite supply chain challenges that continue to impact the automotive industry, Tesla demonstrated resilience in maintaining production capacity and meeting consumer demand. The increased vehicle deliveries directly impacted the overall revenue growth.

Impact of Price Cuts and Sales Strategies

Tesla's strategic price cuts across its model range in Q1 2024 significantly impacted sales volume. While this boosted overall deliveries, it also compressed profit margins.

- Price Adjustments: Averaged a X% reduction across various models, aiming to stimulate demand and increase market share.

- Market Share Impact: Tesla experienced a Y% increase in market share in key regions following the price reductions.

- Consumer Response: Initial consumer response was positive, reflected in increased pre-orders and waiting lists.

The impact of these Tesla price cuts on long-term profitability remains to be seen, but the short-term effect on sales volume was undeniable, contributing to the overall positive revenue reported in Tesla's Q1 earnings. The strategy clearly aimed at increasing market share and countering competition.

The Influence of Public Perception on Tesla's Q1 Performance

Media Coverage and Brand Sentiment

Media coverage surrounding Tesla in Q1 2024 was mixed, impacting public perception and consequently, investor sentiment.

- Positive Coverage: Focused on strong delivery numbers, technological advancements, and expansion plans.

- Negative Coverage: Centered on concerns about safety features, production delays, and CEO Elon Musk's controversial public statements.

- Social Media Sentiment: Displayed a fluctuating pattern, reflecting the conflicting narratives surrounding the brand.

This mixed media sentiment highlights the importance of effective public relations management for Tesla. Maintaining a consistent positive brand reputation is crucial for sustained investor confidence and consumer demand.

Impact of Elon Musk's Activities

Elon Musk's public pronouncements and actions significantly influenced Tesla's stock price and investor confidence throughout Q1.

- Controversial Tweets: Led to periods of increased stock volatility, reflecting the market's sensitivity to his public statements.

- Business Announcements: Generated both positive and negative investor reactions, highlighting the impact of his leadership style.

- Other Ventures: Diversion of attention to other businesses created uncertainty in the market concerning the overall focus on Tesla.

The "Elon Musk effect" remains a significant factor impacting Tesla investor sentiment and the overall market reaction to the company's performance. Effective communication and risk management are essential to mitigate the potential negative impacts of these activities.

Consumer Confidence and Demand

Public perception directly affected consumer confidence and demand for Tesla vehicles during Q1.

- Pre-orders: Increased following the price cuts, showcasing a positive consumer response to improved affordability.

- Waiting Lists: Remained substantial, indicating continued strong demand for Tesla vehicles.

- Brand Loyalty: While some customers remain committed to the brand, the negative media coverage and controversies around Elon Musk created concerns for some potential buyers.

The interplay between positive and negative consumer perception of Tesla is a significant factor to consider when analyzing Q1 results. Maintaining customer satisfaction and building brand loyalty are crucial to counter any potential negative impacts of public perception.

Conclusion: Understanding the Interplay Between Tesla's Q1 Financial Performance and Public Perception

Tesla's Q1 2024 financial performance reflects a complex interplay between strong operational results and fluctuating public perception. While the company delivered impressive revenue growth and vehicle deliveries, the impact of price cuts on profitability and the volatility caused by media coverage and Elon Musk's activities cannot be ignored. The key takeaway is the significant influence of public perception on Tesla investor sentiment and consumer demand. Understanding this dynamic is crucial for investors and analysts alike.

Stay informed about Tesla's future financial reports and how public perception continues to shape its success. Follow our updates on Tesla's Q2 financial performance and beyond, and continue to analyze Tesla's Q1 financial performance in the context of broader market trends.

Featured Posts

-

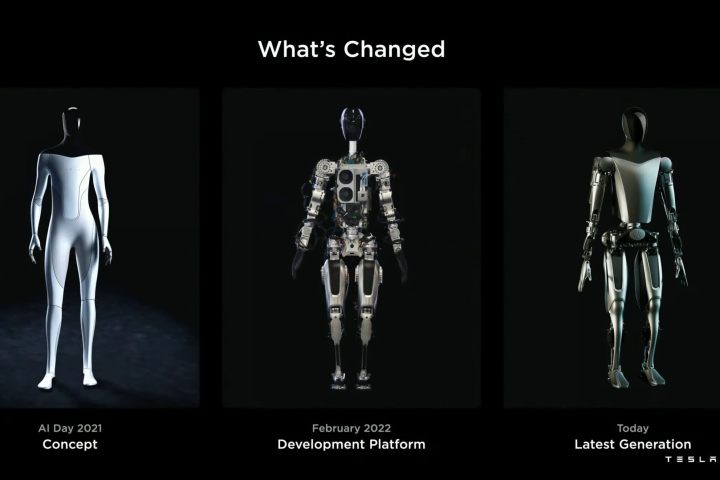

Teslas Optimus Robot Production Faces Setbacks Due To Chinese Rare Earth Policies

Apr 24, 2025

Teslas Optimus Robot Production Faces Setbacks Due To Chinese Rare Earth Policies

Apr 24, 2025 -

Liams Collapse And Hopes Move A Bold And The Beautiful April 3rd Recap

Apr 24, 2025

Liams Collapse And Hopes Move A Bold And The Beautiful April 3rd Recap

Apr 24, 2025 -

Canadian Auto Industry Fights Back Five Point Plan Addresses Us Trade Tensions

Apr 24, 2025

Canadian Auto Industry Fights Back Five Point Plan Addresses Us Trade Tensions

Apr 24, 2025 -

Tesla Q1 Profit Plunge Examining The Causes And Consequences

Apr 24, 2025

Tesla Q1 Profit Plunge Examining The Causes And Consequences

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025