Navigating The Stock Market: How Investors Can Handle Potential Losses

Table of Contents

Understanding the Inevitability of Stock Market Losses

Accepting Volatility as Normal

Market fluctuations are an inherent part of investing; they're not necessarily indicative of poor investment choices. Understanding this is key to managing investment risk and avoiding emotional decisions.

- Historical Context: Consider the numerous market corrections throughout history, such as the dot-com bubble burst in 2000 and the 2008 financial crisis. These events highlight the cyclical nature of the market and the inevitability of periodic downturns.

- Long-Term Perspective: Focusing on the long-term trend rather than short-term fluctuations is crucial. While short-term volatility can be unsettling, long-term market growth typically outweighs temporary setbacks.

- Distinguishing Volatility from Trends: It's essential to differentiate between short-term market noise and significant long-term trends. A single bad day or even a few bad weeks shouldn't trigger drastic changes to a well-diversified portfolio.

Identifying Your Risk Tolerance

Understanding your personal risk tolerance is paramount when it comes to mitigating stock market losses. Your investment strategy should align with your comfort level regarding potential losses.

- Investor Profiles: Investors typically fall into three categories: conservative, moderate, and aggressive. Conservative investors prioritize capital preservation and accept lower potential returns, while aggressive investors are willing to accept higher risks for potentially higher returns.

- Risk Assessment Questionnaires: Many online resources offer risk assessment questionnaires to help you determine your risk tolerance. These questionnaires typically ask about your investment timeline, financial goals, and comfort level with potential losses.

- Adjusting Strategies: Your risk tolerance may evolve over time, based on your age, financial situation, and investment goals. Regularly review and adjust your investment strategy accordingly.

Diversification: Spreading Your Investment Risk

The Power of Diversification

Diversifying your investments across different asset classes – stocks, bonds, real estate, commodities – significantly reduces the impact of losses in any single sector. This is a cornerstone of mitigating stock market losses.

- Diversified Portfolios: A well-diversified portfolio includes a mix of different asset classes, industries, and geographic regions. This reduces the dependence on any single investment's performance.

- International Diversification: Expanding your investments beyond your domestic market can further reduce risk, as different economies often behave differently.

- Mutual Funds and ETFs: Mutual funds and exchange-traded funds (ETFs) provide easy access to diversification, as they invest in a basket of different securities.

Avoiding Over-Concentration

Concentrating too much capital in a single stock or sector exposes you to significant risk. This is a common mistake that can lead to substantial losses.

- Case Studies: Numerous examples exist of investors suffering substantial losses due to over-concentration. Investing heavily in a single company whose stock price plummets can wipe out a significant portion of your portfolio.

- Rebalancing Strategies: Regularly rebalance your portfolio to maintain your desired asset allocation. This involves selling some of your better-performing assets and buying more of your underperforming assets to bring your portfolio back to its target allocation.

Strategic Approaches to Managing Losses

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy that mitigates risk by investing a fixed amount regularly, regardless of market fluctuations. This reduces the likelihood of investing a large sum at a market peak.

- How DCA Works: You invest a set amount of money at regular intervals (e.g., monthly or quarterly), regardless of the current market price.

- Benefits During Downturns: During market downturns, DCA allows you to buy more shares at lower prices, averaging your cost per share over time.

- Comparison to Lump-Sum Investing: While lump-sum investing can be beneficial in bull markets, DCA offers protection against market timing risks.

Stop-Loss Orders

Stop-loss orders are used to limit potential losses on individual investments. They automatically sell your security when it reaches a predetermined price.

- How Stop-Loss Orders Work: You set a stop price below your purchase price. Once the market price hits your stop price, your broker automatically sells your shares.

- Advantages and Disadvantages: Stop-loss orders protect against substantial losses, but they also carry the risk of being triggered by temporary market fluctuations.

- Potential Slippage: There's a chance your shares may sell at a price slightly lower than your stop price, known as slippage.

Rebalancing Your Portfolio

Periodically rebalancing your portfolio to maintain your desired asset allocation is crucial for long-term success. This helps you capitalize on market downturns by buying low and selling high.

- How to Rebalance: Compare your current portfolio allocation to your target allocation. Then, sell some of your overweight assets and buy more of your underweight assets to realign your portfolio.

- Frequency of Rebalancing: The frequency of rebalancing depends on your investment strategy and risk tolerance. Some investors rebalance annually, while others do it quarterly or even more frequently.

- Benefits During Downturns: Rebalancing during market downturns allows you to buy more of the assets that have declined in value, potentially leading to higher returns in the long run.

Emotional Discipline in Investing

Avoiding Panic Selling

Panic selling – making impulsive decisions based on fear during market declines – is a common mistake that can lead to substantial losses. Maintaining emotional discipline is crucial.

- Psychological Impact: Market losses can trigger strong emotional responses, such as fear, anxiety, and regret. These emotions can cloud your judgment and lead to poor investment decisions.

- Strategies for Maintaining Discipline: Develop a long-term investment plan and stick to it, regardless of short-term market fluctuations. Consider seeking advice from a financial advisor.

- Seeking Professional Advice: A financial advisor can help you create a well-diversified portfolio, develop an investment strategy aligned with your risk tolerance, and maintain emotional discipline.

Long-Term Perspective

Focusing on long-term goals and avoiding short-term market noise is essential for success. Market fluctuations are temporary; long-term trends are more important.

- Benefits of Patience: Patience and discipline are rewarded in the long run. Avoid making emotional decisions based on short-term market volatility.

- Setting Realistic Expectations: Understand that market returns are not guaranteed. Set realistic expectations and avoid chasing quick profits.

- Focus on the Bigger Picture: Maintain a long-term perspective and focus on your overall financial goals. Don't get distracted by short-term market noise.

Conclusion

Effectively managing investment risk and mitigating stock market losses requires a multi-faceted approach. The key strategies discussed include diversification across asset classes, utilizing dollar-cost averaging, employing stop-loss orders, regularly rebalancing your portfolio, and maintaining emotional discipline. By understanding and implementing these strategies, you can navigate market downturns more effectively and achieve your long-term financial goals. Don't let the fear of stock market losses paralyze you. Start planning your investment strategy today to effectively manage potential stock market losses and build a secure financial future.

Featured Posts

-

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025

Fsu Security Breach Swift Police Response Fails To Quell Student Fears

Apr 22, 2025 -

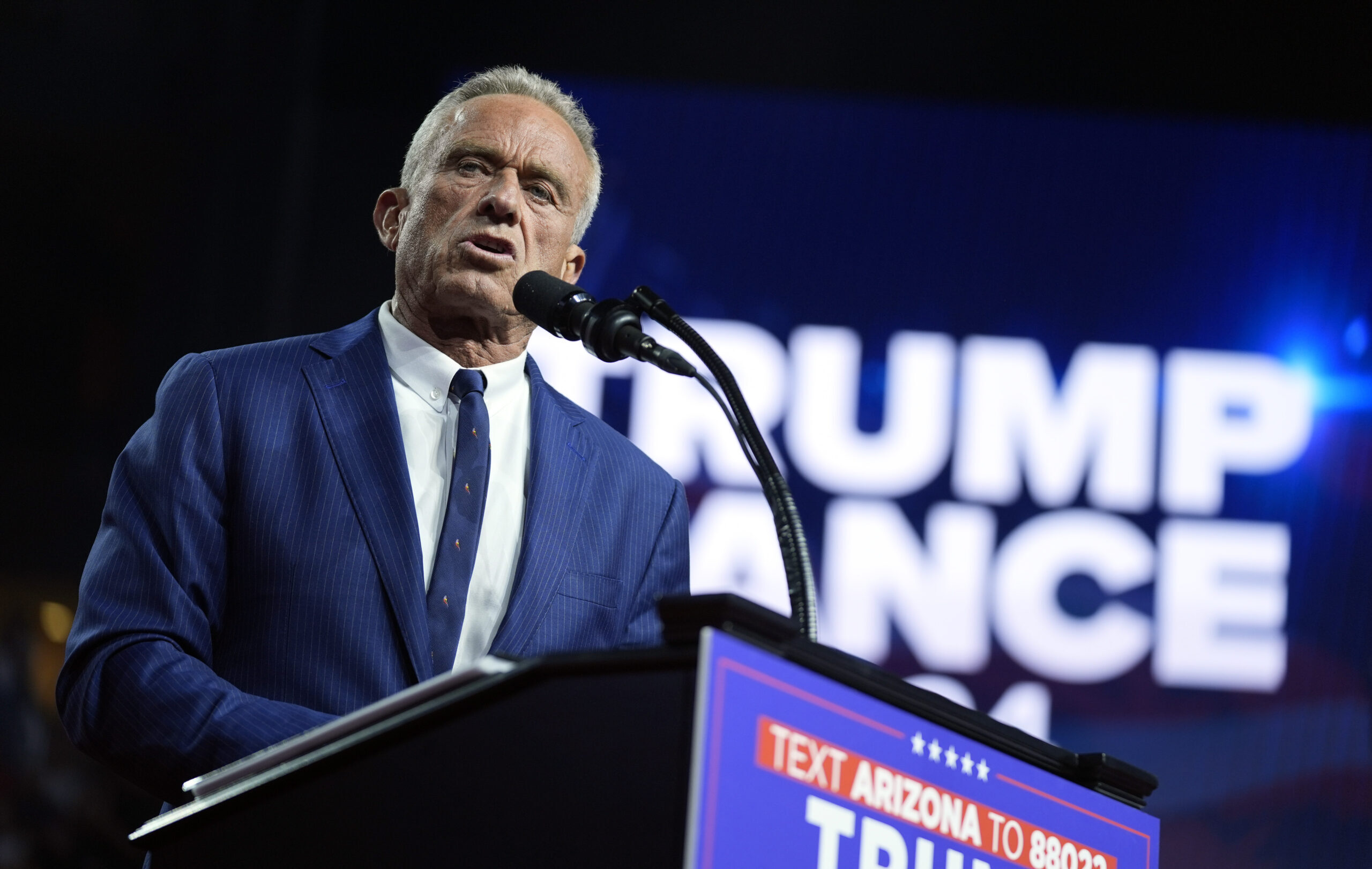

Trump Defends Obamacare Supreme Court Case And Rfk Jr S Political Rise

Apr 22, 2025

Trump Defends Obamacare Supreme Court Case And Rfk Jr S Political Rise

Apr 22, 2025 -

How Tik Tok Videos Show Ways To Avoid Trump Era Tariffs

Apr 22, 2025

How Tik Tok Videos Show Ways To Avoid Trump Era Tariffs

Apr 22, 2025 -

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025

Blue Origin Scraps Rocket Launch Due To Subsystem Problem

Apr 22, 2025 -

Blue Origin Postpones Launch Investigating Subsystem Malfunction

Apr 22, 2025

Blue Origin Postpones Launch Investigating Subsystem Malfunction

Apr 22, 2025