Simkus Warns Of Further ECB Rate Cuts Due To Weakening Trade

Table of Contents

Weakening Trade Data Fuels Concerns

European trade data paints a concerning picture. Export and import figures reveal a significant slowdown in economic activity, contributing to a widening trade deficit. This weakening trade significantly impacts economic growth and inflation across the Eurozone. The negative effects are multifaceted:

- Global economic slowdown: Reduced global demand directly impacts European exports, hindering economic expansion.

- Geopolitical uncertainties: The ongoing war in Ukraine and other geopolitical risks create instability and uncertainty, impacting international trade flows.

- Supply chain disruptions: Persistent supply chain bottlenecks continue to constrain production and trade, driving up costs.

- Increased energy prices: Soaring energy costs increase production expenses, reducing competitiveness and impacting both exports and imports.

The combination of these factors has created a significant headwind for the European economy, fueling concerns about sustained growth and potentially pushing the Eurozone towards a recession. The resulting trade deficit is a key indicator of the economic challenges faced by the region, impacting economic growth and the overall inflation rate.

Simkus's Analysis and Rationale

Dr. Simkus's prediction of further ECB rate cuts is grounded in her analysis of the weakening trade data and its implications for ECB monetary policy. She argues that the persistent slowdown in European trade, coupled with disinflationary pressures, necessitates a more accommodative monetary stance. While specific quotes are unavailable at this time, her analysis emphasizes the need for proactive measures to mitigate the risks of a prolonged economic downturn. Simkus's assessment focuses on key economic indicators, demonstrating a clear link between flagging trade and the need for monetary easing. Her expertise and long-standing experience in the field lend significant weight to her rate cut prediction.

Inflationary Pressure and Rate Cuts

The relationship between weakening trade, inflation, and the need for ECB rate cuts is complex but crucial to understand. While inflation remains a concern, the slowdown in trade activity can lead to disinflationary pressures. Reduced demand can lower prices, thus impacting the overall inflation rate. This could create space for the ECB to implement a more lenient monetary policy by cutting interest rates without exacerbating inflationary pressures. The ECB needs to balance the risk of persistent high inflation with the potential harm of a shrinking economy.

Potential Consequences of Further Rate Cuts

Further ECB rate cuts could have both positive and negative consequences for the Eurozone economy.

- Stimulated economic growth: Lower borrowing costs for businesses and consumers might boost investment and spending, stimulating economic activity.

- Lower borrowing costs for businesses and consumers: This can free up capital for investment and spending, creating a more favorable business environment and potentially driving consumer confidence.

- Potential for increased inflation: Lower interest rates can lead to increased money supply, potentially fueling inflation if not carefully managed.

- Impact on the Euro exchange rate: Rate cuts may weaken the Euro, affecting imports and exports, which adds complexity to the already precarious situation.

A thorough risk assessment is crucial before implementing any further rate cuts. The ECB must carefully balance the potential benefits of economic stimulus against the risks associated with higher inflation and currency devaluation.

Alternative Economic Perspectives

While Dr. Simkus's analysis emphasizes the need for further ECB rate cuts, alternative perspectives exist within the economic community. Some economists argue that the focus should remain on inflation control, even at the cost of slower economic growth. Others suggest that fiscal policy, rather than monetary policy, should play a more significant role in addressing the economic challenges facing the Eurozone. These varying economic forecasts highlight the complexity of the situation and underscore the ongoing ECB policy debate surrounding the most effective approach. The diversity of opinions demonstrates the intricacies of navigating the current alternative viewpoints on navigating the European economy.

Conclusion: Simkus's Warning and the Future of ECB Rate Cuts

Dr. Simkus's prediction of further ECB rate cuts serves as a stark warning about the deteriorating situation in the Eurozone. The underlying cause – weakening European trade – poses a significant challenge to economic growth and stability. The potential consequences, ranging from stimulated growth to increased inflation and currency fluctuations, underscore the need for a carefully calibrated response. Understanding the intricacies of the current economic outlook and keeping abreast of the latest developments is essential. Stay updated on the latest developments regarding Simkus’s predictions and the potential for further ECB rate cuts by following [link to relevant source/news].

Featured Posts

-

Controversy Erupts Cdcs Vaccine Study And The Discredited Information Agent

Apr 27, 2025

Controversy Erupts Cdcs Vaccine Study And The Discredited Information Agent

Apr 27, 2025 -

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025 -

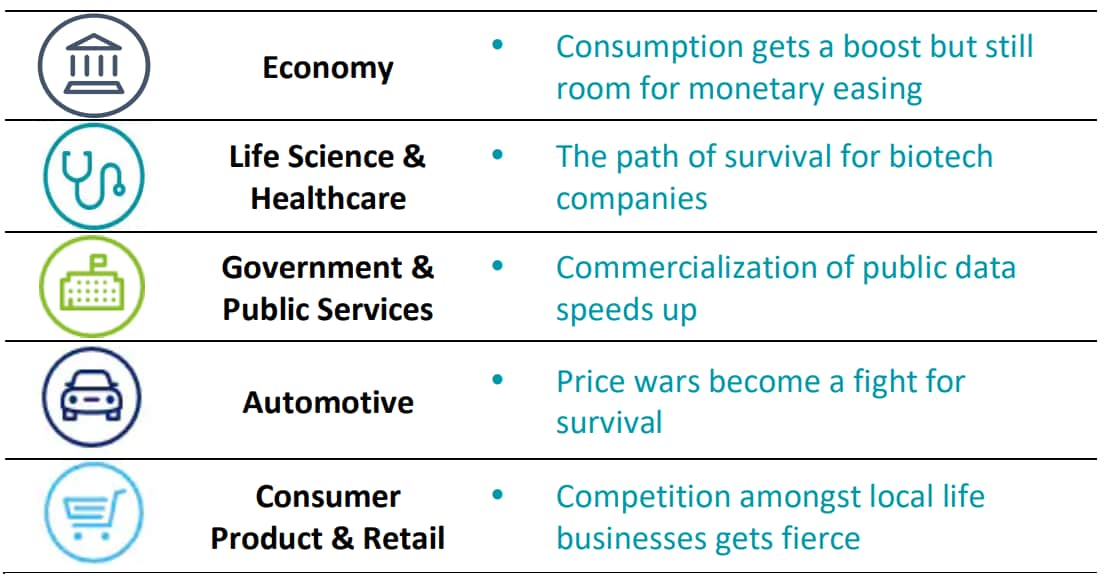

Deloitte Forecasts Considerable Slowdown In Us Growth

Apr 27, 2025

Deloitte Forecasts Considerable Slowdown In Us Growth

Apr 27, 2025 -

Bencic Returns To Wta Final In Abu Dhabi

Apr 27, 2025

Bencic Returns To Wta Final In Abu Dhabi

Apr 27, 2025 -

Ai And Human Creativity An Interview With Microsofts Design Chief

Apr 27, 2025

Ai And Human Creativity An Interview With Microsofts Design Chief

Apr 27, 2025