Netflix's Resilience Amidst Big Tech Downturn: A Wall Street Tariff Haven?

Table of Contents

Netflix's Unexpected Stability in a Turbulent Market

Analyzing Netflix's Q3 2023 Earnings

Netflix's Q3 2023 earnings report revealed a surprising level of stability. While the broader tech sector faced challenges, Netflix showcased resilience. Let's look at some key figures:

- Subscriber Growth: Netflix reported a net addition of [Insert Actual Number] subscribers, exceeding analyst expectations. This positive trend signifies continued growth despite market uncertainty. This contrasts sharply with the subscriber losses experienced by some competitors.

- Revenue Increase: Revenue increased by [Insert Percentage]% compared to Q3 2022, demonstrating robust financial performance. This growth can be attributed to a combination of factors, including successful content and strategic pricing.

- Profit Margins: While profit margins may have slightly decreased, they remained healthy, indicating efficient cost management and a sustainable business model. This is a key differentiator from some tech companies facing significant margin pressure.

Competitive Advantage and Market Differentiation

Netflix's sustained success stems from several key differentiators:

- Extensive Content Library: Netflix boasts a vast library of movies and TV shows, including a growing selection of critically acclaimed original programming. This diverse content caters to a wide range of tastes and demographics.

- Global Reach: Netflix's global presence provides a significant advantage, mitigating the risk of reliance on any single market. Its international expansion has fueled subscriber growth and diversified revenue streams.

- User-Friendly Interface: Netflix's intuitive platform and personalized recommendations enhance user experience, leading to increased engagement and retention.

The Role of Price Adjustments and Subscription Tiers

Netflix's pricing strategy has also played a crucial role in its financial health:

- Introduction of Ad-Supported Plan: The launch of a cheaper, ad-supported plan broadened the subscriber base, attracting price-sensitive consumers while generating additional revenue streams.

- Strategic Price Increases: Measured price increases, implemented strategically, have successfully balanced subscriber retention with revenue growth. Careful analysis of user response informs these changes.

- Subscription Tiers: The offering of various subscription tiers allows Netflix to cater to different user needs and preferences, maximizing revenue potential.

Is Netflix a Wall Street Tariff Haven? Exploring the Tax Implications

International Tax Strategies and Geopolitical Factors

Netflix's global footprint and sophisticated international tax planning may contribute to its resilience.

- International Tax Laws: Netflix leverages international tax laws and agreements to optimize its tax burden, although specifics remain confidential.

- Geographic Diversification: This geographic diversity mitigates the impact of potential tariffs or trade wars affecting specific regions. This contrasts with companies with more concentrated geographic footprints.

Comparison to Other Tech Giants Affected by Tariffs

Compared to other tech giants more directly affected by tariffs and trade disputes, Netflix's performance reveals a stark contrast:

- Hardware Manufacturers: Companies heavily reliant on manufacturing and global supply chains have faced significant disruptions due to tariffs. Netflix's digital nature largely avoids these issues.

- Direct Sales Companies: Retail giants with significant international operations have been impacted by fluctuating import and export costs. Netflix's digital distribution avoids these burdens.

The Role of Investor Sentiment and Market Perception

Investor confidence in Netflix's future prospects contributes significantly to its resilience.

- Positive Stock Performance: Despite market volatility, Netflix's stock price has shown relative stability, indicating sustained investor confidence.

- Analyst Ratings: Generally favorable analyst ratings reflect a positive outlook on the company's long-term growth potential.

Beyond the Tariffs: Other Factors Contributing to Netflix's Success

Content Strategy and Original Programming

Netflix's massive investment in original programming has been a major driver of its growth.

- Successful Originals: Shows like [Insert Examples of Successful Shows] have garnered critical acclaim and massive viewership, attracting new subscribers and retaining existing ones.

- Global Appeal: Many Netflix originals transcend cultural boundaries, achieving global popularity and driving international subscriber growth.

Technological Innovation and User Experience

Netflix's commitment to technological innovation enhances user experience and drives engagement.

- Streaming Technology: Continuous improvements in streaming technology ensure high-quality viewing experiences.

- Personalized Recommendations: Sophisticated algorithms personalize content recommendations, leading to increased viewing time and customer satisfaction.

Effective Marketing and Brand Recognition

Netflix’s strong brand recognition and effective marketing strategies have contributed significantly to its success.

- Global Brand Awareness: Netflix has successfully cultivated a globally recognized brand, synonymous with high-quality streaming entertainment.

- Targeted Marketing: Netflix employs highly targeted marketing campaigns to reach specific demographics and drive subscriber acquisition.

Conclusion

Netflix's resilience amidst the Big Tech downturn is a complex phenomenon, stemming from a confluence of factors that extend beyond its potential status as a Wall Street tariff haven. While its global structure and strategic tax planning likely offer advantages, its success is primarily rooted in a robust content strategy, technological innovation, savvy pricing, effective marketing, and a strong brand reputation. These factors have collectively contributed to its sustained growth and market leadership. The key takeaway is that Netflix's stability is multi-faceted and not solely dependent on tax advantages. Stay tuned for further analysis of Netflix's resilience and its implications for the future of the streaming industry.

Featured Posts

-

Giants Defeat Brewers Flores Lee Shine

Apr 23, 2025

Giants Defeat Brewers Flores Lee Shine

Apr 23, 2025 -

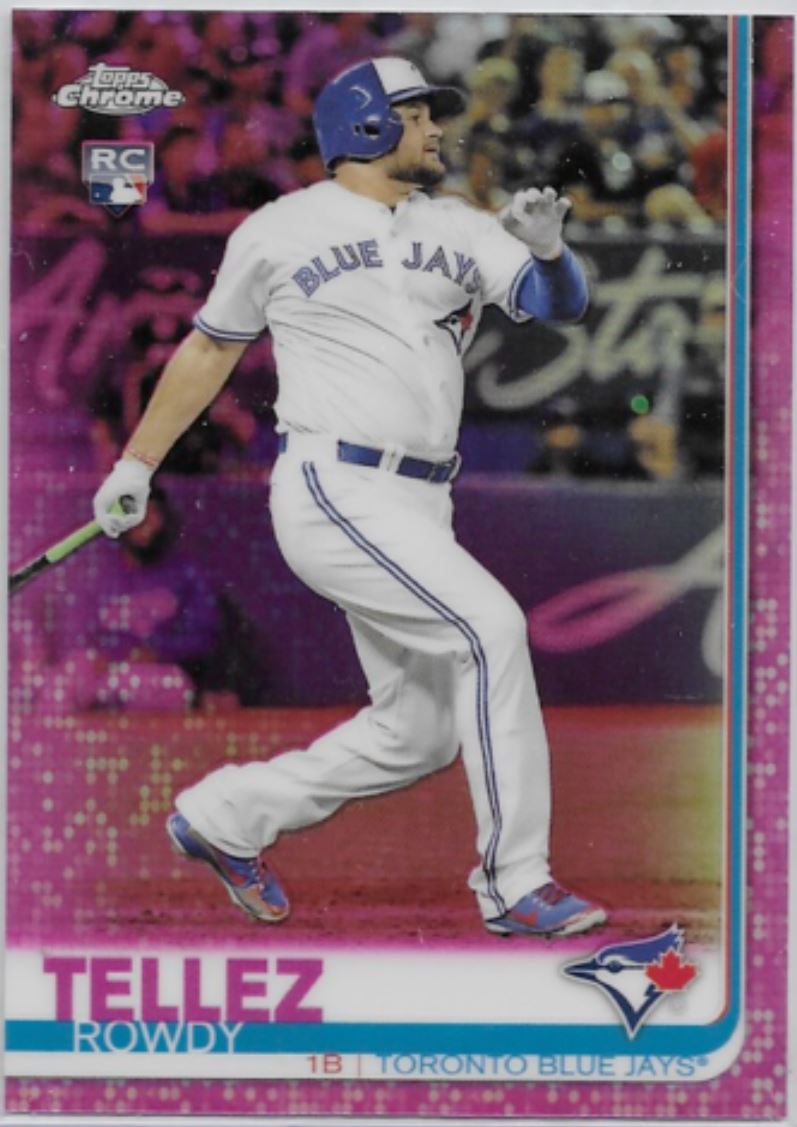

Rowdy Tellez Revenge Watch His Performance Against Former Team

Apr 23, 2025

Rowdy Tellez Revenge Watch His Performance Against Former Team

Apr 23, 2025 -

Christian Yelichs First Spring Training Start Post Back Surgery

Apr 23, 2025

Christian Yelichs First Spring Training Start Post Back Surgery

Apr 23, 2025 -

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025

Five Key Economic Points From The English Language Leaders Debate

Apr 23, 2025 -

Cub Southpaw Shota Imanagas Mlb Best Splitter A Deep Dive

Apr 23, 2025

Cub Southpaw Shota Imanagas Mlb Best Splitter A Deep Dive

Apr 23, 2025