Slowdown In Non-Essential Spending: Credit Card Companies Respond

Table of Contents

Reduced Credit Card Spending and its Impact

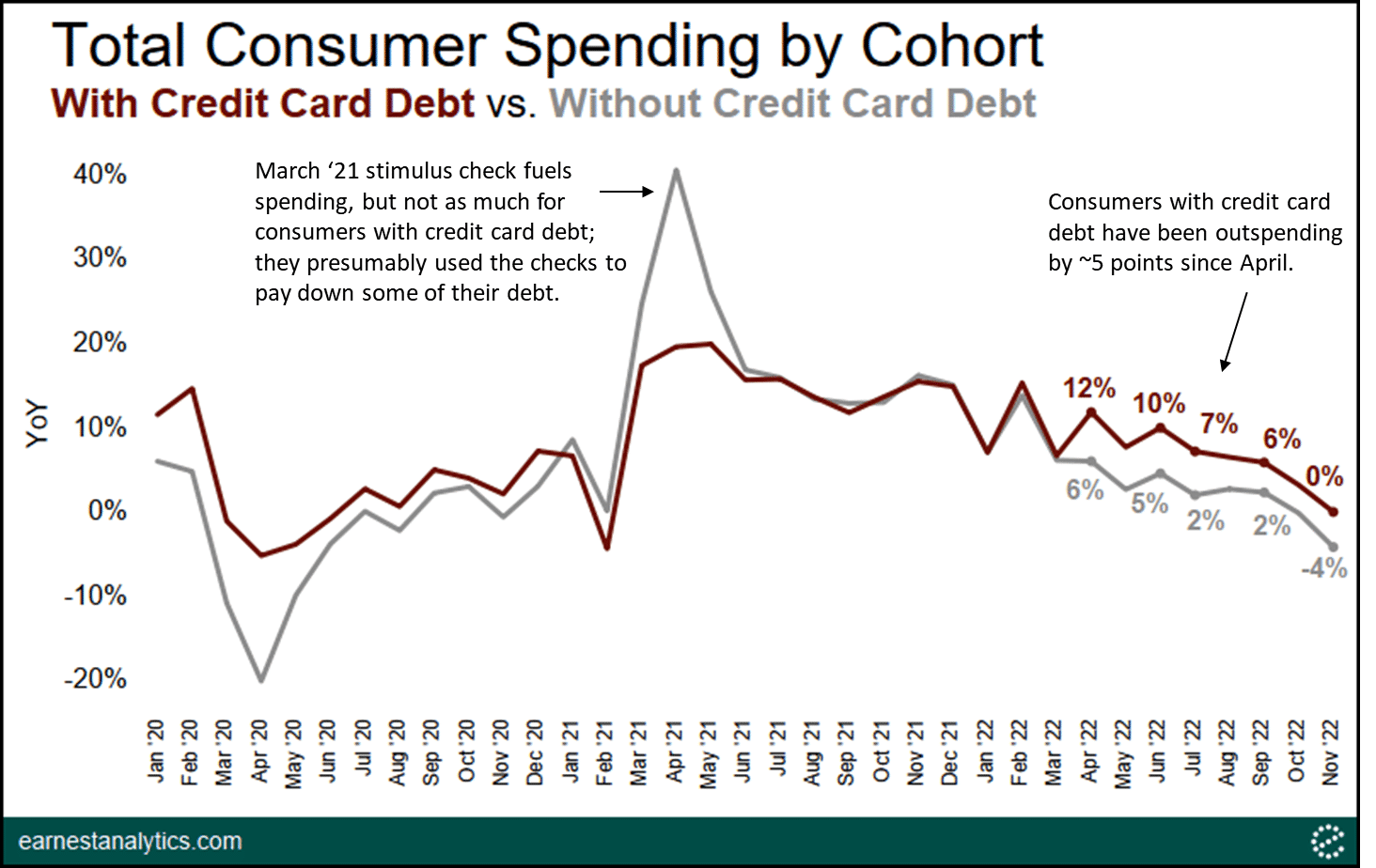

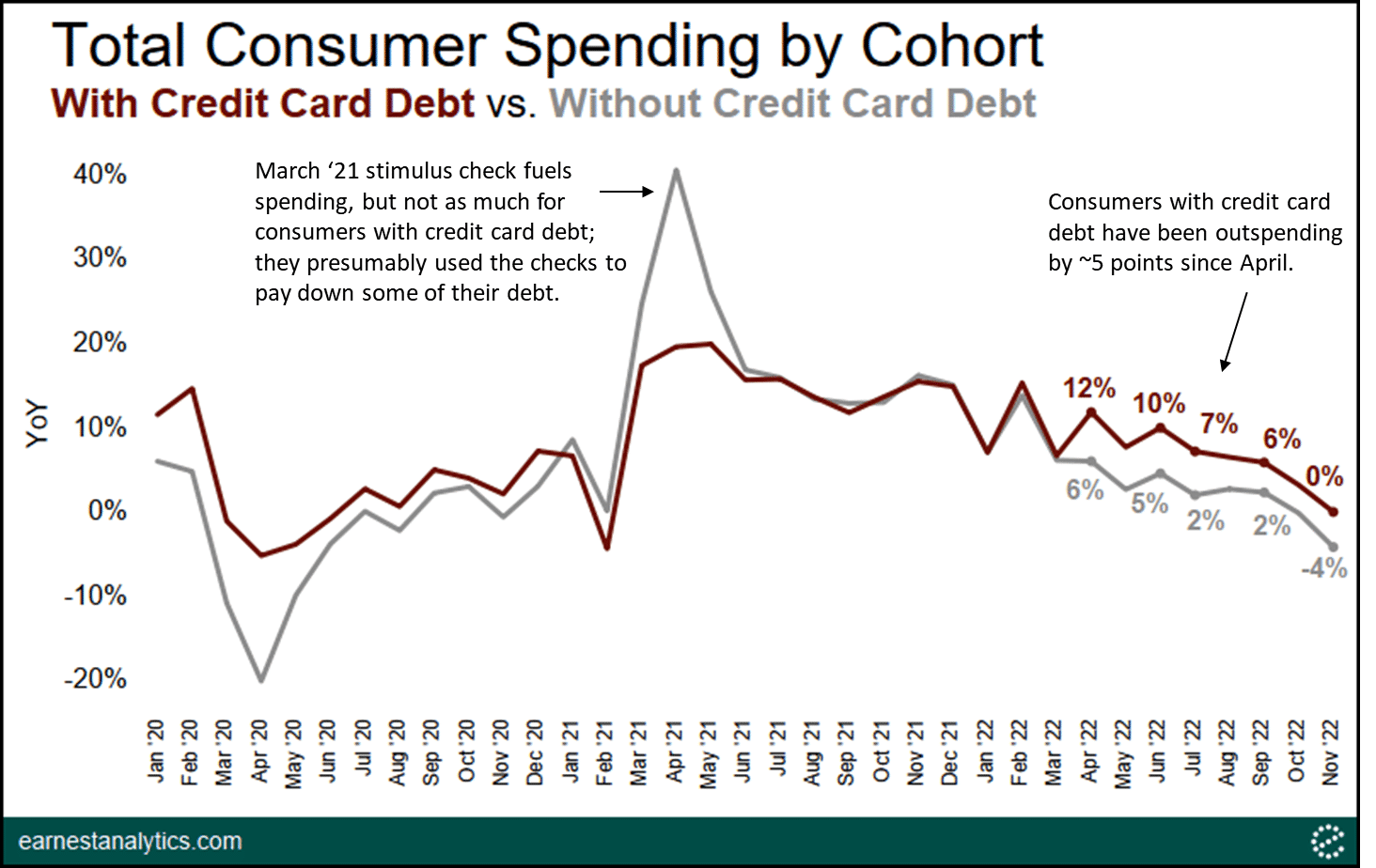

The slowdown in non-essential spending is significantly impacting credit card companies. Analysis of spending patterns reveals a dramatic decrease in several key sectors.

Analysis of Spending Patterns:

- Dining Out: Restaurant spending has plummeted, with many consumers opting for home-cooked meals due to increased food prices and economic uncertainty.

- Travel and Leisure: Travel-related expenses, including flights, hotels, and entertainment, have shown a considerable decline. The lingering effects of the pandemic and rising fuel costs are major contributing factors.

- Entertainment: Spending on entertainment, such as concerts, movies, and sporting events, has also decreased significantly as consumers prioritize essential spending.

[Insert chart or graph here illustrating the decline in spending across various sectors. Clearly label axes and data sources.]

Inflation and economic uncertainty are primary drivers of this trend. Consumers are becoming more cautious with their spending, prioritizing essential goods and services over discretionary purchases.

Impact on Credit Card Companies' Revenue:

The decreased transaction volume directly impacts credit card companies' revenue. Lower spending translates to reduced transaction fees, impacting profitability and potentially shareholder value. Investor confidence may also be affected, leading to market fluctuations in the credit card industry. This situation necessitates a reassessment of their business models and strategic planning, prompting a need for innovative solutions.

Credit Card Companies' Strategies to Mitigate the Impact

Credit card companies are implementing various strategies to counter the slowdown in non-essential spending.

Increased Focus on Essential Spending:

Credit card companies are shifting their focus to essential spending categories like groceries, utilities, and healthcare. They are employing targeted promotions and rewards programs to attract spending in these areas. Data analytics play a crucial role in understanding shifting consumer behavior in essential spending to tailor marketing strategies. Examples include increased cashback rewards on grocery purchases and partnerships with utility providers.

Enhanced Customer Loyalty Programs:

To retain existing customers and encourage continued spending, even if reduced, credit card companies are enhancing their loyalty programs. This includes offering new rewards, benefits, and personalized rewards programs based on individual spending habits. These tailored rewards aim to provide greater value and incentivize continued card usage.

Aggressive Marketing and Promotional Offers:

Credit card companies are employing aggressive marketing tactics to stimulate spending. This includes increased promotional offers, discounts, and 0% APR periods on purchases. While these strategies aim for short-term gains, they also carry potential long-term risks, such as increased debt for consumers. Examples include targeted email campaigns offering discounts on specific goods or services and limited-time promotional periods with increased cashback rewards.

The Long-Term Outlook and Predictions

Understanding the future requires analyzing consumer confidence and predicting future spending patterns.

Analysis of Consumer Confidence:

Consumer confidence plays a crucial role in spending habits. A decline in consumer confidence often leads to reduced spending. Economic forecasts and consumer sentiment surveys are valuable tools for predicting future trends.

Potential Adaptations by Credit Card Companies:

The credit card industry might witness significant adaptations in the coming years. This could include the introduction of new types of credit cards tailored to specific needs and revised reward systems emphasizing value and flexibility. Mergers and acquisitions might also become more prevalent as companies seek to consolidate market share. Technological advancements, such as improved BNPL (Buy Now, Pay Later) integration and enhanced digital wallet functionalities, are expected to shape the industry's future.

Slowdown in Non-Essential Spending: What's Next?

The slowdown in non-essential spending is significantly impacting credit card companies, forcing them to adapt their strategies to focus on essential spending, enhance loyalty programs, and employ aggressive marketing tactics. Predictions for the future indicate potential changes in credit card offerings and increased technological integration. The long-term impact remains uncertain, heavily dependent on evolving consumer confidence and broader economic trends.

Stay updated on the latest developments in the credit card industry and the ongoing impact of the slowdown in non-essential spending by following [link to relevant resource]. Understanding this slowdown in non-essential spending is crucial for navigating the current economic climate.

Featured Posts

-

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Wildfire Betting A Troubling Trend In Los Angeles

Apr 24, 2025

Wildfire Betting A Troubling Trend In Los Angeles

Apr 24, 2025 -

Significant V Mware Price Increase At And Ts Response To Broadcoms Acquisition

Apr 24, 2025

Significant V Mware Price Increase At And Ts Response To Broadcoms Acquisition

Apr 24, 2025 -

John Travoltas Candid Bedroom Photo A Look Inside His 3 M Home And Fan Reaction

Apr 24, 2025

John Travoltas Candid Bedroom Photo A Look Inside His 3 M Home And Fan Reaction

Apr 24, 2025 -

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025