Navigate The Private Credit Job Market: 5 Do's & Don'ts

Table of Contents

5 DO's to Conquer the Private Credit Job Market

Do 1: Network Strategically

Building a strong network is paramount in the private credit job market. It's not just about knowing people; it's about building meaningful relationships with professionals who can offer guidance, mentorship, and potentially, job opportunities.

- Attend Industry Events: SuperReturn, Private Equity International, and other industry conferences are invaluable networking hubs. These events provide opportunities to connect with professionals from leading private credit firms.

- Leverage Online Platforms: LinkedIn is your professional networking ally. Actively engage with posts, join relevant groups, and connect with individuals working in private credit. Tailor your profile to highlight your skills and aspirations within this niche market.

- Targeted Networking: Don't cast a wide net. Focus your efforts on individuals working in specific areas of private credit that align with your interests (e.g., direct lending, mezzanine financing, distressed debt). Research firms and individuals beforehand to ensure your networking efforts are effective and targeted.

- Stay Informed: Follow key players and firms on social media (Twitter, LinkedIn) to stay abreast of industry news, job postings, and emerging trends. This demonstrates your commitment and keeps you ahead of the curve in this dynamic private credit job market.

Do 2: Highlight Relevant Skills & Experience

Your resume and cover letter are your first impression. Tailoring them specifically to each private credit job description is critical.

- Keyword Optimization: Incorporate relevant keywords throughout your application materials. Use terms like "debt financing," "leveraged buyouts," "structured finance," "credit analysis," "underwriting," and "portfolio management," reflecting the specific language used in job descriptions.

- Quantify Achievements: Instead of simply listing your responsibilities, quantify your accomplishments. For example, replace "Managed a portfolio of loans" with "Managed a $50 million loan portfolio, resulting in a 10% reduction in non-performing loans."

- Showcase Transferable Skills: Even if your experience isn't directly in private credit, highlight transferable skills from related fields like investment banking, commercial lending, or financial analysis. Emphasize skills like financial modeling, valuation, and credit risk assessment.

- Tailored Approach: Generic applications rarely succeed. Each application should be a bespoke piece tailored to the specific requirements and culture of the target firm.

Do 3: Master the Art of Financial Modeling

Proficiency in financial modeling is a non-negotiable skill in the private credit job market. Firms rely heavily on these models for investment decisions.

- Model Types: Become adept at building different types of financial models, including discounted cash flow (DCF) models, leveraged buyout (LBO) models, and other valuation techniques relevant to private credit transactions.

- Software Proficiency: Demonstrate fluency in relevant software, primarily Microsoft Excel, and ideally Argus, for more advanced modeling needs.

- Model Assumptions: Understand the underlying assumptions of your models and be prepared to discuss them confidently during interviews. This demonstrates a deep understanding of the modeling process and its limitations.

- Practice: Practice creating models for various private credit transactions, such as unitranche loans, senior secured debt, and subordinated debt. The more you practice, the more comfortable and confident you will become.

Do 4: Understand the Different Private Credit Strategies

The private credit market encompasses a range of strategies. Demonstrating a comprehensive understanding sets you apart.

- Research Strategies: Familiarize yourself with the nuances of direct lending, mezzanine financing, distressed debt investing, and special situations investing. Each strategy presents unique risks and rewards.

- Market Trends: Stay updated on current market trends, analyzing the performance of different private credit strategies under various economic conditions.

- Informed Opinions: Develop informed opinions on the relative merits of each strategy and be prepared to articulate your preferences and rationale during interviews.

- Investment Thesis: Be ready to discuss your understanding of how different private credit strategies generate returns and manage risks. This shows a level of sophistication that many candidates lack.

Do 5: Prepare for Behavioral and Technical Interviews

Thorough preparation is key to succeeding in private credit interviews.

- Behavioral Questions: Practice answering common behavioral interview questions, such as "Tell me about a time you failed," "Describe your work style," and "How do you handle pressure?" Use the STAR method (Situation, Task, Action, Result) to structure your responses effectively.

- Technical Questions: Prepare for technical questions related to financial modeling, credit analysis, and various aspects of private credit transactions. Review fundamental accounting and finance concepts.

- Company Research: Research the firm's investment strategy, recent transactions, and the interviewer's background. This demonstrates your genuine interest and preparedness.

- Mock Interviews: Conduct mock interviews with friends or mentors to refine your responses and reduce interview anxiety.

5 DON'Ts When Applying for Private Credit Jobs

Don't 1: Neglect Due Diligence

Thorough research is non-negotiable. Avoid applying without understanding the firm's investment thesis and culture.

- Target Firm Research: Carefully research each firm before applying. Understand their investment strategy, target sectors, and recent transactions.

- Tailored Applications: Avoid generic applications. Each application should be meticulously tailored to the specific requirements of the job description and the firm's investment strategy.

- Demonstrate Understanding: Show you understand their approach, not just their name. This conveys genuine interest and preparation.

Don't 2: Overlook Soft Skills

Technical skills are crucial, but soft skills are equally important in the collaborative environment of private credit.

- Communication Skills: Highlight your strong communication, interpersonal, and teamwork skills. Private credit involves significant interaction with borrowers, colleagues, and other stakeholders.

- Problem-Solving: Showcase your analytical and problem-solving capabilities, demonstrating your ability to navigate complex situations and make sound judgments under pressure.

- Teamwork: Emphasize your ability to work effectively in a team environment, contributing to a collaborative and productive atmosphere.

Don't 3: Underestimate the Importance of Mentorship

Seeking mentorship from experienced professionals provides invaluable guidance and insights.

- Network Actively: Networking events offer great opportunities to connect with experienced professionals who can offer mentorship.

- Informational Interviews: Reach out to individuals working in private credit for informational interviews. This allows you to learn from their experiences and gain valuable perspectives.

- Long-term Relationships: Build long-term relationships with mentors who can provide ongoing support and guidance throughout your career.

Don't 4: Ignore Industry News and Trends

Staying informed about current events and market trends is vital in the dynamic private credit landscape.

- Read Industry Publications: Stay informed through regular reading of relevant industry publications, such as trade journals and financial news sources.

- Follow Key Individuals: Follow influential figures and firms on social media and actively engage with industry discussions.

- Attend Webinars and Conferences: Attend webinars and conferences to stay updated on the latest developments and network with industry leaders.

Don't 5: Undersell Your Achievements

Clearly articulate and quantify your accomplishments to demonstrate your value.

- Quantifiable Results: Whenever possible, quantify your achievements using concrete metrics and numbers to showcase the impact of your contributions.

- Action Verbs: Use strong action verbs to describe your responsibilities and achievements, highlighting your proactive approach.

- Showcase Impact: Focus on the impact of your actions rather than simply listing your duties. Show how your contributions added value.

Conclusion

Successfully navigating the private credit job market demands a proactive and well-informed approach. By following these five do's and don'ts – focusing on strategic networking, highlighting relevant skills, mastering financial modeling, understanding private credit strategies, and preparing thoroughly for interviews – you significantly increase your chances of securing your desired private credit role. Don't delay your journey to a fulfilling career in the exciting world of private credit; start applying these strategies today to break into this competitive yet rewarding private credit job market.

Featured Posts

-

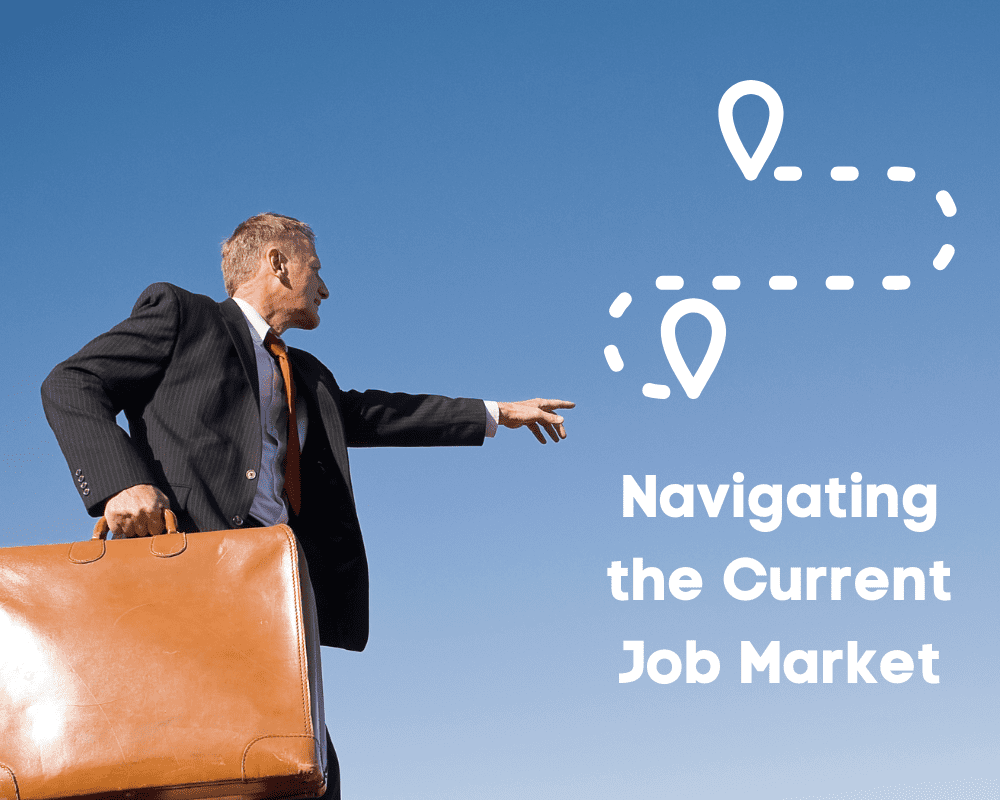

Dismissing High Stock Market Valuations Bof As Argument For Investors

Apr 28, 2025

Dismissing High Stock Market Valuations Bof As Argument For Investors

Apr 28, 2025 -

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025 -

Planning For The Future Replacing Tyler O Neill In The Red Sox Lineup

Apr 28, 2025

Planning For The Future Replacing Tyler O Neill In The Red Sox Lineup

Apr 28, 2025 -

Kuxius Innovation The Solid State Power Bank Explained

Apr 28, 2025

Kuxius Innovation The Solid State Power Bank Explained

Apr 28, 2025 -

Rent Increase Slows But Housing Remains Expensive In Metro Vancouver

Apr 28, 2025

Rent Increase Slows But Housing Remains Expensive In Metro Vancouver

Apr 28, 2025