Minnesota Film Production: The Effectiveness Of Tax Credit Incentives

Table of Contents

The Structure of Minnesota's Film Tax Credit Program

Minnesota's film tax credit program offers a significant incentive for film and television productions to choose the state as their filming location. Understanding the structure is crucial for producers considering utilizing these incentives. The program provides a percentage-based tax credit on qualified production spending within Minnesota.

- Percentage Offered: The current percentage offered needs to be verified with the most up-to-date information from the Minnesota Department of Employment and Economic Development (DEED) as these rates can change. Always check the official source for the most current details.

- Qualifying Spending: Eligible expenses generally include labor costs (both on-screen and off-screen talent), post-production services, location rentals, and other production-related expenditures. Specific details on qualifying expenses should be obtained from the DEED website.

- Application Process: Filmmakers typically apply for the tax credit through a formal application process with DEED, submitting detailed budgets and other supporting documentation. The application process and requirements are outlined on the DEED website.

- Limitations and Restrictions: There are often caps on the total amount of tax credits available annually, as well as specific eligibility requirements for production types and spending thresholds. These restrictions are detailed in the program guidelines.

- Eligible Productions: The program typically covers a range of productions, including feature films, television series, commercials, and documentaries. However, specific criteria for eligibility must be met.

Economic Impact of Film Tax Credits in Minnesota

The economic impact of Minnesota's film tax credit program is multifaceted, impacting job creation, revenue generation, and tourism. By attracting film productions, the state experiences a boost in various sectors.

- Job Creation: Film productions create numerous jobs, both directly (e.g., actors, crew members, directors) and indirectly (e.g., hospitality, transportation, catering). Data from DEED on job growth related to film production should be consulted for specific numbers.

- Revenue Generation: Film productions inject money into the local economy through spending on goods and services, benefiting businesses involved in hospitality, equipment rentals, and other related fields. Economic impact studies conducted by independent organizations can provide quantitative data on this aspect.

- Tourism: Successful productions can put Minnesota on the map, attracting tourists who want to visit filming locations featured in popular movies or TV shows. This indirect tourism boost adds to the overall economic benefit.

- Examples and Case Studies: Specific examples of successful film productions that have leveraged Minnesota film production incentives and their resulting economic impact should be provided here, showcasing the program's success stories. These should include quantifiable results whenever possible.

Challenges and Limitations of the Minnesota Film Tax Credit Program

While Minnesota's film tax credit program offers significant benefits, it also faces challenges and potential limitations. A balanced assessment requires acknowledging these aspects.

- Administrative Burden: The application process for tax credits can be complex and time-consuming, potentially placing a burden on smaller productions. Streamlining the process could improve accessibility.

- Distribution of Benefits: Concerns may exist regarding whether the benefits are equitably distributed among different production companies and across various regions of the state. Analysis of the distribution of tax credits geographically and by company size can address this concern.

- Support for Local Talent: The effectiveness of the program in supporting local talent and crew members requires investigation. Analysis of the employment of Minnesota residents within productions that utilize tax credits should be included.

- Comparison with Other States: A comparison to other states' film incentive programs is crucial to assess the competitiveness of Minnesota's offerings. This should examine if Minnesota's incentives are sufficient to attract major productions compared to neighboring states or those with more generous programs.

Comparison with Other States' Film Incentive Programs

To accurately gauge the effectiveness of Minnesota's film tax credit program, a comparison with other states' initiatives is essential. This involves analyzing the structure, generosity, and overall impact of similar programs elsewhere.

- Comparison Table: A comparative table highlighting key aspects of film incentive programs in other states (e.g., percentage offered, caps, eligibility criteria) provides a clear visual comparison.

- Effectiveness of Different Structures: Analyzing the success of various incentive structures across different states (e.g., tax credits vs. rebates) allows for a better understanding of what approaches work best.

- Factors Beyond Tax Incentives: Location decisions are influenced by various factors beyond tax incentives, including access to infrastructure, skilled labor pool, and overall production costs. This context should be considered when analyzing the program's effectiveness.

Conclusion: Assessing the Effectiveness of Minnesota Film Production Tax Credit Incentives

Minnesota's film tax credit program has demonstrably positive effects on the state's economy, generating jobs and attracting productions. However, challenges concerning administrative burden, equitable distribution of benefits, and competition with other states require attention. Further investigation into the program's effectiveness in fostering local talent and its overall competitiveness is needed. To maximize the impact of Minnesota film production incentives, ongoing evaluation and adjustments to the program are crucial. To learn more about the program and to see if your production qualifies for Minnesota film tax credits, visit the Minnesota Department of Employment and Economic Development (DEED) website. Explore the opportunities available through Minnesota film production incentives and contribute to the continued growth of this thriving industry.

Featured Posts

-

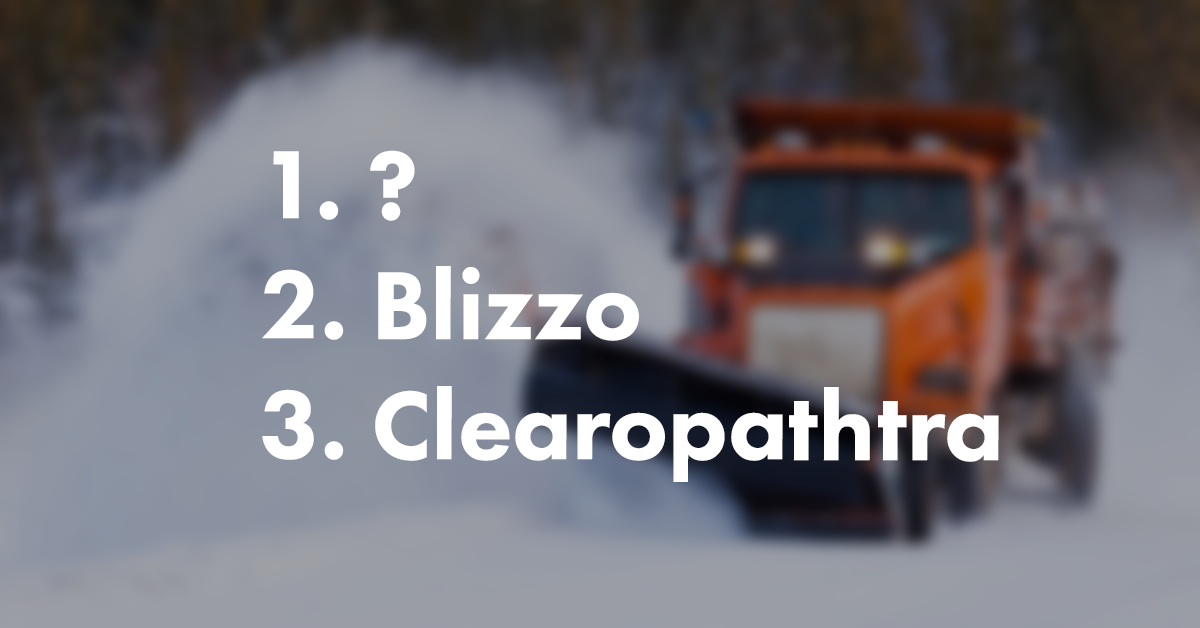

Minnesota Snow Plow Name Winners Announced

Apr 29, 2025

Minnesota Snow Plow Name Winners Announced

Apr 29, 2025 -

Legal Battle Looms Minnesota Defies Trumps Transgender Athlete Ban

Apr 29, 2025

Legal Battle Looms Minnesota Defies Trumps Transgender Athlete Ban

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025 -

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025 -

Announcing The Winning Names For Minnesotas Snow Plows

Apr 29, 2025

Announcing The Winning Names For Minnesotas Snow Plows

Apr 29, 2025