Strong Performance Of Emerging Market Equities: A Comparison With US Market Trends

Table of Contents

Growth Drivers in Emerging Markets

Several fundamental factors drive the robust performance of emerging market equities. These markets offer compelling opportunities for investors seeking diversification and higher growth potential compared to more established markets.

Rapid Economic Expansion

Many emerging markets are experiencing high GDP growth rates, significantly outpacing developed economies. India, for example, consistently demonstrates impressive GDP growth, fueled by a young and expanding workforce. Southeast Asian nations, particularly Vietnam and Indonesia, also exhibit robust economic expansion, driven by manufacturing and export-oriented industries. This rapid expansion creates a fertile ground for equity market growth.

- Examples of high-growth emerging markets: India, Vietnam, Indonesia, Philippines, Brazil

- Statistics on GDP growth: Access the latest World Bank data for specific GDP growth figures for these regions. (Insert a chart or table showing comparative GDP growth rates here).

Rising Middle Class and Consumer Spending

The burgeoning middle class in emerging economies is a significant driver of economic growth. Increased disposable income translates into higher consumer spending, boosting demand across various sectors. This rising consumer power fuels growth in consumer goods, technology, and other related industries.

- Statistics on consumer spending growth: (Insert data on consumer spending growth in key emerging markets here. Source the data from reputable sources like the World Bank or IMF).

- Implications for various sectors: The growth of the middle class is creating significant opportunities in sectors like consumer staples, automobiles, and technology.

Infrastructure Development and Investments

Massive infrastructure investments are underway in many emerging markets. These projects, ranging from transportation networks to energy infrastructure, create jobs, stimulate economic activity, and attract foreign direct investment. This sustained investment boosts overall economic growth and provides long-term growth opportunities for investors.

- Details on major infrastructure projects: (Provide examples of major infrastructure projects in different emerging markets. Mention the Belt and Road Initiative in China as a relevant example).

Technological Innovation

Technological advancements and digitalization are transforming emerging economies. The rapid adoption of mobile technology, e-commerce, and fintech solutions is driving innovation and efficiency, attracting further foreign investment and creating new economic opportunities. This digital revolution is particularly evident in countries with a large young, tech-savvy population.

- Examples of technological advancements impacting the economy: Mobile money adoption in Africa, the growth of e-commerce platforms in Southeast Asia, and the expansion of digital infrastructure in India.

US Market Trends and Comparison

While emerging markets offer exciting growth potential, it's essential to compare them with established markets like the US to understand the relative investment landscape.

Slowing US Economic Growth

The US economy faces challenges like inflation and potential recessionary pressures. These factors can impact investor confidence and affect the performance of US equities. The Federal Reserve's actions to combat inflation, such as raising interest rates, further complicate the economic outlook.

- Recent performance data of major US indices (e.g., S&P 500, Dow Jones): (Insert relevant data and charts showing the performance of major US indices. Source this data from reputable financial websites).

Interest Rate Hikes and Their Impact

Rising interest rates, implemented by the Federal Reserve to control inflation, can impact US equity markets. Higher interest rates generally increase borrowing costs for businesses and can lead to lower corporate earnings and potentially a slowdown in economic growth.

- Analysis of interest rate hikes and their effect on investor behavior: (Discuss how rising interest rates impact investor sentiment and investment decisions. Mention the flight to safety phenomenon).

Market Volatility and Uncertainty

The US market exhibits volatility and uncertainty, influenced by factors such as geopolitical events and economic data releases. This contrasts with the relative stability seen in some emerging markets.

- Current US inflation rate and its effect on the market: (Provide the latest inflation data and discuss its impact on the US market).

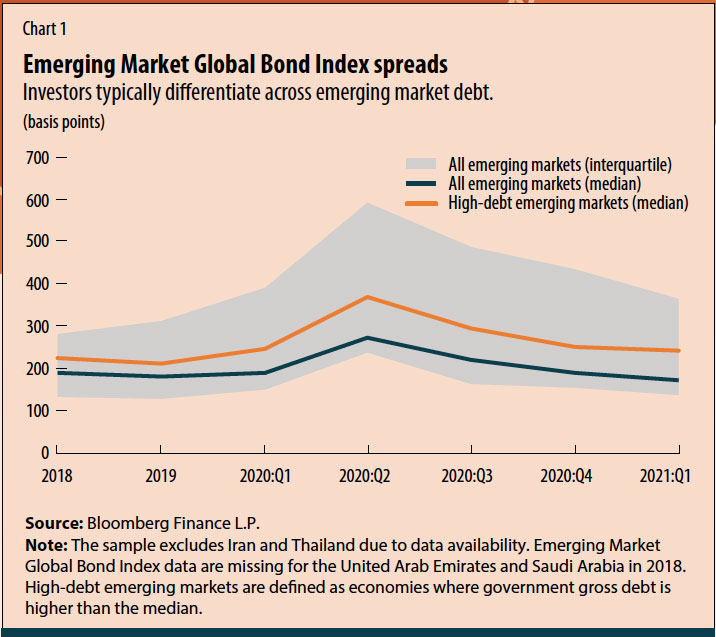

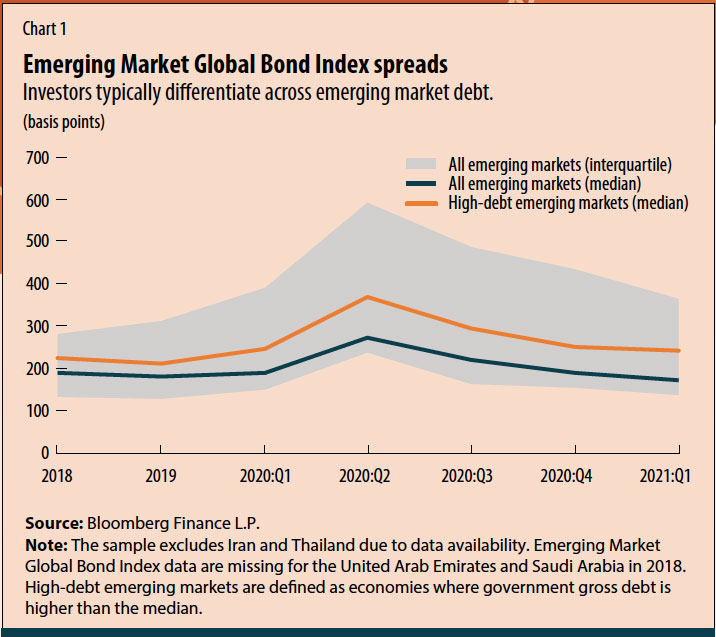

Risk Assessment and Investment Strategies

Investing in emerging markets carries inherent risks, requiring careful consideration and strategic planning.

Geopolitical Risks and Volatility

Geopolitical risks, including political instability and social unrest, are potential challenges in emerging markets. These risks can impact investment returns and require careful assessment.

- Key factors to consider when assessing emerging market risk: Political stability, economic policies, regulatory environments, and currency risks.

Currency Fluctuations and Hedging

Currency fluctuations can significantly impact returns from emerging market investments. Hedging strategies, such as using currency derivatives, can help mitigate these risks.

- Strategies for mitigating geopolitical and currency risk: Diversification, hedging, and thorough due diligence.

Diversification and Portfolio Allocation

Diversification is crucial when investing in emerging markets. By spreading investments across different regions and sectors, investors can reduce their overall portfolio risk.

- Examples of diversified portfolio allocation strategies: Allocate a percentage of your portfolio to emerging market equities, balancing it with investments in developed markets and other asset classes.

Conclusion

The strong performance of emerging market equities presents a compelling alternative to traditional US-centric investment strategies. While inherent risks exist, the significant growth potential and diversification benefits make them a worthy consideration for investors seeking higher returns and portfolio diversification. Understanding the key drivers of emerging market growth, while acknowledging the challenges posed by US market trends, is crucial for developing a robust and diversified investment portfolio. Begin exploring the potential of emerging market equities today and consider diversifying your investment strategy to benefit from the considerable opportunities presented by these dynamic markets. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to emerging market equities or any other investment strategy.

Featured Posts

-

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025

The Bold And The Beautiful Spoilers Liams Medical Crisis And Potential Demise

Apr 24, 2025 -

Fiscal Responsibility And Canadas Future A Critical Analysis

Apr 24, 2025

Fiscal Responsibility And Canadas Future A Critical Analysis

Apr 24, 2025 -

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025 -

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025

Should You Vote Liberal William Watson Examines The Party Platform

Apr 24, 2025 -

Trump Lawsuit Leads To 60 Minutes Executive Producers Resignation

Apr 24, 2025

Trump Lawsuit Leads To 60 Minutes Executive Producers Resignation

Apr 24, 2025